Stock Market Rally Grinds to a Halt as Gold Advanced on China Demand

Stock-Markets / Financial Markets 2009 Apr 26, 2009 - 09:03 AM GMT “Words from the Wise” this week comes to you in a shortened format as my traveling in the US precludes me from doing my customary commentary. However, a full dose of excerpts from interesting news items and quotes from market commentators is provided.

“Words from the Wise” this week comes to you in a shortened format as my traveling in the US precludes me from doing my customary commentary. However, a full dose of excerpts from interesting news items and quotes from market commentators is provided.

On Friday, Federal Reserve regulators have released a white paper outlining the criteria they used to assess the financial health of the nation’s 19 biggest banks. On the same day they also briefed the banks about how their companies had fared in the examination. The banks will have until Tuesday to dispute any of the results before they are made public on May 4.

According to the Financial Times, senior Fed officials said US authorities will ask some of the country’s biggest banks to raise more capital following the completion of bank stress tests. The officials also indicated that a second, larger, group of banks will be asked to improve the quality of their capital by increasing their amount of common equity.

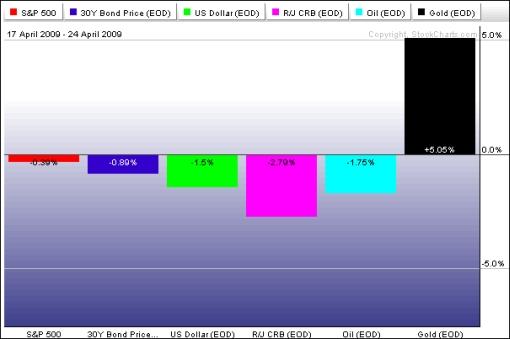

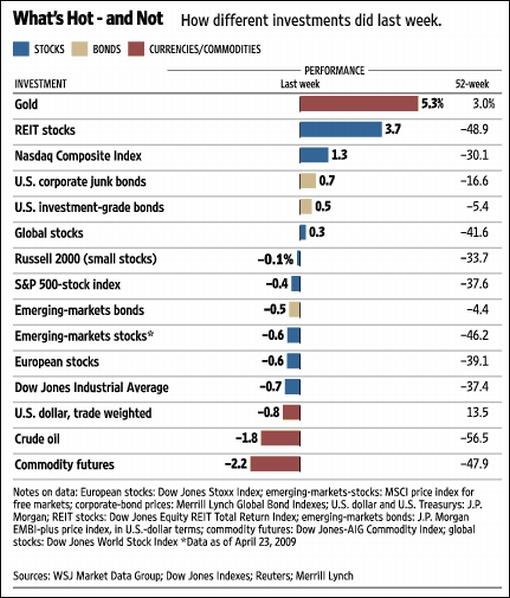

Last week investors’ mood was also influenced by tentative signs of economic stabilization in a number of countries and a barrage of earnings report - generally better than feared. As the equity rally ground to a halt on some bourses, the US dollar and government bonds offered little safety appeal and edged weaker. Gold, on the other hand, advanced after China revealed it has almost doubled its gold reserves since 2003. Treasury Inflation Protected Securities (TIPS) also improved on the week.

The performance of the major asset classes is summarized by the chart below, courtesy of StockCharts.com.

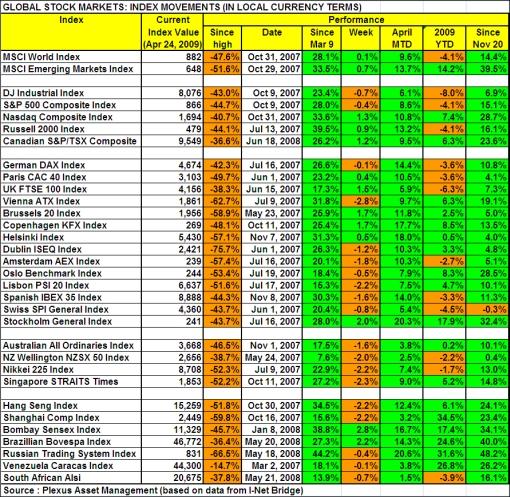

After rising for six consecutive weeks, global stock markets experienced a volatile week, including the worst losses since early March on Monday. In the end, the MSCI World Index gained 0.1% (YTD -4.1%) on the week and the MSCI Emerging Markets Index 0.7% (YTD +14.2%), but the S&P 500 Index shaved off -0.4% (YTD -4.1).

