Why the Big Money in Gold Shares Still Lies Ahead

Commodities / Gold & Silver Stocks Jun 12, 2007 - 12:50 AM GMTBy: John_Mauldin

This week in Outside the Box we take a quizzical gander at the gold market, its growth-to-date, and potential future investment opportunity. We have witnessed a significant rise in the gold market from a July 1999 price of $252 an once, to $653 an once today, an increase of 159%. David Galland, of Casey Research, provides an intriguing analysis of the gold market today and the inherit investment opportunity existent on account of severely curtailed research exploration, institutional obstacles, NGOs, and rising global demand, driven primarily from the emerging market economies.

This week in Outside the Box we take a quizzical gander at the gold market, its growth-to-date, and potential future investment opportunity. We have witnessed a significant rise in the gold market from a July 1999 price of $252 an once, to $653 an once today, an increase of 159%. David Galland, of Casey Research, provides an intriguing analysis of the gold market today and the inherit investment opportunity existent on account of severely curtailed research exploration, institutional obstacles, NGOs, and rising global demand, driven primarily from the emerging market economies.

I have known Doug and David a very long time. I made my first dollar on gold stocks back in the mid-1980s when Doug Casey personally called me up and told me to by a particular stock. It was quite a home run and I have paid attention to what Doug says on gold stocks ever since. They take their research on gold stocks very seriously, and have been quite successful over the past years. If you are interested in specific gold stocks and gold stock investing, I really suggest you subscribe to Doug Casey's letter. They will send you his recent update, which covers in-depth all the stocks he likes and a few he says to avoid. For more information on how to subscribe, please click here .

John Mauldin, Editor

You'd be correct in suspecting that the easy money in gold shares has already been made. It has. But it would be financial folly of the highest order to assume that it's too late to make the big money. The big money is still on the table.

The reason has to do with something that's simple to understand but that not one investor in a thousand has heard about: the exploration cycle.

ABCs of Exploration

In a manufacturing business, an entrepreneur buys raw materials from suppliers and then assembles the materials into cars, shoes, candlesticks or some other final product. But in the extractive industries, such as oil or gold, the first step isn't to buy raw materials but to find them. And it's not easy, because nature has hidden them under the earth's crust, perhaps in a remote or even dangerous corner of the world.

Understanding the timing of the exploration process is critical to understanding why the big gold profits are still ahead, and why it is so important to get positioned in the quality companies today, while there is still time to do so.

The process, greatly abbreviated here, begins when a team of geologists -- perhaps working for a big mining company, but more often than not, for a fleet-footed junior Canadian exploration company -- come up with a geological concept. ("Geological concept," if you're not familiar with the term, is geology talk for "educated guess.")

Gathering up picks and shovels, the team spends days, weeks or even months poking through the brush looking for rocks that would suggest their idea has some merit. If they find anything promising, they'll collect samples and send them to an assay lab for a mineral analysis.

If the assay lab had nothing else to work on, our geologists might get a report back in days. But in fact, assay labs aren't nearly as numerous as, say, donut shops. And due to the surge in exploration in recent years (a topic I'll return to momentarily), there is a large and growing backlog at the world's few assay labs. So explorers must wait 2 to 4 months or even longer to learn whether their rocks carry traces of a valuable deposit or are just... rocks.

Assuming the assay results are encouraging, the explorers move on to the next phase, trying to verify that an ore deposit is waiting beneath the surface. Of course, they can't see under the dirt and rock, so they do the next best thing, which is to drill deep holes and dig out samples.

Before you can drill, however, you must get a permit to disturb the ground, a process that, depending on where your property is located, can take two months to a year - or in some ecologically sensitive areas, forever.

Because our hypothetical exploration team is on the ball, we'll assume they get the permit. Which takes them to the next hurdle: while the shortage of assay labs is acute, the shortage of drills and experienced crews to run them is far, far worse. How much worse? If you want to drill a project in 2007 and don't already have a drill lined up, the odds of finding one this late in the game are somewhere between slim and none.

Okay, but our team is lucky - or well connected - and so is able to lock up a drill. Now begins the long and expensive process of punching enough holes in the ground to find out what's really there and to map out the boundaries and orientation of the deposit. The drilling may proceed just a few holes at a time, so that what's learned from each hole can be used to point where the next ones should be drilled. Of course, at each step, the sample the drill pulls out of the ground must be sent to an assay lab to wait its turn for analysis... and the clock ticks on.

In time, the geologists are able to assemble the assay data into a reliable geological model. Around this time, the focus shifts to verifying that the minerals they've found are present in sufficient quantities to warrant the expense of clawing them out of the ground, that expense being influenced by a multitude of factors, not the least of which is how far below surface the deposit is located and in what kinds of rock.

