Obama Risks Global Trade War With China on Misguided Tariffs

Politics / Global Economy Sep 14, 2009 - 01:38 AM GMTBy: Mike_Shedlock

On Wednesday, in a dispute over the price of steel pipe, the US Fires Opening Salvo In Trade Wars With China. Late Friday evening trade wars heated up again as Obama Fires the US' Second Shot In Trade War With China.

On Wednesday, in a dispute over the price of steel pipe, the US Fires Opening Salvo In Trade Wars With China. Late Friday evening trade wars heated up again as Obama Fires the US' Second Shot In Trade War With China.

In what is widely considered a test case of the president's union support, Obama slaps duties on tire imports from China.

U.S. President Barack Obama slapped steep additional duties on tire imports from China on Friday in a move that pleased domestic labor groups but drew a strong rebuke from Beijing.

The United Steelworkers union, which represents workers at many U.S. tire production plants, filed a petition earlier this year asking for the protection. It said a tripling of tire imports from China to about 46 million in 2008 from about 15 million in 2004 had cost more than 5,000 U.S. tire worker jobs.

An additional 35 percent duty will be placed for a year on Chinese-made passenger vehicle and light truck tires, the White House said in a statement.

"For far too long, workers across this country have been victimized by bad trade policies and government inaction. Today, President Obama made clear that he will enforce America's trade laws and stand with American workers," United Steelworkers President Leo Gerard said.

The ITC had recommended starting with a 55 percent tariff that would fall to 45 percent in year two and 35 percent in year three. The steelworkers asked initially for a quota of 21 million that would grow by 5 percent each year.

Analysts expect Friday's action to encourage other labor groups or domestic manufacturers to seek relief under Section 421, which does not require petitioners to prove unfair trade practices are responsible for a surge in imports.

No American tire manufacturer supported the case and one, Cooper Tire, publicly opposed it.

"We are certainly disheartened that the president bowed to the union and disregarded the interests of thousands of other American workers and consumers," said Marguerite Trossevin, counsel to the American Coalition for Free Trade in Tires.Obama Faces an Early Trade Test

Prior to the decision, the Washington Post was writing As Cheaper Chinese Tires Roll In, Obama Faces an Early Trade Test.

ALBANY, Ga. -- At the vast Cooper Tire plant here, workers heard for years about their rivals in Chinese factories.

The plant employed 2,100 people in this small south Georgia city is being shut down, and the troubles afflicting the U.S. tire industry are at the core of what many consider to be one of President Obama's first major decisions on trade policy.

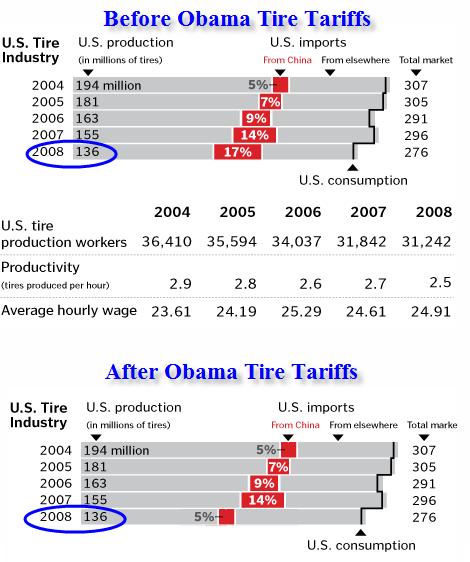

From 2004 to last year, the number of Chinese tires imported to the United States more than tripled, and their share of the U.S. market rose from 5 percent to 17 percent. Over the same period, the share of the U.S. market served by U.S. factories declined by a similar amount. More than 5,000 U.S. jobs were lost.

Congress passed legislation in 2000 that allows the United States to impose tariffs and other protections if a surge in Chinese imports damages a U.S. industry. China agreed to the provision while negotiating to join the World Trade Organization.

The general "safeguard" provisions of the law have never been invoked, however. The Bush administration was asked four times to impose measures to protect a U.S. industry, but it declined each time.

The proposed tire tariff represents the first such case presented to Obama, and his action will be closely watched and weighed against his campaign promises to "crack down on China" and "work to ensure that China is no longer given a free pass to undermine U.S. workers," as his Web site put it.

The United Steelworkers union, which represents many of the nation's tire workers and brought the complaint, helped Obama win the presidency. The other side, meanwhile, boasts the aid of several former U.S. trade officials, who are representing the Chinese manufacturers and U.S. companies that import from China.

"You don't keep jobs here by forcing companies into unprofitable lines of business," said Marguerite Trossevin, who represents a coalition of U.S. tire companies that import Chinese tires to sell under their brands.Tire Tariffs Seen And Unseen

First steel, now tires. Let's see how China responds. China might put import duties on meat hurting US farmers, or perhaps they decide to buy planes from Airbus instead of Boeing. Perhaps they simply buy fewer planes from Boeing.

[Note: I wrote the above on Saturday, we now have an answer from China, discussed below]

What about dock worker jobs unloading tires from China? What about millions of consumers who benefit from lower prices?

