U.S. Economy GDP, The Hood Looks OK But It's A Mess Underneath

Economics / US Economy Jun 29, 2012 - 01:03 AM GMTBy: Tony_Pallotta

This week the final revision to Q1 2012 GDP was released. The headline is simple, GDP remains unchanged at 1.9%. Not great but not horrible either, right? I mean 2% growth amid outright contraction in Europe is good. Perhaps the US has finally decoupled?

This week the final revision to Q1 2012 GDP was released. The headline is simple, GDP remains unchanged at 1.9%. Not great but not horrible either, right? I mean 2% growth amid outright contraction in Europe is good. Perhaps the US has finally decoupled?

You don't need an economics degree (trust me on that one) to look underneath the hood and see that this "unchanged revision" was actually indicative of something more sinister. That the US economy is not only in trouble but is clearly "coupled."

In fact if it was not for the BEA's ability to cut inflation in nearly half one could easily argue the US economy is already in recession. See Chairman Bernanke, deflation is not so bad after all.

The 2011 Stick Save

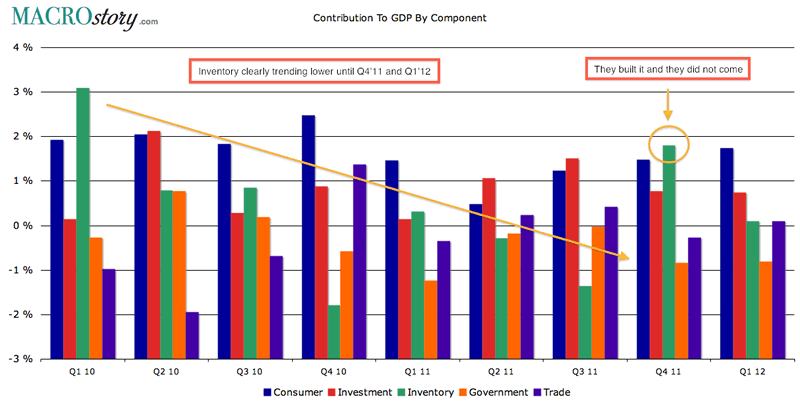

As the second half of 2011 rolled around something else was rolling as well. The US economy began rolling over. Yet somehow recession was averted. Was it Operation Twist? Highly doubtful. Low rates have been here for a long time and are doing nothing to stimulate growth. But what did happen is a multi-quarter down trend in inventory suddenly reversed.

Inventory levels jumped in Q4 2011, causing regional Fed surveys and national ISM surveys, etc to show a sharp improvement in economic output. The US had "decoupled" from the world (sarcasm). So as inventory levels rose, labor markets showed relative improvement. After all you need more people to make more stuff. And when you hire more people confidence grows. All was good. The US was once again a happy place.

Now if we fast forward to 2012 the same economic deterioration is occurring. And we are "fortunate" (sarcasm) to have Operation Twist extended through 2012. Stick save again? Recession averted? Highly doubtful. Why? The inventory growth experienced in Q4 2011 and less so in Q1 2012 is unsustainable.

They built it and yet the consumer had no real (inflation adjusted) income growth to buy it. Demand has simply faltered. Sure manufacturers and wholesalers can continue building more "stuff" but remember retail is not buying said stuff. So the question becomes do those pushing product through the pipeline really want to hold more inventory? Are they willing to tie up more capital in a rather illiquid asset?

Obviously the answer is no, so what does this mean for all the labor they have? After all, regional Fed surveys are deteriorating fast but the employment component is holding on. Are these companies going to keep staff for the sake of being kind? Again, highly doubtful.

Price Deflator VS CPI

When the BEA (Bureau of Economic Analysis) estimates GDP they have one very simple, yet powerful calculation. They must adjust nominal GDP for inflation which yields real GDP. If I sell 10 "$1 widgets" in 2011 and 12 "$1 widgets" in 2012 real GDP is 20%. That is a real increase in economic output. But if prices rise 20% and I sell only 10 widgets in 2012, nominal GDP is 20% but real GDP is unchanged. There was no increased output. It was all inflation. But if I underestimate inflation I can show real GDP growth. Cute, right?

So perhaps I am oversimplifying my argument but why does the BEA use a measure of inflation in the price deflator at 2.0% when annual CPI averaged 3.6% during Q1 2012? That simple discrepancy would say that of the 1.9% GDP reported for Q1 that 1.6% is attributed to understating inflation (see Mr. Chairman sometimes deflation can be one's friend).

Simply said if the BEA would use a measure of inflation that CPI says all consumers are experiencing, then Q1 2012 GDP rose 0.3%?

Where Does The Economy Go Next?

Is the US economy heading for recession? I believe the answer is yes. In fact the US economy may already be in recession. Purely from a cycle standpoint the US is "due for" recession. The recovery was weak at best so the cycle time between the prior recession and the current and or future is likely reduced.

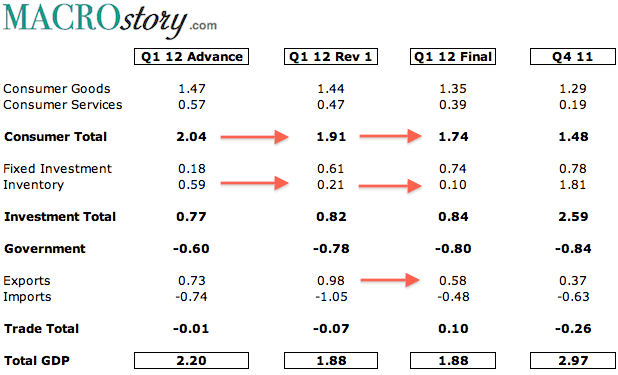

The final revision to Q1 GDP shows two disturbing trends that highlight the risks facing the US economy. First, in the table below, look at how the consumer component which represents 70% of total economic output has been continually revised lower. Originally estimated at 2.04% is now 1.74%. Still a healthy level but the trend has deteriorated fast. And if the consumer is deteriorating remind me again, who is going to buy that inventory?

Second and this is probably the biggest risk. Look at how much exports have declined. Estimated at 0.98% after the first revision, the final measure was 0.58%. In other words something happened over the past month to cut nearly in half total US exports as a percent contribution to GDP. Don't look for comfort in the imports as an offset either which does not bode well for the consumer. Remember we love our low priced, imported goods.

Clearly the global economy is deteriorating and in some cases such as Italy and Spain, very rapidly. As export markets contract further so will the trade component of GDP.

Bottom Line

If you simply adjust for "real" inflation the US economy is already skirting the lines of recession. Forget about escape velocity, we are lucky to be near stall speed. Add in a consumer that is clearly weakening amid no income growth and a contracting export market and the US economy is in some serious trouble.

Operation Twist will do little. And without inventory levels expanding further there is very little source of economic growth. Sure the BEA can play the CPI, price deflator discrepancy game a bit longer. Perhaps that is why they are always late in declaring recession. After all telling the truth when reality has set it in is much easier.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.