Gold and Silver - Yes, they do ring a bell!

Commodities / Gold & Silver May 24, 2007 - 01:12 AM GMTBy: Peter_Degraaf

The challenge is to be able to hear it when it is ringing.

The good news is that the bells for silver and gold are starting to ring again! Initially only a few people can hear them. In this essay we will look for these bells, and check to find out if they are loud enough to excite those investors who like to ‘buy low and sell high'. After all before we can sell high, we must first buy low!

First some fundamentals:

• The money needed for gold to rise, is already in the system! According to a recent report in the Economist, money supply in the following countries is rising at a rate in excess of 8% per year: Australia , Britain , Canada , China (19%!), Denmark, Euro-land, Sweden and the USA. According to sources who track the US M3, that measure is currently rising by 15% per annum. We live in a period unparalleled in history! Every major country is involved in monetary inflation, all at the same time! Not that Zimbabwe is a ‘major', but inflation there is over 1,000%.

• The supply of gold is drying up! Global gold production is down by 8%! Even South Africa and Australia are producing less gold, and in most industrialized countries, the regulations for starting a new gold mine, even after gold has been discovered, require many millions of dollars, and up to ten years, before production can even start.

• The mining industry is running out of qualified people! There are very few WW2 generation miners left in the workforce, and the Boomers are getting ready to retire. Due to the bear market in resources from 1981 to 2000, not enough people chose a mining profession as a career. It is estimated that the labor shortage will last until at least 2014.

• The central banks are rapidly approaching the point where they simply will not sell any more gold, because history has taught us that when fiat money collapses, (and fiat money always eventually collapses), the only way back to normalcy is to introduce new money, backed by gold.

• Central banks in developing countries are contemplating converting foreign cash and bonds into gold. According to figures compiled by the World Gold Council and reported 02/2007 AD, some of the following central banks would like to improve the ratio between paper and gold. (Foreign central banks hold five trillion dollars worth of non-gold (paper) reserves).

Country Gold reserves (tonnes) Percentage of reserve assets.

China 600 1.07%

Hong Kong 2 0.03%

India 358 3.85%

Japan 765 1.65%

Korea (S) 14 0.12%

Singapore 127 1.76%

Taiwan 423 2.97%

I read an interesting statistic about China . If you were to stand on a street corner in Beijing , and you watched a parade of Chinese, consisting of every citizen in China , marching 6 abreast, the parade would never end. One of the sad aspects of Chinese life, is the intolerance of the communist government towards any kind of religious activity. There are currently 20 million people in prison for ‘religious crimes'. (Source: Voice of the Martyrs).

• US gold reserves are somewhat ‘suspect' . According to the World Gold Council, current US official gold holdings are reported as 8,133 tonnes. The last time this gold was audited was in 1953! At that time the gold was referred to as: ‘gold bullion reserves'. In 2001 the description was changed to: ‘custodial gold bullion'. Six months later the description was changed again, to: ‘deep storage gold'.

Could it be that the gold has been sold and or leased, and has been replaced by gold that is still in the ground, yet to be mined, possibly committed to the government by one or more mines?

• In the US there close to 10,000 mutual funds that, because of regulations, cannot sell stocks ‘short'. If and when the Dow and NASDAQ turn down, and the mutual fund managers no longer wish to invest in generic stocks because of a ‘down-trend', they will pile into the resource sector.

• US debt is ballooning. Federal debt is 8 trillion dollars. Social Security liability is 20 trillion dollars, Medicare Liabilities total 32 trillion dollars. Total indebtedness is 60,000 billion dollars. A billion seconds ago was 1959. A billion minutes ago was the life of Jesus. A billion dollars ago, in the spending cycle of the US government, was 8 hours ago.

