U.S. and European Economies Accelerating Decent into Marxism

Economics / Credit Crisis 2009 Jun 05, 2009 - 12:45 PM GMTBy: Ty_Andros

Fingers of Instability, Part III:

Fingers of Instability, Part III:

The Banks

Command Performance

Wealth Creation

Descent into Marxism!

Introduction - The descent into MARXISM is accelerating at a startling rate. Public servants and blind ideologues are stopping at nothing to achieve CREEPING CONTROL over the private sector of the United States of America. As the US economy continues to plummet, the mainstream media continues to talk about GREEN shoots and recovery to get the sheeple, er ... people to FEEL GOOD long enough to get their plans ENSHRINED in law. Once passed, never repealed, and essential to your future security.

I refer to nationalization of the health care system and something called the American Clean Energy and Security Act of 2009. A nice title to garner support from the functionally illiterate products of the public schools who can neither think logically, nor have any knowledge of history or any interest in the facts behind the headlines. The resulting outcomes are EXACTLY the opposite of its title, as it moves the United States further and further from energy security. Only the most HOPEFUL can believe the government can solve their healthcare and energy problems. You can expect costs to increase 100 to 1,000% once they have worked their SOLUTIONS.

Look no further than Fannie Mae, Freddie Mac, AIG, the Post Office, Medicare, Medicaid and social security to see what healthcare and the energy industry will become, because consuming more than you produce increasingly expands into these areas of the economy. These are known in China as "STATE OWNED ENTERPRISES" since they are permanent wards of the state, never profitable, can't compete in the marketplace except through mandates of market share, and only kept open to provide employment to avoid civil unrest or to reward a primary constituency. It is a good description of what's unfolding in Amerika, er ... America.

Who pays for this? Not the government, not Congress, not the President: you do! I predict GM and Chrysler will NEVER make a penny of profit again and the cars they make will sell only because they will pass laws and regulations forcing you to purchase them, rather than that be of your own choosing. Why compete if the owners of the company can just pass a law and force market share to themselves? You can look for this to increasingly unfold as Chrysler and GM continue making cars that MANY DO NOT WANT. Politics is clearly at work as revelations that all the Chrysler dealers who supported the GOP were the ones that GOT THE AXE! Illinois politics on a national level.

Radical environmentalists are IN CONTROL of the federal government, and US domestic oil and gas production is under full scale assault from our overlords (and their campaign supporters) in Washington, D.C. America exports hundreds of billions of dollars a year for imported oil. This was a prime issue in the last election in which BOTH parties PROMISED to allow domestic energy development. A case of amnesia has descended and now the prospects for keeping more of those exported dollars at home creating domestic resources and jobs is UP IN SMOKE. While they were at it, they have brought the domestic mining industry to a virtual halt as well, TO PROTECT YOU.

Can you imagine ANY public servant not believing in maximizing domestic production of energy, FUELS and natural resources for domestic use? What do you think we will do when the dollar is worthless and we have to buy these supplies in something other than dollars? Do you think we will be secure then? Do you think wind, solar and biofuels will substitute? Traditional domestic power generation is also being prohibited from development and new nuclear, coal and oil generation is on the cusp of being regulatory casualties and virtually OUTLAWED.

The existing energy industry is about to have their profits confiscated through the above mentioned legislation and their capital REDIRECTED to primary supporters of the Administration and Congress, into industries such as ethanol and green energy, which will NEVER produce more than they consume in capital. This is misallocation of precious capital to MALINVESTMENTS which will NEVER pay for themselves or turn a profit. Who pays for this? Not Congress. The public, aka "you" do!

They call this WISDOM in Washington and the DEATH of common sense on MAIN STREET, unless you have been brainwashed by the mainstream media, public schools and CRONY capitalists who are SET TO FEED at the public trough, aka YOUR WALLET. You know who they are as they appear with politicians and sing the siren song of GLOBAL WARMING, a hoax on the uninformed and functionally illiterate who fall for this new version of the "TAXMAN in DISGUISE"!

