U.S. Consumer Confidence Falls More than Expected

Economics / Recession 2008 - 2010 Jul 28, 2009 - 12:30 PM GMTBy: Mike_Shedlock

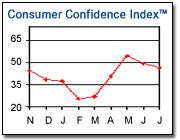

After rebounding from the depths of hell in February, the Consumer Confidence Survey shows Consumer Confidence Numbers Retreat Again.

After rebounding from the depths of hell in February, the Consumer Confidence Survey shows Consumer Confidence Numbers Retreat Again.

The Conference Board Consumer Confidence Index™, which had retreated in June, declined further in July. The Index now stands at 46.6 (1985=100), down from 49.3 in June. The Present Situation Index decreased to 23.4 from 25.0 last month. The Expectations Index declined to 62.0 from 65.5 in June.

The Conference Board Consumer Confidence Index™, which had retreated in June, declined further in July. The Index now stands at 46.6 (1985=100), down from 49.3 in June. The Present Situation Index decreased to 23.4 from 25.0 last month. The Expectations Index declined to 62.0 from 65.5 in June.

Says Lynn Franco, Director of The Conference Board Consumer Research Center: "The decline in the Present Situation Index was caused primarily by a worsening job market, as the percent of consumers claiming jobs are hard to get rose sharply. The decline in the Expectations Index was more the result of an increase in the proportion of consumers expecting no change in business and labor market conditions, as opposed to an increase in the percent of consumers expecting conditions to deteriorate further."

Those saying business conditions are "bad" increased to 46.3 percent from 45.3 percent, however, those saying conditions are "good" increased to 9.1 percent from 8.1 percent. Those claiming jobs are "hard to get" increased to 48.1 percent from 44.8 percent, while those claiming jobs are "plentiful" decreased to 3.6 percent from 4.5 percent.

The percent of consumers anticipating an improvement in business conditions over the next six months decreased to 18.0 percent from 20.9 percent, however, those expecting conditions to worsen decreased to 18.9 percent from 20.4 percent.

The labor market outlook was also mixed. The percentage of consumers expecting more jobs in the months ahead decreased to 15.0 percent from 17.5 percent, however, those expecting fewer jobs decreased to 26.3 percent from 27.6 percent. The proportion of consumers expecting an increase in their incomes declined to 9.5 percent from 10.1 percent.

Consumer Confidence Falls More Than Expected

A few extra details on the Consumer Confidence numbers are in Bloomberg's report U.S. Consumer Confidence Falls More Than Forecast.

The Conference Board’s confidence index dropped to 46.6, a second consecutive decline, following a reading of 49.3 in June, a report from the New York-based group showed today. The figure reached a record low of 25.3 in February.

The share of consumers who said jobs are plentiful dropped to 3.6 percent, the lowest level since February 1983. The proportion of people who said jobs are hard to get climbed to 48.1 percent from 44.8 percent.

Company results indicate households are being frugal, even with spending on food. PepsiCo Inc., the world’s largest snack maker, said second-quarter profit fell as consumers favored less-expensive drinks.

Today’s figures corroborate other reports. The Reuters/University of Michigan final index of consumer sentiment declined in July for the first time in five months as surging unemployment and stagnant wages shook households.Your Bag of Chips got Bigger

In regards to increasing frugality on food, inquiring minds have noted Your bag of chips got bigger but price stays the same.

Your eyes are not deceiving you in the grocery store. Yes, your bag of Doritos just got bigger. No, the price didn't change.

Last year, food packages shrank as food-makers, dealing with record high ingredient costs, struggled to maintain their profits. But the weakened economy has caused a slump in demand for ingredients such as corn and oil, pushing those prices back down. With lower ingredient costs -- and higher consumer demand for more value -- some brands such as Frito-Lay are shifting back to bigger packages, and doing it without raising prices.

So far, the most evident size boosting is in the chip aisle, where Frito-Lay dominates. The company has boosted package sizes for brands such as Doritos, Cheetos and Fritos by 20 percent, reversing cuts made to bag sizes last year. Bags on shelves feature a white stripe announcing: "Woa there's 20 percent more free bold bites in here."

Certain Doritos flavors have gone from 12 ounces back to 14.5 ounces, while Fritos bags are 17.5 ounces, up from 14.5 ounces. The pricing is unchanged, ranging from $2.89 to $3.99. A spokesman said Frito-Lay was unsure if these changes would be permanent.

Experts say offering larger sizes -- along with other methods, such as coupons or buy-one-get-one-free promotions -- can persuade shoppers who are trying to save money to stick with name brands.Name brands have been running "buy one get one free" campaigns on and off for at least a year. Now they have increased the number of ounces in the bag as well. Of course all they really did was put back the ounces they last took out, but it's a start.

From chips to cars it's clear that companies must respond to the Incredible Shrinking Boomer Economy where boomers have begun to downsize and generations X and Y are more concerned about value shopping or "cheap chic" than they are in "quintessential boomer brands" such as Mercedes.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.