A Kamloops BC Copper/Gold Junior Giant

Commodities / Gold & Silver Stocks May 11, 2009 - 08:58 AM GMTBy: Richard_Mills

Abacus Mining AME.tsx-v (amemining.com) signed a deal with Teck Cominco (TC) in 2002 to earn into a group of claims around the old Afton mine site ten kilometers southwest of city center Kamloops, British Columbia. TC had been mining the Afton pit, as well as other pits (Ajax) to run its 10,000 tonne per day (tpd) copper/gold operation until mining was suspended in 1997 because of low copper prices.

Abacus Mining AME.tsx-v (amemining.com) signed a deal with Teck Cominco (TC) in 2002 to earn into a group of claims around the old Afton mine site ten kilometers southwest of city center Kamloops, British Columbia. TC had been mining the Afton pit, as well as other pits (Ajax) to run its 10,000 tonne per day (tpd) copper/gold operation until mining was suspended in 1997 because of low copper prices.

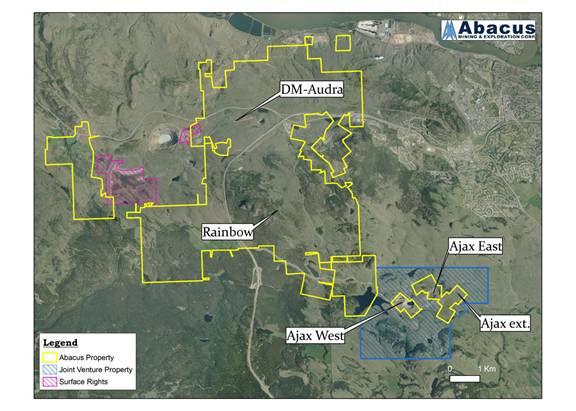

Abacus also bought the infrastructure at the old Afton mine from Teck. The infrastructure includes a tailings impoundment (An independent evaluation concluded that the tailings pond can be upgraded to hold 250 million tonnes of new material), water rights, mill and shop buildings, rights of way and surface rights.

Abacus Mining has been advancing and developing it’s multiple copper porphyry deposits in the Afton Mining Camp since 2002 and now has an updated (January 2009) NI 43-101 resource estimate on the Ajax project which states the resource area has 365 million tonnes, measured and indicated, grading 0.31% Cu and 0.20 g/t Au, which contains 2.51 billion lbs of Cu, and 2.29 million ounces of Au. This 365 million tonne resource is an in pit resource, meaning it is totally contained within the proposed Ajax pit walls, it is not a property wide global resource.

That’s 365,000,000 tonnes of $19.15 rock at $905 gold and $1.95 copper. An in situ (in ground value) of almost $7,000,000,000.00 with enormous blue-sky potential to drastically increase the size of the resource on both the JV ground and AME’s 100% owned ground! As it stands right now there’s $5.6 billion worth of metal on AME’s 100% held ground and $1.4 billion on JV ground of which the lion’s share, $840,000,000.00 belongs to AME. Abacus, using the metal prices quoted above, controls $6.44 billion dollars of copper and gold ten minutes outside a major mining center and just a few hours by rail from a major deep-sea port.

The resource estimate is based on 415 exploration drill holes totaling over 142,560 meters. The resource area encompasses Ajax East and West, as well as the AME / NGD.tsx joint venture land in between. Abacus President Doug Fulcher expects a single massive open pit to be built encompassing both Ajax East & West and the JV lands between the two Ajax’s as geological information gathered to date suggests there is one very large mineralized body, rather than three smaller deposits.

After what has been a series of obviously extremely successful drill programs management plans to complete a preliminary economic assessment by May 2009 that contemplates a 60,000tpd operation. This would mean a mine life of approximately 17 years based on today’s existing resource. The preliminary economic assessment will be immediately followed by a pre-feasibility study to be completed in Q3, 2009. Abacus management is under the opinion that the new resource coupled with the existing infrastructure will allow the company to move quickly towards production in 2012.

NGD Joint Venture

Abacus holds a 60% interest in, and would be the operator of any open pit operation occurring on joint venture land to a maximum pit depth of 500 meters. 20% of AME’s current resource is located on joint venture ground and the bulk of this resource lies between the Ajax West and Ajax East deposits. The company holds 100% interest in resources located within their own property boundaries, the newly discovered Ajax Extension is not part of the JV and is 100% owned by AME.