The Banks

The banking system is as INSOLVENT as it was last week, last month, last year and two years ago. Eviscerating FASBY 157 did not change the losses sitting on their balance sheets or the lack of dealing with them. Most, if not all, of the PROFITS from the first quarter came from a little accounting sleight of hand that lets you record a profit when the value of outstanding bond issues declines (issued debt from the bank). For example, let's say a Citigroup bond is priced at 70 on January 1, 2009, and on April 1, the bond is trading at 63, a loss of 10% for the bondholder; but Citigroup gets to record a PROFIT of an equal amount, because if they bought the debt back on April 1, they would have paid less to their lender. Of course they DID NOT buy the bond back, which would have actually been a profit, but they get to BOOK the profits anyway. NO MATTER in the eyes of the accounting regulators, it still counts.

The stress tests were and are a joke. When they did not fall into the areas of solvency which the 19 banks desired, they just argued their way to values they could accept. The regulators are obviously CONTROLLED by those that they regulate. NO NEWS in that supposition. Let's look at lobbying and CAMPAIGN contributions from a recent Wall Street Journal article leading up to the political pressure on the Financial Accounting Standards Board until they changed the rules in late April;

Congress Helped Banks Defang Key [Accounting] Rule!

This is a partial list of fiscally and morally bankrupt lawmakers and financial industry associations colluding to FOOL the public as to the solvency of the financial institutions. The total lobbying expense ($27,571,656) and CAMPAIGN ($285,851) is $27,857,507, which is a cheap price indeed to mask trillions of dollars of losses and their fiscal and moral bankruptcies. All are Benedict Arnolds, public servants and the Oligarch industry trade groups. It is just amazing how thoroughly controlled the beltway is by the banksters, er ...bankers. In addition, everyone talks about the capital ratios and tangible equity levels. They are a joke, as in January, HUNDREDS of BILLIONS of OFF BALANCE SHEET toxic assets fall back onto BIG BANK balance sheets, instantly puncturing the illusions now being put into the headlines.

Take look at these unfolding categories of lending distress which are from the New York Times:

These loans are at record "all time highs" in terms of defaults and are not going to be turning around any time soon. In fact, all categories of credit deterioration can be expected to accelerate into the fall, as the federal government SUCKS the life out of the private sector with their borrowing requirements. This means less ability for the private sector to access, roll over and service credit. The belief that the worst is over for the banks is a fairy tale.

Whoever is buying their debt and equity is just the latest patsy. When they realize they have been DUPED by the US Treasury, the Fed and the Administration, watch what will unfold when HOPE turns to FEAR. Credit availability is crumbling, so credit cannot roll over. Look for acceleration in defaults throughout the rest of the year.

Deflation looms as nails in the coffins of lenders and borrowers:

Deflation looms as nails in the coffins of lenders and borrowers:

The Fed and Treasury could care less about the borrowers (other than lip service), but the lenders own them. You can expect massive new amounts of money to be shoveled to them, in one way or another, in plain sight or hidden from view in off-balance-sheet transactions, of which it has been reported there are over $9 Trillion already.

In today's Wall Street Journal, prominent analysts and Moody's Credit Rating Agencies said:

"I'm an optimist by nature, but it's perplexing because there are still problems out there," said William Mutterperl, a lawyer at Reed Smith LLP in New York and a former vice chairman at PNC Financial Services Group Inc. "No one has suggested foreclosures are going down, and I don't think anyone is saying loan quality is getting any better."

Analysts at Moody's Investors Service warned Tuesday that U.S. banks with debt that is rated by the Moody's Corp. unit face about $470 billion in losses through next year. If the economy continues to suffer, those losses could swell to $640 billion, and Moody's would likely accelerate its bank-debt downgrades.

"In such a scenario, absent continuation, and likely deepening, of U.S. government capital and liquidity support programs for the banking industry, numerous banks would be insolvent," the Moody's analysts wrote.

One executive at a New York bank said investors seem to be embracing any tidbit of good news, while ignoring red flags about banks' ill health. He compared the industry with an intensive-care patient who has stabilized but remains critical. "A bucket of cold water will be thrown in people's faces," the executive said.

