Gold Going Over $1600, Top 20 Quotes

Commodities / Gold and Silver 2011 Aug 02, 2011 - 02:58 AM GMT The world's investment community, including besieged private investors, is reeling at the twin terrors of sovereign financial breakdowns on both sides of the Atlantic. Gold has responded by rising nearly $150 in less than a month under heavy global demand. No sooner does the dust settle in Europe than something is kicked up in the United States, or vice versa, complicating the decision-making process and narrowing the options. We thought it would be interesting to catalogue in one place the best quotes on gold going over $1600 -- the thought-provoking, the witty, the profound (not necessarily in order of preference).

The world's investment community, including besieged private investors, is reeling at the twin terrors of sovereign financial breakdowns on both sides of the Atlantic. Gold has responded by rising nearly $150 in less than a month under heavy global demand. No sooner does the dust settle in Europe than something is kicked up in the United States, or vice versa, complicating the decision-making process and narrowing the options. We thought it would be interesting to catalogue in one place the best quotes on gold going over $1600 -- the thought-provoking, the witty, the profound (not necessarily in order of preference).

| 1 | "Ron Paul last week asked Chairman Bernanke during the Humphrey Hawkins type hearings if he thought gold was money and he (Bernanke) said, 'no.' My answer would have been, it's better than money. Yes, $1,600 gold is insulting central bankers in the following fashion, it's saying gold is going up because what you are doing to the fiat currencies of the world is not tolerable to smart investors."

|

|---|---|

| 2 | "They'll print money until we run out of trees."

|

| 3 | "[I]n 1980 the only players were the Americans, they were essentially the only players in the gold market, or the dominant players. Today the dominant players are China and India, 58% of all the gold sold this year will be sold in these two countries. So they are by far the dominant players and as I've said the Chinese love gambling. When we reach that phase (the mania) I told you and I will tell anyone who wants to listen, watch out because it will truly make your head spin."

|

| 4 | "I pay attention to the price of gold. But I think it reflects a lot of things. It reflects global uncertainties. I think the reason people hold gold is as protection against of what we call tail risks, really, really bad outcomes. And to the extent that the last few years have made people more worried about the potential of a major crisis then they have gold as a protection."

|

| 5 | "China's frenzy for gold prompted the central bank to step up sales this year of gold and silver Panda Coins.The People's Bank of China plans to sell 500,000 1-ounce gold coins, or 66 percent more than its earlier target of 300,000. It also tripled sales targets for half-ounce, quarter-ounce, 1/10-ounce, and 1/20-ounce gold coins to 600,000 each from 200,000 earlier."

|

| 6 | "Record high prices won't scare away [Chinese] investors, Investors are likely to chase the rally and continue to buy gold because paper money feels increasingly worthless and they are worried about inflation."

|

| 7 | "I think it was the foundation for people to start thinking that maybe gold's not headed to $1,650 an ounce or $1,700 an ounce, maybe it is headed toward $1,800 an ounce or even $2,000 an ounce."

|

| 8 | "A close above $1,600 on gold, similar to silver closing over $40, would create a huge bunch of short-covering. The commercials have been adding short positions in gold, but should we get a close above $1,600, I think you will find the smaller of those shorts are going to start covering their shorts because it's going to be too much pain. This could result in a $50 move overnight."

|

| 9 | "If you held gold or silver, it was a pretty good week. If you own your own house, it pretty much amounts to where you live. If you live in Vegas or Phoenix, you bought in the wrong area. If you bought in San Diego or San Francisco you've done right. If you saved your dollars for "a rainy day," you probably wonder what you can buy with your dollars. If you saved your gold for your old age, you've probably already sold your gold for dollars, and what the hell, 'let it rain.'"

|

| 10 | "Warren Buffett's problem is that he only understands balance sheets and earnings. The value of a Picasso or a gem diamond or a bar of gold is outside Buffett's understanding. Which is sad, because Buffett's lack of understanding has kept many an American on the sidelines while gold surged higher in terms of Buffett's beloved paper currencies."