As far as the earnings season is concerned, Bespoke indicated that 156 S&P 500 companies had reported earnings by Thursday, beating estimates in 67% of the cases. Also, so far earnings are down 16.6% versus the first quarter of 2008. While down, this is much better than the -37.3% expected at the start of the earnings season. “The earnings season still has a long way to go, but the current trend has investors optimistic,” said Bespoke.

In an attempt to cast light on the debate of whether we are dealing with a bull market or a bear market rally, William Hester (Hussman Funds) highlighted the following: “Contracting volume is not enough evidence to qualify that this is a bear-market rally with certainty. There are other measures that are showing more strength - such as various indicators of market breadth. But new bull markets, whether at their inception or soon after, have a history of recruiting noticeable improvements in volume. So far this rally lacks that important quality. Over the next few weeks stock market volume will be a metric to watch closely.”

The stock market will show its hand in due course, but it is crucial that the lows of March 9 hold in order for base formation development to remain intact. Should these levels - 677 for the S&P 500 and 6,547 for the Dow Jones - be breached, further downside movements may be in store.

For more discussion on the direction of stock markets, see my recent posts “Video-o-rama: Economy - Recovery or relapse?” and “Has stock market rally run its course?” (And do make a point of listening to Donald Coxe’s webcast of April 24, which can be accessed from the sidebar of the Investment Postcards site.)

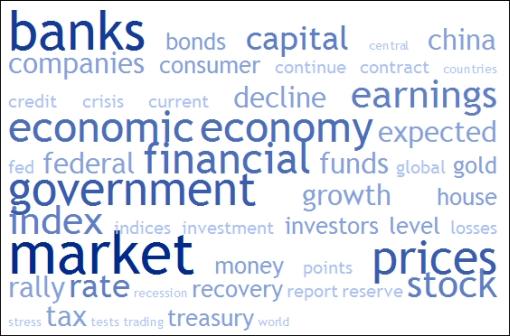

Next, a quick textual analysis of my week’s reading. No surprises here, with key words such as “banks”, “market”, “economy”, “economic”, “government” and “prices” featuring prominently.

Economy

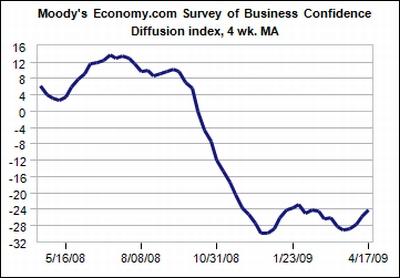

“Global business sentiment remains very poor, but it has taken on a slightly better hue in recent weeks. Broad assessments of current and prospective conditions have also moved up measurably since the beginning of the year,” said the latest Survey of Business Confidence of the World conducted by Moody’s Economy.com. “It is premature to conclude that businesses are turning measurably more upbeat, but recent survey results are somewhat encouraging.”

For a further perspective on the outlook for the global economy, also read my posts “Economic rate of decline slowing down?“, “Goldman raises China’s growth forecasts” and “Chinese economy on the rebound“.

A snapshot of the week’s US economic data is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

April 24

• New Home Sales appear to be stabilizing

• Durable Goods Orders report - weak, but pace of decline is moderating

April 23

• Sales of Existing Homes appear to be stabilizing at a low level

• Initial Jobless Claims erase part of the improvement seen in recent weeks

April 22

• House Price Index points to moderation in pace of decline

April 20, 2009

• Leading Index - continues to send message of weak economic conditions

• Chicago Fed National Activity Index shows a small but noteworthy improvement

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Apr 20 | 10:00 AM | Leading Indicators | Mar | -0.3% | -0.3% | -0.2% | -0.2% |

| Apr 22 | 10:35 AM | Crude Inventories | 04/17 | +3857K | NA | NA | +5670K |

| Apr 23 | 8:30 AM | Initial Claims | 04/18 | 640K | 620K | 640K | 613K |

| Apr 23 | 10:00 AM | Existing Home Sales | Mar | 4.57M | 4.70M | 4.65M | 4.71M |

| Apr 24 | 8:30 AM | Durable Orders | Mar | -0.8% | -2.0% | -1.5% | 2.1% |

| Apr 24 | 8:30 AM | Durable Orders, Ex-Auto | Mar | -0.6% | -1.5% | -1.3% | 2.0% |

| Apr 24 | 10:00 AM | New Home Sales | Mar | 356K | 340K | 337K | 358K |

Source: Yahoo Finance, April 24, 2009.