Additionally, household wealth and income HAS collapsed:

Throughout the G7, the insolvency is also percolating along: Spain, the UK, Germany and others hide behind their respective government regulators. Losses are just piling up day after day with NO RECOGNITION of the deteriorating COLLATERAL values or that of their secured and unsecured lending.

Look at Spain, which virtually HAS NOT recognized falling real estate mortgage values. I could not figure out how they dodged the bullet. Now it's clear: they took it and NEVER REPORTED THE LOSSES. You can't make this stuff up. It's called regulatory forbearance, and it is now a virus THROUGHOUT Europe, as banksters and G7 public servants COLLUDE to fool and hide these issues from the public. Money printing is the only thing that can save these banks, borrowers and lenders and it will be done, by hook or by crook. Inflation is the only escape... When the true story is known about the moral and fiscal bankruptcy of the G7 financial and public servants' actions during this time, the consequences will be a "Crack-up Boom".

Command Performance

As investors around the world question the new Administration and Congress about their plans for funding the legislation they are implementing, Treasury Secretary Tim Geithner is in Beijing for a hastily-scheduled meeting with the Chinese. The Chinese are very good at math, having invented it thousands of years ago. Every investor in the world who holds dollars or treasury securities - both IOU's - must be concerned. The Gang up on the hill in D.C. have shown no intention of changing their spending or legislative assault on the US economy, the dollar or the bond markets, purposely driving investors off a cliff. They are immoral, fiscally- and mentally-bankrupt public servants and their elite constituents and crony capitalists.

Treasury Secretary Geithner is not there for a polite tea party. He is being called on the carpet to clearly lay out Washington, D.C. spending and printing plans. I am sure they did not like the message, or his attempt to speak to them the way he does to the DUMBED-DOWN American electorate. He spoke at Beijing University about the virtues of risk-free securities known as Treasury Bills and Notes. When he finished his speech, the attendees LAUGHED! This is a very bad turn of events for the bozos in D.C. Basically he said: don't worry, we will get responsible AFTER we print the money. I don't think they laughed after that message.

Most people know of Professor Nouriel Roubini and his accurate diagnosis of the unfolding financial industry implosion. Years ago he was looked at as some nut, today he is recognized as some sort of seer, and here is what he sees now:

"If we're going to finance budget deficits by printing money, we may have high inflation, even risk of hyperinflation in some countries. That's what happened in Germany in the 1920s during the Weimar Republic. We are having large budget deficits and increasing the public debt, we don't know whether it's going to be $5 trillion or $10 trillion of more debt. But there are only a few ways of resolving that debt problem: either you default on it as countries like Argentina did; or you use the inflation tax to wipe out the real value of the debt; or you have to raise taxes and cut government spending. And given the size of the deficits, over time that's going to be a painful political choice to make." ~ Nouriel Roubini, May 24, 2009

It's no choice at all for the fools on Capitol Hill as they say "we got the votes", and now it is time for them to implement their perceived mandates for "change", regardless of the COST. In addition to the budget deficits which will double the ON BALANCE SHEET borrowing, nobody is talking about the OFF BALANCE SHEET LIABILITIES which are mushrooming higher like a nuclear blast! Let's take a look at the other inescapable issues and their costs if properly accounted for:

The recognized "cash based" numbers are set to double over the next four years, but the bigger columns of numbers are widely understood as the REAL extent of the liabilities by readers of this letter, as I have been reporting them for years along with many others. EVERYONE pretends they are not there, including the Chinese and all other Dollar holders. But these off balance sheet liabilities and accounting fictions are not limited to the US. This picture is woven throughout the fabric of the G7 and the EU to varying extents.

The venerable Art Cashin of UBS notes:

"On May 27th Moody's said it had no plans to reduce America's coveted AAA debt rating. But on the same day John Taylor, a professor at Stanford University and the creator of the Taylor rule on monetary policy, wrote in the Financial Times that the American government "is now the most serious source of systemic risk."

