Stock Markets Best Month for 20 Years

Stock-Markets / Financial Markets 2009 Jul 31, 2009 - 10:35 PM GMTBy: NewsLetter

Dear Reader

Dear Reader

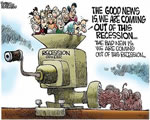

The stock markets close July with many widely tracked indices experiencing their best performance for the month of July for more than 20 years. Many commentators are writing "where are the investors?", as few have ridden the rally, which is the whole point of a stocks stealth bull market as most investors smarting from the bear market remain paralysed by fear of the preceding bear market that either miss or in fact consistently bet against, convinced by a stream of statistics as to why this rally should imminently terminate, no matter that the so called 'bear market rally" has risen some 40% and for asian markets more than 100% since the March lows.

Dow Jones Index ended July at 9171, Up 725 points, 8.6% on the month, Up 2701 points, 41.8% from the March 6470 low.

In mid March i wrote -Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470

In Summary - We have in all probability seen THE stocks bear market bottom at 6470, which is evident in the fact that few are taking the current rally seriously instead viewing it as an opportunity to SELL INTO , Which is exactly what the market manipulators and smart money desires. They do not want the small investors carrying heavy losses of the past 18 months to accumulate here, No they want the not so smart money to SELL into the rally so that more can accumulated at near rock bottom prices! Therefore watch for much more continuous commentary of HOW this is BEAR MARKET RALLY THAT IS TO BE SOLD INTO as the Stealth Bull Market gathers steam.

Most recent analysis of 23rd July projects towards a 2009 target of 9,750 to 10,000 by the end of October 09.

FTSE 100 Index ended July at 4608 Up 359 points, 8.5% on the month, Up 1148 points, 32% from the March 3460 low.

In mid March i wrote -FTSE 100 Index Stealth Bull Market as Bear Market Bottoms at 3,460

This article is a quick update which includes summaries of recent analysis and the initial FTSE buy triggers for what I expect will turn out to become a multi-year bull market whilst the vast majority of market participants (small investors / analysts) FAIL to recognise the stealth bull market now underway until many months and a good 30% rally has already taken place as the perma bears that have enjoyed much press coverage as the bear market raged WILL continue to convince most investors from failing to participate, leaving only the smart money, i.e. hedge funds, fund money pools and yours truly to accumulate.

I expect the FTSE to follow a similar track to the Dow and target 5,000 this year.

Your Stealth Bull Market Trading Analyst

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Vicious Stocks Stealth Bull Market Eats the Bears Alive!, What's Next? |

By:Nadeem_Walayat

The price action following the SELL signals earlier this month can only be described as a VICIOUS BEAR TRAP !, We got sell signals, good ones for Stock BULLs such as myself (as of Mid March 2009) it was a clear sign to get ready to accumulate more, for bears it was a sign to double up for the long awaited bear market RETEST and maybe to make back some of the money lost shorting the rally ?

| 2. Citizens of the United States Welcome to Animal Farm 2009 |

By: James_Quinn

“All animals are equal, but some animals are more equal than others.” - George Orwell – Animal Farm

| 3. Liberté, Egalité, Fraternité – Providence, Miracle or What Really Happened |

By: Robert_Singer

Warning: Reading the following may be hazardous to your mental health. The material herein has caused readers to experience Cognitive Dissonance (CD). CD is the discomfort felt at the discrepancy between what you already know or believe, and new information or interpretation that contradicts a strongly held belief system – It’s that queasy feeling that rises in your gut and screams, I DON’T BELIEVE THAT! Because, if you accepted the new information, you would have to admit you been ”had,” or ”conned,” in this case into shopping for stuff to trash the planet.

| 4. Gold Bull Market Guaranteed to Make new Highs During 2009 |

By: Douglas_V._Gnazzo

Gold - For the week gold gained $14.10 (+1.50%) to close at $951.50 (continuous contract). This was the highest weekly close in the last seven weeks, so it is a positive development, especially if it holds.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. From Stocks Bear Trap to Bull Market? The US Dollar is Key |

By: The_BullBear

A false breakdown has reversed sharply to new highs. Has a new Bull Market begun?

Since the last BBMR on May 25th, the equities markets have made a top, established a new downtrend and then threatened to break down out of a head and shoulders formation. The break was rejected with a violent upside thrust to new highs. Market action and technicals are suggestive of a renewed bull trend.

| 6. Hey Professor Roubini! The Street Says The Dow Is Going to 15,000! Are They Nuts? |

By: Andrew_Butter

We didn't hear much talk about that "dead-cat-bounce-sucker-rally" recently, and all those guys with those pretty brightly-colored P/E ratio charts and pages and pages of verbiage predicting S&P 500 going to 450 seem to have disappeared along with the “Gold piercing $1,000 and on to the stratosphere” theorists. Perhaps they are on holiday?

| 7. Agricultural Commodities Bull Market |

By: Sean Broderick

World cereal prices hit record highs in 2007 and in the first half of 2008. Consequently, food prices spiked, which in turn triggered riots in dozens of countries along with a series of food export bans. Since then, prices have fallen due to a good harvest in 2008.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.