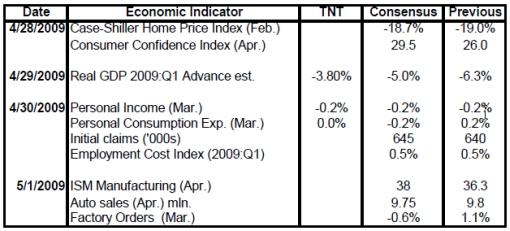

In addition to interest rate announcements by the Federal Open Market Committee (FOMC) (Wednesday, April 29) and the Bank of Japan (Thursday, April 30), the US economic highlights for the week include the following:

Source: Northern Trust.

Click here for a summary of Wachovia’s weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online, April 24, 2009.

“To find yourself, think for yourself,” said Socrates (hat tip: Charles Kirk.) And we know the stock market is a dangerous place if you don’t think rationally and know your own investment personality. Hopefully the “Words from the Wise” reviews will assist Investment Postcards readers in crystalizing their thoughts to come up trumps with their investment decisions.

That’s the way it looks from Cape Town (or, more accurately, from beautiful Dana Point, California, for the next few days).

Source: Slate.com

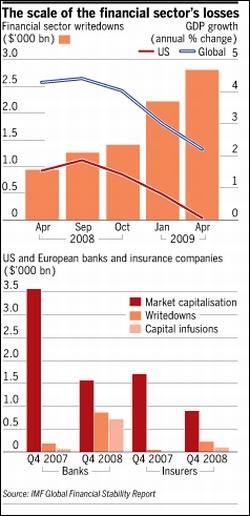

Financial Times: IMF puts financial losses at $4,100 billion

Financial Times: IMF puts financial losses at $4,100 billion

“The deteriorating global economy means financial institutions now face total losses of $4,100 billion on loans and other assets, the International Monetary Fund said on Tuesday, urging governments to take ‘bolder steps’ to shore up institutions - including nationalising them where necessary.

“The IMF said in its Global Financial Stability Report that many loans sitting on institutions’ balance sheets were eroding in value, not just the toxic sub-prime securities which first triggered the crisis.

“The IMF estimated that total writedowns on US assets would reach $2,700 billion, up from the $2,100 billion estimate it made in January and almost double what it forecast in October last year. Including loans originated in Japan and Europe, the writedowns would hit $4,100 billion, it added.

“Banks would bear about two-thirds of the losses, it said, with insurance companies, pension funds, hedge funds and others taking the rest.

“Efforts to cleanse these bad assets from balance sheets and replenish viable institutions with capital had so far been ‘piecemeal and reactive’, the IMF said, calling for more decisive government action.

“‘The current inability to attract private money suggests the crisis has deepened to the point where governments need to take bolder steps and not shrink from capital injections in the form of common shares even if it means taking majority, or even complete, control of institutions,’ it said.”

Source: Sarah O’Connor, Financial Times, April 21, 2009.

The New York Times: Regulators disclose criteria for bank “stress tests”

“Federal regulators released the criteria they used to assess the financial health of the nation’s 19 biggest banks on Friday, but provided little new information for investors to distinguish the industry’s weak players from the strong.

“In a 21-page report, the Federal Reserve regulators broadly laid out the tools they used to project bank losses if the economy worsens, and officials established an unspecified baseline to measure how much additional capital the banks should add as a buffer against higher losses. But they provided no concrete metrics to assess the depths of the troubles facing the industry or specific banks.

“Still, the Federal Reserve report suggested that regulators are focusing on the amount of capital that they want banks to hold in common stock, which makes it easier for them to absorb future losses as the recession wears on. That could force at least a handful of the 19 banks to raise significant amounts of new capital and could lead to greater government ownership stakes in the banks.

“‘Losses associated with the deepening recession and financial market turmoil have substantially reduced the capital of some banks,’ the Federal Reserve report on the stress test said. ‘Lower overall levels of capital - especially common equity - along with the uncertain economic environment have eroded public confidence in the amount and quality of capital held by some firms, which is impairing the ability of the banking system to perform its critical role of credit intermediation.’

