Fed's Economic Forecast Worsens; Still Ridiculously Optimistic

Economics / Recession 2008 - 2010 May 21, 2009 - 11:54 AM GMTBy: Mike_Shedlock

The peak in initial claims might be in but the peak in unemployment is nowhere close. Continuing claims hit 6.66 million, setting a record for the 16th straight week.

The peak in initial claims might be in but the peak in unemployment is nowhere close. Continuing claims hit 6.66 million, setting a record for the 16th straight week.

Please consider the Department of Labor Weekly Claims Report.

Seasonally Adjusted Data

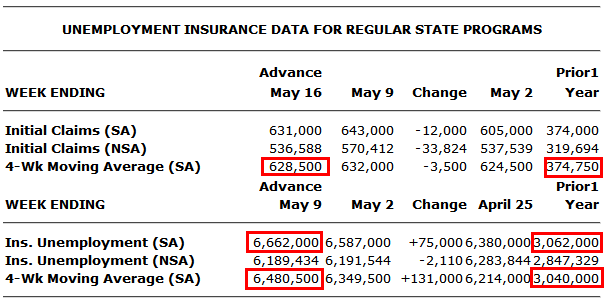

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 631,000, a decrease of 12,000 from the previous week's revised figure of 643,000. The 4-week moving average was 628,500, a decrease of 3,500 from the previous week's revised average of 632,000.

The advance seasonally adjusted insured unemployment rate was 5.0 percent for the week ending May 9, an increase of 0.1 percentage point from the prior week's unrevised rate of 4.9 percent.

The advance number for seasonally adjusted insured unemployment during the week ending May 9 was 6,662,000, an increase of 75,000 from the preceding week's revised level of 6,587,000. The 4-week moving average was 6,480,500, an increase of 131,000 from the preceding week's revised average of 6,349,500.Weekly Claims

Last week I said ...

Economists expect to see unemployment by 10% at the end of the year. I expect to see it at 9.8%+- by August and approaching 11% by the end of the year. Bear in mind the "stress-free tests" conducted by the Fed had an adverse scenario of 10.3% at the end of 2010.

Green Shoots Not So Green

The Fed is fessing up that the green shoots are not as green as they thought. Please consider Fed's economic forecast worsens.

Central bank now expects unemployment to rise to a range of 9.2% to 9.6% this year. Fed also predicts a sharper decline in GDP than it had forecast in January.

The Federal Reserve's latest forecasts for the U.S. economy are gloomier than the ones released three months earlier, with an expectation for higher unemployment and a steeper drop in economic activity.

The Fed's forecasts, released as part of the minutes from its April meeting, show that its staff now expects the unemployment rate to rise to between 9.2% and 9.6% this year. The central bank had forecast in January that the jobless rate would be in a range of 8.5% to 8.8%, but the unemployment rate topped that in April, hitting 8.9%.

The Fed also now expects the gross domestic product, the broadest measure of the nation's economic activity, to post a drop of between 1.3% and 2% this year. It had previously expected only a 0.5% to 1.3% decline.Fed's New Range 9.2-9.6% is Ridiculous

Is Bernanke dense enough to actually believe that revised forecast or is he a liar? Either way, when you are losing 500,000+ jobs a month, for months on end, with current conditions as described in Jobs Contract 16th Straight Month; Unemployment Rate Soars to 8.9%, one can easily see how silly the forecast is. Unemployment is likely to be at 9.2% next month!

Expect many more downward revisions if the Fed is going to be this disingenuous.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.