Has the Stock Market Peaked for 2009?

Stock-Markets / Financial Markets 2009 Jun 27, 2009 - 08:45 AM GMT Unemployment claims unexpectedly rise... First-time claims for state unemployment benefits rose unexpectedly in the latest week, the Labor Department reported Thursday. The number of initial claims in the week ending June 20 rose 15,000 to 627,000. It's the highest level since mid-May. A Labor Department official said that some states reported more end-of-school-year claims. Many states allow bus drivers and cafeteria workers to file for unemployment during school breaks.

Unemployment claims unexpectedly rise... First-time claims for state unemployment benefits rose unexpectedly in the latest week, the Labor Department reported Thursday. The number of initial claims in the week ending June 20 rose 15,000 to 627,000. It's the highest level since mid-May. A Labor Department official said that some states reported more end-of-school-year claims. Many states allow bus drivers and cafeteria workers to file for unemployment during school breaks.

…while consumer incomes and spending rose.

Consumer spending rose for the first time in three months in May as incomes jumped by the most in a year, a sign that government efforts to revive the economy may be starting to pay off. The 0.3 percent gain in purchases followed no change in April, the Commerce Department said today in Washington. Incomes surged 1.4 percent, reflecting tax cuts and Social Security payments from the Obama administration’s stimulus and driving up the savings rate to a 15-year high.

Consumer spending rose for the first time in three months in May as incomes jumped by the most in a year, a sign that government efforts to revive the economy may be starting to pay off. The 0.3 percent gain in purchases followed no change in April, the Commerce Department said today in Washington. Incomes surged 1.4 percent, reflecting tax cuts and Social Security payments from the Obama administration’s stimulus and driving up the savings rate to a 15-year high.

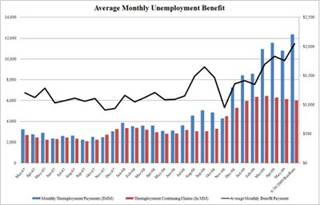

Government efforts to restore the flow of credit and prop up incomes (see chart) are making it possible for consumers to spend even as unemployment climbs to levels last seen in the early 1980s. The loss of wealth caused by the worst housing slump in seven decades will prompt households to keep rebuilding savings, indicating an economic recovery will be slow to develop.

A new trend may be forming.

--U.S. stocks fell as the highest American savings rate in 15 years spurred concern that spending will slow, while falling oil drove down energy producers. While the stock market has rebounded since March on optimism the deterioration in the global economy will slow, U.S. business activity is probably contracting for a fourth consecutive quarter, according to economists’ estimates. This may show up in earnings announcements next month.

--U.S. stocks fell as the highest American savings rate in 15 years spurred concern that spending will slow, while falling oil drove down energy producers. While the stock market has rebounded since March on optimism the deterioration in the global economy will slow, U.S. business activity is probably contracting for a fourth consecutive quarter, according to economists’ estimates. This may show up in earnings announcements next month.

Treasury bonds not severely affected by bond auction.

-- Treasuries headed for their best week in three months on optimism there is sufficient demand to absorb the government’s record bond sales as it raises funds to snap the recession. Fed officials also voted to maintain the size and pace of their $1.75 trillion program to buy mortgage debt and Treasuries. The statement indicated policy makers need more time to assess the prospects for a recovery starting in the second half of the year before deciding to embark on any exit from their unprecedented credit programs.

-- Treasuries headed for their best week in three months on optimism there is sufficient demand to absorb the government’s record bond sales as it raises funds to snap the recession. Fed officials also voted to maintain the size and pace of their $1.75 trillion program to buy mortgage debt and Treasuries. The statement indicated policy makers need more time to assess the prospects for a recovery starting in the second half of the year before deciding to embark on any exit from their unprecedented credit programs.

Gold gains favor again.

Gold gained for a fourth day, poised for the first weekly increase in four, as investor expectations of record-low U.S. interest rates boosted demand for the metal as a store of value and a rally in the dollar faltered. The precious metal found investor support after retracing approximately 50% of its previous rally. This shows a healthy interest in the precious metal. This is the second decline to retrace 50%. There may be an opportunity for gold prices to go much higher.

Gold gained for a fourth day, poised for the first weekly increase in four, as investor expectations of record-low U.S. interest rates boosted demand for the metal as a store of value and a rally in the dollar faltered. The precious metal found investor support after retracing approximately 50% of its previous rally. This shows a healthy interest in the precious metal. This is the second decline to retrace 50%. There may be an opportunity for gold prices to go much higher.

Nikkei trading volume reduced while investors seek trends.

-- Japanese stocks rose, extending a weekly gain, as forecasts by Bridgestone Corp. and Nippon Electric Glass Co. lifted optimism earnings are recovering. The number of stocks traded in Tokyo dropped to the lowest level in three months. The Nikkei, which slumped 3.5 percent last week, has soared 40 percent since reaching a quarter- century low in March. However, gains cannot be sustained on low trading volume.