“The stress test criteria were released as federal regulators started briefing top executives from the 19 large banks about how their companies fared on the examination. In closed-door meetings at the regional Federal Reserve Bank offices, the regulators plan to review their preliminary findings and inform bankers if they need additional capital. The banks will have until Tuesday to dispute any of the results before they are made public on May 4.”

Source: Eric Dash, The New York Times, April 24, 2009.

The New York Times: US may convert banks’ bailouts to equity share

“President Obama’s top economic advisers have determined that they can shore up the nation’s banking system without having to ask Congress for more money any time soon, according to administration officials.

“In a significant shift, White House and Treasury Department officials now say they can stretch what is left of the $700 billion financial bailout fund further than they had expected a few months ago, simply by converting the government’s existing loans to the nation’s 19 biggest banks into common stock.

“Converting those loans to common shares would turn the federal aid into available capital for a bank - and give the government a large ownership stake in return.

“While the option appears to be a quick and easy way to avoid a confrontation with Congressional leaders wary of putting more money into the banks, some critics would consider it a back door to nationalization, since the government could become the largest shareholder in several banks.

“The Treasury has already negotiated this kind of conversion with Citigroup and has said it would consider doing the same with other banks, as needed. But now the administration seems convinced that this maneuver can be used to make up for any shortfall in capital that the big banks confront in the near term.

“Each conversion of this type would force the administration to decide how to handle its considerable voting rights on a bank’s board.

“Taxpayers would also be taking on more risk, because there is no way to know what the common shares might be worth when it comes time for the government to sell them.

“Treasury officials estimate that they will have about $135 billion left after they follow through on all the loans that have already been announced. But the nation’s banks are believed to need far more than that to maintain enough capital to absorb all their losses from soured mortgages and other loan defaults.”

Source: Edmund Andrews, The New York Times, April 19, 2009.

Financial Times: US to put conditions on Tarp repayment

“Strong banks will be allowed to repay bailout funds they received from the US government but only if such a move passes a test to determine whether it is in the national economic interest, a senior administration official has told the Financial Times.

“‘Our general objective is going to be what is good for the system,’ the senior official said. ‘We want the system to have enough capital.’

“His comments come as Goldman Sachs, JPMorgan Chase and other relatively strong banks are pressing to be allowed to repay their bailout funds. On Sunday, Lawrence Summers, President Barack Obama’s top economic adviser, told NBC’s Meet the Press that repayments could eventually help the government provide further resources to help the sector. Such a move could also allow healthier institutions to differentiate themselves from weaker banks and free them from constraints on executive pay, and other activities, that come with bailout money.

“‘Not surprisingly different banks are in different situations; they are going need different levels of assistance of taxpayers,’ Mr Obama told a press conference at a summit in Trinidad on Sunday, while promising: ‘I’m not going to simply put taxpayer money into a black hole.’

“The official, meanwhile, said banks that had plenty of capital and had demonstrated an ability to raise fresh capital from the market should in principle be able to repay government funds. But the judgment would be made in the context of the wider economic interest. He said the government had three basic tests. It needed first to ‘make sure the system is stable’. Second, to not create ‘incentives for more deleveraging which would deepen the recession’. Third, to make sure the system had enough capital to ‘provide credit to support the recovery’.”

Source: Krishna Guha and Daniel Dombey, Financial Times, April 19, 2009.

Fox Business: Will banks make the grade?

“Rochdale Securities analyst Dick Bove on the 19 banks receiving government ’stress test’ results today [Friday]. Bove says the results could be dangerous to the overall economy and wonders if the banks that fail could raise capital either from the government or the marketplace.”

Source: Fox Business, April 24, 2009.

PBS: Bill Moyers talks to Simon Johnson and Michael Perino

“Bill Moyers talks about the economy and Wall Street’s future with Simon Johnson, former chief economist of the International Monetary Fund (IMF) and a professor at MIT Sloan School of Management, and Michael Perino, professor of law at St. John’s University and an advisor to the Securities and Exchange Commission.”

Source: Bill Moyers Journal, PBS, April 24, 2009.