|

| 11 | "Central banks have the will to increase gold holdings, but it is not a practical option and rather difficult. Gold supply simply doesn't grow as fast as China's foreign reserves. Only the increase in U.S. debt can match that. . .We can buy whatever with our money without causing price distortion, but a $2-trillion, $3-trillion [gold purchase] elephant will certainly cause distortion."

|

| 12 | "One of the big US banks texted me today to say that if QE3 actually happens, . . We could see gold at $5,000 and silver at $1,000. I feel terribly sorry for anybody on fixed incomes tied to a fiat currency because they are not going to be able to buy things with that paper money."

|

| 13 | "We expect $1900 gold by October."

|

| 14 | "[As an option] the US Treasury could eliminate the Fed's entire holding of Treasury bonds at a stroke, gaining an extra two years. This would be a simple accounting transaction. Ben Bernanke might feel uncomfortable, and gold might blast to $3,000, but the Bernanke Fed has proved itself supple."

|

| 15 | "The 'fiat' dollar is one of the world's astounding monetary creations. That a currency of no intrinsic value is accepted as money the world over is an achievement that no monetary economist up until not so many decades ago could have imagined. It'll be 40 years next month that the dollar has been purely faith-based. I don't believe for a moment it's destined to go on much longer. I think the existing monetary arrangements are so precarious, so ill-founded, and so destructive of the economic activity they are supposed to support and nurture that they will be replaced by something better."

|

| 16 | "I think there's a really high chance, this is the year that you do not want to fight the gold market. This is a trend that you just have to bite the bullet and be invested and go with it, I feel very strongly about that. Various liquidity is going to be coming from all corners of the world. At no time has gold pulled back throughout any of this credit tightening process, the market is going higher. We are in my opinion going to see a $2,000 handle this year."

|

| 17 | "I just calculated if we take an average gold price of say around $350 in the 1980s and then we compare that to the average monetary base in the 1980s, and to the average U.S. government debt in the 1980s. But if I compare this to the price of gold to these government debts and monetary base, then gold hasn't gone up at all. It's gone actually against these monetary aggregates and against debt it has actually gone down. So I could make the case that probably gold is today very inexpensive."

|

| 18 | "We have liked gold for a long time and we remain very constructive. It is more than just a hedge against recurring bouts of global financial volatility. The growth rate of gold production is roughly stagnant while the growth rate of fiat currency in most parts of the world continues to accelerate. It's all about relative supply curves - the supply curve for bullion is far more inelastic than is the case for paper money. It really is that simple."

|

| 19 | "Internationally, precious metals will become the preferred reserve assets, not just an important one. Their prices will then relate more closely to the total volumes of each international currency in the world. As you can imagine, the prices of precious metals will then have to be higher than most people even thought possible. With the gold market being such a small one in volume terms, silver will then become a monetary metal too, at considerably higher prices."

|

| 20 | "July/August is traditionally a weak time for gold. Purchasing from Asia - perhaps the main gold price driver - falls off, picking up again once festival seasons start in late Summer/early Autumn. Yet gold is standing at an all-time high as August approaches. That should indeed be telling us something. The chickens are coming home to roost and gold will continue to be the major beneficiary. This writer was looking to see gold in the $1700s by year-end in Mineweb's January gold price competition. This is beginning to look as if it could be a very conservative prediction indeed!"

|

Alf Field's Last Elliott Wave Advisory

Editor's Note: With gold going through the $1600 mark, I thought it a good time to dust off this classic piece of analysis by Alf Field first published at our USAGOLD website in late 2008. This remarkable analysis was Field's last on the gold market, and for an admirable reason, which he reveals toward the end of the essay. ________

As this is going to be the last of these Updates, it is appropriate to review the reasons for writing this series of articles on Elliott Wave and the gold price. This will involve revealing a lot of personal detail and also unveiling an extremely high forecast for future gold prices.

