The Shamans Economic Solution: Why Failure is Imminent

Economics / Recession 2008 - 2010 Jul 14, 2009 - 05:58 AM GMTBy: Anthony_Ebin

Lets say that Bernanke, Geithner, Krugman are all correct in saying that government stimulus/intervention is the only way to stimulate the economy out of recession/depression. So they ask Obama to spend enough money to create enough jobs to eventually solve the problem. Now there are 2 main ways that government can raise the amount of money that people like Geithner and others have calculated would be enough to stimulate the economy:

Lets say that Bernanke, Geithner, Krugman are all correct in saying that government stimulus/intervention is the only way to stimulate the economy out of recession/depression. So they ask Obama to spend enough money to create enough jobs to eventually solve the problem. Now there are 2 main ways that government can raise the amount of money that people like Geithner and others have calculated would be enough to stimulate the economy:

1. They can use savings or raise taxes. But of course America doesn't have any public savings1 and Obama might have lost the election if he had been forthright about the number of new tax schemes he would have to introduce. Cap and trade is just the beginning. And since Obama is such an honorable guy he's not going to do something that he promised he wouldn't. So raising taxes is out of the question(for the time being).

2. They can borrow the money. This borrowed money comes from 3 main sources:

i. They can borrow from their own citizens, like during WW2, when they asked citizens to purchase govt. IOU's2. But unfortunately the last 50 years of binge spending left Americans with very little private savings. This option flies out the window quicker than it opened the door.

3

3

ii. They can borrow from foreign banks/governments/citizens. And this is what they did this time. Obama approved massive loans from China and the middle east. But would you know it, this wasn't enough and so the last, most insidious option comes into play.

iii. They borrow from the central bank. This is when the US treasury sent about $300 billion of bonds to the federal reserve. The fed pays for these bonds by creating money out of nothing. Its a cliche now. So the newly minted money goes to the US govt. which uses it to finance major government programs that are justified by the guise of creating employment. Even war creates employment. But is that a reason to go to war?

Now I personally see two main problems with a government spending plan:

1. All these methods take money out of one part of the economy and puts it into another at the government's discretion. They call it redistribution of wealth. I contend that redistribution of wealth is a fancy term for stealing. Robin Hood is said to have stolen from the rich and given to the poor. Even if he was actually redistributing wealth, we have no qualms about saying that he stole that wealth. Here's an excerpt from wikipedia about Robin Hood:

"Robin Hood has become shorthand for a good-hearted bandit who steals from the rich to give to the poor. It is also a proverbial expression for somebody who takes other people's giveaways and gives them to people he or she knows who could use them. This can be called "Robin Hood giving." There have even been so-called "Robin Hood laws" which involve the government taking money from wealthy judicial areas (such as school districts) and redistributing it to poorer ones. Many countries and situations boast their own Robin Hood characters."4

But lets forget for a moment the inequitable nature of stealing. Lets look instead at the effects of stealing and redistributing wealth. Lets say Robin Hood stole money from a wealthy landlord named Jimmy Canes and gave that money to the poor people of Great Dappers. We know that Jimmy is now worse off than before. But are the people of Great Dappers better off? Well to know the answer to that we have to know why they were worse off in the first place. If the people of Great Dappers were poor because they chose to be poor then they will continue to be poor and the economy as a whole is worse off because Great Dappers is not better off and Jimmy Canes is worse off. One might ask how can anybody choose to be poor? And my answer is quite simple, choice is reflected in one's actions and not one's answers to a survey. When you have a child you can't afford, you are making a choice of making yourself poorer. When you buy a million dollar house with a five-figure income, you are making a choice. When you reject a job that pays below minimum wage even though that is all that you are qualified for, you are making a choice.

