U.S. Doubling Unemployment Pay Checks to Stimulate Economy

Economics / Financial Markets 2009 Jun 18, 2009 - 04:24 PM GMT What if the Fed had a sale and no one came?

What if the Fed had a sale and no one came?

The Federal Reserve received no requests from investors for loans to buy new commercial mortgage-backed securities under an emergency program aimed at reducing borrowing costs and reviving U.S. economic growth.

The Fed has made $25.2 billion in TALF loans for other securities, including those backed by auto and credit-card debt. “This is not an embarrassment for the Fed, but it does show there is a slow discovery process on the part of investors and originators,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. As Roseanna used to say, “Oh, nevermind!”

Let’s see if Bank of America’s party is more successful.

Bank of America Corp. and Morgan Stanley are marketing securities backed by commercial mortgage bonds. Bank of America is selling $368 million in debt backed by nine commercial mortgage bonds, according to a person familiar with the offering. Morgan Stanley plans to sell $210 million in similar securities backed by a single commercial mortgage bond, according to a person familiar with the sale. The people declined to be identified because the terms aren’t public.

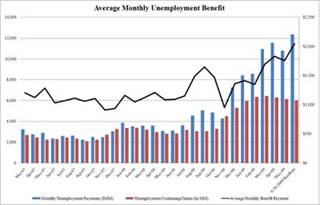

Increased unemployment checks may be one more way to push dollars into the economy.

The Average Monthly Unemployment "Paycheck" has exploded from on average $1,000 to $1,800 in recent months (and over $2,000 projected for June). Has the government  been "pushing" higher benefits to the unemployed since December of 2008, when the increase commenced?

been "pushing" higher benefits to the unemployed since December of 2008, when the increase commenced?

Since consumers aren’t borrowing and banks aren’t lending, this may be a way to keep the economy afloat. It may feel good for the unemployed, but is it legal?

The end of a trend?

--Today’s headline reads, “U.S. Stocks Gain as Data Boost Optimism Economy Is Recovering.” However, they are bouncing from a lower level than last week. Technical analysts often put a “trendline” under a rally to discover when the market is no longer positive. The 200-day moving average is also shown, since the last time the S&P touched that line was May 2008. A drop below that line may suggest the bear market is resuming.

--Today’s headline reads, “U.S. Stocks Gain as Data Boost Optimism Economy Is Recovering.” However, they are bouncing from a lower level than last week. Technical analysts often put a “trendline” under a rally to discover when the market is no longer positive. The 200-day moving average is also shown, since the last time the S&P touched that line was May 2008. A drop below that line may suggest the bear market is resuming.

Treasury bonds will be having their moment of doubt next week.

-- Ten-year treasury bond yields earlier climbed from a two-week low on concern sales will overwhelm demand amid speculation the recession is easing. The Federal Reserve bought $7 billion of debt due between 2016 and 2019 yesterday, less than the $7.5 billion acquired at the last so-called coupon pass in that range. The Treasury will sell $101 billion of notes next week.

-- Ten-year treasury bond yields earlier climbed from a two-week low on concern sales will overwhelm demand amid speculation the recession is easing. The Federal Reserve bought $7 billion of debt due between 2016 and 2019 yesterday, less than the $7.5 billion acquired at the last so-called coupon pass in that range. The Treasury will sell $101 billion of notes next week.

Gold fell 50% of last rally. Will it recover?

Gold, little changed in Asia, may gain after the dollar’s rally this week failed to push prices below their 100-day moving average. The precious metal “has found support” near $927 an ounce, which marks a 50 percent retracement of its rally from $865 in mid-April to $990 this month. Gold traded as low as $925.80 on June 15, against its 100-day moving average of $926.41 today.

Gold, little changed in Asia, may gain after the dollar’s rally this week failed to push prices below their 100-day moving average. The precious metal “has found support” near $927 an ounce, which marks a 50 percent retracement of its rally from $865 in mid-April to $990 this month. Gold traded as low as $925.80 on June 15, against its 100-day moving average of $926.41 today.

Japanese stocks could not “round up.”