The first article titled "Elliott Wave and the Gold Price" was published on 25 August, 2003. In August 2003 the gold price was in the region of $350 and there were a number of conflicting views about the future direction of the gold price. Robert Prechter, for example, was predicting a move to below $253 and possibly below $200. For a number of reasons I was of the opinion that gold was in the very early stages of a major bull market. My views were thus the opposite of Prechter's and I eventually plucked up the courage to say so.

I count Robert Prechter as a friend, so my purpose was not to disparage his views. I was more interested in setting up some parameters or guidelines that would help determine the likely outcome if the gold price exceeded those levels. I concluded that if the gold price dropped below $309, the odds would favour Prechter's view. If it pushed above $382, then my bullish view would probably be favoured.

This was more than just an academic exercise because in 2002 I had made a major change to our family investments, moving some 40% of the capital into gold and silver bullion plus a selection of gold and silver mining shares. If Prechter's view prevailed, our family finances would have taken a serious drubbing.

A roadmap for gold

Another reason for publishing the Updates was to illustrate a major advantage of the EWP, which is the ability to prepare a template forecast (or "road map") of how the market is likely to unfold in both the long and short term, including the possible terminal prices. The original article produced a template based on the rhythms that had been observed in the early stages of the bull market, based naturally on the assumption that my bullish views would prevail.

The early stages of the bull market revealed corrections of 4%, 8% and 16% at increasing orders of wave magnitude. Those numbers were used in the original template published in that 2003 article, a template that forecast that the first major move upwards could reach $630 after which a correction of the order of 25% to 33% would probably follow. In fact, if the sequence had been extended logically, the larger correction should be double 16%, or 32%, but this was shaved to 25-33%.

I thought that the $630 forecast was conservative and that this number would probably have to be adjusted upwards later once the minor waves unfolded. In 2003, with gold in the mid $300's, a forecast of $630 was both courageous and extremely daring. There was no purpose served in taking the exercise beyond that point until after the $630 target had been achieved.

In addition, the 2003 article concluded that if $382 was surpassed, then the gold price would move rapidly to $424 without a serious correction. That did indeed happen, with gold reaching $425 before the anticipated correction occurred. That success encouraged me to write an article updating the original forecast. I did not anticipate that the consequence of that first update would be the production of this Update 23 some five years later.

There was a further undisclosed reason for writing these articles and that was to eventually highlight the massive potential of the gold bull market. I was reluctant to reveal what I really believed in 2003 as it was so bullish that it would have invited the arrival of the guys with straight jackets and padded cells.

Back of the envelope calculations in 2003

As this will be the last of these Updates, I will reveal my previously unpublished "back of the envelope" calculations in 2003. They were as follows.

Major ONE - up from $256 to approximately $750 (a Fibonacci 3 times the $255 low);

Major TWO - down from $750 to $500 (a serious decline of 33%);

Major THREE - up from $500 to $2,500 (a Fibonacci 5 times the $500 low);

Major FOUR - down from $2,500 to $2,000 (another serious decline);

Major FIVE - up from $2,000 to $6,000 (also a 3 fold increase, same as ONE)

A case can be made for an 8 fold increase in Major FIVE, which would continue the Fibonacci sequence 3, 5, 8. You can do the maths if you like, but the fact is you can pick your own number for the gain in Major FIVE. Three times the low of $2,000 was actually the conservative expectation, producing a bull market peak target of $6,000.

I would not have invested 40% of the family capital into gold, silver and the corresponding mining shares based solely on my bullish EWP expectations. The following is a quote extracted from "Elliott Wave and the Gold Price" written in 2003 and referenced above:

"I am not a gung ho advocate of the EWP. I discovered not only its strengths but also its weaknesses. I prefer to have fundamentals, technicals and the EWP all in place (if possible) before committing myself to an investment."

