Wave of Small Bank Failures Following Commercial Real Estate Losses

Companies / Credit Crisis 2009 May 19, 2009 - 06:21 PM GMTBy: Mike_Shedlock

Wall Street Journal Study of 940 Lenders Shows Potential for Deep Hit on Commercial Real Estate. Please consider Local Banks Face Big Losses.

Wall Street Journal Study of 940 Lenders Shows Potential for Deep Hit on Commercial Real Estate. Please consider Local Banks Face Big Losses.

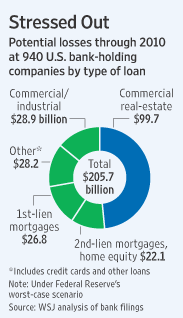

Commercial real-estate loans could generate losses of $100 billion by the end of next year at more than 900 small and midsize U.S. banks if the economy's woes deepen, according to an analysis by The Wall Street Journal.

Commercial real-estate loans could generate losses of $100 billion by the end of next year at more than 900 small and midsize U.S. banks if the economy's woes deepen, according to an analysis by The Wall Street Journal.

Such loans, which fund the construction of shopping malls, office buildings, apartment complexes and hotels, could account for nearly half the losses at the banks analyzed by the Journal, consuming capital that is an essential cushion against bad loans.

Total losses at those banks could surpass $200 billion over that period, according to the Journal's analysis, which utilized the same worst-case scenario the federal government used in its recent stress tests of 19 large banks.

Under that scenario, more than 600 small and midsize banks could see their capital shrink to levels that usually are considered worrisome by federal regulators. The potential losses could exceed revenue over that period at nearly all the banks analyzed by the Journal.

That $200 billion is in addition to the $599 billion that the 19 stress-tested banks could face if the adverse stress test scenario comes true.

Given the baseline scenario was more like a cake-walk than a stress test, it is reasonable to assume another $800 billion is going to be needed by banks. 58 banks have been seized since 2008, 33 of them this year. More are coming and the FDIC is preparing for them.

FDIC to Open a Temporary East Coast Satellite Office

Inquiring minds are reading FDIC to Open a Temporary East Coast Satellite Office.

The Federal Deposit Insurance Corporation (FDIC) today announced it will open a temporary satellite office in Jacksonville, Florida, to manage receiverships and to liquidate assets from failed financial institutions primarily located in the eastern states.

After conducting a competitive leasing acquisition process, the FDIC entered into a short-term agreement to lease space at 7777 Baymeadows Way in Jacksonville. The decision was based on mission needs and workload.

The new office will provide facilities for up to 500 nonpermanent staff and contractors. Staffing will be based on the workload needs of this office, based on the number of closings in the eastern states, the resulting number of receiverships, and the post-closing workload.

Throughout its history, the FDIC has used these offices to keep temporary asset resolution staff closer to the concentration of failed bank assets they oversee. As the work diminishes, the temporary satellite offices are closed.

The FDIC expects to gradually move into the space starting in mid-September 2009.Expect a wave of failures starting no later than September.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.