Federal Reserve Balance Sheet Mushrooms to over $2Trillion, Audit the Fed

Stock-Markets / Financial Markets 2009 Sep 19, 2009 - 05:06 AM GMT Why audit (HR 1207) the Fed?

Why audit (HR 1207) the Fed?

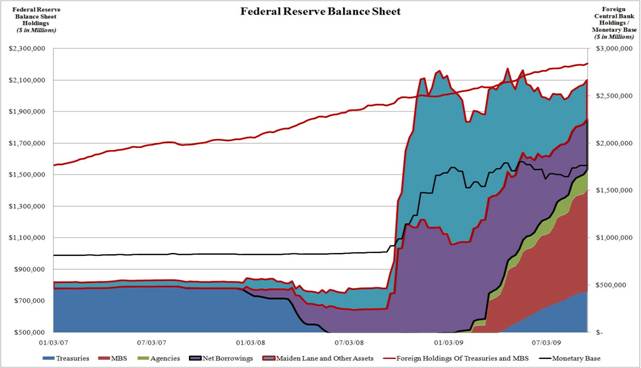

Total Federal Reserve balance sheet assets for the week of September 16 of $2,101 billion ($30.7 billion higher compared to the prior week's $2,071 bn), just $73 billion shy of the all time high of $2,174 billion recorded on April 22 (start of quantitative easing), consisting of:

- Securities held outright: $1,533 billion (an increase of $83.9 billion MoM, resulting from $27 billion in new Treasury purchases, $43.7 billion increase in MBS and $13.2 billion in Agency Debt), or $31.3 billion increase sequentially

- Net borrowings: $320.3 billion: H.3 number had not been updated as of this posting

- Float, liquidity swaps, Maiden Lane and other assets: $248.3 billion, a $659 million decrease based on a 2.3 billion reduction in CPFF and a $506 million reduction in liquidity swaps.

- Foreign holdings increased by $16.7 billion. Foreign holdings? Are they kidding???

With HR 1207 passage now guaranteed in the House, it is time to focus attention on the Senate. As of last count, there were 25 co-sponsors for Sen. Bernie Sanders' S 604 Bill: "The Federal Reserve Sunshine Act of 2009."

Who’s buying this rally?

--U.S. stocks rose, extending the market’s second straight weekly advance, as analyst upgrades of companies from Procter & Gamble Co. to SanDisk Corp. and Chevron Corp. overshadowed concern equities have grown too expensive. The 58 percent rebound in the S&P 500 from its 12-year low on March 9 has pushed valuations in the index to about almost 20 times the reported earnings from continuing operations of its companies, the highest level since 2004, according to weekly data compiled by Bloomberg.

--U.S. stocks rose, extending the market’s second straight weekly advance, as analyst upgrades of companies from Procter & Gamble Co. to SanDisk Corp. and Chevron Corp. overshadowed concern equities have grown too expensive. The 58 percent rebound in the S&P 500 from its 12-year low on March 9 has pushed valuations in the index to about almost 20 times the reported earnings from continuing operations of its companies, the highest level since 2004, according to weekly data compiled by Bloomberg.

Are bonds climbing a wall of worry?

-- Treasuries fell, heading for their first weekly loss since the start of August, before the U.S. offers a record $112 billion of notes next week and the Federal Reserve meets to discuss the economy and rates.

-- Treasuries fell, heading for their first weekly loss since the start of August, before the U.S. offers a record $112 billion of notes next week and the Federal Reserve meets to discuss the economy and rates.

U.S. debt declined after reports on retail sales and housing starts showed the U.S. recovery is gaining momentum. Investors speculate the central bank, meeting in Washington on Sept. 22-23, will discuss its exit strategy from programs intended to revive the economy from the worst slump in seven decades.

Gold continues advancing.

--Gold headed for a fifth weekly advance, the longest winning streak since November 2007, as investors bought precious metals and other commodities on speculation a reviving economy will stoke inflation. Bullion closed above $1,000 for a fifth day yesterday as the Dollar Index, which gauges the strength of the U.S. currency against those of six major trading partners, dropped to the weakest level in almost a year. U.S. housing starts rose to the highest level in nine months and manufacturing in the Philadelphia region expanded more than forecast, adding to signs that a recovery in the economy is taking hold.

--Gold headed for a fifth weekly advance, the longest winning streak since November 2007, as investors bought precious metals and other commodities on speculation a reviving economy will stoke inflation. Bullion closed above $1,000 for a fifth day yesterday as the Dollar Index, which gauges the strength of the U.S. currency against those of six major trading partners, dropped to the weakest level in almost a year. U.S. housing starts rose to the highest level in nine months and manufacturing in the Philadelphia region expanded more than forecast, adding to signs that a recovery in the economy is taking hold.

Japanese consumers are in trouble, too.

-- Japanese stocks fell, led by financial shares after consumer lender Aiful Corp. said it will hold talks with creditors in an effort to delay loan repayments. “Aiful is just the tip of the iceberg,” said Kiyoshi Ishigane, a senior strategist at Mitsubishi UFJ Asset Management Co. “What’s behind Aiful’s trouble is a deepening recession amid falling incomes and rising unemployment. People don’t borrow money for shopping sprees when they don’t have jobs.”

-- Japanese stocks fell, led by financial shares after consumer lender Aiful Corp. said it will hold talks with creditors in an effort to delay loan repayments. “Aiful is just the tip of the iceberg,” said Kiyoshi Ishigane, a senior strategist at Mitsubishi UFJ Asset Management Co. “What’s behind Aiful’s trouble is a deepening recession amid falling incomes and rising unemployment. People don’t borrow money for shopping sprees when they don’t have jobs.”

