The Case for Market Timing

Stock-Markets / Forecasts & Technical Analysis Aug 13, 2009 - 03:48 AM GMTBy: Mike_Stathis

To those of you who say it's impossible to time or forecast the market; to those of you who keep wasting your time reading and watching the clowns positioned as so-called "experts" by the media; I ask you where have their forecasts been?

To those of you who say it's impossible to time or forecast the market; to those of you who keep wasting your time reading and watching the clowns positioned as so-called "experts" by the media; I ask you where have their forecasts been?

Instead of writing Humpty-Dumpty sat on a wall, Humpty-Dumpty consumed so much he had a great fall…mantras each week, and forecasts that the dollar is going to 0 and gold to the moon, while preaching buy-and-hold the entire time, you need to start asking yourself if you have made money on every major market move; up and down.

Are you taking advantage of this historic level of market volatility?

If not then you haven't been paying attention to real experts.

And you have lost out on some easy money in my opinion.

Furthermore, you are placing your investments at great risk if you aren’t actively managing them.

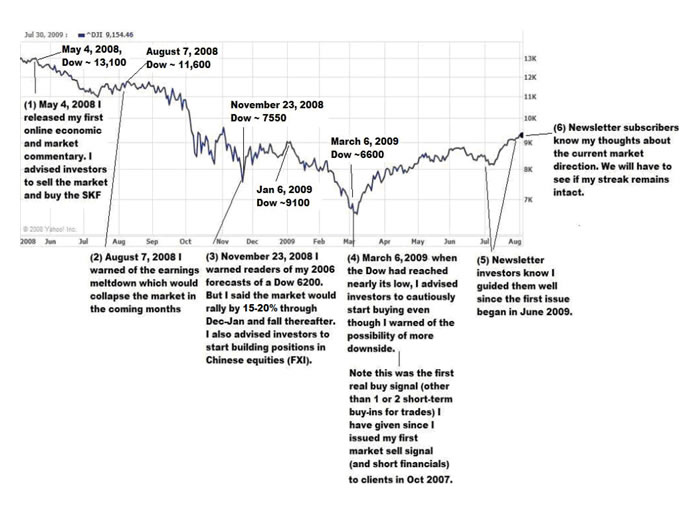

Below is a chart of the DJIA since the Spring of 2008, when I first started to devote time to try and help Main Street. Each market call has been referenced with articles posted in the public domain for verification.*

(1) http://www.avaresearch.com/article_details-74.html

(2) http://www.avaresearch.com/article_details-84.html

(3) http://www.avaresearch.com/article_details-334.html

(4) http://www.avaresearch.com/article_details-90.html

(5) June and July AVAIA newsletter

(6) August AVAIA newsletter

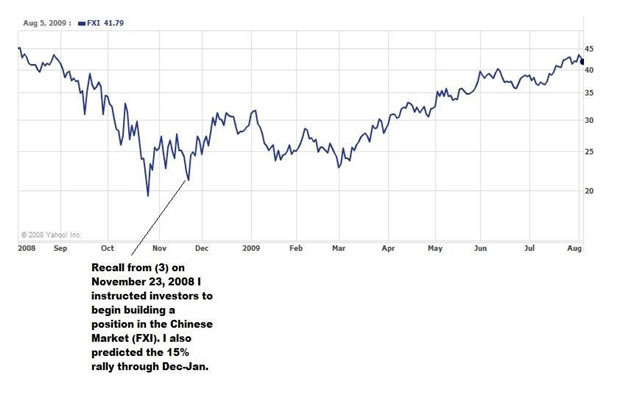

You'll also note that as bullish as I have been on China and commodities, I warned of a major correction to both markets in my 2006 book America's Financial Apocalypse. I reiterated this several times since publishing articles online and stated this would be the time to buy into both markets.

In fact, even in my first online publication (1), I stated the following...

"Watch out though, because if things get really bad, the entire world will be affected. But that will represent a buying opportunity in Chinese and Brazilian equities."

"With rare exception, investors should stay clear of traditional asset classes. If you haven’t already done so, you’d be wise to invest in commodities, gold, oil trusts, and foreign currencies (Yen and Swiss Franc). In addition, investors without short investment horizons should have some exposure in China and Latin America. Keeping cash on hand is also advised. When the market sells off, you may choose to buy in."

So let's summarize the effects of playing these market calls.

If you had bought into China (FXI) when I recommended at the end of November when it made its lows, you'd be up by over 110% in less than a year.

If you had sold the market in May 2008 and only bought back in when I issued my market buy in March 2009, you'd have spared yourself losses of 50% (or made 50% if you shorted the Dow).

If you'd bought the ultrashort financials (SKF) you'd have made even more (assuming you traded it short-term so as to avoid the adverse effects of holding ultrashort ETFs over long periods).

If you still had not sold despite my May 2008 recommendation, you could have sold on August 7, 2008 and waited for the earnings meltdown, followed by the market collapse. After saving yourself from 35% losses (or registering gains of 35% via shorting the market), you could have bought back the market on November 23, 2008 on my estimate that the market would rally by up to 15-20% by years end ~ January (which occurred).

Then if you sold by the beginning of January as I recommended (i.e. I warned of a sell-off thereafter), you'd have avoided another 30% losses or made 30% if you'd have shorted. You would have known when to cover your shorts when I recommended the gradual buy-in on March 6, 2009 when the Dow reached 6600.

Who says you can’t time the market?

To be honest, it’s extremely difficult to do with consistency, even for the best investment minds in the world. But it can be done. I’ve been doing it for several years.

Those who pay very close attention to what I say will do quite well; but only if you follow me consistently. If you stubble upon my articles here and there, you will likely misinterpret things and do poorly.

I urge you all to review my track record prior to, during and since the collapse. Once you have, you will realize I have the best track record in the world. The best way to confirm this is to read America’s Financial Apocalypse, Cashing in on the Real Estate Bubble and my online archives.

The best way to stay patched into my insights is through the AVA Investment Analytics newsletter, offered to individual investors, financial advisers, family offices and hedge funds. This is also the best way to profit from the difficulties that lie ahead.

Unlike others, I don’t sell securities or gold so I have no bias or agendas. I sell my investment intelligence; something very few are capable of.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.