-- Japanese stocks rose, extending a weekly gain, as forecasts by Bridgestone Corp. and Nippon Electric Glass Co. lifted optimism earnings are recovering. The number of stocks traded in Tokyo dropped to the lowest level in three months. The Nikkei, which slumped 3.5 percent last week, has soared 40 percent since reaching a quarter- century low in March. However, gains cannot be sustained on low trading volume.

“Less bad” is better in China.

-- China’s industrial-company profits fell at a slower pace as commodity prices declined from a year earlier and a 4 trillion yuan ($585 billion) stimulus package boosted demand. Net income sank 22.9 percent in the five months through May to 850.2 billion yuan ($124.4 billion), the statistics bureau said today. Profits plunged 37.3 percent in the first two months. The data is released at three-month intervals.

-- China’s industrial-company profits fell at a slower pace as commodity prices declined from a year earlier and a 4 trillion yuan ($585 billion) stimulus package boosted demand. Net income sank 22.9 percent in the five months through May to 850.2 billion yuan ($124.4 billion), the statistics bureau said today. Profits plunged 37.3 percent in the first two months. The data is released at three-month intervals.

The U.S. dollar is being kicked while it is down.

-- The dollar fell against most of its major counterparts after China repeated its call for a supranational currency “delinked” from sovereign nations. The U.S. currency headed for its biggest weekly loss against the euro in a month after the People’s Bank of China said the International Monetary Fund should manage more of members’ foreign-exchange reserves. Will China change its tune if the dollar recovers?

-- The dollar fell against most of its major counterparts after China repeated its call for a supranational currency “delinked” from sovereign nations. The U.S. currency headed for its biggest weekly loss against the euro in a month after the People’s Bank of China said the International Monetary Fund should manage more of members’ foreign-exchange reserves. Will China change its tune if the dollar recovers?

The day the Mall died.

Our consumption-driven society is being turned on its head, leaving household names staring down the barrel of bankruptcy. So many things we have accepted as "absolute givens" are going to be stressed to the breaking point. One of them is the Mall — that icon of consumption itself. In fact, on April 16, 2009, "The Mall" as we know it actually died. That was the day Chicago-based General Growth Properties (GGP) — the second-largest mall owner in the United States — filed for bankruptcy in federal court.

Our consumption-driven society is being turned on its head, leaving household names staring down the barrel of bankruptcy. So many things we have accepted as "absolute givens" are going to be stressed to the breaking point. One of them is the Mall — that icon of consumption itself. In fact, on April 16, 2009, "The Mall" as we know it actually died. That was the day Chicago-based General Growth Properties (GGP) — the second-largest mall owner in the United States — filed for bankruptcy in federal court.

It looks like a break in the price of gasoline.

Energy Information Administration Weekly Report suggests that, “The national average price for regular gasoline increased for the eighth week in a row. The price rose two cents to $2.69 per gallon, yet even with a cumulative increase over the past eight weeks of 64 cents, the price remained $1.39 below this week last year. For the second consecutive week, prices fell in the Midwest, sliding two cents to settle at $2.66 per gallon.”

Energy Information Administration Weekly Report suggests that, “The national average price for regular gasoline increased for the eighth week in a row. The price rose two cents to $2.69 per gallon, yet even with a cumulative increase over the past eight weeks of 64 cents, the price remained $1.39 below this week last year. For the second consecutive week, prices fell in the Midwest, sliding two cents to settle at $2.66 per gallon.”

Peak Summer demand meets slowing economy.

The Energy Information Agency’s Natural Gas Weekly Update reports, “Almost on cue with the official start of summer this week, temperatures in the southern and middle parts of the country soared, likely boosting air-conditioning demand. Although cooling demand represents a major consumption segment in the natural gas industry, in the past week higher demand from electric generation companies seems to have only limited declines in prices. Concerns over the state of the economy and ample supplies continued to dominate the pricing environment.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Almost on cue with the official start of summer this week, temperatures in the southern and middle parts of the country soared, likely boosting air-conditioning demand. Although cooling demand represents a major consumption segment in the natural gas industry, in the past week higher demand from electric generation companies seems to have only limited declines in prices. Concerns over the state of the economy and ample supplies continued to dominate the pricing environment.”

Wall Street trying to polish its image.

Wall Street’s largest trade group has started a campaign to counter the “populist” backlash against bankers, enlisting two former aides to Treasury Secretary Henry Paulson to spearhead the effort.

“This effort, which is not uncommon for a trade association, is designed to ensure our ideas for improved accountability, oversight and transparency are heard by the widest possible audience,” Ryan said. The industry has “a duty to help craft a solution, so we’ll continue leading by example in our efforts to properly safeguard our financial system and serve the needs of the overall economy, local communities and individual investors,” he added. Hogwash!

NEoWave Warns Stock Market Has Peaked for 2009

Glenn Neely, founder of NEoWave Institute and prominent Elliott Wave analyst, today announces a startling prediction: The S&P 500 is forming a major top in June, which will be followed by a large decline, eventually pushing the stock market to record lows for the decade. No need to say more.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.