The Commodity World Is Growing In Strength, Gold the Special One!

Commodities / Commodities Trading Aug 15, 2009 - 02:17 PM GMTBy: Aden_Forecast

The commodity market is bubbling. Whether it be sugar reaching a three year high, copper and other base metals reaching almost one year highs, or oil and gold rising further. The markets are looking good.

The commodity market is bubbling. Whether it be sugar reaching a three year high, copper and other base metals reaching almost one year highs, or oil and gold rising further. The markets are looking good.

They’re moving up on signs that the global recession is easing. This is boosting demand, especially in China and Asia, which is pushing prices up.

TANGIBLES ARE “IN”

Tangibles are growing in strength. From the metals, natural resources, energy and food, these markets are rebounding strongly and they’re poised to continue rising in the years ahead. Demand is the driving force, making commodities a powerful market.

The Chinese are astute investors. They’re buying up lots of hard assets and commodities for infrastructure, and they’re using their dollar reserves to buy these goods.

The world is on sale and China is the main buyer. The Chinese have already been focusing on resource rich developing countries, and less on monetary investments. They’re using their reserves to support and speed up overseas expansion and acquisitions by Chinese companies.

This is a growing tendency, and it’s not just China. Other countries are doing the same to lock in natural resources for the future.

China’s economy is showing impressive strength, boosting raw materials’ consumption even more. Top Chinese officials have been commenting about this in recent weeks.

A research chief, for example, said China should buy gold and U.S. real estate instead of Treasuries. Another top economic official said China should use more of its $2 trillion reserves to buy energy and natural resources. He also believes their 2% gold reserve is too small, even though China has already increased their gold reserves about 75% over the last five years.

COPPER: Almost one year high

With this kind of demand, it’s not surprising to see the base metals rising from major low areas with some like zinc, lead and nickel reaching 10 month highs. Plus, copper jumped up further this month, turning clearly bullish along the way (see Chart 1). The same is true of oil.

ASSET CLASSES STILL MOVING TOGETHER

The more it looks like the financial crisis and global recession is over, the more this pushes up commodities, stocks and currencies. They are all rising for the same reason, which is understandable, but keep in mind that this is not normal.

Commodities and the stock market don’t usually move together and at some point they will go their separate ways. When this will happen and what will trigger it remains to be seen but it’s something we have to keep a close eye on. Most important is to understand why each market is rising in the first place.

For commodities, its demand together with a weak dollar which is very bullish. For stocks, it’s optimism for a better economy, but inflation would eventually kill the rise. For currencies, it’s the weak dollar, and also the commodity rise for the commodity currencies. For bonds, it’s the financial health of the global economy and inflation.

The world is slowly moving towards tangibles and away from financials. The ongoing commodity bull market is eight years old and considering that commodity bull markets over the past 100 years have lasted on average 17 years, the current bull-run could go on for another decade. And the long-term leading indicators for oil, copper and the base metals are all reinforcing this.

GOLD: THE SPECIAL ONE

As for gold, its main purpose is money. Gold is the ultimate currency, it’s a safe haven and it thrives during economic uncertainty. Gold and commodities tend to move together in a general wave but it will outperform or underperform the other metals and commodities at times.

China is on the mend and its plans to add more gold to its reserves is very bullish for gold. China could easily overtake India in gold consumption this year, especially since it’s the first nation to rebound from the global recession. China’s GDP recently rose to 7.9% as the massive stimulus plan and record bank lending began to take effect.

Gold’s big picture is bullish as you can see on Chart 2. The mega trend is up and the bull market rise since 2001 is turning 8½ years old this month. This is important because the eight year mark has been a key low point for gold going back to the 1960s when gold began trading in the free market.

THE TIME FOR TRUTH

Chart 2 shows that this pattern has repeated four times since 1969 and the fifth low is now on the longer side of the normal time span. This low period can vary from 7 to 8½ years, following the previous low, which means that, if gold stays above last November’s low, then that $705 low was the low for this time around. This would make it a 7 year 10 month low following the previous February 2001 low… just three months shy of the 8 year mark. We’d say that’s pretty close.

So if the 8 year pattern repeats, and we believe it will, then current prices are still at good levels for buying new positions. We should have all of our positions bought this month because come the Fall, we could really see gold take off.

TIMING GOLD

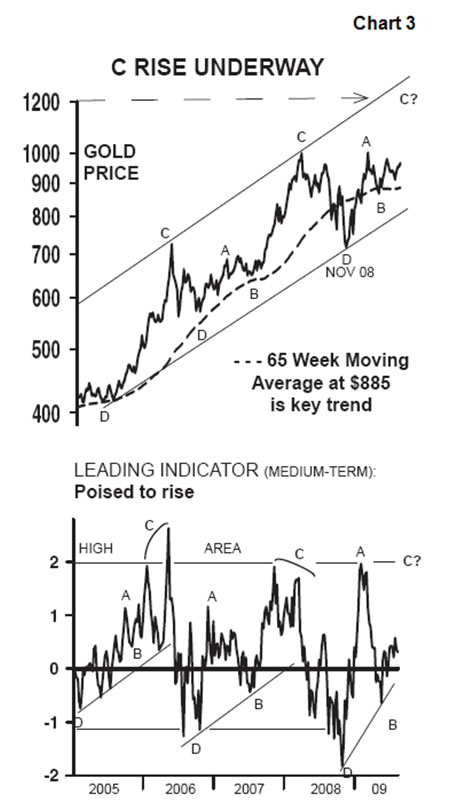

Chart 3 shows a closer look at gold’s intermediate moves and as you can see, gold has been forming a springboard for upcoming higher prices. As our subscribers know, gold moves in an A-D pattern on an intermediate basis. D declines tend to be the worst decline and gold reached the last D low in November.

It then rose from those lows in a moderate rise we call “A” which peaked last February. This is when the springboard began as gold declined from that high to form a moderate “B” low last April at $868.

Since then, a C rise has begun. It’s been quietly forming a coil and gold looks ready to take off. Gold’s been rising this past month and it’s strong above $935. It reached a nine week high and it would be very strong above $985. A super strong C rise would be underway above $1004, the record high.

Keep in mind, C rises tend to be the best rise in the pattern. By hitting a new record high, gold would confirm that the bull market is entering an even stronger phase and it could then rise to near $1200. It would also confirm that the 8 year low indeed happened last November.

Since November, gold’s been posting higher lows which is also positive action. For now, if gold stays clearly above the July 8 low at $909, it’ll be reinforcing its strong uptrend since November and all systems will continue to be go!

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

TraderJoe

16 Aug 09, 01:40 |

Aden Gold bug

Every article you write is bullish on gold. What does that say about its value ? |