For One Third of American's, Frugality is now the "New Normal"

Economics / Recession 2008 - 2010 Jul 22, 2009 - 11:34 AM GMTBy: Mike_Shedlock

A Gallop Poll of Americans’ future spending trends show One-Third Still Set on Spending Less.

A Gallop Poll of Americans’ future spending trends show One-Third Still Set on Spending Less.

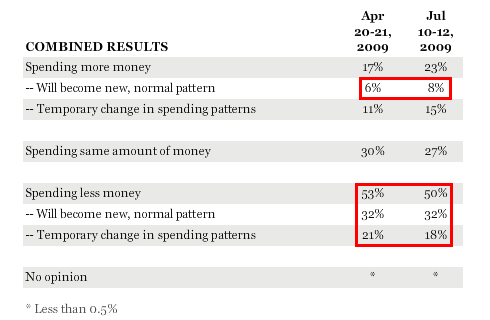

Here are the results of the question: If spending more or less money, just your best guess, is the change in spending habits your new, normal pattern for years ahead or just a temporary change?

There is little variance between April and July. However, note that most of those expecting to spend more think it will be temporary, while most of those who will be spending less think it will be the "New Normal".

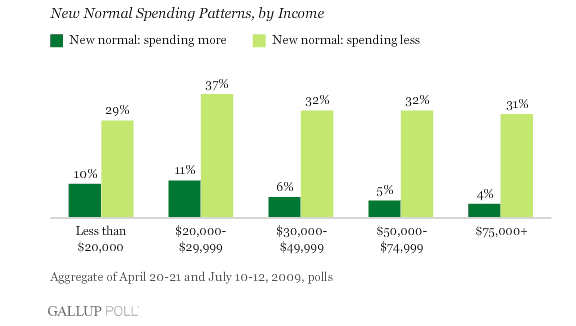

Given that tax hikes will hit the upper pay scales more and it is the middle to upper income ranges most devastated by the stock market and housing crashes, one might expect a significant falloff in spending in the middle and upper income groups. Such was not the case as those claiming to spend less are fairly uniform across all income groups as the following chart shows.

Multiplied across tens of millions of American households, even a small reduction in spending, perhaps coupled with a small increase in saving, could have a major effect on the consumer economy in the years ahead. And these data suggest that if one takes Americans at their word, there will be at least some shift in the nation's economy to a "new normal" of more restrained consumer economic activity for some time to come.

Spending Not Quantified

Wen it comes to spending, the poll does not quantify how much more or less. Nonetheless, it's significant that those willing to spend more are concentrated at the low end of the income scale ($30,000 and below).

Perhaps some low income workers expect a boost in the minimum wage to help. But if so, shouldn't it be permanent?

One in Four Americans Expect to Save More

The poll also showed that 25-27% expect to be saving more. Indeed the US Savings Rate Hits 6.9%, Highest In 15 Years.

In response to the above, I received many emails saying people were not saving, they were paying down bills.

The fact of the matter is: Paying down bills is saving. Similarly, putting money in the bank while racking up more debt is not savings.

For most wage earners, the savings rate is after-tax salary minus personal consumption expenditures (PCE).

By definition, the savings rate ignores interest income, capital gains, asset prices, etc.

Please see What's Behind The Soaring Savings Rate? for a more precise definition and further discussion of the savings rate.

Spending Patterns vs. Corporate Profits

Two-thirds of the economy is consumer spending and 50% of consumers claim they will be spending less while only 20% (concentrated at the low economic wage scales), think they will be spending more. Furthermore, most of those claiming to be spending more think it will be temporary, while most of those who think they will be spending less think it will be the "New Normal".

If it plays out that way, think corporate profits and the GDP are going to bounce strongly and stay up with those kind of numbers? If so, think again.

Target must be thinking again given they just canceled construction on a 185,000-square-foot SuperTarget store unless the developer agrees to rework the terms of the deal. See Moody's Commercial Real Estate Scorecard Accelerates To Downside for more details including grim hotels and industrial stats.

Consumer demand is not there and more importantly, it is not coming back. The implications are ominous for commercial real estate and the much hoped for recovery in jobs.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.