Stock Market Consolidation Continues... Nasdaq Leading

Stock-Markets / Stock Index Trading May 30, 2009 - 10:42 AM GMTBy: Jack_Steiman

There is a lot of anxiety out there. You can feel it. It has an energy. It has a vibration to it. It's the feeling of fear. The feeling that things are about to fall apart. Like we're sitting on the precipice of disaster. Maybe we are. Are we? You want to try and anticipate things if you're a market player. You want to be ahead of the next big move. We've been lucky enough or fortunate enough to be able to do that the past many years. One of the ways that gets done is when you see something technically that goes against the grain of the current trend.

There is a lot of anxiety out there. You can feel it. It has an energy. It has a vibration to it. It's the feeling of fear. The feeling that things are about to fall apart. Like we're sitting on the precipice of disaster. Maybe we are. Are we? You want to try and anticipate things if you're a market player. You want to be ahead of the next big move. We've been lucky enough or fortunate enough to be able to do that the past many years. One of the ways that gets done is when you see something technically that goes against the grain of the current trend.

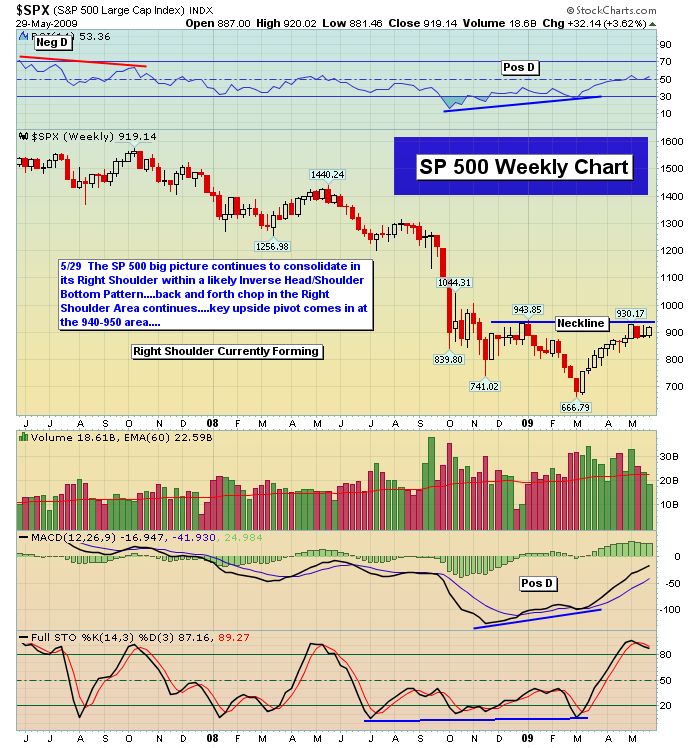

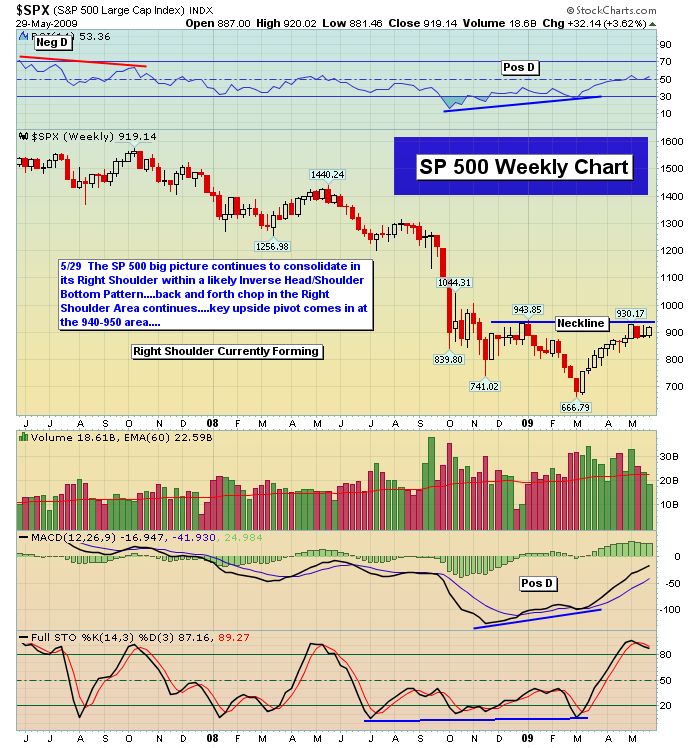

We know the current trend is higher. We broke through the 50-day exponential moving averages and the S&P 500 neckline to boot at and the market has not broken those levels since it took place. There's a belief that markets can only go so far once a bear market rally has taken place. You get to those 200-day exponential moving averages and the rally is toast. Maybe it all will come crumbling down, but I ask the bears, where is the technical evidence that this is about to happen? We've spent five weeks consolidating a prior seven-week manic upside move. What's not normal about that?! Have we lost any critical levels of support? No, we have not. We have held the 50-day exponential moving averages with no problem. We have had two tests of that 875 neck line I've drilled in to your heads. We're simply in a right side handle or lateral consolidation. I'll say it again, maybe it does come crashing down, but there is no evidence to such as event from a purely technical perspective. Lateral consolidation sounds harmless. Lateral seems easy enough.

Consolidation seems easy enough. They're the toughest emotional combination on Wall Street. The whipsaw created, once the channel has been established price wise, can be devastating. Stocks set up bullish. Stocks set up bearish. The whipsaw flips them upside down. Then right side up but before they're made right, you get chased out because the emotional component takes over. Lateral consolidations are a traders worst enemy. Don't let anyone tell you to the contrary. If they say otherwise, they're not being honest. They offer no sense of trust. They feel like trend changers because the trend in place (this time up) has stopped dead in its tracks thus things must be ready to turn back down is what it feels like. That's not at all what's necessarily going on. We'll know in time. I can only say that there is no evidence that says we're about to get crushed. If and when we lose the 50 day exponential moving average on the SPX then we can say we're in trouble. That's at 868 and rising slowly every day we trade above that level. For now we respect the trend in place and the lateral consolidation for what it is. It allows overbought daily oscillators to unwind. Nothing more and for now, nothing less.

