Here is a chart of gold that I have been following

Commodities / Gold & Silver 2009 Apr 24, 2009 - 12:15 PM GMTBy: Mike_Shedlock

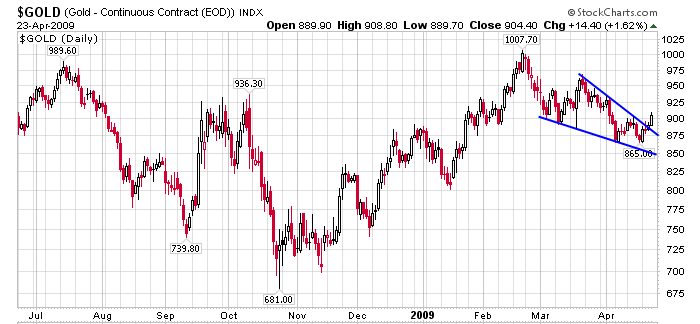

Here is a chart of gold that I have been following.

Here is a chart of gold that I have been following.

The traditional seasonal strong period for gold is August through January. The chart shows that for quite some time it's a case of "seasonals be damned".

Earlier this year gold was moving lock step with the dollar as noted in You Can't Fool Gold. That pattern too has ended.

Gold Inflows into ETFs up by more than 300 Percent

Inquiring minds are reading Gold: Inflows into ETFs up by more than 300pc.

Figures from the World Gold Council show that investors appetite for gold showed no sign of abating with record inflows in to gold exchange traded funds.

Inflows into gold ETFs continued to grow throughout the quarter, with investors buying a record 469 tonnes of gold, dwarfing the previous quarterly record of 145 tonnes, set in the third quarter of last year. This took the total amount of gold in ETFs to 1,658 tonnes, worth US$48.6 billion, the World Gold Council said.

Ongoing risk aversion, growing uncertainty over where consumer prices are headed and a renewed vigour in the search for effective portfolio diversifiers all supported gold investment demand throughout the first quarter of 2009, the Council’s latest Gold Investment Digest.

Regarding the broader economic backdrop, commentators expressed two distinct views with respect to where consumer prices are headed. One sees inflation coming, as a consequence of the staggering increase in public spending and the quantitative easing measures being put in place by central banks around the globe.

The other view argues that deflation is the more likely prospect, pointing to recent inflation figures - US consumer prices were unchanged on an annual basis in January for the first time since 1954 - and the continued deterioration in consumer confidence and spending. Both scenarios have possible positive implications for gold:

“Gold is not just effective during a financial crisis. The unique and diverse drivers of gold demand and supply mean that changes in the gold price do not correlate with changes in the prices of other financial assets, regardless of the health of the financial sector or broader economy,” Dempster said. “Gold is an effective portfolio diversifier regardless of the stage of the economic cycle.”The idea that gold does well in periods of inflation and deflation is easily disproved. Gold fell from over $800 to $250 over the course of 20 years with inflation all the way. The reality is gold does well in periods of high economic stress (deflation, stagflation, hyperinflation, and periods of prolonged credit stress).

When it comes to trading, it's frequently a mistake to look for reasons, because they are often not known until it's far too late. In this case, there is no doubt we are in a period of extreme credit stress. Moreover, nearly every country on the planet is attempting to debase their currency simultaneously.

By those measures, gold should be acting well, and it is. Seasonals be damned.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.