Grand Supercycle Favors Gold & Silver

Commodities / Gold & Silver 2009 Sep 19, 2009 - 05:17 AM GMTBy: The_Gold_Report

A serious student of equity market cycles and stock charts, market technician Clif Droke pulls no punches about the fact that the 120-year Grand Supercycle bodes ill as it approaches its end. Although his analyses of charts and cycles suggest some bright days on the near-term horizon, they also foretell depressing darkness by the middle of the next decade. Clif peppers this exclusive interview with The Gold Report with eye-opening and jaw-dropping insights—cut (thankfully!) with a note of caution that cycles aren't the only forces in play and some thoughts about how to take advantage of an impending "recoil rally" before we close out the "best recovery year in memory."

A serious student of equity market cycles and stock charts, market technician Clif Droke pulls no punches about the fact that the 120-year Grand Supercycle bodes ill as it approaches its end. Although his analyses of charts and cycles suggest some bright days on the near-term horizon, they also foretell depressing darkness by the middle of the next decade. Clif peppers this exclusive interview with The Gold Report with eye-opening and jaw-dropping insights—cut (thankfully!) with a note of caution that cycles aren't the only forces in play and some thoughts about how to take advantage of an impending "recoil rally" before we close out the "best recovery year in memory."

The Gold Report: Clif, there's a lot of talk right now about a market pullback. A recent missive on your website claims it's because market participants still recall the great unwinding of last September-November. They're afraid to get into the market. But when you analyze 10-year cycles, you conclude that the market should indeed increase now and through the end of the year. Why are people so fearful?

Clif Droke: There's an old term most Gold Report readers will know—the wall of worry. As more and more investors and market participants worry about a crash or decline in the stock market, it actually tends to be counterproductive and produces the opposite effect. The market keeps rising on those fears, using fear as a wall to climb higher, as it were. This theory applies only in bull markets, however.

It's debatable as to whether you want to call this year a bull market. Most people think we are in a long-term bear market and, within the context of the K-wave, maybe we are. Still, there's no denying this has been one of the best recovery years in memory. The S&P 500's recovery in percentage terms has been quite impressive. One reason is that the 10-year cycle peaks this year. So I have to define 2009 as a bull market recovery year. For that reason, I say the wall of worry is intact and the more investors worry about a crash or a decline, the more likely the market is to do the opposite and go higher. Certainly, we've seen that up until now.

TGR: But if the 10-year cycle is peaking, doesn't a market pullback await us on the other side of the peak?

CD: That's a good point, but every major cycle has a half-cycle component. So in that sense, a five-year cycle is coming down at the same time that the 10-year cycle peaks. Every time the 10-year cycle peaks—which is always around September to October of the ninth year of the decade (so that would be 2009, 1999, and so on)—it's always the ninth year of the decade.

Anyway, the 10-year cycle peaking does tend to produce a sharp pullback. If you look at S&P charts around October of the ninth year of the decade, you will see a sharp pullback almost every time. It usually lasts about one to two weeks. However, when the peak is over, the five-year cycle has bottomed, which usually gives you a recoil rally that lasts about two to three months. So, typically, the S&P closes at or near its highs for the year after the 10-year cycle has peaked. We saw that last in 1999 and should see it again this fall.

TGR: So the 10-year cycle will peak in September-October, and then we may have a one- or two-week pullback followed by a two- or three-month recoil rally.

CD: That's normally what happens. Typically, the cycle peaks right around the beginning of October, then you see that one- to two-week pullback and then the recoil rally usually into December. I expect that pattern to basically repeat this time around.

TGR: That sounds encouraging.

CD: As I said, I do expect this year to end on a positive note. It's been positive thus far, and I think the next time we get a pullback, investors who have been on the sidelines all year long—and let's face it, average retail investors have been on the sidelines; they've missed this remarkable rally—will be licking their chops to get in.

TGR: Then what's on the horizon for 2010?

CD: The fact of the matter is that we are in a deflationary period within the context of the long-term cycles. With the four-year cycle—that's the dominant cycle in 2010 being down—there will be some headwinds against stock prices next year. When we get past the recoil rally of the 10-year cycle next year, 2010, the 10-year cycle is no longer up. The four-year cycle, which is also known as the business cycle, bottoms next October. So next year could be a down year for equities overall.

