If You Aren’t Making Music with Commodities, Try This Song Instead

Commodities / Commodities Trading Dec 14, 2018 - 02:44 PM GMTBy: EWI

Cocoa's 2016-7 bear market reversal was in total harmony with one kind of analysis

Cocoa's 2016-7 bear market reversal was in total harmony with one kind of analysis

If financial markets were styles of music, equities, especially the most stable Big Board stocks, are like great classical compositions: They're made up of consistent, steady tempos you could listen to all day with the occasional booming or crashing note.

Commodities are different. They're the jazz players delivering choppy, frenetic tunes with jolting chord changes.

It's easy to write it off as chaos; to believe these markets open every morning as a blank slate, riffing off each other or external "vibes" in the moment. That's the very basis of fundamental market analysis and its reactive claim that outside news events drive price action.

But that's not the only option. Maybe you've heard of technical market analysis? It's based on a closed system of values, such as momentum, relative strength, bar patterns, Japanese candlesticks, and so on -- that provide an objective way to measure near-, and long-term future price trajectories.

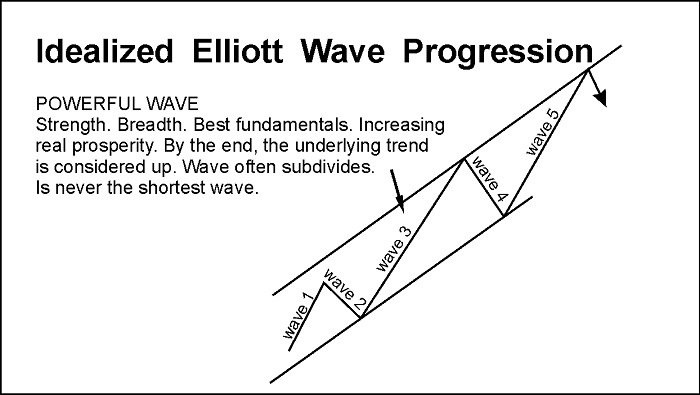

A popular choice for market "techies" is Elliott wave analysis. It's incredibly user-friendly, thanks to the fact that there are only five core Elliott wave patterns to remember. One of them is called an impulse wave, defined as a five-wave move in the direction of the larger trend in which:

- Wave 2 never retraces 100% of wave 1

- Wave 4 does not enter the price territory of wave 1

- Wave 3 is never the shortest among waves 1, 3, and 5

Wave 3 is never the shortest because it's usually the most powerful wave in the sequence. Ralph Nelson Elliott himself described third waves as "wonders to behold." Think of the part in a song that builds and builds and then bursts into crescendo (price surge) or quiets into decrescendo (price selloff). That's a third wave.

Cocoa: From Rockstar to Has-Been

Remember the gut-wrenching crash that occurred in cocoa back in 2016-7 in which prices plummeted 40%-plus to a 10-year low? Turns out, that was an Elliott third wave in action!

Not everyone originally saw it that way, as memory serves.

See, after a record year of gains in 2015, the fundamental backdrop in cocoa going into 2016 was fully-loaded to the bull side, including: a global supply deficit, production shortfall, rocketing demand, and a supply-eroding El Nino in West Africa.

According to the news-following analysts, cocoa prices were set to "riff" off these bullish chords and makes sweet gains, as these news items from the time confirm:

- "Cocoa futures soar as global chocolate demand grows... [Chief market strategist] doesn't see the uptrend slowing down anytime soon." (Nov. 1, 2015 CNBC)

- "Cocoa is a long-term bull" (June 20, 2016 Seeking Alpha)

- "Cocoa Futures Savoring a Tasty Upward Swing... Cocoa could prove to be a delicious landing spot for commodities investors targeting opportunities as far into the future as 2018." (Sept. 1 The Street)