Cooper Tire has a plant in Georgia but it also imports tires from China. Will this stop the imports? The answer is no. However, it will temporarily add supply constraints and inefficiencies, perhaps forcing prices up temporarily. To get around the tariffs, production will shift to other countries instead.

When supply shifts to other producers, will that mean more tariffs against other countries? If so, are we supposed to think those countries will not retaliate?

For now let's assume 5000 jobs would be "saved" by this measure. Let's total up the gains and losses from the Tariffs.

Gains From Tire Tariffs

- 5,000 Jobs

- China reduces orders for planes and/or imposes agricultural tariffs in response. China will retaliate somehow those are possible examples how.

- Costs go up as production shifts from China to US or elsewhere.

- Millions of US consumers temporarily have to pay unnecessarily high prices for tires as long as normal supply chains disrupted.

- Fewer dock workers are needed as both imports from China and exports to China drop

Let's revisit those gains. Does anyone really think 5,000 jobs are coming back to the US as a result of this action? Better yet, did we really lose 5,000 jobs in the first place as a result of tire imports from China?

Let's explore those questions with a look at tire production.

Tire Production Before And After Tariffs

The Washington Post article has a graph of tire production. I duplicated the chart and doubled it up showing what I believe to be the before and after effects of the tariff. Annotations in blue are mine.

Think anything was gained by Tariffs? I don't.

Probe 'not revenge' for hefty tire tariff

It was Saturday when I wrote "First steel, now tires. Let's see how China responds. China might put import duties on meat hurting US farmers, or perhaps they decide to buy planes from Airbus instead of Boeing. Perhaps they simply buy fewer planes from Boeing"

By Sunday evening, China had already responded. Please consider Probe 'not revenge' for hefty tire tariff.

Just two days after the decision by the United States to levy heavy import tariffs on Chinese tires, the government here has reacted by launching an anti-dumping and anti-subsidies investigation into automotive and chicken exports from the US.

The Ministry of Commerce (MOFCOM) Sunday did not label it as retaliation against the tire dispute, but said it acted simply in a response to domestic concerns.

The probe, which is in line with World Trade Organization (WTO) rules, follows complaints from Chinese manufacturers that US-made products entered the nation's markets with "unfair competition" and harmed domestic industries, said the ministry in a statement.

Washington played down the dispute on Saturday, claiming it is simply "enforcing the rules" and did not expect the move to escalate into a trade war.

"Chinese tire producers pose no direct competition to those in the US," he said before adding that China's tire exports to the US had not witnessed a remarkable increase as claimed by the USW.

Last year, the country's tire exports to the US grew by just 2.2 percent compared to 2007 and, in the first half of this year, fell 16 percent compared to 2008, explained [MOFCOM spokesman] Yao.

Analysts claim the actions of the Obama administration are at odds with its public statements about how protectionism could deepen the ongoing crisis.

USW's International President Leo Gerard hailed the tariff hike by saying it "sent the message that we expect others to live by the rules, just as we do".

However, Marguerite Trossevin, legal counsel to the American Coalition for Free Trade in Tires, a pro-business group, said: "We are certainly disheartened the president bowed to the USW and disregarded the interests of thousands of other US workers and consumers."Chinese Exporters Ask For Retaliation

Inquiring minds are reading Unite against tire tariff hike, exporters urged.

The chairman of the China Rubber Industry Association was especially incensed as he feels the decision was made based on "bunch of lies". "The new tariff will be highly damaging to China's tire industry and may cause 100,000 Chinese tire workers to lose their jobs," said an emotional Fan. He urged the Chinese government to adopt mandatory retaliatory measures against US manufacturers of agricultural products and automobiles.

He Weiwen, council member for the China Society for American Economy Studies, said China would be justified in taking retaliatory measures. "We could levy higher tariffs on tires and automobiles imported from the US. China should not let the US car firms make easy money from its vast car market. We should teach them a lesson," said He.If the US lost 5,000 jobs over tires, it is highly unlikely China will lose 100,000. Nonetheless sentiment is running very high and this could easily ignite into something devastating.

Right now it is autos and chickens vs. tires and steel. Will the spat stop there? Let's hope so, but I rather doubt it.

No Benefits, Only Losses From Tariffs

Not a single job will return to the US as a result of these tariffs. Imports from China will drop but imports from elsewhere will rise.

Thus, the unfortunate tragedy in this mess is that Obama's kowtowing to the unions is going to cost union jobs. The ultimate irony is misguided unions are cheering every step of the way.

To date, Obama is repeating the same mistakes Roosevelt and Hoover made during the Great Depression. Cash-For-Clunkers was a horrid policy decision that led to the destruction of productive assets much the same as Roosevelt's policy of illegally burning crops hoping to force up prices. See Government Bailouts and the Stock Market - The Seen and the Unseen for more details.

Now, Obama's tire and steel tariffs will strongly encourage more unions and labor groups to seek relief under "Section 421" of U.S. trade law. That misguided law does not require petitioners to prove unfair trade practices.

If Obama keeps this foolishness up, which right now seems highly likely, he risks a global trade war similar to the global trade crash kicked off by the Smoot-Hawley Tariff Act signed by President Hoover in the early stages of Great Depression.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.