What's begun to happen is now the indexes are using those 20-day exponential moving averages to act as big time support on any selling. That's a change of trend positive as they are above the 50-day exponential moving averages and thus providing some additional support for those critical areas of price. 894 on the SPX is the 20 day and now is acting as real support to protect 868.

The further up the 20 climbs, and it is climbing daily, the healthier the support gets. The 20 days are also acting like an ascending bottom, for as it rises daily and acts as support, it's creating higher lows on all pullbacks and this too should be construed more as a bullish indicator. weaker markets tend to ignore the 20-day averages and make a bee line right for the 50-day moving averages which then are threatened more easily in terms of losing that critical support area. As long as we're seeing the 20's come to the rescue of the 50's, you have to hold a more bullish slant on things.

The financial's are looking pretty good here and a strong break out of its current triangle would set this market up even better. A breakout of that triangle would have the bears covering rather quickly. The financial's made a decent move very late in the day and if this continues somehow on Monday, a breakout would occur. Some overbought big caps did pull back today to relieve an overbought market, such as Research in Motion (RIMM), but notice how the market still found enough heavy weighted stocks to march higher on the averages.

Many stocks have unwound their daily stochastic's all the way back to just above oversold and their Macd's, on those daily's, have also unwound back to the zero line from very elevated levels. Again, all classic consolidation action. Nice unwinding without breaking critical levels of price. it feels ugly but isn't ugly technically. When you look at leaders such as Federal Express (FDX), 3M (MMM) and American Express (AXP), notice how far down on their daily charts the stochastic's have fallen yet their 50-day moving averages held perfectly. This is true for hundreds of stocks. Good overall action.

Listen, this is not an easy market. Wild, crazy daily swings abound. The bears are trying to defend the 200-day exponential moving averages. They have failed for the first time for two consecutive days with regards to the Nasdaq. They can't be very happy about that but they have not given the bulls the 200 days on the Dow nor the SPX.

Only when all of them together are over those critical 200's can we say with more certainty that things will keep on moving higher. Watch 943 and falling daily on the SPX. If we clear with force then you can feel a lot better about things. if we get there you will see the fight of fights from the bears, trust me on that. It will NOT be an easy time for the bulls at 943 and being cash at that levels makes a lot of sense. we take things one day a at time as always. Slow and easy. Hang in there.

Peace,

By Jack Steiman

Jack Steiman is author of SwingTradeOnline.com ( www.swingtradeonline.com ). Former columnist for TheStreet.com, Jack is renowned for calling major shifts in the market, including the market bottom in mid-2002 and the market top in October 2007.

Sign up for a Free 30-Day Trial to SwingTradeOnline.com!

© 2009 SwingTradeOnline.com

Mr. Steiman's commentaries and index analysis represent his own opinions and should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret Mr. Steiman's opinions as constituting investment advice. Trades mentioned on the site are hypothetical, not actual, positions.

Jack Steiman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.