The Coming Stock Market Crash: Time to Review

Stock-Markets / Financial Crash Jun 16, 2009 - 03:29 AM GMTBy: Brian_Bloom

Yesterday this analyst had the bizarre experience of watching two consecutive and conflicting items on the evening Television news:

Yesterday this analyst had the bizarre experience of watching two consecutive and conflicting items on the evening Television news:

1. A well respected economic forecasting organization is expecting Australian domestic real estate prices to rise by around 19% over the coming three years.

2. Over one million homeowners in Australia have fallen behind in their mortgage payments in an environment where one of the country’s largest banks has just moved to raise its mortgage interest rates.

Question: If 2 above is a fact, then how can 1 above be possible?

Not surprisingly, the incumbent Labor government was incensed by this act of “selfishness” on the part of the bank in question – implying that, in the government’s view, the banks exist for the purpose of providing a socially responsible service.

Hmmm? Is the Australian Government off with the pixies, or are they worried that Australia’s “green shoots” will wilt in the noonday sun and they are looking to sheet the blame elsewhere?

The following is a quote from an article entitled “Bear Market Bounce” which this analyst published on March 31st 2009.

“When the current market bounce is exhausted, the Primary Bear Trend is more likely than not to resume with a vengeance – given that it will be patently obvious to a blind man that the authorities will have thrown everything but the kitchen sink at the economic downturn; and failed to arrest it.” (http://www.marketoracle.co.uk/Article9758.html )

Perhaps its time to review:

Dow Jones Industrial Index

The chart above (courtesy BigCharts.com) reflects two patterns which, when read together, indicate that the Bear Market Bounce might be drawing to a close.

1. The three rising trend lines in the price section of the chart reflect what is known as a “fan formation” and yesterday’s closing price for the DJI Index penetrated the third fan line on the downside. This is bearish.

2. From the middle of March 2009, even though the index was rising in price, the accompanying volume was steadily falling – indicating that it has been more an absence of selling pressure than a presence of buying pressure which has given rise to the rising DJI Index. This is also bearish.

Given that the On Balance Volume Chart has not yet given a sell signal it cannot be definitively stated that the Bear Market bounce is about to reverse. However, the evidence suggests that it is probably drawing to a close.

In looking back to the time when the financial Titanic collided with the sub-prime iceberg, it was a matter of pragmatism that the authorities should have been more concerned with keeping the financial ship afloat than in indentifying and addressing the reasons why the collision occurred in the first place. In this context, the authorities’ focus on bailing out the banks and financial institutions was the logical top priority at that time i.e. It was a “necessary evil”.

However, as this analyst has opined on many occasions, the core issue revolves around a lack of understanding on the part of our political and financial authorities regarding what constitutes wealth creation activity. Perhaps one should be less circumloquatious and less charitable about what is really happening. Our political and financial leaders are men and women who are possessed an above average level of intelligence and the probability is high that they absolutely do understand what constitutes wealth creation activity. From their perspective, the question is whether or not a focus on wealth creation activities will get the politicians re-elected and/or will increase the profitability of the financial institutions in the short term (next bonus year)? The answer to both of these questions is a resounding “no”. Seeding wealth creation activities is like planting acorns. Those who plant the acorns typically don’t get to sit under the shade of the oak trees. Ultimately, that’s why the authorities have been dragging their heels. There’s no skin in that game for them personally.

Unfortunately, by throwing money – indiscriminately – at “shovel ready” projects to create job opportunities, and by handing out billions of dollars of tax refund gifts to consumers, all that the authorities achieved was that they pumped the gushing water out of the ship’s flooding hold. Unfortunately, this action did nothing to patch the hole in the ship’s hull or to strengthen the hull itself.

Now the authorities have nowhere to turn. The bilge pumps are running out of fuel and the water is about to start gushing back into the ship’s sodden hull. Unfortunately, the US has used up the goodwill of its creditors and cannot continue to fund the politically motivated gestures of economic largesse which turned out to be nothing more than fingers in the dyke. All this talk of “green shoots” was pure garbage. For example, it takes between 3-5 years for the green shoot of an olive tree to grow to become fruit bearing. In simple English, green shoots take time to mature.

The reality is that, now, if the authorities continue to print money, the US Dollar will tank and there will likely be a rapid escalation of “cost push” inflation within the USA’s borders. Importantly, it needs to be recognized that cost push inflation is very different from “demand pull” inflation. With unemployment in the USA trending towards 11%, and with wages lagging price inflation, demand is unlikely to hold up. This will have seriously deleterious consequences to the economies of those countries which export to the USA and which rely on these exports for their own economic momentum.