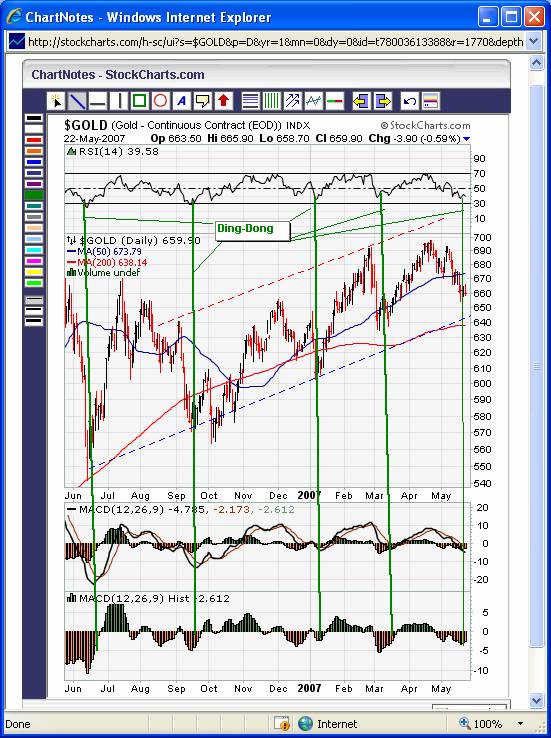

Let's look and see if we can find a few ‘bells being rung' to let us know that the trend in gold is continuing its rise. Charts courtesy of www.stockcharts.com

Well what do you know! The bells are ringing again! Every green vertical line is a bell that was rung. Three of the past four were ‘right on', while one (September), was 10 days early. According to successful traders, “in a bull market, every dip near the 200 DMA (daily moving average – red line on this chart), is an opportunity to buy. Even those who listened to the ‘bell that rung' in September, made out OK, providing they hung in there, aided by the fact that the 200 DMA kept rising.

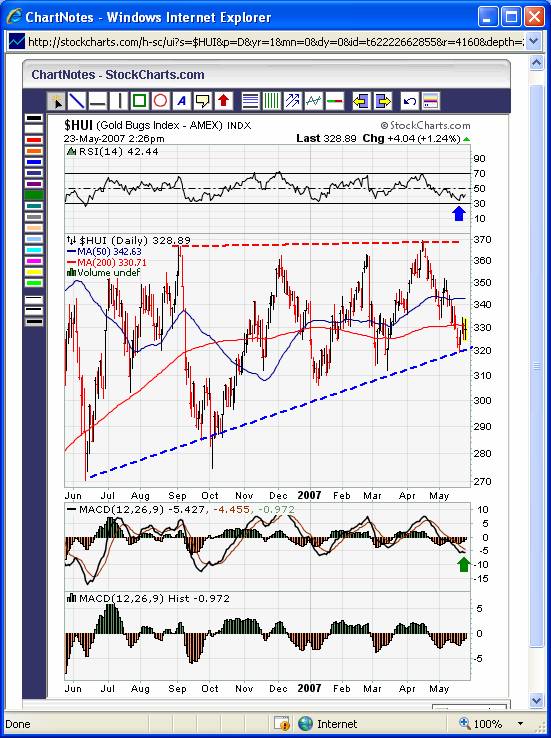

Featured is the HUI index of unhedged mining stocks. The chart pattern is positive. Price has bounced up off the advancing trendline, the RSI is rising up from oversold territory, (blue arrow), the MACD is getting ready to bottom out in the seven month old support area (green arrow). The 50 DMA and 200 DMA (blue and red lines), are in positive alignment to each other. “Looking good!”

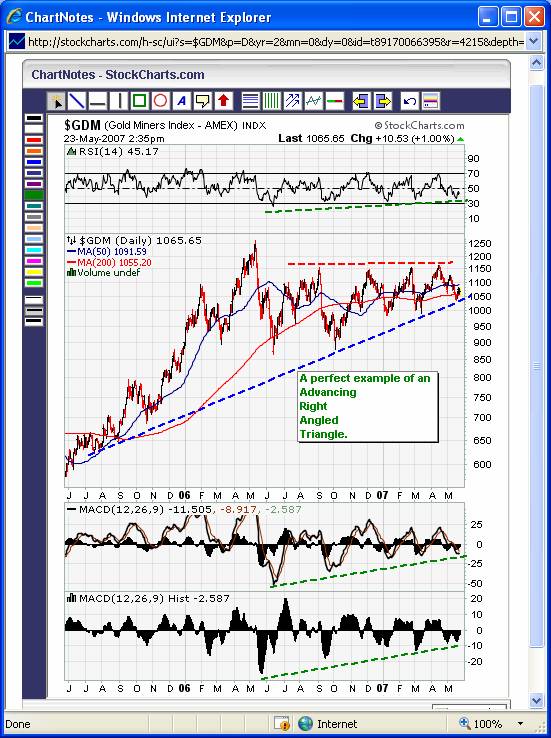

One look at this chart should convince even a skeptic that the bull market in gold is ‘alive and well', and that the current upturn, away from the rising trendline is one more ‘bell being rung!'

