U.S. Housing Bust: The Epic Garage Sale of America Is Under Way

Housing-Market / US Housing May 28, 2009 - 01:53 AM GMTBy: Graham_Summers

“Everyone’s furious at him” - In the last 18 months, the topics under discussion at my local café have shifted genres from comedy to horror. I know the CNBC news anchors are high-fiving over the alleged jump in consumer confidence. But if you judge sentiment based on un-massaged data points like the conversations in the café down the street, things aren’t improving.

“Everyone’s furious at him” - In the last 18 months, the topics under discussion at my local café have shifted genres from comedy to horror. I know the CNBC news anchors are high-fiving over the alleged jump in consumer confidence. But if you judge sentiment based on un-massaged data points like the conversations in the café down the street, things aren’t improving.

Back in 2006, I almost stopped going to the place because I was so sick of hearing the clientele blathering about “the Dow going to 20,000” or “geniuses” flipping McMansions like hotcakes. It’s not that I don’t enjoy the good times. It’s just that I knew those good times were illusory, fueled by a credit bubble that was primed to burst. So I hope you’ll forgive me when I say that hearing my local realtor explaining how “you can’t lose buying real estate” to his clients over a cappuccino in August 2006 always left a bad taste in my mouth.

However, in the last year or so, the conversational tones have changed dramatically. I never see realtors in the place anymore. And the conversational topics all center on ravaged 401(k)s, questioning whether it’s time to finally buy gold, or simply pull out one’s money (in spite of a 37% market rally since March).

However, even these horror stories pale beside what I heard last night. A man (50ish) and his wife were sitting at the table next to mine talking with their niece about their home (one of several) in Port St Lucie in Florida.

According to the man, his neighborhood is one of the best in the area with prices ranging from $700K to $8 million (judging from his watch and wife’s jewelry, they were in the upper range of homes there).

Apparently, one of their neighbors has single-handedly destroyed the neighborhood’s property value by recently accepting a low-ball offer for his home. Two years ago, he’d turned down an offer for $400K, thinking it too low. However, he’s since lost his job and is unable to make his mortgage payments. With Florida’s real estate market at a virtual standstill, he took the only offer he received, a mere $180K.

That one sale has pulled down the entire neighborhood’s property values like a stone. You’d have to go back nearly 20 years to find a comparable sales price for the neighborhood. No one else even wants to consider listing their home unless they absolutely have to.

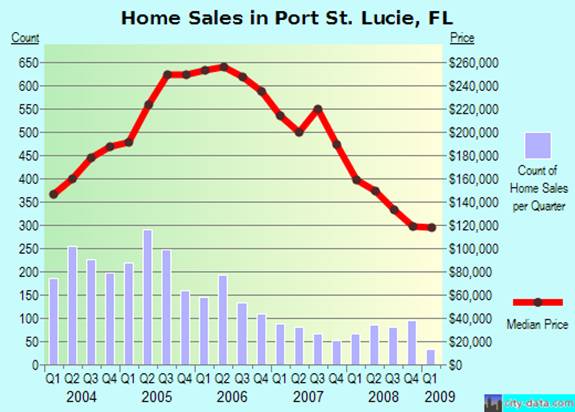

Port St Lucie, like most of the US, has been hit by the housing bust with median home prices falling more than 50% since 2006 (see the chart below). However, according to the gentleman sitting at the table beside mine last night, the high-end market wasn’t hit as hard as cheaper demographics… until last month.

These kinds of stories are popping up more and more often in the media. The Wall Street Journal recently ran a story on the Peacock family in Florida holding an auction for their 10,000 square foot home, “featuring 100 hunting trophies -- including a hyena and the head of an elephant.” http://online.wsj.com/article/SB124268209889631903.html

I wrote about this topic of “private de-leveraging” back in September 2008, predicting the entire world would be like a giant garage sale. With luxury homes selling for $180K and stuffed wildebeest selling for $250, it’s looks like the garage sale is in full swing. If you’re sitting on cash and want to finally buy some of those toys you dreamt about as a kid, start scrolling eBay, Craigslist, and local auctions. Everything from Ferraris to Tuscan Villas is on sale.

Just make sure the neighbors don’t hate you for ruining their property values.

Good Investing,

By Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.