Is it time to exit China?

-- The Shanghai Composite Index fell, declining from a one-month high, as investors speculated recent gains were excessive relative to earnings prospects. “We have seen the market rebound almost 20 percent in the two weeks preceding today’s drop, so there are profits to take for those who bought the dip successfully,” said Howrd Wang, head of the Greater China team at JF Asset Management, which oversees $50 billion.

-- The Shanghai Composite Index fell, declining from a one-month high, as investors speculated recent gains were excessive relative to earnings prospects. “We have seen the market rebound almost 20 percent in the two weeks preceding today’s drop, so there are profits to take for those who bought the dip successfully,” said Howrd Wang, head of the Greater China team at JF Asset Management, which oversees $50 billion.

The dollar breaks below the wedge. Will it recover?

-- The dollar advanced from the weakest level in a year versus the euro as concern the global financial system remains weak led investors to reduce holdings of higher-yielding assets. “The Lloyds problem played into dollar strength today,” said Jack Spitz, managing director of foreign exchange at National Bank of Canada in Toronto. “Short-dollar positions have become a crowded dance floor. There’s some short squaring going into the weekend.” A short position is a bet an underlying asset will decline.

-- The dollar advanced from the weakest level in a year versus the euro as concern the global financial system remains weak led investors to reduce holdings of higher-yielding assets. “The Lloyds problem played into dollar strength today,” said Jack Spitz, managing director of foreign exchange at National Bank of Canada in Toronto. “Short-dollar positions have become a crowded dance floor. There’s some short squaring going into the weekend.” A short position is a bet an underlying asset will decline.

Thank you, government stimulus, for the rally.

-- For anyone who argues the relevance of government stimulus on housing recovery, I submit the following. One third of all home buyers in the past several months have taken advantage of the $8000 home buyer tax credit. In the new construction market, builders say the credit has been instrumental in boosting sales as well as confidence among builders. Since the start of the credit, the builder sentiment survey has gone from a record low in January to a steady gain three months running. Toll Brothers are selling shares again.

-- For anyone who argues the relevance of government stimulus on housing recovery, I submit the following. One third of all home buyers in the past several months have taken advantage of the $8000 home buyer tax credit. In the new construction market, builders say the credit has been instrumental in boosting sales as well as confidence among builders. Since the start of the credit, the builder sentiment survey has gone from a record low in January to a steady gain three months running. Toll Brothers are selling shares again.

Gasoline prices still slipping…more slowly.

The Energy Information Administration Weekly Report suggests that, “For the fifth consecutive week, the U.S. average price for regular gasoline went down. The average slipped a penny to $2.58 per gallon, bringing the cumulative drop for the past five weeks to seven cents. The national average was $1.26 below last year.”

Economic recovery…or manipulation?

The Energy Information Agency’s Natural Gas Weekly Update reports, “Significant price increases at all markets in the lower 48 States occurred during the report week, as some positive economic news suggested that demand for energy commodities may be recovering. During the week, reports from the U.S. Department of Commerce showing improved retail sales and a report from the Federal Reserve showing improved levels of industrial production likely were factors in the improved outlook. While many spot prices for natural gas are still trading at roughly half of their levels at this time last year, significant price increases this report week suggest that the year-long trend of declining prices may be coming to an end.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Significant price increases at all markets in the lower 48 States occurred during the report week, as some positive economic news suggested that demand for energy commodities may be recovering. During the week, reports from the U.S. Department of Commerce showing improved retail sales and a report from the Federal Reserve showing improved levels of industrial production likely were factors in the improved outlook. While many spot prices for natural gas are still trading at roughly half of their levels at this time last year, significant price increases this report week suggest that the year-long trend of declining prices may be coming to an end.”

Treasury Announces Expiration of Guarantee Program for Money Market Funds

Program Winds Down as anticipated, Generates $1.2 billion in participation fees for U.S. Taxpayers

The U.S. Department of the Treasury today announced that the Guarantee Program for Money Market Funds (the "Program") will expire today. The Program was initially established for a three-month period that could be extended up through September 18, 2009. Since inception, Treasury has had no losses under the Program and earned approximately $1.2 billion in participation fees.

"As the risk of catastrophic failure of the financial system has receded, the need for some of the emergency programs put in place during the most acute phase of the crisis has receded as well," said Treasury Secretary Tim Geithner. "The Guarantee Program for Money Market Funds served its purpose of adding stability to the money market mutual fund industry during market disruptions last fall and ultimately delivered a healthy return to taxpayers."

Treasury designed the Program to stabilize markets after a large money market fund's announcement that its net asset value had fallen below $1 per share ("broke the buck") in the wake of the failure of Lehman Brothers in September of 2008. Maintaining confidence in the money market mutual fund industry was critical to protecting the integrity and stability of the global financial system. Should we be concerned?

Wall Street…or Las Vegas?

In response to the question: What does Wall Street have to change to produce better leaders, a different culture and a more long-term focus?

Forget about it. Don't even waste time thinking about it. The purpose of Wall Street firms is to trade value for their own benefit not to build value for the economy either short-term or long-term. While at one point in its history, a non-trivial part of Wall Street's activity involved financing the growth of American companies, that is now a minor piece of its business. Wall Street is primarily engaged in encouraging individuals and companies to trade value between one another and tolling the parties for the service, and trading against the outside economy for its own account.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.