Silver is just waiting for a ‘bell to be rung'. As soon as we see a solid close above the green resistance line (green arrow), the 'bell will be ringing'. The blue dashed lines indicate support, and as the pro's say: “In a bull market every dip near the 200 DMA is a buying opportunity”

===============================================

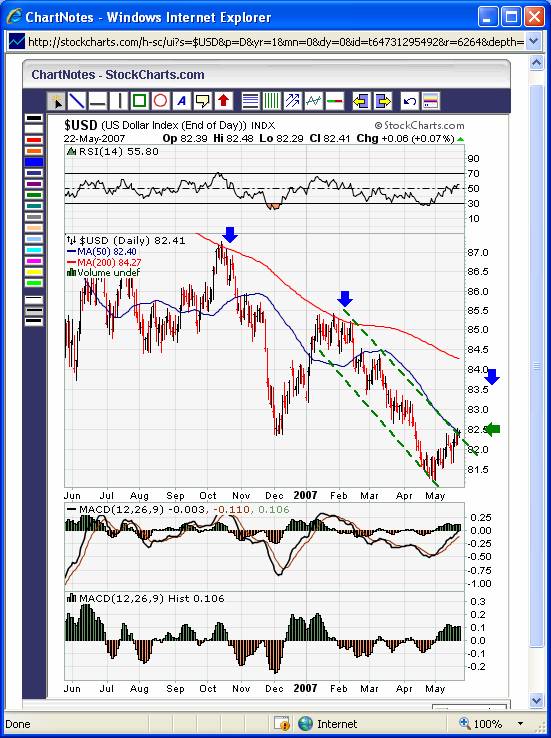

Featured is the US dollar index. The green ‘speed-lines' show the five month down-trend. The green arrow is the immediate target which has now been reached. A drop below 81.50 will indicate that the green target was ‘it'. Two closes above the green arrow, establishes a target at the 200DMA (blue arrow), something that has happened twice before. The latter event would likely be a temporary ‘drag' on the metals.

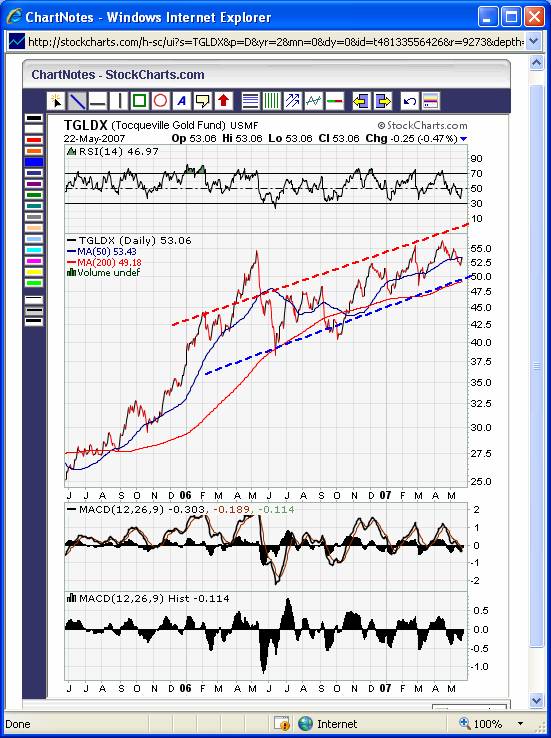

Featured is the TGLDX gold fund. This is a very well managed fund. Everything about this chart spells: UP AND AWAY! The latest downswing in the gold bullion price, (which lasted about a month), barely made a dent in this chart. Price never even came near the 200DMA!

Summary:

The COT report for gold positions dropped last week, from 173,000 147,000 which is positive, and the total could be even lower this week, as price was down for a day or so after the report was issued.

According to Julian Philips, every day 90,000 new bank accounts are opened in China . The Chinese have loved gold for millennia, and the only way they can legally obtain it is through a bank.

One of the ‘hottest' jewelry fashions in China is a ‘hollow gold ball'. It consists of a gram of gold, shaped like a ball, and worn on a chain.

The precious metals look great. After a month in down-trend, the first few bells are ringing, and more bells can be expected to ring as these markets turn up.

> Freebee! Every investor should read a classic book titled: ‘Fiat money, Inflation in France ', by Andrew Dickson White. It can be downloaded for free! www.gutenberg.org/etext/6949

By Peter Degraaf.

Peter Degraaf is an online stock trader with over 50 years of metals trading experience. He sends out a weekly E-mail to his many subscribers. For a 60 day free trial, contact him at ITISWELL@COGECO.CA

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.