As mentioned in this quotation, I prefer to have fundamental and technical analyses in line with the EWP before committing to a position. Obviously I was satisfied with the fundamental and technical outlook for gold when I made the dramatic change in our investment portfolio in 2002.

The technical analysis included the following:

# 1. The 21 year bear market in precious metals had ended with the multi-decade down trend line being broken on the upside.

# 2. The precious metal markets were oversold with sentiment and emotional indicators sporting extreme negative readings with bullish connotations.

# 3. In the 1970's bull market, gold increased from a low of $35 to a peak of $850, a massive 24.3 times the low price. If the current bull market was to be of the same order, then one could project an ultimate peak of over $6,221 ($256 x 24.3). This matched the $6,000 target determined under the EWP.

The fundamental analysis was the real clincher. I had become convinced that the world, and especially the USA, was heading for a major financial crisis that would be so powerful that it would overwhelm all other factors. It would become the single most important criteria impacting on investment decisions. Privately I referred to this as the "Big Kahuna" crisis.

I anticipated that the Big Kahuna would give rise to the risk of a systemic meltdown, which would result in the authorities "throwing money at problems", bailing out all the banks and large corporations that got into trouble. This would lead to the destruction of the currency. I wrote about this in more detail in "Seven D's of the developing Disaster" in April, 2005, an article that can be found at:

http://www.freebuck.com/articles/afield/050428afield.htm

The consequence of the systemic meltdown would be a vast increase in newly created money which would result in a massive rise in the gold price of the order that I was anticipating. A further consequence would be the introduction of new national and international monetary systems. Several articles followed in the next few years, culminating in "Crisis Cogitations" which was published just 2 weeks ago at:

http://news.goldseek.com/AlfField/1226560260.php

If you haven't read "Crisis Cogitations", I would urge you to do so in order to better understand the current crisis. Obviously the current financial crisis is the Big Kahuna that I had been anticipating, although I didn't expect it to take five years to emerge.

Reverting back to the situation in 2003, both the technical and fundamental underpinnings for gold seemed to be pretty solid. Consequently I felt confident that the bullish EWP forecasts, both the shorter term and the undisclosed longer term expectation, would work out. There was no purpose served in revealing the potential for the market to reach $6,000. To get there, gold had to get to the $630 target first, which was a sufficiently daring forecast in 2003.

The current situation

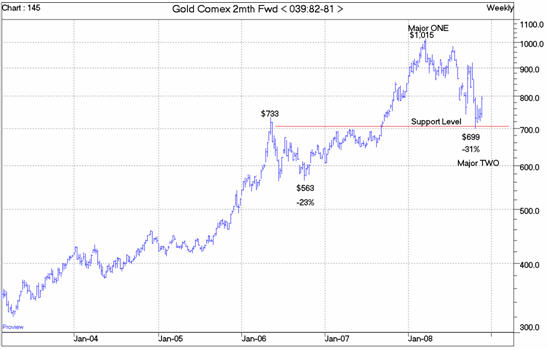

The chart below depicts the Comex Gold price on a weekly basis. In February 2006, in Update IV, the $630 target was increased to $768 as a result of intervening market action. A couple of months later the gold price exceeded $630 and moved to $733 in May 2006. From that point a 23% correction to $563 occurred.

Confusion reigned because a relatively minor correction had been anticipated, to be followed by a rise to $768. Thereafter the long awaited 25% to 33% correction was scheduled to occur. Instead, the decline measured 23% and the obvious conclusion was that this was the long awaited 25% to 33% correction, albeit slightly stunted. Quite possibly I was overly influenced by my previously unpublished rough target of $750 followed by a decline to $500. The actual outcome of a peak of $733 and a correction to $563 was remarkably close to my rough estimate and seemed to adequately fit the requirement for the end of Major ONE and the corrective wave Major TWO. In coming to this conclusion I glossed over the fact that the correction to $563 was an obvious triangle, and triangles are almost always 4th waves, yet I was calling it a 2nd wave, Major TWO. I also glossed over the fact that the correction was below the 25% to 33% magnitude required.

