Bank Credit: Securities vs. Loans - Guidance about Lags from History

Interest-Rates / Credit Crisis 2010 Oct 07, 2010 - 04:35 AM GMTBy: Asha_Bangalore

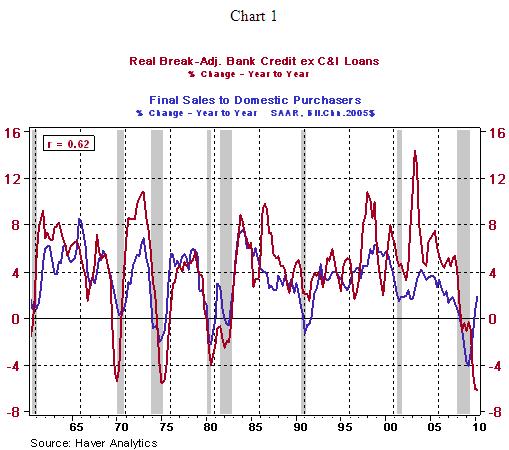

The role of bank credit in economic recoveries was the theme of the August U.S. Economic and Interest Rate Outlook (Bank Credit: One Month Does Not Make a Trend, But..). The main conclusion of the commentary: A lack of growth in bank credit is the major culprit behind the lackluster recovery. Chart 1, a repeat from the August commentary, illustrates the close link between bank credit and economic growth.

The role of bank credit in economic recoveries was the theme of the August U.S. Economic and Interest Rate Outlook (Bank Credit: One Month Does Not Make a Trend, But..). The main conclusion of the commentary: A lack of growth in bank credit is the major culprit behind the lackluster recovery. Chart 1, a repeat from the August commentary, illustrates the close link between bank credit and economic growth.

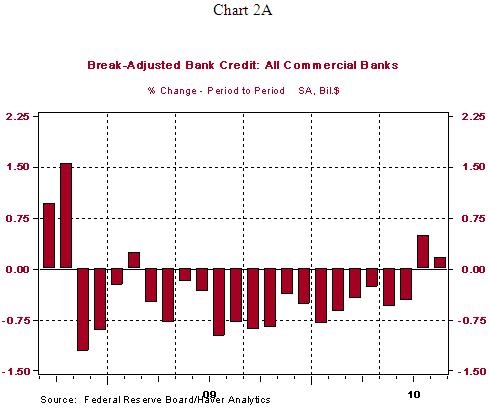

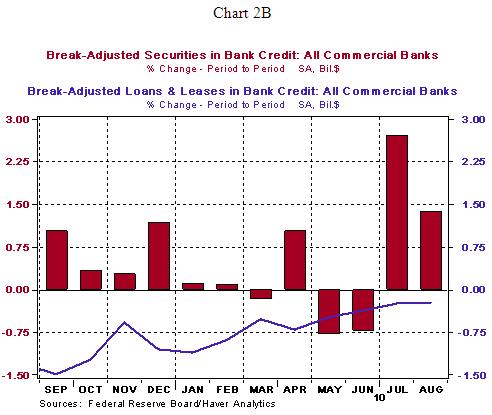

Recent data indicate bank credit has increased in July and August (chart 2A), while partial September data suggest another monthly gain. This is a positive and noteworthy development, but skeptics point out that bankers have been purchasing securities not extending loans (Chart 2B). True.

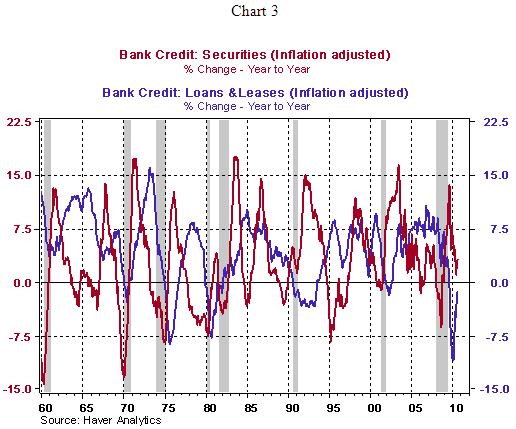

However, one has to dig deeper to differentiate between the disparate trends of the components of bank credit. As noted earlier, bank credit is made up of two major components - (a) securities and (b) loans and leases. These components do not move together as the economy recovers. In fact, as chart 3 indicates, purchases of securities and that of loans and leases trace distinctly different paths as the economy gathers momentum. More importantly, purchases of securities have posted gains early in the recovery phase after each recession since 1960 and their growth rate peaks well ahead of loans and leases (see chart 3). By contrast, loans and leases have picked up momentum at a later stage of all economic recoveries (see chart 3) compared with purchases of securities.

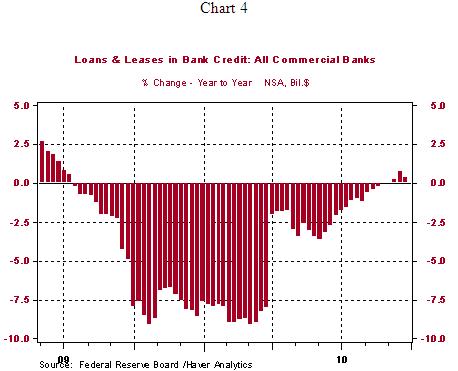

Furthermore, loans and leases show an extended lag vis-à-vis an economic recovery if a banking crisis has accompanied a recession. After the 1991 economic recovery commenced in March 1991, purchases of securities shot up rapidly but loans and leases staged a comeback only in June 1993, a little over two years after the recession had officially ended. The 1990-91 recession involved a banking crisis of significantly smaller in dimension compared with the current recession. Fast forwarding to more recent developments, loans and leases (inflation adjusted) have contracted, on a year-to-year basis, every month since August 2009 but these declines are noticeably small in July and August. At the same time, purchases of securities show a decelerating trend in recent months.

If history is our guide, a turnaround in loans and leases in the months ahead should not be surprising. Nominal weekly data of loans have recorded three consecutive weekly gains (see chart 4). Stay tuned for updates on bank credit growth.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.