-- Japanese stocks fell for the third time in four days as the local currency strengthened to a two- week high, diminishing the earnings prospects for makers of cars and electronics. After hitting 10,000, Japanese investors started to concentrate on what could happen wrong to their economy. The trendline has also been broken here.

-- Japanese stocks fell for the third time in four days as the local currency strengthened to a two- week high, diminishing the earnings prospects for makers of cars and electronics. After hitting 10,000, Japanese investors started to concentrate on what could happen wrong to their economy. The trendline has also been broken here.

China resuming public offerings of stocks, may see decline soon.

-- China’s shares rose 1.56% at a near 11-month high as investors speculated on whether Beijing would lend more money to the markets as new Initial Public Offerings were being announced. There is concern that the newly-issued shares may pull the markets down, especially after the tremendous run-up it has had. Of course, banks and the companies offering the new shares benefited the most from the rumors.

-- China’s shares rose 1.56% at a near 11-month high as investors speculated on whether Beijing would lend more money to the markets as new Initial Public Offerings were being announced. There is concern that the newly-issued shares may pull the markets down, especially after the tremendous run-up it has had. Of course, banks and the companies offering the new shares benefited the most from the rumors.

The U.S. dollar is still under attack, but coming back.

-- The dollar fell for a third day against the euro before a U.S. report that may show the Philadelphia region’s manufacturing shrank for a ninth month, adding to signs the Federal Reserve will keep interest rates low. The dollar declined as traders cut bets the Fed will raise its benchmark rate this year to a 45 percent chance from 64 percent odds a week ago.

-- The dollar fell for a third day against the euro before a U.S. report that may show the Philadelphia region’s manufacturing shrank for a ninth month, adding to signs the Federal Reserve will keep interest rates low. The dollar declined as traders cut bets the Fed will raise its benchmark rate this year to a 45 percent chance from 64 percent odds a week ago.

The Housing Market: The Disappointment Of The Decade or the Century?

Alexander Green writes, “My colleague Dr. Mark Skousen and I have been having a long-running, good-natured disagreement about the direction of the national housing market He calls buying real estate “the investment of the century.” I think it’s more likely to be “the disappointment of the decade.” He thinks housing prices are about to rebound. I say rebounds (in the price of anything) only come off a genuine bottom. And, despite the precipitous drop in some areas, we still haven’t seen a bottom in home prices.”

Alexander Green writes, “My colleague Dr. Mark Skousen and I have been having a long-running, good-natured disagreement about the direction of the national housing market He calls buying real estate “the investment of the century.” I think it’s more likely to be “the disappointment of the decade.” He thinks housing prices are about to rebound. I say rebounds (in the price of anything) only come off a genuine bottom. And, despite the precipitous drop in some areas, we still haven’t seen a bottom in home prices.”

The price of gasoline is lower than a year ago, but it sure doesn’t feel like it.

Energy Information Administration Weekly Report suggests that, “For the seventh consecutive week, the national average price for regular gasoline increased, moving up five cents to $2.67 a gallon. Despite a cumulative increase of 62 cents over those seven weeks, the price was $1.41 below the average a year ago and $1.44 below the all-time high set on July 7, 2008. With the exception of the Midwest, prices increased in every region throughout the country.”

Energy Information Administration Weekly Report suggests that, “For the seventh consecutive week, the national average price for regular gasoline increased, moving up five cents to $2.67 a gallon. Despite a cumulative increase of 62 cents over those seven weeks, the price was $1.41 below the average a year ago and $1.44 below the all-time high set on July 7, 2008. With the exception of the Midwest, prices increased in every region throughout the country.”

There is no fundamental reason for a price spike.

The Energy Information Agency’s Natural Gas Weekly Update reports, “Natural gas spot prices increased at all market locations in the Lower 48 States. Moderate weather in some large-consuming areas of the country this week appeared to have little effect on spot prices.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Natural gas spot prices increased at all market locations in the Lower 48 States. Moderate weather in some large-consuming areas of the country this week appeared to have little effect on spot prices.”

Could it be the “hot money” speculators at work?

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.