Upside Down Gold Trend and the Great Credit Contraction

Commodities / Gold & Silver 2009 May 08, 2009 - 06:15 AM GMTBy: David_Morgan

John Exter was an internationally known banker and a gold bug in the true sense of the word. He graduated from Harvard and was present when Keynesian economics first came to the fore. He lived through World War I, witnessed the founding of the Federal Reserve, the Great Depression, and the establishment of the International Monetary Fund (IMF). He also presided over the New York Federal Reserve Bank. Mr. Exter’s work can be found on the Internet with a simple Google search.

John Exter was an internationally known banker and a gold bug in the true sense of the word. He graduated from Harvard and was present when Keynesian economics first came to the fore. He lived through World War I, witnessed the founding of the Federal Reserve, the Great Depression, and the establishment of the International Monetary Fund (IMF). He also presided over the New York Federal Reserve Bank. Mr. Exter’s work can be found on the Internet with a simple Google search.

One of his most famous quotes is, “The U.S. and world economies are on the threshold of a deflationary crash that will make the 1930s look like a boom. Gold will be the single best investment to own. Buy it now while it’s still cheap.”

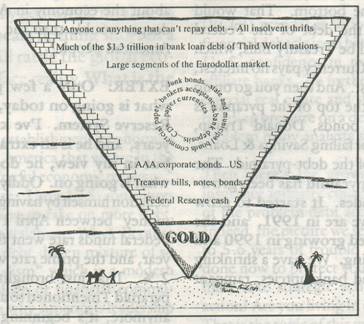

A pyramid is one of the most stable structures ever envisioned by humans. However, Mr. Exter is perhaps most famous for his inverted pyramid of how a debt-based monetary system is constructed.

Logically, an up side down pyramid implies one of the most “unstable” structures one can imagine.

Logically, an up side down pyramid implies one of the most “unstable” structures one can imagine.

Mr. Exter believed there would be a deflationary collapse rather than an inflationary blow-off. He stated that creditors would move down the pyramid out of the most illiquid debts. Looking at the pyramid, we almost have to hold back some amusement, from the standpoint of what was known in his day as "illiquid" compared to the casino fiasco, presently.

When Mr. Exter constructed his model, the top of the pyramid had junk bonds, failing banks, failing insurance companies, and, we might add, failed investment banks/brokerage houses. Creditors will get out of weak debts and move down the debt pyramid, to the very bottom! Near the bottom we find currency (dollar bills), even though they pay no interest. Next above currency are Treasury bills, issued by the government and backed by the Federal Reserve. They are almost as safe as currency notes, plus they pay interest. However, you have to liquidate the bills to get money of some sort to buy something.

The higher debtors sit in the pyramid, the less liquid they are, and this is why the Fed has become the “buyer of last resort.” No one wants to buy any of these toxic assets, and furthermore, no one really can price many of them, because in fact some are truly worthless. According to Mr. Exter, this explains why we are headed for deflation. Creditors will move out of debts high in the debt pyramid as many of them will fail through defaults & bankruptcies--that is deflationary.

At the bottom of the debt pyramid sits gold, the asset that needs no bank, Fed, or human “blessing” of any kind to be valued by both the individual and the banking system (although they hate to admit it) alike.

Has the rush to gold started? Yes, but barely, because only recently have we seen a nation admit they are moving into gold. China and of course the gold bugs have been buying since the recent bottom in 2000, but this pales in what this writer sees ahead; now that the structure is failing, more and more nations, institutions, and individuals will be heading to the bottom for safety and liquidity (gold).

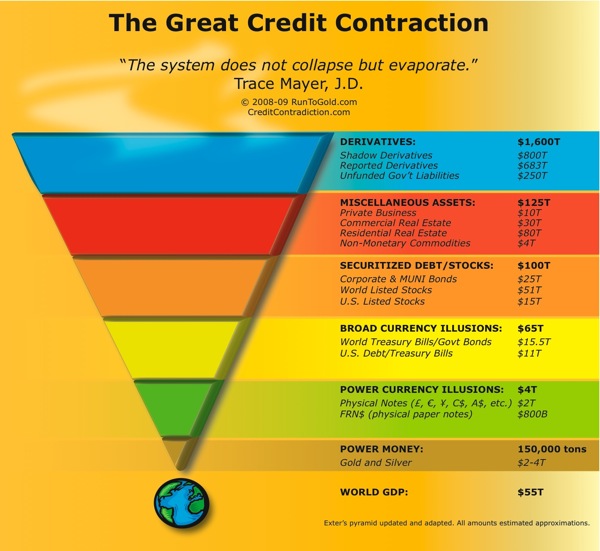

A new e-book titled The Great Credit Contraction has been written by a friend named Trace Mayer, J.D., and it gives us more insights into the current situation.

As can clearly been seen from a more modern form of the debt pyramid below, the broadest and most unstable “asset” class is the derivatives at the top. This is what is causing the current worldwide financial adjustment as the central banks continue to assure the markets that everything is going to be just fine, and they pump “money/credit” into the system until …??

CREDIT CRISIS AUTOPSY

The Great Credit Contraction is fine analytic work from Trace. He comes to the gold community with a different slant and background. He is a legal scholar with an emphasis on the Constitution, focusing on gold and currency issues. In his e-book, one can read about the historical significance of a crisis that will surely reshape the world. The global economy is built on an illusion currency that is evaporating before our very eyes. This book is an autopsy of the current worldwide systems and begins with financial history, discusses the current great deflationary credit contraction, projects the future environment, and concludes with suggestions on how to protect, preserve, and generate wealth in this challenging time. An appendix analyzes important topics. Click here to order.

It is an honor to be.

Sincerely,

David Morgan

Mr. Morgan has followed the silver market for more than thirty years. He wrote the book, Get the Skinny on Silver Investing. Much of his Web site, Silver-Investor.com, is devoted to education about the precious metals, it is both a free site and does have a members only section. To receive full access to The Morgan Report click the hyperlink.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

David Morgan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.