The Gold Stocks Are Still Undervalued

Commodities / Gold & Silver Stocks Jul 17, 2009 - 02:24 PM GMTBy: Jordan_Roy_Byrne

Even after a massive recovery with sustained gains the gold stocks are still significantly undervalued. At the major highs of Gold $1030/oz and HUI 520, the costs to these companies were very high. Oil was high, steel was high and because of general inflation most costs were escalating. Now we have Gold 940, and HUI 350, but Oil and Steel are much lower.

Even after a massive recovery with sustained gains the gold stocks are still significantly undervalued. At the major highs of Gold $1030/oz and HUI 520, the costs to these companies were very high. Oil was high, steel was high and because of general inflation most costs were escalating. Now we have Gold 940, and HUI 350, but Oil and Steel are much lower.

Also the local price of Gold everywhere except in the US and Japan is higher than at the peak in March 2008. If you mine in Canada, you care about the price of Gold in Canadian Dollars, not the regular quoted Gold price. That is because most of your costs are in Canadian Dollars.

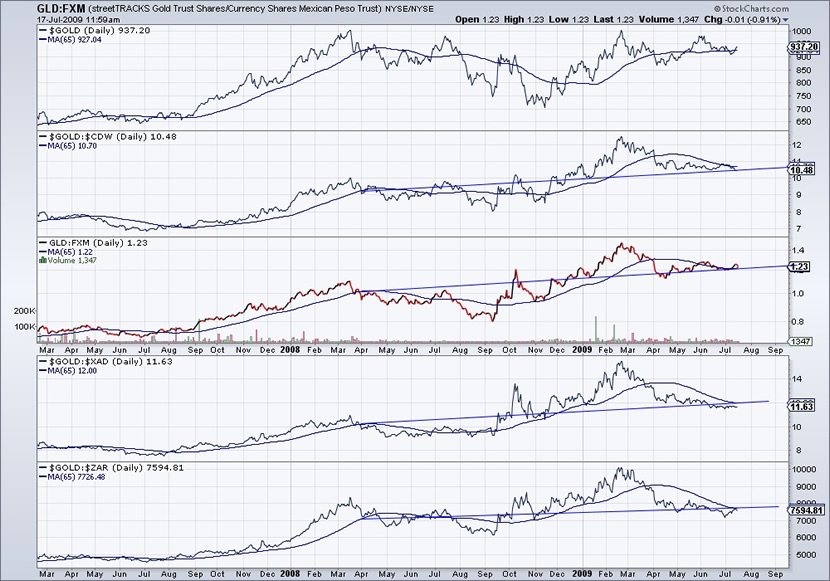

In a previous editorial, we have shown variations of the following charts. We show them again because they always help us in analyzing the fundamentals of gold stocks.

First we show the price of Gold against the other currencies, with a 65-day moving average, which can help us gauge an average price for a quarterly period. In every case, (including the US dollar Gold price) the moving average is at or above where it was at its peak in 2008. If you are producing Gold in Mexico (3rd from top) or Canada (2nd from top), then based on the local price, you are better off than at the peak in 2008. We should note that while Gold has rebounded in recent days, it needs to show better strength against currencies. Four of the five moving averages are trending down.

The second chart shows Gold/Gyx followed by Gold/Oil and then GDM/Gold. GDM is the broadest gold stock index. We know that Oil is a cost in mining. Gyx is the industrial metals index. We use Gyx as a proxy for the industrial costs in mining (steel, machinery, industrial equipment, etc). We can see that when Gold is outperforming Wtic (Oil) and Gyx, the gold stocks are likely to outperform Gold.

Conclusion

The HUI would have to rise nearly 50% to reach its all time high. Yet, today key input costs are lower and the price of Gold in most currencies is higher today than in March of last year. These positive developments bode very well for gold sector earnings over the next several quarters and for share prices of course. And if can Gold can breakout on its own without the reflation trade, then gold stocks could be looking at spectacular gains over the next twelve to eighteen months. Remember though, just because something is undervalued, doesn’t mean it will become fully valued within days or weeks.

If you are interested in more detailed and thorough analysis of Gold, Silver, the Dollar, and numerous gold/silver stocks, then you can click the link below to find out all the details about our new newsletter. We specialize in tracking the technicals and sentiment (short term options data and short interest) on 40 gold/silver stocks. http://trendsman.com/Newsletter/GSletter.htm

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.