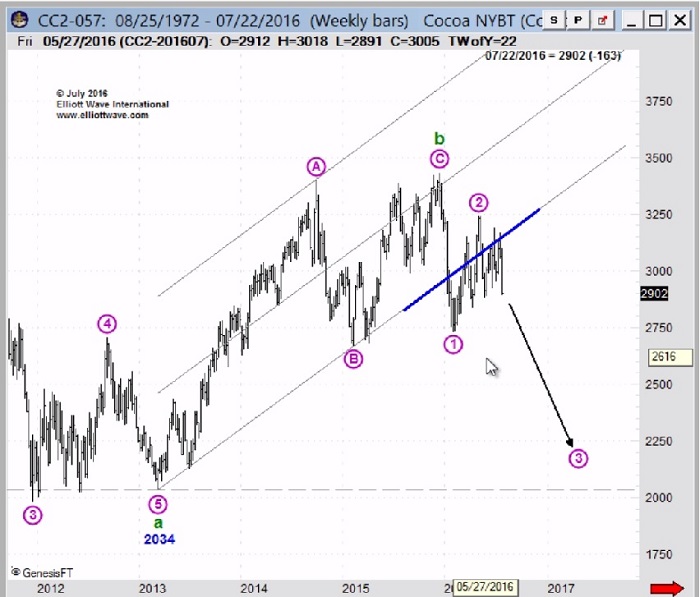

But for Elliott Wave International's chief commodities analyst Jeffrey Kennedy, cocoa prices were singing a very different tune; namely bearish. In his July 2016 Monthly Commodity Junctures' "Featured Market" video update, Jeffrey presented this chart and explained how cocoa prices were ideally positioned for a powerful wave three decline. In Jeffrey's own words:

"We've seen a decisive break of the lower boundary line of the corrective price channel. This price action confirms that the counter-trend [rally] that's been in force since January of this year is finally complete.

"We can now anticipate this larger wave three selloff targeting at the least 2194. This is very, very exciting and opens the door for further selling well into 2017..."

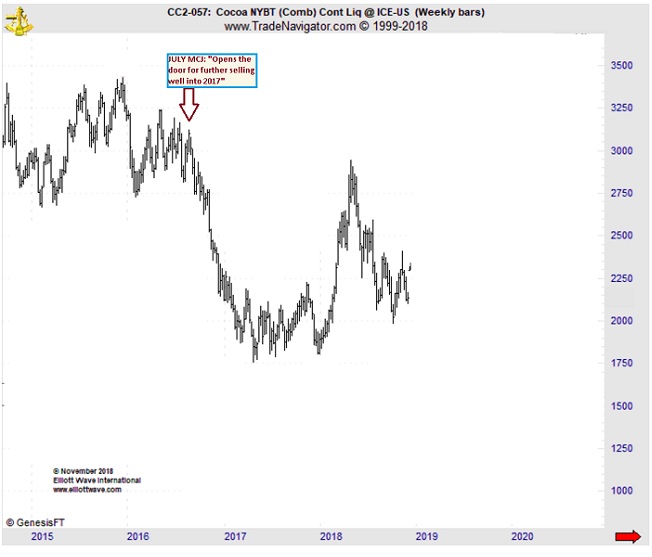

From there, cocoa prices hit the skids, reversing from a near 5-year high to a 10-year low into mid-2017 before pressing the brakes.

(Editor's Note: See and hear Jeffrey Kennedy's analysis of four major commodity markets -- sugar, soybeans, lean hogs and cotton -- for FREE!)

From a fundamental, news-moves-markets perspective, cocoa's bear market crash sounded like chaos; a move with no ties to the clearly bullish "score" laid out before it.

But from the view of technical analysis, specifically Elliott wave analysis, the market's reversal was in complete harmony with the objective, third wave pattern in which prices were developing.

Take part of this all-inclusive event from our friends at Elliott Wave International and get instant access to exclusive video clips from Jeffrey's Commodity Junctures lessons, which reveal his long-term forecasts for sugar, soybeans, lean hogs, and cotton in the months and years ahead.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.