Death of the Consumer

Economics / Recession 2008 - 2010 Aug 24, 2009 - 09:33 AM GMTBy: Moses_Kim

Moving forward, the most critical indicator of the viability of our economy will be consumer spending. Simply put, without a buoyant consumer, there will be no recovery. Due no doubt to the negative characteristics of consumer data, the death of the consumer is receiving scant coverage.

Moving forward, the most critical indicator of the viability of our economy will be consumer spending. Simply put, without a buoyant consumer, there will be no recovery. Due no doubt to the negative characteristics of consumer data, the death of the consumer is receiving scant coverage.

America is a nation whose growth in recent decades has been predicated on a model of consumption. From a nation that used to save to invest, we now borrow to consume. As buying power in Treasuries from foreign entities wanes, we will be forced to fund our consumption through currently non-existent savings. An increased savings rate will put pressure on consumption, which will in turn pressure GDP.

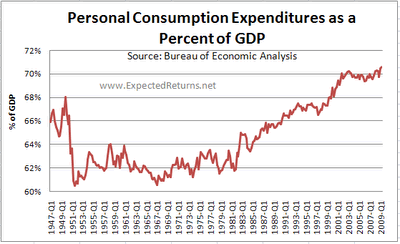

In the following chart, notice how consumption as a percent of GDP remains above historical norms. Consumption would have to contract another $800 billion for personal consumption expenditures as a percent of GDP to revert to historical levels.

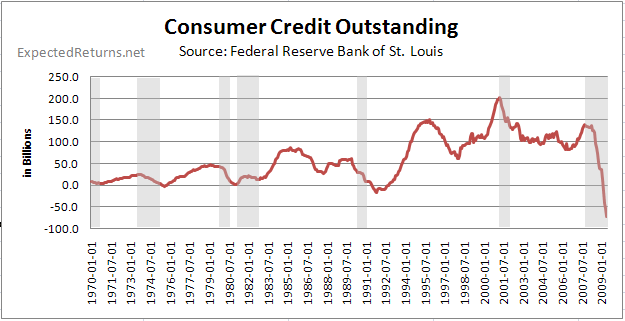

It is important to realize that what we are experiencing now isn't a classic inventory-led downturn, but a structural debt deflation. Since Americans have been wont to save, consumer credit has played an outsized role in our economic growth.

As such, it is critical to be keen on developments in the availability of credit, which can be measured by consumer credit outstanding.

Consumer credit outstanding, a measure of short and intermediate-term credit, is falling precipitously. Banks are, quite justifiably, not willing to service loans to deteriorating credit risks. Until the unemployment picture improves, banks are unlikely to rapidly increase the extension of credit.

Notice that consumer credit outstanding has rebounded off of every single downturn besides the recession of 2001. Before we can realistically call for an end to the recession, we need to see a halt in the decline of consumer credit outstanding, and eventually a rebound. We are experiencing nothing of the sort yet.

Retail Sales

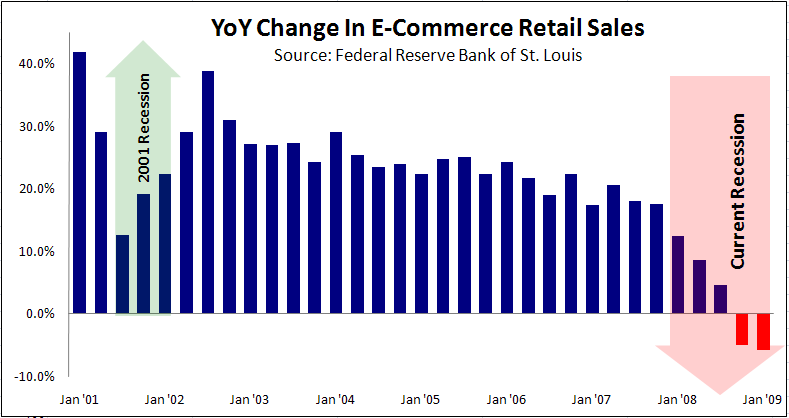

Consumption in the past decade, as reflected by retail sales, has enjoyed an impressive and inexorable rise. Year over year E- commerce sales growth remained robust even in the midst of the recession of 2001.; in fact, the rate of growth accelerated.

As you can see from the following chart, E-commerce retail sales are declining dramatically.

The consumer is conspicuously missing in this supposed "green shoot" environment. At the very least, the V-shaped recovery thesis is not corroborated by data on the consumer front. Hopes of recovery must therefore be regarded as mere presumption until the outlook for the consumer improves.

By Moses Kim

http://expectedreturns.blogspot.com/

Graduate of Columbia University with a B.A. in History. Student of the markets focused on long-term economic trends. I believe the markets are inefficient, and that these inefficiencies can be exploited to attain profitable returns.

© 2009 Copyright Moses Kim - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.