US DEBT Out Of Control!

Economics / US Debt Sep 18, 2009 - 02:46 AM GMTBy: Andrew_Abraham

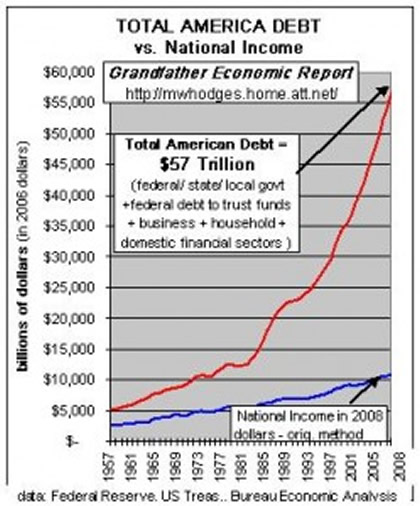

It is not my imagination. The total US debt is sky rocketing. People are entitled to their opinions…but not entitled to the facts.

The US Govt debt this year is spiraling out of control. Estimates place the increase of debt by at least $2 trillion dollars. The question is, can this debt reach 100% of GDP at around $13 trillion. Putting things into context…before the Great Depression in 1929 the US Govt debt was only 15% of GDP! To make matters even worse, the US in 1929 was a creditor nation. Today the US is a debtor nation. Comparing the current situation to the situation prior to the Great Depression total US debt (individual, business,local, state and federal) was approx 170% of GDP.

Today the total US debt to GDP is approx 425%. Will the US start making toys for China in the near future. The ramifications are scary. Speaking about China, investors are stock piling copper, zinc, silver plus of course Gold. I have not heard of too many Americans buying copper to put in their houses as a source of bastion of safety. Click on the hyper link to read the story…

Today the total US debt to GDP is approx 425%. Will the US start making toys for China in the near future. The ramifications are scary. Speaking about China, investors are stock piling copper, zinc, silver plus of course Gold. I have not heard of too many Americans buying copper to put in their houses as a source of bastion of safety. Click on the hyper link to read the story…

Could the US ,the UK as well as the rest of the world be entering a crisis worse than the Great Depression? I state this because of the amount of debt that in all reality can not be paid back. I am not even mentioning all the trillions of derivatives floating around, that are virtually WORTHLESS! Can the situation really get worse because the whole world is in the same boat? The interwining of the global economy is unprecedented in world history.

As a commodity trading advisor that trusts the merits of trend following, maybe I am just playing mental games with myself. What I do know that in the majority of the crisis’s of the world, commodity trading advisors that trend follow without an opinion, not just survive but make money. Who knows how this will turn out. So many are convinced the US dollar is finished and going to crash. Can you imagine the position they could be in if the US dollar rallies? The same can go for gold bullion that so many are believe is destined to reach $5,000. Trend following commodity trading advisors just follow price action without an opinion. Commodity trading advisors that trend follow will have countless small losses but they will not stay on the side of a losing trade for any long period of time.

The point is we are a historic time of our lives where virtually no one knows what to do. I do not know the future but in order to preserve capital or even make money I do not need to know the future. I know I will have many small losing trades…some small profitable trades…I avoid the big losing trades like the plague…and once in a while… I am in the position to win big during times of a crisis. I believe in real assets. I have never heard of any country has ever solved a credit crisis by printing more money. When countries print money…eventually inflation ( the wealth destroyer) raises it ugly head. We saw first hand in 1998 Debt Deflation in East Asia brought on tremendous inflation. Nothing ever changes. Protect your assets…learn about trend following.

Andrew Abraham

www.myinvestorsplace.com

Andrew Abraham has been in the financial arena since 1990. He is a commodity trading ddvisor and co manager of a Commodity Pool. Since 1993 Andrew has been a proponent of quantitative mechanical trading programs. Andrew's major concern is not only total return on investment but rather the amount of risk that one would have to tolerate in order to achieve returns He focuses on developing quant models that encompass strict risk adherence and correlation. He has been a speaker at conferences as well as an author of numerous articles. Andrew has spent years researching ideas that have the potential to outperform indices as well as maintain fewer draw downs.

Visit Angus Jackson Partners (http://www.angusjacksonpartners.com) Contact: A.Abraham@AngusJackson.com (mailto:A.Abraham@AngusJackson.com)

© 2009 Copyright Andrew Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.