American's Tea Party Protests Against Fraudulent Bank Bailouts and Stimulus Spending

Politics / Credit Crisis Bailouts Apr 17, 2009 - 12:51 PM GMTBy: Andy_Sutton

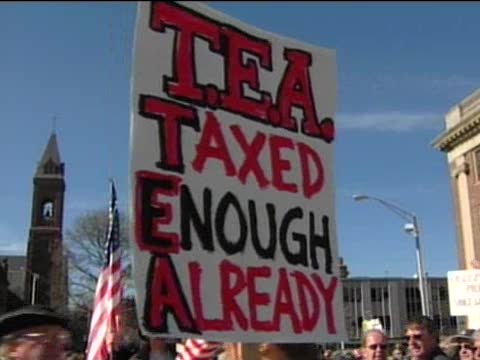

“Elephants and Tea Parties” - It is really no wonder that thousands of people across the nation showed up Wednesday to protest everything from the $787 stimulus package to big bank bailouts done under the cover of darkness. A failing economy, a government determined to insert itself fully in the specter of control, state sovereignty movements, and a good old fashioned tax day frown all combined to whip up enough ire to get folks to take to the streets. Still, many in the media don’t understand why this wave of protest is occurring.

“Elephants and Tea Parties” - It is really no wonder that thousands of people across the nation showed up Wednesday to protest everything from the $787 stimulus package to big bank bailouts done under the cover of darkness. A failing economy, a government determined to insert itself fully in the specter of control, state sovereignty movements, and a good old fashioned tax day frown all combined to whip up enough ire to get folks to take to the streets. Still, many in the media don’t understand why this wave of protest is occurring.

Main Street Under Pressure

Main Street Under Pressure

Since last summer there have been fairly regular stories even in the mainstream press about banks cutting limits on credit cards. It would seem as though the bankers had decided that the age of consumerism had gone too far. Ironically, these actions happened concurrently with the largest giveaways in the history of mankind. In the past 9 months the United States, #1 on the world financial stage, has committed an entire year of economic output to stem the ongoing crisis. How do banks respond? By cutting credit card limits. It is like giving a small child sweets until the kid is in a frothing sugar-frenzy, then locking up the candy dish. The analogies are nearly limitless, but the point is obvious. While the banks screamed for the elixir of easy Fed credit, they slammed the door on Main Street. For their part, consumers at some levels have cut back on their spending, which is a good thing. The unfortunate reality is this: Even the most prudent and responsible consumer will have a bad month. There will be a string of unexpected expenses, and that individual might need to carry a balance for a while to get things straightened out. Job losses will cause exactly this type of situation and now in many cases the credit is not there.

Another unintended consequence is that when credit lines are cut, utilization goes up and suddenly the most frugal appear to be on a spending bender. Take the person who has $25,000 in total credit from a number of different sources. Say on average the individual uses $5000/month for regular expenses, but never carries a balance. Now let’s assume that their lines are cut in half. Their utilization just doubled from 20% to 40%. Their new application for a small business loan might now be rejected because they’re judged to be a bad credit risk due to the 40% utilization. More unintended consequences.

Another amazing development has been the continuation and acceleration of foreclosure activity despite all the political rhetoric over the past 15 months from both sides of the aisle in terms of ‘helping’ homeowners. According to RealtyTRAC, foreclosure activity, which includes default notices, repossessions, and auction sale notices, increased 6% from January 2009. This same measure increased nearly 30% from February 2008. So despite trillions of dollars pledged to Fannie, Freddie, Bobby, Lulu, and anyone else with a leaky balance sheet to supposedly assist homeowners, not only is foreclosure activity not abating, it is increasing.

Runaway government spending

As most are acutely aware this tax day, their contribution to the team effort of bailing out the economy will not be near enough. Not only will their continued (and increasing) participation be needed, but that of their children, and grandchildren will be required as well. While I could sit here and tally up the various tabs, totals, and sums, it would be pointless. The public is mind-numb from hearing these staggering figures. It is very difficult to even fathom a billion let alone a trillion. However, this reality has dawned on an increasing number of people over the past few months and they are understandably perturbed. We have hopefully learned a valuable lesson, and that is that liberty is akin to a seedling. It is planted, but then must be watered, fed, and protected from the harsh environment in which it lives. While Americans were out collectively living it up over the past umpteen years, that harsh environment has wreaked havoc on our seedling. The bad news is that we’ve got a lot of work to do. Hopefully the sheer magnitude of our task doesn’t discourage us from doing it.

Big Bank Profits = Bubble Watch

After 6 quarters of dire forecasts, failures, predictions of failure, and uncounted bailouts, big banks are suddenly earning money again. Interestingly enough, most of these newfound profits are coming from the investment banking sides of their businesses. Translated, that means they’re back to their old tricks again and it is back to business as usual. Secure in the knowledge that their backs are securely covered by ‘We the People’ and without fear of extinction, the winners of the 2008 financial crisis have been refreshed, revived, and are back at it. Since our economy and monetary system are still compromised by the same structural imbalances that existed before the crisis, it is again time to go on “Bubble Watch”. The ingredients are there: very cheap money from the Fed and existing dislocations in many markets. The only thing missing is you. And this little fact could cause quite a problem. Americans, quickly growing weary of the accelerating boom-bust cycles, and still punch drunk from the last beating are not likely to be as willing to participate in the next bubble.

One of last fall’s pieces focused on the causes of the Great Depression and tried to dispel the myth that the market crash of 1929 was somehow solely responsible for the mess that followed. We pointed to a nagging reality from 1929 and that was the proportion of Americans living in poverty. More than half were living below a minimum subsistence level, which at the time was $750/year. Essentially one half of the population was unable to support further economic growth. That was one of the underlying structural imbalances. The crash and subsequent misguided government responses were the triggers that caused the Depression.

How much different are we really today? Sure, the poverty line has been adjusted upwards in nominal terms, but fundamentally, how many Americans are below it now? Perhaps the most important variable that has changed in the past 70 years is the reliance we have on credit as a society. How many of us would be living below the poverty line, unable to participate in the economy were it not for VISA, Mastercard, and equity lines of credit? The recent spikes in unemployment will only exacerbate the situation, causing further reliance on credit for subsistence; credit which is shrinking by many measures.

In conclusion, it is particularly disheartening that nearly all of the political focus spanning the last two administrations has been about getting credit flowing again, with only token talk of job creation and fostering legitimate economic growth. The actions have been no better. The vast majority of bailout and stimulus dollars have gone to the financial system to encourage lending and borrowing rather than to the real economy. Our fiat monetary system’s reliance on debt for its growth is the elephant standing in the room each time a press conference or media event is held. It is the elephant nobody in charge wants to talk about. It is the question nobody in media wants to ask. And, at the end of the day, I would imagine that is why so many people came out on Wednesday and will continue to do so.

They aren’t interested in parties. They just want to talk about elephants.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.