Why the Time Could Be Right for Investing in Gold Mining Stocks

Commodities / Gold & Silver 2009 Jun 08, 2009 - 01:35 PM GMTBy: Frank_Holmes

Conditions have improved for gold equities, and economic policy decisions being made in Washington could further increase the investment appeal of these mining stocks.

Conditions have improved for gold equities, and economic policy decisions being made in Washington could further increase the investment appeal of these mining stocks.

The charts below clearly illustrate the relationship between gold-mining stocks and the federal budget.

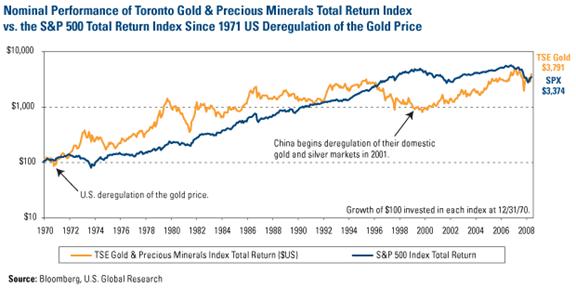

The top chart below compares the total-return performance of the S&P 500 (blue line) with that of the Toronto Gold & Precious Minerals Index* (gold line) going back to 1971, when President Nixon ended dollar convertibility into gold and deregulated the price of gold.

At that time, the United States was in the thick of the Vietnam War and was pumping billions of dollars into the financial system to pay for it. The dollar’s value dropped compared to other currencies, and the demand for gold and its price shot up. At the same time, the U.S. stock market was languishing.

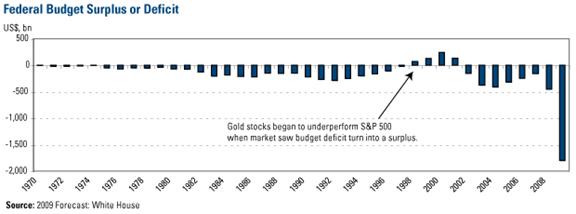

The bottom chart shows the federal budget, and the trend is readily noticeable—when the federal government is spending more than it takes in, gold stocks tend to outperform the broader market.

As indicated in the top chart, $100 invested in the S&P 500 at the start of 1971 underperformed the gold-stock index essentially for a quarter-century. In each of these years, the federal government engaged in deficit spending. The S&P 500 surpassed the gold-stocks in 1997, in the midst of the tech boom and budget surpluses under President Clinton.

When those surpluses reverted to widening deficits after the September 11 attacks, you can see the spread between the broad market and gold equities narrowing. At the same time, another important event occurred—China began to deregulate its precious metals markets. During that period, the S&P 500 dropped before largely leveling off, while gold stocks charged forward.

Gold stocks have delivered a 9.9 percent average annual return since 1971, while the S&P 500’s annualized return has been 9.6 percent. That $100 invested in gold stocks in 1971 would have grown to nearly $3,800 at the end of May, while the same amount in the S&P 500 Index would be worth about $3,400.

So now that we’ve established the relationship between gold stocks and the federal budget, let’s look at the current situation.

The federal government, which has spent huge amounts to save the banks and stimulate the domestic economy, is expected to see a $1.8 trillion gap between revenue and expenditure. You can see from the long blue line at the far right of the bottom chart that this is a deficit on a scale beyond what we’ve seen in the past.

If the federal budget projections are accurate, we can expect massive deficits to continue, which will likely fan inflation fears and keep downward pressure on the dollar. These large deficits, combined with China’s growing appetite for gold, create the potential for gold stocks to remain an attractive investment relative to the broader market for some time to come.

* Time series for Toronto Gold & Precious Minerals Index is a composite of this index’s returns from 1970 to 2000. Thereafter, the S&P/TSX Gold Index is used. Both series are analyzed based on their returns achieved in US dollar terms.

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.