But let's say it appears to be an economically large deposit - say, a million or more ounces of gold. Now the exploration company has to confirm the metallurgy, a branch of science of great complexity. On ascertaining that you will be able to economically (there's that word again) separate the shiny yellow stuff from the dirt and rock, you move onto the next square.

Oh, No... NGOs!

Throughout this process, the smarter explorers invest considerable time and energy in softening up the local population and politicians. Get it right, and you might only have to wait a year or two for the environmental and construction permits needed to build your mine. Get it wrong, and you could be looking at delays of a decade or more.

Throughout modern times, getting the locals to accept a mine has been a stiff challenge, whether dealing with citizens who hate the idea of a mine in their backyard or politicians who see the project as an opportunity for nationalistic grandstanding or outright extortion. Today, however, there's a new army of nay-sayers: dozens of well-funded Non-Governmental Organizations (NGOs), whose officers earn the entirety of their paychecks by trying to stop all mining in all countries.

Make no mistake, these NGOs, some of which are playpens for committed Luddites, are well financed, well organized and increasingly well acquainted with the many ways a proposed mine can be tied up legally or by stirring up the local or national population.

If by this time a mining entrepreneur hasn't decided to change careers and go into something less challenging, such as trying to build pipelines in Iraq, and he's able to battle through the NGOs, he still needs to build the mine - which means securing a lot of power and water. And because mine output is not light and easy to ship, all manner of additional infrastructure is needed. One intrepid would-be Yukon miner we're acquainted with will first have to spend $2 billion to build, among other things, a road and power line more than 60 miles long. The work, scheduled to begin soon, is expected to take until 2012 to complete.

This sort of build-out is difficult enough in a friendly environment, but most of the world's remaining large mineral deposits are located in places such as the Congo, the high Andes or, literally, Outer Mongolia.

Of course, all of this is voraciously time consuming, and none of it is cheap.

While you may think I'm overtelling the story, I'm actually short-handing the description of the process. The reality is much, much more challenging. It is no wonder, therefore, that only about 1 in 3,000 geological targets ultimately makes it into production. And even for the rare success, years pass between the original geological idea and the first mine shipment.

Okay, Can We Get to the Making-Me-Money Part?

Between the years 1980 and 2000, gold and pretty much all other commodities suffered a grim bear market. Gold dropped from a high of $850 in January 1980 all the way down to $252 in July of 1999, after which it traded pretty much sideways until the current bull market started to emerge in Q102.

At $850 per ounce, crawling over the figurative fields of ground glass to get a gold mine into production was worth the risk and hassle. Decidedly not the case at $252 per ounce.

Not surprisingly, with dark clouds cloaking the mining landscape for 20 years, the mining industry went into hibernation. Drill rigs were left to rust, universities stopped offering programs in economic geology, and former mining promoters reinvented themselves as dot-com impresarios.

Importantly, and understandably, funding for the junior Canadian exploration companies that are now leading the charge into the remote corners of the world to search for new deposits was virtually non-existent.

Exploration's recent dark age is over now, but it had a profound effect that hasn't yet played out. And it's an effect that you can profit from - and profit soon.

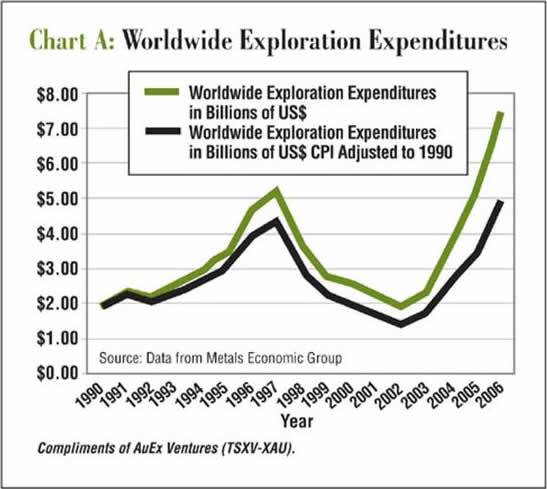

In Chart A , Ron Parratt, President of AuEx Ventures and one of the world's most successful exploration geologists, shows worldwide exploration expenditures between 1990 and the present (the only period for which data is readily available).

As you can see, other than the mid-1990s' upswing -- caused by a series of fluke discoveries, one of which turned out to be a massive fraud - the default mode for this period was for exploration expenditures to bump along near the bottom of the possible range. (Even in the worst of times, expenditures don't go to zero, because the major mining companies want to replace what they sell, so that they won't sell themselves out of business.)

It doesn't take going through the whole Aristotelian logic thing to figure out that a drastic reduction in exploration spending, meaning fewer geologists out in the field looking for new deposits, will, in time, result in fewer and fewer new deposits being found.