Bluesky Potential

There is a tremendous amount of potential left on Abacus’s 100% owned claims to add to the resource total. Besides the 365 million tonne resource there are several other areas of known mineralization on they’re 100% owned +8,000 hectare property.

*Rainbow Zone and DM-Audra Zone mineralization are NOT included in AME’s Ajax resource of 365,000,000 tonnes.

The newly discovered Ajax Extension (old Monte Carlo). In December 2008 Abacus geologists identified a new mineralized fault offset block of the Ajax deposit approximately 200 meters east of the Ajax East pit. Five holes were drilled into the Ajax Extension but were not included in the 43-101 compliant resource estimate. The extension area is wide open for exploration due to the lack of outcrop in the area and little previous work.

Ajax Extension Drill Highlights

- Hole AM-08-013 intersects 192 meters (629.9 feet) averaging 0.44% copper and 0.33 g/t gold; including 97 meters (318.2 feet) averaging 0.60% copper and 0.40 g/t gold. These intercepts lie within a 371 meter (1217.2 feet) long intercept averaging 0.32% copper and 0.25 g/t gold.

- Hole AM-08-014 intersects 39.7 meters (130.2 feet) averaging 0.44% copper and 0.26 g/t gold; including 26.7 meters (87.6 feet) averaging 0.58% copper and 0.35 g/t gold. Further down the hole, it intersects a separate 18 meter (59.1 feet) intercept averaging 0.59% copper and 0.22 g/t gold.

- Hole AW-08-015 intersects18 meters (59.1 feet) averaging 0.72% copper and 0.25 g/t gold; and a 30.2 meter (99.1 feet) intercept averaging 0.60% copper and 0.30 g/t gold; including 16 meters (52.5 feet) of 0.98% copper and 0.50 g/t gold.

There are also underground mining possibilities, the company has never run out of grade when drilling anywhere on their property and indeed the grades increase with depth.

There might be an opportunity to increase the resource on the JV property.

I believe there is the very real possibility of Abacus increasing the existing resource by at least 50% and perhaps as much as doubling it.

Metallurgy

Chalcopyrite is the dominant copper mineral and occurs as veins, veinlets, fracture fillings, disseminations and isolated blebs in the host rock. Gold mineralization is directly correlated with copper concentrations, where there’s copper there’s gold.

Metallurgical work has been ongoing and we can expect more information in the Preliminary Economic Assessment (PEA), which is due soon.

Share Structure

Issued and Outstanding 122,545,679

Stock Options 11,420,000

Warrants 6,516,578

Fully Diluted 140,482, 257

Treasury

The last decade has seen a pine beetle problem that has devastated the forest in the area. The northern part of the Provinces economy has been based almost exclusively on logging but because of the recent Lodge Pole Pine Beetle infestation and the resulting destruction of a large part of the working forest the Liberal government is actively trying to diversify the northern economy and mining is hoped to play a large part in the plans success. The upside of BC’s pine-beetle infestation is a government rebate, the Mineral Exploration Tax Credit (METC), a 30% rebate on exploration hard dollars spent in declared bug kill areas of the province. Abacus has $1.9 million in its treasury and debt of $2.5 million. $3.2 million is coming from the BC government’s METC rebate program.

The Team / Management

This management group, being under one roof like it is, should be sending a strong signal to potential investors that they are there to build a mine and have the talent and knowledge necessary to get the job done. It’s a very impressive team, these guys build, operate and fine tune world class mines, they have personal relationships with top mining people and companies throughout the world.

The high level and enormous volume of work they’ve completed in the last year is staggering, the 43-101 was done to meet PEA specifications, the PEA will be very close to a pre-feasibility which will be very close to a full bankable feasibility. This management team is operating ahead of the curve and are quickly advancing the Ajax prospect down the development path towards being a mine.

Complete biographies on each team member are on Abacus’s website, www.amemining.com, I’m sure you’ll be as impressed as I am.

Conclusion

These days when I look at base metal plays my preference is copper with gold credits.

Copper will be the next sector of the mining industry to pick up after gold.

It is irreplaceable in a number of uses and it is in relatively short supply.

Abacus, with its massive copper/gold project so close to a major mining center and a deep sea port is an extremely undervalued junior. With the recent additions to its management board and all they have managed to accomplish in so short a time I expect this project to move forward quickly and attract a lot of attention.

If you're interested in the junior resource market and would like to learn more please come and visit us at www.aheadoftheherd.com

By Richard (Rick) Mills

Copyright © 2009 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.