What was it like when interest rates were last at 5.50percent?

Personal_Finance / UK Interest Rates Jun 15, 2007 - 09:54 AM GMTBy: MoneyFacts

Julia Harris, Mortgage Analyst at Moneyfacts.co.uk – the money search engine, comments:“It’s over a month since base rate rose a further quarter point to 5.50% and with the last MPC decision to keep rates on hold the mortgage market is starting to show signs of settling down. But with another rise anticipated in the short term the market will just have time to come up for air before products are repriced yet again.

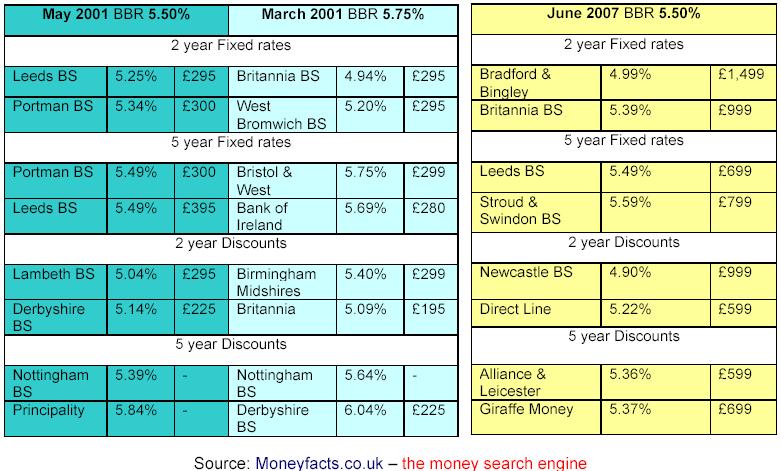

“So how do today’s best deals compare with when rates were last 5.50% in May 2001 and 5.75% in March 2001?

“It may be surprising to see that the best rates available today are as much as 0.47% lower than the comparable deals back in 2001, when base rate was last 5.50%. However this doesn’t tell the full story, as the mortgage fees on these deals are up to five times higher, and no fee deals are nowhere to be found within this selection of best rate mortgages.

“Take the best two year fixed rate deals today compared with May 2001, on a £100K mortgage (capital repayment, over 25 years). According to eMoneyfacts.co.uk the true cost over the two year deal period is over £800 more expensive, and the best discount deal is also over £500 more expensive over the two-year term.

“Not only have the deals become more expensive, so too has the revert-to rate. Today the Moneyfacts average SVR is 7.32%, which is 0.36% higher than in March 2001 and 0.13% higher than when base rate was 5.75% in May 2001.

“As competition in the mortgage market intensifies and demand for houses continues to grow, one would have expected the deals to become more competitive over time. While it could be argued that mortgage regulation has increased the costs of arranging a mortgage, this holds little water as the additional costs of the change should now have been absorbed, and it is difficult to see that it would amount to £400 per year for each borrower.

“With swap rates almost 0.90% lower in 2001, we would have expected rates to be much lower than those found today. But as the table shows the results illustrate a different picture, with rates today being lower or only fractionally higher today, with the lenders seemingly using fees to compensate.

“Perhaps the increased competition and affordability crisis is having a detrimental effect on the best mortgage deals. As lenders become more creative in their product designs and the high fee low rate combination is commonplace, it is more important than ever that borrowers compare the true cost of any deal when speaking to their lender or IFA.

“So while the rates appear more competitive then six years ago, the deals certainly are not, with inflated fees being the prime culprit. Lenders are squeezing yet more profit from each mortgage deal they complete.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.