Let’s now look at how demand is holding up

Below are a couple of representative examples:

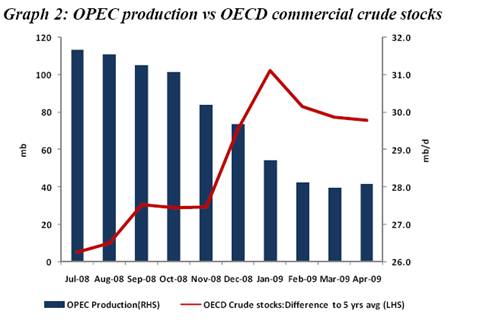

The following, from OPEC’s June 2009 monthly report at page 3, is a chart of the OPEC oil production vs OECD oil stocks. (source: http://www.opec.org/.. )

Note that whilst OPEC oil production has fallen dramatically, OECD oil inventories are still substantially higher than the average of the preceding five years. The bottom line is that oil consumption has been falling in the OECD countries.

Why has oil demand been falling? There are a few reasons:

1. Freight tonnages have been in serious decline:

a. “The American Trucking Association Tonnage Index declined a seasonally adjusted 2.2% in April. This is better than the 4.5% contraction in March, but still negative.”

b. “U.S. rail carload traffic in May 2009 fell 24.7 percent”, the worst y/y % decline of the recession. People that believe commodities are soaring because the economy has turned the corner should note that “U.S. rail carloadings fell in May 2009 in all 19 major commodity groups tracked by the AAR, including coal (down 89,134 carloads, or 15.8 percent); motor vehicles and equipment (down 35,674 carloads, or 52.3 percent); and metals and metal products (down 33,987 carloads, or 62.7 percent). Carloads of chemicals were down 23,147 carloads (18.3 percent) and carloads of grain were down 21,910 carloads (24.5 percent).”

Source: http://www.ritholtz.com/..

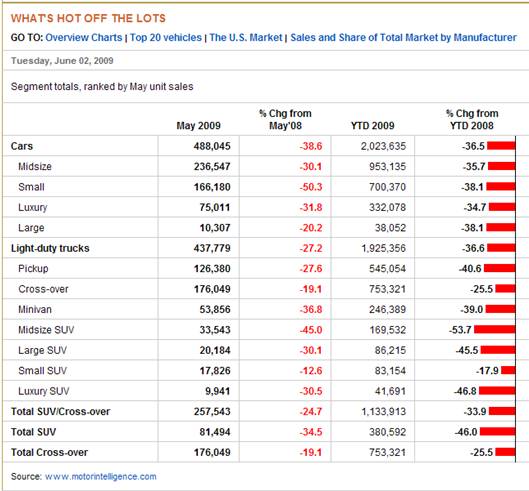

2. The market in the USA for high fuel consumption automobiles has been falling apart as can be seen from the table below, which shows that year-to-date unit sales to May 2009 were down by over 33% across all categories combined.

Source: http://online.wsj.com/..

- The statistics for Germany reflected similar experiences, as can be seen from the following:

“For the first five months of 2009, BMW delivered 487,906 vehicles, or 21.1 % fewer than in the same period of 2008.

Mercedes-Benz sold 433,100 cars, which was also a drop of 21.1%.

Audi sold 374,350 cars, for a more modest decline of 12.1%.”

(Source: http://www.industryweek.com/.. )

- By contrast, motor vehicle sales in China (typically of lower fuel consumption vehicles) have been booming:

“After slowing late last year as the impact from the global financial crisis deepened, China’s auto sales have risen for five straight months. In March, sales hit a monthly record high of 1.11 million units.” (Source: http://blog.taragana.com/..)

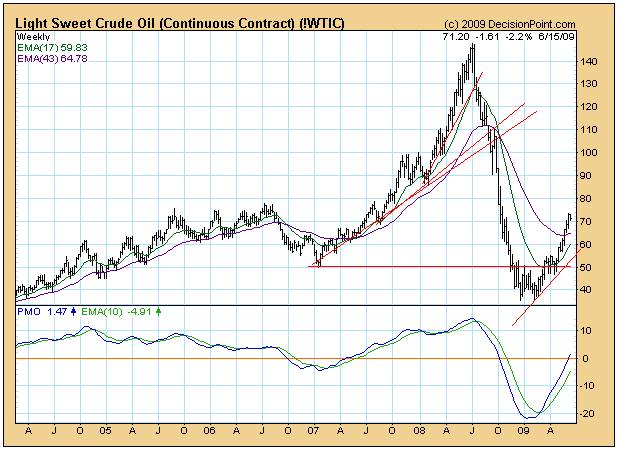

Of interest is the fact that the oil price has been rising as can be seen from the following chart (courtesy DecisionPoint.com):

But this should not be taken at faced value. The chart below (of the oil price in US Dollars relative to the US Dollar Index) seems to indicate that the primary cause of the rising oil price (in US Dollars) has been a fall in the US Dollar Index. (Chart courtesy StockCharts.com)

Interim conclusion

The falling OPEC oil production has not given rise to supply shortages in the market place. Rather, it has been mirroring an on-balance decline in sales of various elements of the transport industries. With this in mind, the rising oil price has been caused more by technical (trading) forces than fundamental (demand growth) forces. By implication, the same reasoning will apply to the Dow Jones Industrial Index. With underlying economic activity still contracting – as shown by the rail transport statistics – and with “green shoots” needing time to incubate, the DJI Index has been rising for technical reasons.