I mentioned previously that the early corrections were 4%, 8% and 16% at increasing orders of magnitude. If one were to be pedantic, one would say that the next level of correction should be 32%. Looking at the chart below, the correction from $1015 to $699 is 31%! It sticks out like a sore thumb. Surely this is exactly the 32% correction that we should have been anticipating for Major TWO?

Assuming that the $699 low on 23 October 2008 turns out to be the actual low point of the correction, and that remains to be proven, then we can conclude that we have seen the low point for Major TWO. That will allow us to update my original "back of the envelope" template to much higher levels, as follows:

Major ONE - up from $256 to $1,015 (actually 4 times the $255 low);

Major TWO - down from $1015 to $699, say $700 (a decline of 31%);

Major THREE - up from $700 to $3,500 (a Fibonacci 5 times the $500 low);

Major FOUR - down from $3,500 to $2,500 (a 29% decline);

Major FIVE - up from $2,500 to $10,000 (also a 4 fold increase, same as ONE)

Once again, you can pick your number for the gain in FIVE and multiply it by $2,500. The numbers become astronomical and can really only be possible in a runaway inflationary environment, something which many thinking people are suggesting has become a possibility as a result of the actions taken during the current crisis.

Concentrating on the $3,500 target for Major THREE, which is a five fold increase from the low point of about $700, there is a case advanced in "Crisis Cogitations" for a five fold increase in money and prices in order to arrive at a "Less Hard" economic landing. In the USA, total debt recently exceeded $50 trillion and this is unsustainable given an economy with a GDP of only $14 trillion. The suggestion is that the debt level will reduce through bankruptcies to say $35 trillion while the new money created to save the situation will push up the nominal GDP to $70 trillion. A $35 trillion debt level is manageable with a GDP of $70 trillion.

It requires a five fold increase in prices to achieve the above result. Gold has retained its purchasing power over the centuries and will no doubt continue to do so in the current environment. Consequently gold will almost certainly increase five fold (or more) if the level of prices in the USA increases five fold.

In "Crisis Cogitations" it is acknowledged that the current credit/debt deflation could get out of hand and result in a serious deflationary depression. There is debate as to how gold will react in a deflationary environment, but the fact is that in a serious depression bankruptcies will be rife and price levels will decline. This may result in cash and Government bonds performing better than gold, but this is not certain. Gold cannot go bankrupt and is thus an asset that people can hold with confidence in a deflationary depression. It is possible that demand for a "safe haven" investment may be large enough to cause the metal to perform better than cash or Government Bonds.

The odds, however, strongly favour an inflationary outcome. Given a strong will and the ability to create any amount of new money via the electronic money machine, it seems a foregone conclusion that runaway inflation will be the end result. If Mugabe could do it in Zimbabwe, there seems little doubt that Ben Bernanke and his associates in other countries will have no trouble in doing it too.

Why quit writing these reports?

I have noticed from the emails that I receive that many people are using these reports to guide their trading activities in gold. I have had no objection to this in the past, but feel that it would be foolish to trade gold in the circumstances of the Big Kahuna crisis that we are living though at the moment. It has become a question of individual financial survival in an environment where things are happening more rapidly and with increasing violence. I feel very strongly that it is time to quietly hold onto one's gold insurance and not attempt to trade it. I do not wish to provide interim levels that may cause people to be encouraged to trade their gold to skim a few extra fiat dollars or other currencies, but lose their gold as a result.

So it is Good Bye, Good Luck and God Bless,

Alf Field 25 November 2008 Comments to: ajfield@attglobal.net

This article reprinted at USAGOLD by kind permission of the author, Alf Field.

For a free subscription to our newsletters, please click here.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.