Stocks Bull Market or Bear Market Rally, Which is it ?

Stock-Markets / Financial Markets 2009 Aug 08, 2009 - 07:36 PM GMT The Monthly Jobs Report did it again!

The Monthly Jobs Report did it again!

Sy Harding reports, “As I have been pointing out for many years, the Labor Department’s monthly jobs report has the record for coming in with a surprise in one direction or the other more often than any other economic report, and therefore produces more immediate triple-digit moves by the Dow in one direction or the other in reaction.

It happened again on Friday. Wall Street, and therefore the media, jumped on Friday’s surprise report that only 247,000 more jobs were lost in July, which was better than Wednesday’s ADP report of a loss of 371,000, and better than economists’ forecasts that 275,000 jobs would be lost.” Read the full article here.

The NASDAQ 100 ... Has it Been in a Bull Market Rally, or in a Bear Market Rally?

Marty Chenard comments, “Many investors believe the current NASDAQ 100 run-up has been a Bull market rally. Others think it has been a Bear market rally. What's the answer?

The answer is pretty easy to decipher if you simply look at a 10 year chart of the NASDAQ 100 ...”

After looking at Marty’s charts, you will want to stay tuned next week!

The VIX may have completed its reversal pattern.

--After today’s Employment Situation Report, The equities markets turned giddy with joy because the report was LESS BAD than expected. From an Elliott Wave perspective, the decline in the VIX was a wave c of an a-b-c correction. Even though it is below critical support at 35.34, the reversal pattern now appears complete. A rally above 26 should break out of the wedge.

--After today’s Employment Situation Report, The equities markets turned giddy with joy because the report was LESS BAD than expected. From an Elliott Wave perspective, the decline in the VIX was a wave c of an a-b-c correction. Even though it is below critical support at 35.34, the reversal pattern now appears complete. A rally above 26 should break out of the wedge.

The SPX may have reached its apex...

--The SPX rallied to the 38.2% retracement of its entire decline from October 2007 to March 2009. It is a rally that rivals the “recovery” from the Crash of 1929. It also has taken exactly the same number of days so far – 154.

--The SPX rallied to the 38.2% retracement of its entire decline from October 2007 to March 2009. It is a rally that rivals the “recovery” from the Crash of 1929. It also has taken exactly the same number of days so far – 154.

The indexes are in the window now for a Trading Cycle (average 56 days) bottom. In addition, the Primary Cycle (average 86 days) is also due in the next two weeks. The broadening top is now due for a very swift retracement of its month-long rally. A decline below critical support at 1003 will be sufficient…

.

The NDX shows even more weakness.

--The NDX could not rally to a new high after it reached 1633 on Tuesday. Since then it may have completed a reversal pattern and appears ready to resume its decline. A drop below critical support at 1615 should set things in motion.

--The NDX could not rally to a new high after it reached 1633 on Tuesday. Since then it may have completed a reversal pattern and appears ready to resume its decline. A drop below critical support at 1615 should set things in motion.

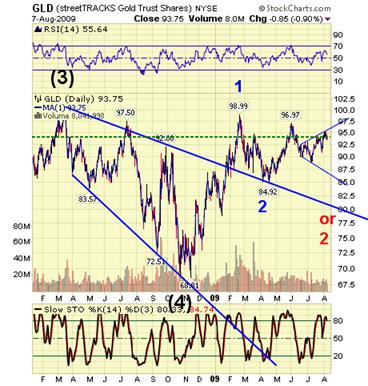

GLD has made a Fibonacci retracement.

-- GLD has crossed below critical support today at 94.35 and appears to be ready to decline even more next week. One very probable target may be the bottom of the expanding triangle, which is approaching 85. So I have changed to a sell signal as of Friday. It appears that GLD is being influenced by the same powers governing the equities market.

-- GLD has crossed below critical support today at 94.35 and appears to be ready to decline even more next week. One very probable target may be the bottom of the expanding triangle, which is approaching 85. So I have changed to a sell signal as of Friday. It appears that GLD is being influenced by the same powers governing the equities market.

The Oil Bubble got a reprieve.

--USO crossed below critical support today. There also appears to be a triangle formation that is expanding in the same manner as GLD. The pattern now calls for a decline at least to the bottom of the expanding triangle if not much deeper. It has crossed below critical support at 37.96 and is on a sell signal.

--USO crossed below critical support today. There also appears to be a triangle formation that is expanding in the same manner as GLD. The pattern now calls for a decline at least to the bottom of the expanding triangle if not much deeper. It has crossed below critical support at 37.96 and is on a sell signal.

TLT is in a strong pullback.

-- Treasuries are in retreat as the pending Treasury bond and note sale for the third quarter looms ahead. Next week’s auction includes 3-year notes, 10-year notes and 30-year bonds. Treasuries are temporarily losing their appeal as a safe haven, with market participants expecting more selling pressure in coming weeks on a brightening economic outlook and rising debt supply. Critical resistance is at 91.74. I am looking for a bounce here and am bullish above 89.94.

-- Treasuries are in retreat as the pending Treasury bond and note sale for the third quarter looms ahead. Next week’s auction includes 3-year notes, 10-year notes and 30-year bonds. Treasuries are temporarily losing their appeal as a safe haven, with market participants expecting more selling pressure in coming weeks on a brightening economic outlook and rising debt supply. Critical resistance is at 91.74. I am looking for a bounce here and am bullish above 89.94.

The Dollar retests support.

--UUP will have completed its reversal pattern once it rises above the wedge formation. It is above critical support at 23.21, but I have suggested to subscribers that the better part of valor is to wait for a clear break above the wedge. We are waiting for the breakout…

--UUP will have completed its reversal pattern once it rises above the wedge formation. It is above critical support at 23.21, but I have suggested to subscribers that the better part of valor is to wait for a clear break above the wedge. We are waiting for the breakout…

Have a great weekend and I’ll be back next week.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.