What about the potential for hyperinflation?

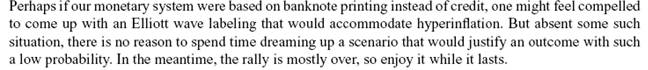

What is hyperinflation? Bob Prechter made an interesting observation in the June issue of The Elliott Wave Theorist, a copy of which happened to land on this analyst’s desk the other day. Prechter wrote:

Here is this analyst’s take:

Hyperinflation (of prices) comes about as a result of hyperinflation of the money supply. But if the Fed is choosing to inflate credit availability which the US Government is spending whilst the public’s levels of consumption are contracting in volume terms, why would “demand” push prices up?

From another perspective, many are arguing that the US Dollar is almost certain to collapse, giving rise to massive rises in “cost push” US$ denominated prices. But will the US Dollar collapse?

Here is a chart of the US Dollar. (courtesy StockCharts.com)

Note how the dollar index has broken up from a Diamond reversal pattern.

Technically, the US Dollar might rise to 84 from this level – which happens to be at a level above the 200 day moving average.

Could it be that the US’s financial and political leaders are finally coming to the realization that if we have a savage collapse of the financial markets in anticipation of deflation within the economy, there will still be an economy left to manage at the end of it all; and that if we have hyperinflation within the economy, the logical end result will be dysfunctional and unmanageable markets/economy? If so, it might well turn out that the US authorities will bend to the pressures being exerted on them by the foreign holders of dollars and slow down on credit creation. At least the economic cowboys will still have a herd of financial calves to lord it over, and maybe those calves will one day become bulls.

In summary: If the Fed slows down on credit creation, it could be that interest rates are really rising not because the markets are anticipating hyperinflation, but because they are anticipating a credit crunch.

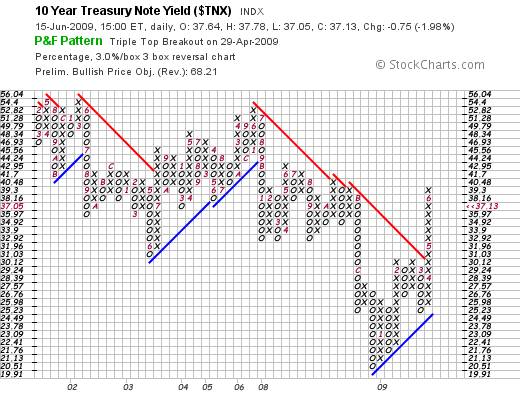

The 3% X 3 box reversal Point and Figure chart below of the 10 year Treasury Bond Yield would indicate that something may indeed be changing structurally given that the yield has broken up strongly and a target yield of 6.8% is being anticipated. (Chart courtesy StockCharts.com)

To this analyst, rising interest rates may be more representative of a market expecting a credit crunch (shortage of credit) than a market which is expecting hyperinflation (surplus of money).

Conclusion

The bottom line (in this writer’s view) is that we are heading for a stock market crash as a precursor to a credit crunch and a further savage contraction of the world economy. Our leaders sowed the wind and we – the voters who put them into positions of power – will reap the whirlwind.

Can anything be done about this?

As a statement of fact as opposed to ego aggrandizement, this analyst is on record as having been anticipating for over seven years an emergence of the broad brush state of affairs we are now facing. That is why he sat down in October 2005 to write Beyond Neanderthal, a factional novel which might be looked upon as a strategic vision for a world economy in strife and a rudderless world government. The reader should understand that whilst a vision differs from a dream in that it is actionable, this particular vision will require a wide open mind to embrace. Written in a light hearted novel format, it contains outside the box ideas which seem, at face value, to fly in the face of conventional (pragmatic) wisdom. But, in this analyst’s view, there is a finite probability that these ideas may in fact be actionable. Now that the original cost of publishing Beyond Neanderthal has been largely recouped, the price has been reduced significantly to be affordable by most people and can be ordered via the website below. Perhaps the reader hereof will have been (or will soon be) convinced that we can’t just sit and twiddle our thumbs. We need to act in a focused manner within the confines of an articulated holistic plan of action and Beyond Neanderthal presents one such plan.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.