Bill King (The King Report): Ken Lewis’s testimony

“NY AG Andrew Cuomo in a letter to Congressional Leaders about Ken Lewis’s shocking testimony:

‘Immediately after learning on December 14,2008 of what Lewis described as the “staggering amount of deterioration” at Merrill Lynch, Lewis conferred with counsel to determine if Bank of America had grounds to rescind the merger agreement by using a clause that allowed Bank of America to exit the deal if a material adverse event (”MAC”) occurred. After a series of internal consultations and consultations with counsel, on December 17,2008, Lewis informed then-Treasury Secretary Henry Paulson that Bank of America was seriously considering invoking the MAC clause. Paulson asked Lewis to come to Washington that evening to discuss the matter.

‘At a meeting that evening Secretary Paulson, Federal Reserve Chairman Ben Bernanke, Lewis, Bank of America’s CFO, and other officials discussed the issues surrounding invocation of the MAC clause by Bank of America. The Federal officials asked Bank of America not to invoke the MAC until there was further consultation. There were follow-up calls with various Treasury and Federal Reserve officials, including with 2 Treasury Secretary Paulson and Chairman Bernanke. During those meetings, the federal government officials pressured Bank of America not to seek to rescind the merger agreement. We do not yet have a complete picture of the Federal Reserve’s role in these matters because the Federal Reserve has invoked the bank examination privilege…

‘On the issue of terminating management and the Board, Secretary Paulson indicated that he told Lewis that if Bank of America were to back out of the Merrill Lynch deal, the government either could or would remove the Board and management. Secretary Paulson told Lewis a series of concerns, including that Bank of America’s invocation of the MAC would create systemic risk and that Bank of America did not have a legal basis to invoke the MAC (though Secretary Paulson’s basis for the opinion was entirely based on what he was told by Federal Reserve officials).

‘Secretary Paulson’s threat swayed Lewis. According to Secretary Paulson, after he stated that the management and the Board could be removed, Lewis replied, “that makes it simple. Let’s deescalate.” Lewis admits that Secretary Paulson’s threat changed his mind about invoking that MAC clause and terminating the deal. Secretary Paulson has informed us that he made the threat at the request of Chairman Bernanke. After the threat, the conversation between Secretary Paulson and Lewis turned to receiving additional government assistance in light of the staggering Merrill Lynch losses.’”

Source: Cuomo’s letter, April 23, 2009 (hat tip: The King Report).

Calculated Risk: BofA CEO - “Credit is bad, going to get worse”

“BAC CEO Ken Lewis on the conference call:

“‘Let me make a couple comments about our given environment. Credit is bad and we believe credit is going to get worse before it will eventually stabilize and improve. Whether that turn is later this year or in the first half of 2010, I’m not going to hazard a guess … For the rest of the year we look for charge-offs to continue to trend upward …”

Source: Calculated Risk, April 20, 2009.

CEP News: IMF revises down global growth estimates

“The International Monetary Fund expects the global economy to contract 1.3% in 2009, a downward revision from the previous forecast calling for a contraction of between 0.5% and 1.0%, according to its semi-annual report released on Wednesday.

“The Fund also said that in 2010 the global economy should grow 1.9% versus a previous forecast for 3% growth.

“‘This is not the time for complacency, and the need for strong policies, both on the macro and especially on the financial fronts, is as acute as ever,’ said IMF chief economist Olivier Blanchard. ‘But, with such policies in place, there is light at the end of this long tunnel. World growth can turn positive by the end of this year, and unemployment can start decreasing by the end of next year.’

“All G7 nations are expected to contract in 2009 with the US economy shrinking 2.8% in 2009, with zero growth in 2010.

“The Japanese economy is expected to contract 6.2% in 2009 and grow 0.5% in 2010, the euro zone economy is forecast to shrink 4.2% in 2009 and 0.4% in 2010, the Canadian economy is seen falling 2.5% in 2009 and growing 1.2% the following year, and the UK economy is expected to decline 4.1% in 2009 and 0.4% in 2010.

“‘These projections are based on an assessment that financial market stabilization will take longer than previously envisaged, even with strong efforts by policy-makers,’ according to Blanchard and José Viñals, head of the IMF’s Monetary and Capital Markets Department, in a joint statement.”

Source: CEP News, April 22, 2009.

BCA Research: From economic free-fall to sliding

“The flow of economic and earnings data has continued to beat expectations in recent weeks, helping to gradually heal investor sentiment.

