Gold Warning, Risk of 50% Retracement to $650

Commodities / Gold & Silver 2009 Sep 13, 2009 - 10:43 AM GMTBy: Ronald_Rosen

“The Concept of Probability in the Mathematical Representation of Reality” by Hans Reichenbach

“The Concept of Probability in the Mathematical Representation of Reality” by Hans Reichenbach

"Real mathematics is not crunching numbers but contemplating them - and the mystery of their connections." ---Charles Krauthammer, Pulitzer Prize winning essayist

“The natural world is loaded with patterns. From leaves on plants to the shape of a nautilus shell, numbers can help us to describe and understand these patterns. In 1202 A.D., Leonardo Fibonacci discovered a unique mathematical sequence that has importance today. It is one way in which many of nature's most beautiful, strange, and seemingly unrelated objects show similarities.”Fibonacci WebQuest

-----------------------------------------------------------------------------------

There are numerical realities that have occurred in the past that we know with absolute certainty have taken place. If these realities show a consistent pattern we can project them into the future and reach reasonable probabilities based on past behavior.

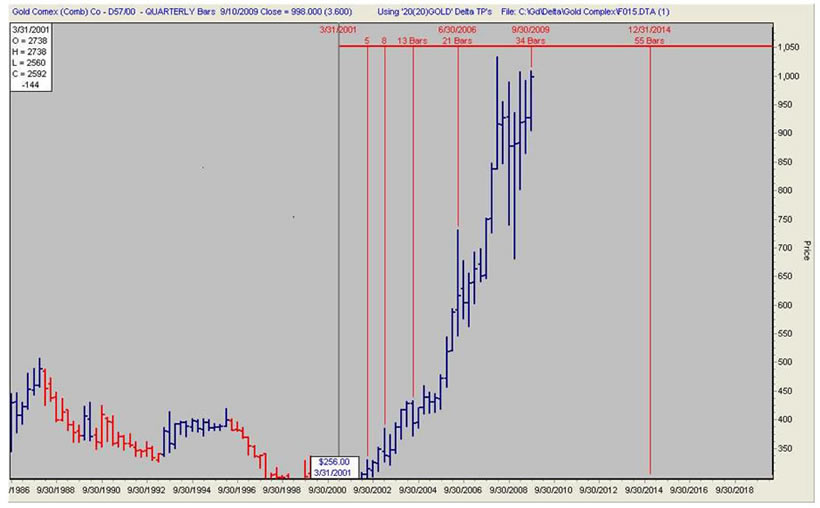

Since the bottom at $256 in the quarter ending 3/31/2001, the quarterly chart of gold has reached a peak in subsequent quarters 5, 8, 13, and 21. Each peak was followed by a correction of at least one quarter.

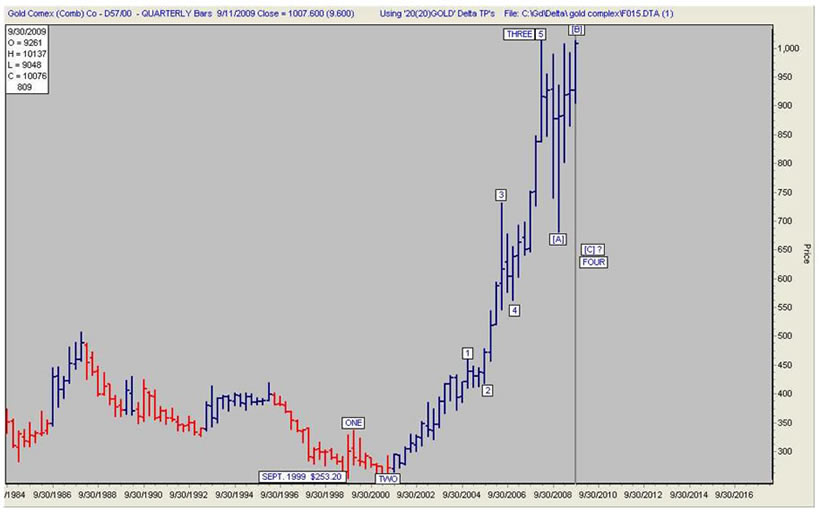

The next peak is due in quarter number 34. That peak is due this month, September 2009. I believe it is a reasonable probability that this peak, which should be a new all time high, should be labeled the [B] wave high of the [A], [B], [C] correction that I have been writing about.

Elliott Wave Theory is based on Fibonacci mathematics. Whatever the eventual correct wave count looks like, we can not deny the past. This bull market in gold has proven to us that since the bottom at $256.00 in the March quarter of 2001 a peak followed by a correction has occurred in quarters 5, 8, 13, and 21. It is my contention that the highest probability is that there will be another peak in quarter 34 followed by a correction. In spite of all other projections from all sources, I can not envision a higher probability than a correction following gold bullion making a temporary peak and a new high in September 2009 which is quarter number 34.

“Time is more important than price; when time is up price will reverse.” W.D.Gann

A peak followed by a correction has occurred in quarters 5, 8, 13, and 21.

There may be another new high in quarter 34 followed by a correction.

GOLD QUARTERLY CHART # 1

This chart depicts a reasonable wave count based on obvious turning points.

GOLD QUARTERLY CHART # 2

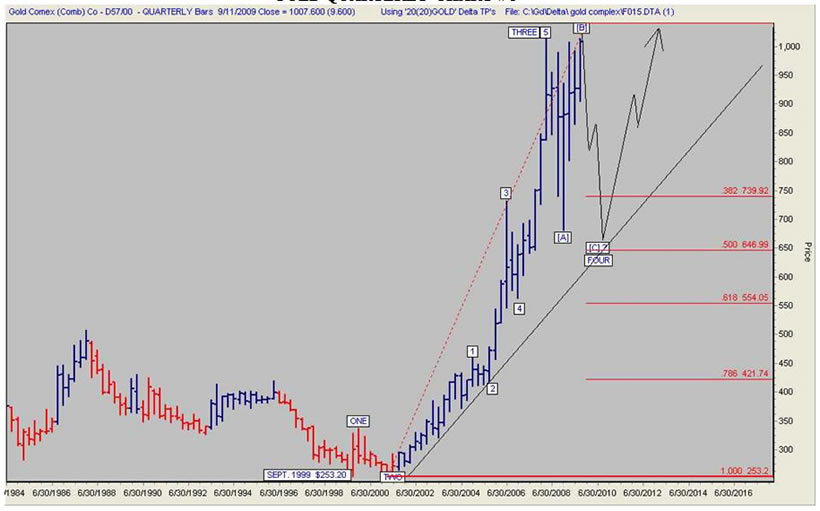

Wave FOUR has the potential for retracing approximately 50% of the rise of wave THREE.

GOLD QUARTERLY CHART # 3

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.