Now if Robin Hood gave Great Dappers this gift of stolen money when they made the choice to be poor what happens is quite logical. If they chose to be poor, whatever choice they made can be said to be harmful to their wealth. Giving them money is rewarding them for making the 'wrong choice'. This gives them enormous incentive to continue making that same choice because they haven't felt the consequences. For e.g. If Great Dappersians had a habit of overproducing offspring, sooner or later the scarcity of resources will remind them of their bad choice and guide them towards an equilibrium where the rate of reproduction will be sustainable by the limited resources. This may seem like catastrophe to the untrained eye but it is actually much better than the alternative because it was chosen and not forced upon them. If instead Great Dappers had been gifted gold by Robin Hood stolen from Jimmy Canes every time they had a shortage of resources, Great Dappers will use the gold to continue living in the same unsustainable way that they were before and the resources would deplete much sooner and Great Dappers will be looking at migration/starvation/extinction.That is the economic consequence of charity.

However if Great Dappers is poor because they were forced into poverty then the situation changes. For e.g. If Great Dappers is poor because they were bonded slaves of Jimmy Canes then a revolution is entirely justified. But you can't steal from Jimmy and give to Great Dappers because the question arises who deserves what? And it just perpetuates the problem of forced choice. What is required is freedom. The slaves have to acquire freedom and here there might be a role for a government. But this is still debatable and should not be settled soon. What should be settled is that after the abolition of slavery and the spread of democracy, choice has played a greater role in poverty than bondage. Today, people in democratic countries can have a say in almost all aspects of life. The truth is that today one can choose to be rich, if one can also choose to sacrifice when necessary. A governments only role should be to protect this right of choice as long as it does not impinge on another's right of choice. A government that taxes directly or through inflation is just perpetuating poverty through forced choice.

2. The second issue is that the loans have to be paid back or defaulted on. But to pay back a loan you have to earn enough money. The real outstanding debt of the US can be found at http://www.truthin08.org/ which estimates the US debt at $62 trillion at the time of writing this article. This is over and above the reported debt of $11 trillion because of unaccounted liabilities like social security. The current US GDP is at $13 trillion. This amount is has been given the regular accounting touch up but can still be used as an optimistic estimate. So given a debt of $62 trillion and an income of $13 trillion how much does the US have to earn to pay back this debt? It doesn't matter because it is not going to be paid back as is explained below. You see, a curious feature of modern economics is the acceptance of the pretentious nature of money made out of debt. Is it the case that we do not understand fractional reserve banking with fiat money or that we understand it and willfully ignore the consequences as something to be dealt with in the never to come future. A tomorrow never dies situation. Even if the general masses(including Obama) do not understand money, I'm sure that at least economists like Bernanke and Krugman do.

I'm going to give a simplified explanation of the money creation process. For further details please refer to Modern Money Mechanics a booklet by the Chicago Federal Reserve widely circulating on the Internet.

I will make some simplifying assumptions:

1. Bank A is the only bank in the system(reasonable assumption since the banking industry is a closed system and using one bank in hypothesis is like using a combined balance sheet of all banks put together).

2. There is no money in the system initially and the amount of currency in the system is zero i.e. most money exists as bytes on computers.(in reality currency is a small percentage of the total money supply anyway)

Step 1. The Federal Reserve Bank purchases government securities worth $100, bank reserves increase. This happens because the seller of the securities receives payment through a credit to a designated deposit account at a bank (Bank A) which the Federal Reserve effects by crediting the reserve account of Bank A.

Observation: Now the total money supply is $100

Note: Since Bank A is the only bank in the system any checks that the dealer writes on his account will return to Bank A in the form of new deposits. So the whole money expansion process takes place within the balance sheet of Bank A.