“Our global leading economic indicator and boom/bust index have both ticked higher, albeit from historically depressed readings. Similarly, purchasing managers’ surveys and business confidence measures appear to have bottomed across the developed world, after free-falling late last year. Even last week’s release of the Fed’s Beige Book highlighted that the level of economic activity remains extremely weak, although slightly less so than the previous report.

“Still, the economy has merely shifted from falling off a cliff to sliding down a slope. The latter is certainly less terrifying and justifies the unwinding of Armageddon trades but is hardly bullish. Risk assets may continue to move higher from oversold levels over the next few weeks but sustained upside will require evidence that the spate of positive second derivative of growth indicators will turn into a meaningful recovery.

“Aggressive fiscal stimulus in most countries, combined with the potential for a positive inventory adjustment, should stabilize GDP growth in Q3 and Q4. However, an ongoing improvement in growth conditions will be reliant on fixing the global banking system and credit channels, allowing liquidity to begin flowing to the real economy. While our financial sector stress index has eased modestly, it remains extremely elevated. Similarly, bank lending surveys have improved but standards are not yet easing.

“Bottom line: Policymakers will need to continue acting aggressively for the recovery in risk assets to persist. We are positioned modestly in favor of reflation but prefer taking bets in fixed income spread product rather than equities due to relative value and a better yield pickup in case a sustainable upleg takes time to develop.”

Source: BCA Research, April 24, 2009.

Nouriel Roubini (Rediff News): End of economic gloom?

“Mild signs that the rate of economic contraction is slowing in the United States, China and other parts of the world have led many economists to forecast that positive growth will return to the US in the second half of the year, and that a similar recovery will occur in other advanced economies.

“The emerging consensus among economists is that growth next year will be close to the trend rate of 2.5%.

“Investors are talking of ‘green shoots’ of recovery and of positive ‘second derivatives of economic activity’ (continuing economic contraction is the first, negative, derivative, but the slower rate suggests that the bottom is near).

“As a result, stock markets have started to rally in the US and around the world. Markets seem to believe that there is light at the end of the tunnel for the economy and for the battered profits of corporations and financial firms.

“This consensus optimism is, I believe, not supported by the facts. Indeed, I expect that while the rate of US contraction will slow from -6% in the last two quarters, US growth will still be negative (around -1.5 to -2%) in the second half of the year (compared to the bullish consensus of +2%).

“Moreover, growth next year will be so weak (0.5 to 1%, as opposed to the consensus of 2% or more) and unemployment so high (above 10%) that it will still feel like a recession.

“In the euro zone and Japan, the outlook for 2009 and 2010 is even worse, with growth close to zero even next year. China will have a more rapid recovery later this year, but growth will reach only 5% this year and 7% in 2010, well below the average of 10% over the last decade.

“Given this weak outlook for the major economies, losses by banks and other financial institutions will continue to grow. My latest estimates are $3.6 trillion in losses for loans and securities issued by US institutions, and $1 trillion for the rest of the world.”

Click here for the full article.

Source: Nouriel Roubini, Rediff News, April 15, 2009.

Barry Ritholtz (The Big Picture): The (false) glimmer of hope

“Nice cover image from The Economist on the brown shoots.

“Excerpt: ‘But, welcome as it is, optimism contains two traps, one obvious, the other more subtle. The obvious trap is that confidence proves misplaced - that the glimmers of hope are misinterpreted as the beginnings of a strong recovery when all they really show is that the rate of decline is slowing. The subtler trap, particularly for politicians, is that confidence and better news create ruinous complacency. Optimism is one thing, but hubris that the world economy is returning to normal could hinder recovery and block policies to protect against a further plunge into the depths.’”

Source: Barry Ritholtz, The Big Picture, April 23, 2009.

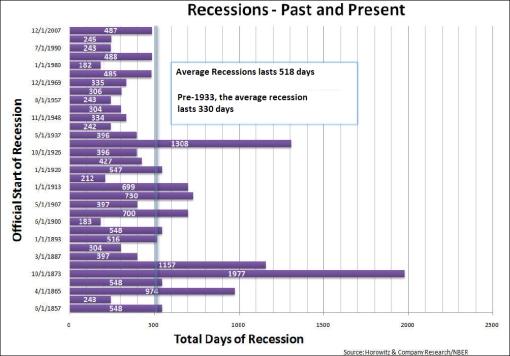

Horowitz & Company: Recessions - past and present

Source: Horowitz & Company, April 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.