ISM Shows Recession Not Over Yet

Economics / Recession 2008 - 2010 Aug 05, 2009 - 10:43 AM GMTBy: Mike_Shedlock

The horn tooters have to wait at least another month before the recession is over judging from the non-manufacturing ISM numbers.

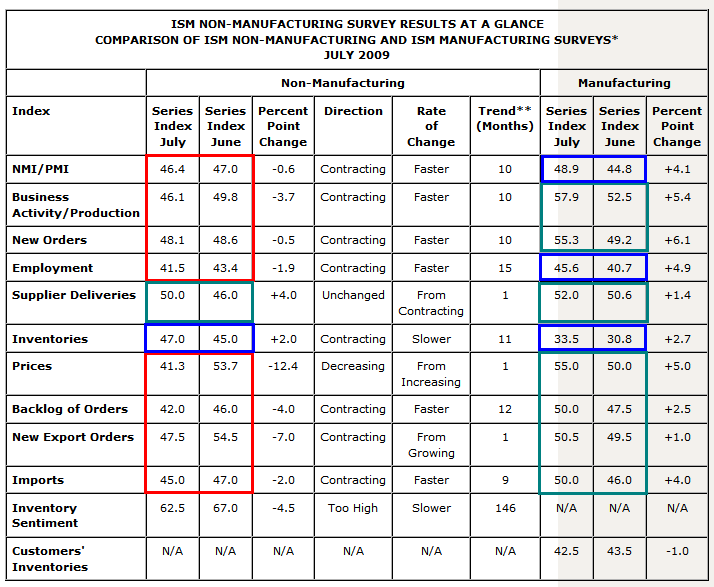

Please consider the July 2009 Non-Manufacturing ISM Report On Business®.

The report shows the NMI (Non-Manufacturing Index) dropped .6% in July to 46.4, contracting for the 10th consecutive month at a slightly faster rate.

Manufacturing vs. Service Sector ISM

The table shows that 8 out of 10 Non-Manufacturing components are worse this month than last month. Only deliveries are in the green while inventories are contracting at a slower rate.

By contrast, 7 out of 10 Manufacturing components are in the green and the other three are contracting at a slower pace.

I compared the 10 numbers that had direct equivalents.

Looking at the data, one has to wonder if the manufacturing numbers are an outlier and/or skewed by auto manufacturing anomalies.

Regardless, the NBER is unlikely to declare the end of the recession on numbers like these. Put away your party hats and horns for at least another month.

David Rosenberg commented this morning in Coffee and Muffin with Dave

"We ran some regressions that suggest that the equity market is already priced for the ISM to hit the 51 mark — as we saw in February 2002 when the index pierced 50 amid visions of a sustained inventory cycle, it was right at that time that the S&P 500 began to sputter. That's the problem when all the good news — and then some — gets discounted so quickly. We still think disappointment will inevitably set in over the sustainability of an inventory re-stocking that fails to be backed up by a revival in consumer demand."

Indeed. The Global GDP Rebound Is Underway, But Who's The Buyer? The answer of course is government, not the consumer, except for inventory rebuilding and "free money" programs like "cash for clunkers".

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.