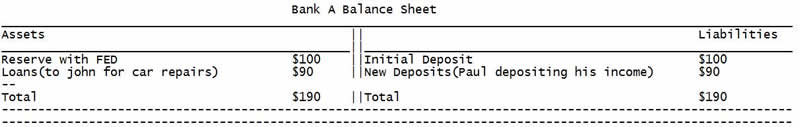

Step 2. Reserve requirements by the FED means that Bank A has to hold 10% of its deposits as reserves. The remaining, which is known as excess reserves is loaned out or invested. $10 is held as reserve while $90 is loaned out. The loan is made exactly as when the FED loaned the treasury. They do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers' transaction accounts. Since Bank A is the only bank in the system any checks that the dealer writes on his account will return to Bank A in the form of new deposits.E.g. John borrows $90 from 'Bank A' to pay Paul the repair man for car repairs. Paul takes the money and deposits it into his account at 'Bank A'. So Bank A's balance sheet looks something like this:

Observation: Now the total money supply is $190 and since a loan has been made the bank has to collect interest on it. Lets say the interest is 10%. So $9(10% of 90) is outstanding interest that Bank A is yet to receive.

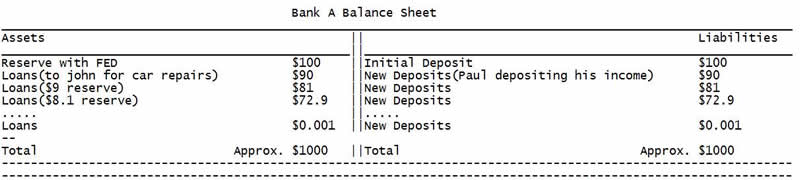

Step 3. This process continues until the balance sheet looks something like this

Observation: So the final money supply of $1000 has been created entirely out of debt until you realise that the money has to be paid back. If we total up the outstanding interest it comes up to $100. And the total principal is $1000. So you can see my dilemma of having to pay $1100 when the system has only $1000.

We can use the above balance sheet to create a formula for money supply, interest outstanding and principal at the end of the expansion process. It is known as the multiplier. The money/debt multiplier is the inverse of the reserve ratio. The interest multiplier is the inverse of the interest rate. So the money multiplier and the interest multiplier are both 10.

Lets go back to our question: given a debt of $62 trillion and an income of $13 trillion how much does the US have to earn to pay back this debt? Now you know why it doesn't matter and the debt is never going to be paid back.

So ultimately the debt that the US and other countries have taken out to get them out of even more debt is not going to help. In fact this is perpetual debt. Exponentially rising debt. The money borrowed into existence cannot be paid back. Ever! it has to be defaulted on(not such a bad idea) or a policy of print the money and repay has to be employed. Mint and pay again is unsustainable because if a country does it enough times no one will want to lend more money and then the debt has to be defaulted on.

But there are other reasons the government should not be given the money it wants. Has anyone wondered why governments all across the board have experienced corruption, bureaucracy and inevitably fail to live up to campaign promises. Again I think the answer is simple. The Government has too much power. They have no competition. Governments all over the world have monopolies in industries either vital to the economy or to national security. Without competition consumers can't show their true preference through the bidding mechanism, instead they show their artificial preference through the election process where consumers have no immediate stake in the process. If people had to pay to vote it is much more likely that the true preferences are being represented. For e.g. When are you more likely to scrutinise a house? when you get one as a gift or when you buy one?

That is why this massive global stimulus plan is just a massive sleight of hand in my eyes. Governments all over the world are acquiring more and more power at the exorbitant expense of our freedom. As everyday passes it seems that the state is making more and more decisions on my behalf. Why should the government be better than me at spending my money?

And yet we continue on this pointless endeavour of sustaining an unsustainable lifestyle. Why? Maybe my next article will help in answering this question. But don't expect it to be palatable to a closed mind. Until next time

By Anthony Ebin

Anthony Ebin is currently studying for a degree in Banking and Finance from the London School of Economics but his views do not necessarily reflect the views of the LSE.

References

1. http://www.treasurydirect.gov/NP/BPDLogin?application=np

for a truer reference - http://www.truthin08.org/

2. http://www.u-s-history.com/pages/h1682.html

3. Graphs from economagic.com

4. http://en.wikipedia.org/wiki/Robin_Hood

© 2009 Copyright Anthony Ebin - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.