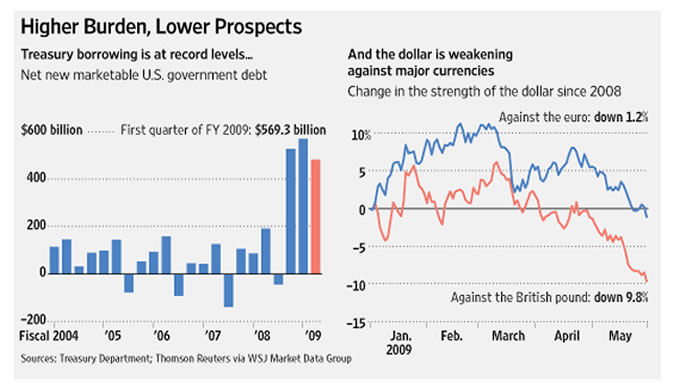

Let's look at the NEW run rate for borrowing by the US government:

It dwarfs the past deficits, and the Administration says they will address it AFTER a recovery has taken hold. If you believe that, I have a bridge to sell you, because there will be no recovery as the stimulus plan is a PERMANENT expansion of government, not a stimulus bill. Year over year, US government revenues have declined 34% through April. 50 cents of every Dollar spent is going to be borrowed. Try that with your personal finances. It's absurd. So they will borrow the money and send you, foreign lenders and Dollar holders, the bill.

What do you think will happen if Treasury Bonds and Notes, as well as the Dollar, decline 20% in the next 6 months? What do you think foreign holders will do when confronted with these potential losses? The answer is self evident. I said it in the last newsletter: the US economy will be buried by the beltway, legislatively, over the next 6 to 8 weeks, thus guaranteeing a HYPERINFLATIONARY depression as incomes collapse, borrowing skyrockets, and the printing press is the only avenue of escape.

The debts and future liabilities are unpayable and it will end as has every other fiat currency and credit system since history began, through the soft defaults of the printing press. The idea that you can store wealth in worthless coupons called G7 money is false. You can store wealth in money as long as it exhibits these following functions.

Real Money has five functions, as:

- A Medium of exchange

- A Store of value

- A Measure of value

- A Standard of value

- No one else's liability

Imitation money has three definitions:

- A Medium of exchange

- Someone else's liability

- Supply which can be printed on paper at virtually no cost or created with a keystroke

The Chinese and many others ATTEMPT to store wealth in IMITATION money. You and they can't. The Zimbabwe-ization of the G7 is unfolding right in front of us....

Wealth Creation

The deindustrialization of the US economy commenced just after the Korean War. At that time, America was the greatest industrial power in the world and over 30% of GDP was from manufacturing. Today, that percentage has declined to less than 10% and the wealth creation from those activities now comes from MISSTATED inflation masquerading as growth. The following was sent to me in an email. I do not know who wrote it, but it is true:

WHY AMERICA'S ECONOMY FELL OFF THE CLIFF

John Smith started the day early having set his alarm clock (MADE IN JAPAN) for 6 a.m.

While his coffeepot (MADE IN CHINA) was perking, he shaved with his electric razor (MADE IN HONG KONG).

He put on a dress shirt (MADE IN SRI LANKA), designer jeans (MADE IN SINGAPORE) and tennis shoes (MADE IN KOREA).

After cooking his breakfast in his new electric skillet (MADE IN INDIA) he sat down with his calculator (MADE IN MEXICO) to see how much he could spend today. After setting his watch (MADE IN TAIWAN) to the radio (MADE IN INDIA) he got in his car (MADE IN GERMANY) filled it with gas (FROM SAUDI ARABIA) and continued his search for a good paying AMERICAN JOB.

At the end of yet another discouraging and fruitless day checking his computer (MADE IN MALAYSIA), John decided to relax for a while. He put on his sandals (MADE IN BRAZIL), poured himself a glass of wine (MADE IN FRANCE) and turned on his TV (MADE IN INDONESIA), and then wondered why he can't find a good paying job in AMERICA.

And now he's hoping he can get help from a president (MADE IN KENYA), Mr. Obama (Originally Born African Managing Americans).