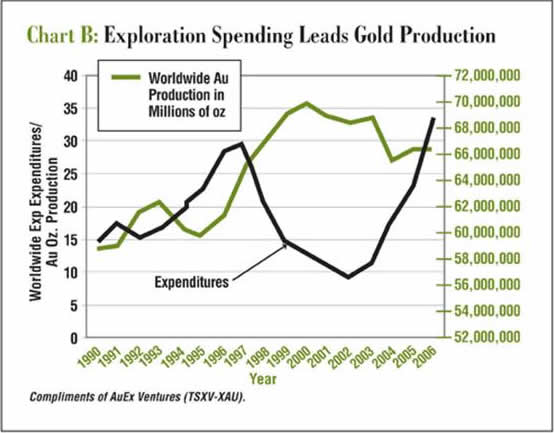

Now here's where it gets interesting. In Chart B Ron overlays mine production.

Immediately apparent is the long lag between exploration expenditures and new production coming on line. The lag is unsurprising if you recall my explanation of the laborious and slow-moving exploration cycle.

The fact of the matter is that unless you have the luxury of exploring an area contiguous with an existing mine - low-hanging fruit for which the exploration/production cycle could be as quick as 2 to 4 years - the time required to move a good geological idea into production is typically 6 to 10 years.

As you can see in the chart, recent production increases have come from the increased exploration back in the mid-1990s. Importantly, we haven't yet picked the fruit from the soaring exploration expenditures that kicked off in earnest only in 2003.

Today expenditures have reached historic levels. As in "never before" has so much money been spent poking at rocks. It is inevitable, therefore, that as sure as night follows day, so, too, will a series of major discoveries. And most of those discoveries will be made by micro-cap junior Canadian exploration companies - many of which still trade below $1.00 and boast market capitalizations under $50,000,000. By positioning yourself in the higher-quality and better-managed of these stocks today, you put yourself on the path of extreme profits. How extreme? When I tell you, you are going to like the path.

Back to the Mid-1990s' Discovery Market

I mentioned the mid-1990s' discovery market, a raging albeit short-lived bull market in Canadian exploration stocks that literally turned dimes into dollars and even tens of dollars. The table below gives a quick sampling of returns investors actually made in the better companies.

Importantly, these returns were made against a backdrop of generally flat to falling gold prices. The bull market was triggered by a series of mineral discoveries, including those made by Diamet (diamonds), Diamond Fields (nickel) and Arequipa (gold)... with the final "discovery" being that of Bre-X (fools gold), later unmasked as a really big fraud, which deflated investor enthusiasm and killed off the bull market in gold shares almost overnight.

Even so, during this period, in which investor interest rose to the level of a minor mania, companies with little more than drill holes were selling for $20 a share.

Which brings us to the present. Unlike the action in the mid-1990s, the next round of attention-grabbing discoveries will occur in the folds of a secular gold bull market, one that is soundly based on concerns over the impact of a faltering U.S. dollar on the global monetary system. Which is to say, it could have several years left to run (currency trends tend to last a decade or more, once in motion).

When will the first of the inevitable big discoveries be made - the one that makes the market sit up and take notice? It literally could be any day now. In fact, in the pages of our International Speculator , we're already following several companies working deposits with the potential to be giants, including one that just hit into what looks to be a rare gold porphyry (most porphyries are copper dominant). If the next round of drilling confirms this, we could be looking at an elephant deposit of 20 million ounces - or more.

The market cap of that company? Currently around $100 million. By the time this is over, it could be 10 times that amount.

The gold market and, for leverage, the high-quality gold exploration shares, are just getting warmed up for the really big show just ahead.

As my favorite partner and long-term friend Doug Casey is fond of saying, the trick to making the big money from investing is to be timid when everyone is bold... and bold when everyone is timid. With a new round of major discoveries just over the horizon, this is definitely the time to be bold.

David Galland is the managing editor of Doug Casey's International Speculator , now in its 27th year of helping independent-minded investors with unbiased recommendations on investment with the potential to double or better within a 12-month horizon.

An example from the most recent edition, June 1, 2007: within days of being recommended in the International Speculator, a junior gold exploration company announced a spectacular gold intercept, sending the stock from its $2.74 recommended price to $3.78... a 38% gain in just 7 days (and it's just beginning to gain momentum).

Most investors risk 100% of their money in the hope for a 10% return. The International Speculator reverses that formula, helping you reduce overall portfolio risk while boosting performance. To find out how you can give it a try, risk-free, click here .

I hope you found that thought provoking. Once more, if you are interested in subscribing, please click here .

Your looking for that pot of gold on the other end of the investment rainbow analyst,

By John Mauldin

http://www.investorsinsight.com

To subscribe to John Mauldin's E-Letter please click here: http://www.frontlinethoughts.com/subscribe.asp

Copyright 2007 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.