Gold Trading Update: Time to Lock in Profits?

Commodities / Gold & Silver 2009 Jun 04, 2009 - 02:30 AM GMTBy: Chris_Vermeulen

I thought that I would send out a quick update on the gold sector to show where prices stand from a technical point of view for those of your wondering what to do with today’s sell off.

I thought that I would send out a quick update on the gold sector to show where prices stand from a technical point of view for those of your wondering what to do with today’s sell off.

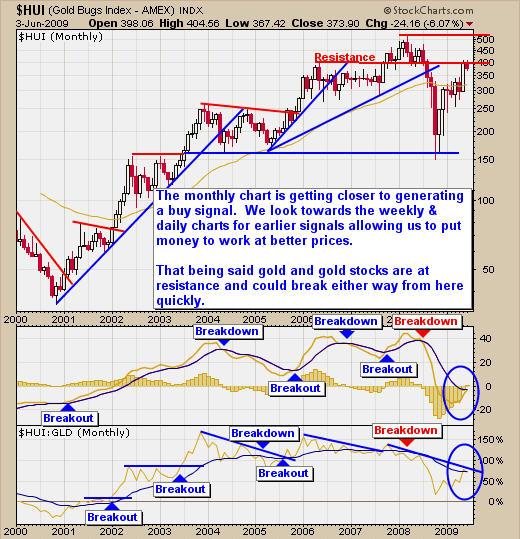

Monthly Gold Bugs Index – Gold Stocks

This chart clearly shows that gold stocks are at levels, which are creating resistance from previous highs and lows. This chart looks bearish at first glance because of the resistance level, it’s important to take into account the MACD and price performance indicators below, which are still showing some solid upward momentum. Momentum is still up on a monthly basis, so holding a core position is crucial for traders taking some profits at these high levels.

HUI:Gold Ratio – Weekly Chart

This ratio shows the overall performance of gold and gold stocks. When this chart is moving higher we tend to see gold stocks out performing the price of gold bullion, which is bullish. This week it has reached the first resistance zone and has started to find resistance. We could see a 1-2 week pull back in the gold sector before we get another leg higher, if we happen to be so lucky.

HUI Daily Chart – Gold Stocks

Gold stocks have been on the run, performing much better than gold bullion in the recent rally. As you can see, they have broken to the up side, but are now testing my support trend line. A break below this line will most likely be the start of a much deeper pullback in prices, which could last a couple weeks.

Current Gold Trade in GLD

GLD made a clean break providing me with a low risk setup back in May. Today we took profits on half our position to lock in a 7.1% gain. We continue to hold a core position with our Stop set at $91.00 and it will continue to move higher with my support trend line.

TheGoldAndOilGuy Trading Conclusion: GLD has been providing excellent short term trades, just like this, time and time again. Many traders are using the DGP 2x leveraged fund to really take advantage of the consistent trades.

Technical analysis can provide a very simple way to trade the gold sector but the difficulty comes down to following through with the plan and setups. These charts above, show exactly how I trade and use my charts to generate a comfortable income from gold.

While I am bullish on gold in the longer term, I am not afraid to lock in gains along the way and accumulate more on a pullback, when there is another low risk entry point.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

I have put together a Recession Special package for yearly subscribers which is if you join for a year ($299) I will send you $300 FREE in gas, merchandise or grocery vouchers FREE which work with all gas stations, all grocery stores and over 100 different retail outlets in USA & Canada.

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.