Gold Stocks Still in the Early Stages of a Historic Multi Year Bull Run

Commodities / Gold & Silver Stocks Sep 17, 2009 - 10:13 AM GMTBy: Jordan_Roy_Byrne

Gold Stocks vs. Other Stocks - Compared to various stock groups, gold stocks offer good value. Take a look at these ratios. In nominal terms the GDM index is well above its 1994 & 1996 high. Yet in real terms (against these other stock groups), GDM is considerably below the high in the mid 1990s. Why should we care? It indicates that we have yet to see a widespread move out of other stock sectors and into the gold stocks. That is pretty amazing considering that gold stocks have been rising for nine years.

Gold Stocks vs. Other Stocks - Compared to various stock groups, gold stocks offer good value. Take a look at these ratios. In nominal terms the GDM index is well above its 1994 & 1996 high. Yet in real terms (against these other stock groups), GDM is considerably below the high in the mid 1990s. Why should we care? It indicates that we have yet to see a widespread move out of other stock sectors and into the gold stocks. That is pretty amazing considering that gold stocks have been rising for nine years.

Gold Stocks Leverage to Gold

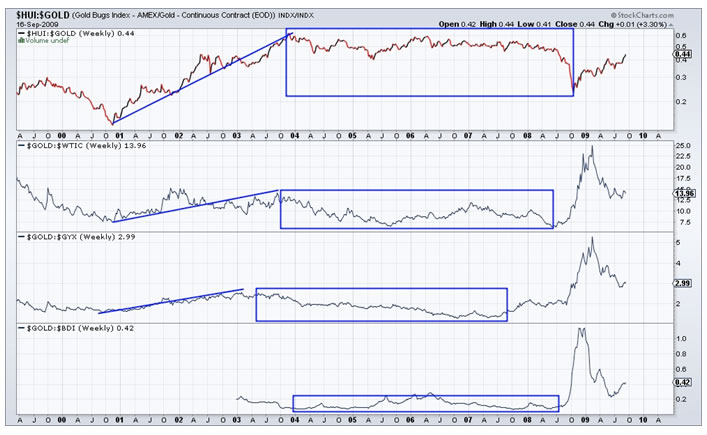

First let me apologize to those who get sick of this, as I do show the following chart quite a bit. We can get an idea of where HUI/Gold will go based on the following ratios: Gold/Oil, Gold/Industrial Metals, and Gold/Baltic Dry Index. Oil is 25% the cost of mining and since mining is a heavy industrial activity, we can use the Gyx (Industrial Metals prices) as a proxy for that. The BDI is not a perfect proxy but since it reflects prices for another heavy economic activity, shipping, I like to track it in terms of Gold. As we can see, there is a good correlation between the HUI/Gold ratio and these other ratios. The ratios exploded higher during the most severe stage of the credit crisis and the HUI/Gold ratio rebounded strongly.

What is the outlook going forward? The previous chart shows Gold starting to reassert itself. Let’s take a look at the next chart. The major difference is that Gold has no overhead resistance while the other markets (our proxies for cost inputs) are facing huge resistance. Also, the fundamentals strongly favor Gold. It is going to be a while before Oil, Industrial Metals and the Baltic Dry Index approach their old highs. That reflects the fact that the global economy is not going to have a sustained recovery anytime soon. However, when that happens it will be time to shift from precious metals to energy and base metals. Simply put, look for strong and continued increases in the margins of gold producers into 2010 and likely 2011 as well.

Gold & Silver Stocks

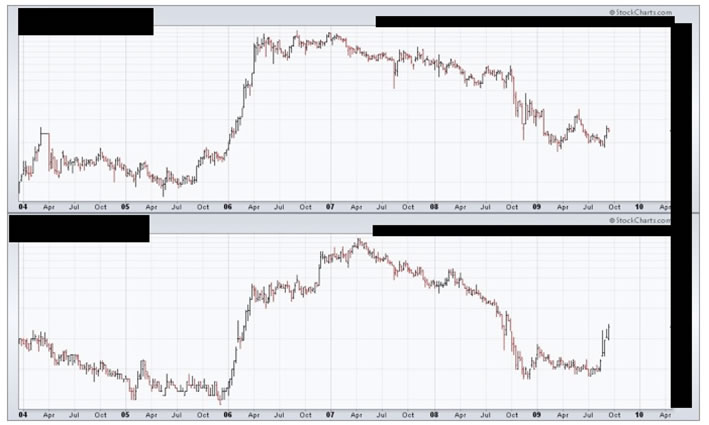

We track 50 gold/silver stocks in our newsletter, highlighting the best opportunities. Here we show various charts but we black out all the names and info. It wouldn’t be fair to out paying subscribers.

The first chart is a gold stock that tends be a leader for the entire sector. It led the market higher in the 2005-2006 period. It failed to make a new high in 2008, a non-confirmation of the rally in the sector. The stock also did not decline past its 2007 lows as the HUI did. Recently, the stock climbed to a new bull market high, ahead of the sector. The stock is in a very bullish consolidation pattern and could breakout at anytime. There is a strong Fibonacci target that is 100% higher than Wednesday’s close.

This is a junior gold producer with a sub $100mm fully diluted market cap. The only thing I don’t like about the company is a large amount of dilution. That being said, the stock is emerging from a nice double bottom. The stock has underperformed the HUI since 2004. Stocks like this will outperform should Gold hold above $1000.

The chart below shows two silver juniors emerging from double bottom patterns. If Silver is going to hit $25 or $30, there are a lot of tiny silver producers that, although very speculative, would triple and quadruple from current levels.

Conclusion

Aside from the obvious there are two key reasons why gold stocks are primed for a historic advance over the next several years. First, the gold stocks are cheap compared to other stocks. Gold stocks are nearly ten years into this bull market and we’ve yet to see a sizeable move out of various stock groups into gold stocks. That move began in late 2008 and is likely to accelerate in 2010.

Secondly, Gold is very likely to accelerate not only in nominal terms but also in real terms. In other words, Gold will accelerate against its cost inputs. We see this happening in the next 18 months and believe that gold/silver stocks will have significant leverage to the metals. The HUI/Gold ratio will rise to a new high.

These two factors could very well catapult the gold stocks much higher (over the next 12-24 months) than even the most ardent gold bugs expect. Regarding the current outlook, one should certainly be judicious here. Resistance points, put-call ratios and sentiment surveys (as well as our gut) tell us that this move could run a bit further before we see a correction.

For more info on our gold/silver newsletter, visit: http://trendsman.com/Newsletter/GSletter.htm

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.