Thank you, Mr. or Ms. Anonymous. Wealth is created when you produce more than you consume and accumulate capital and savings to invest in future production, and it has DIED in the G7. Real wealth creation from small business and entrepreneurs is moving toward extinction in the US, replaced by the printing press and BORROWING. It could not be recovered even if we wanted it to be, as American labor, corporate tax and regulatory policies are locally and globally uncompetitive. On top of which, the current Administration and Congress do not understand that the private economy must GROW to create rising incomes. Growth in government is not growth as politicians believe. If the government spends +12 % of GDP on new programs and the GDP contracts at -6%, then if the spending does not occur, the actual rate of economic decline is negative - 18 % (the Commerce Department measures government spending growth and calls it GDP growth even if the money is borrowed, an illusion of growth). An ever expanding leviathan government creates not one dime of new wealth or income taxes...only private sector jobs and businesses do...

Descent into Marxism!

I couldn't resist passing this article on to all TedBits readers this from PRAVDA out of Moscow commenting on the rapid slide of Amerika, er ... America into Marxism. The irony is PRICELESS: http://english.pravda.ru/opinion/columnists/107459-0/

Of course it's all true and that is the saddest part of this.....

In conclusion:

The G7 economy is essentially still descending into an inflationary depression. The quantitative easing is flowing directly into financial and commodity markets seeking shelter from the unfolding blizzard of printed money of all stripes: Dollars, UK Pounds, Yen, Swiss Francs, and soon Euros. Today, Chancellor Angela Merkel of Germany BLASTED the G7 central banks for their policies of money printing. Kind of like the pot calling the kettle black, since the German banks are maybe the most insolvent and highly leveraged in the world. Trillions will need to be printed to rescue them before this crisis has passed.

In congressional testimony today, Fed Chair Ben Bernanke said the Federal Reserve WILL NOT monetize the debt, setting the stage for a showdown with the FOOLS on Capitol Hill and the President. His term is up in January, and he either buckles or he will be replaced by someone who will monetize it: i.e., Larry Summers, Chair of the President's Council of Economic Advisors.

What happens when they do monetize the debt further? Contrary to his assertions... Be very afraid. This is slated to happen in the next 6 months as Treasury borrowing is set to explode to over $2 Trillion and many multiples of this number in the G7. Many of these auctions are bound to fail unless long-term interest rates skyrocket or quantitative easing is DRAMATICALLY accelerated.

The pickup in the housing markets has been halted by the backup in mortgage rates, so expect them to reaccelerate to the downside. Foreclosures are picking up as the foreclosure moratoriums end. Massive new supply and more expensive money will do this.

Incomes continue to plummet on all levels: Federal, State, Municipal, Corporate and individual, insuring the increasing distress in the Bond, banking, and financial communities. You can expect the insolvencies to accelerate as well as the defaults on the borrowing of all of the above.

Marc Faber is interviewed on www.Bloomberg.com and reports: Prices may increase at rates "close to" Zimbabwe's gains, Faber said in an interview with Bloomberg Television in Hong Kong. Zimbabwe's inflation rate reached 231 million percent in July, the last annual rate published by the statistics office.

"I am 100 percent sure that the U.S. will go into hyperinflation," Faber said. "The problem with government debt growing so much is that when the time will come and the Fed should increase interest rates, they will be very reluctant to do so and so inflation will start to accelerate."

The only way to stem the Dollar's and Bond's decline would be a flight to quality from a huge down move in stocks to create a perceived FLIGHT to quality. Be on the lookout for the groups (plunge protection team) monetizing the stock markets to quit doing so. They have largely accomplished the re-inflation of bank stocks to attract new patsies to FUND their unfolding insolvencies. It's done and possibly so is the rally.

The bright side to this is VOLATILITY is set to rise again and "Volatility is Opportunity" in all markets. Investments with the potential to thrive in rising and falling markets should be considered. Just keep in mind that the G7 will "print the money"; on that you can be sure....

I will be doing several presentations on the unfolding "Crack-up Boom" and inflationary depression at FREEDOMFEST, July 9th through the 11th. I urge you to attend. You can find information at www.freedomfest.com. I will be meeting with people upon request. Just call me and let's get together... Hope to see you there; last year was exciting.

Please remember that subscribers generally receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Please remember that subscribers generally receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.