TGR: So an individual investor's best opportunity for gains is toward the end 2009, with cautious investing through the four-year cycle.

CD: Exactly. I see 2010 as being a trading range year. Even though the path of least resistance heading into next October probably will be down, in-and-out trading will provide some opportunities for capturing gains along the way. If you look historically at the zero year, the first year of the new decade, that's usually what you get. The year 2000 was similar to that. After the 10-year cycle peak in 1999, we had a trading range year in the Dow in 2000 and it afforded a few good in-and-out trades. It was a tough year, though, and if you weren't a good trader, it was very hard to do any kind of buy-and-hold investing. I think that will be true for 2010, too.

TGR: What about in the longer haul?

CD: The cycles I look at are part of what's known as the Grand Supercycle. This 120-year cycle is the major dominant long-term cycle, but it also can be split into components. The 10-year cycle is one of them. So is the 60-year cycle; commonly referred to as the K-Wave, it's actually the half-cycle component of the 120-year cycle. The last time the 120-year cycle bottomed was 1894. Before that it was 1774.

The 120-year cycle is also known as the revolutionary cycle because when it bottoms, not only does it produce a meaningful change in the economy, very often it produces a revolutionary change in the sociopolitical fabric. So we could see, for instance, the American Revolution of the 1770s occurring with the bottom of the 120-year cycle. And then the next time the 120-year cycle bottomed in the 1890s, there was a major depression and U.S. transitioned from an agricultural economy to an industrial economy. That's another revolution. This time around, the 120-year cycle is bottoming in 2014. I do expect depression-type conditions certainly in the last three years of this cycle—that's 2012 to 2014.

TGR: Whoa!

CD: And probably when it's all said and done, America will see another revolution. I think it's safe to assume the revolution is going to be socialist; the government will wind up with greater control over everything. It may even mean the end of the capitalist economy that we're living in.

TGR: Aside from the overwhelming social implications that implies, this sounds exceedingly depressing from an investor's point of view. We have through 2014 until this 120-year cycle bottoms. What do you do?

CD: Two things. The long-term investor has to start thinking in terms of becoming an interim trader in order to realize meaningful gains in equities. As far as buy-and-hold positions, I think the days of expecting long-term gains in stocks are over between now and 2014. However, gold has supplanted equities as a buy-and-hold investment. So long-term investors who are concerned about what's going to happen in the next few years would certainly have a core position of gold or gold equivalent in their portfolios.

TGR: What do you define as core position?

CD: That depends on the individual investor—age, financial condition. It's hard to put a definite percentage on it, but at this point I would say at least 15% to 20% on average. With the advent of the exchange traded funds, the gold ETFs, that's certainly another avenue that can be pursued.

TGR: You've indicated that gold prices spike at the end of the 10-year cycle. It's been trading upwards of $1,000, and earlier this year it was around $950. Do you see $1,000-plus as the peak or will it go exponentially higher?

CD: I have a conservative upside target in gold of about $1,040 to $1,050, based simply on chart measurements between now and whenever the 10-year cycle peaks. Some people are saying we could hit $1,200 based on the chart measurements. If you're into chart pattern analysis, there's what's known as an inverse head-and-shoulders pattern in the long-term gold chart. Even though the 10-year cycle is peaking and that's usually beneficial for gold, I don't know that I believe gold can reach $1,200 between now and October.

TGR: Why not?

CD: Simply because gold is becoming exceptionally overbought on a longer-term basis. Certainly, my $1,050 target does not anticipate a big rally such as what we saw in September 1999, the last time the 10-year cycle peaked and gold exploded. Gold also did extremely well in the fall of '89 and, of course, '79. We're just in a different economy right now. That's the best way I can explain it. If we don't have a magnificent rally in gold between now and October, all I can say is, it's the economy.

TGR: You said earlier that as the 120-year cycle comes toward its end, long-term buy-and-hold investments typically won't work except for gold. Where do you expect gold to be when that cycle hits its bottom in 2014?

CD: I would think that, especially during the final hard-down years of the 120-year cycle—between 2012 and 2014—gold will be the ultimate benchmark for safety for the average investor and I would expect it to increase dramatically by then. I don't have an upside target; I'm really not much into making long term upside targets. I much prefer to follow direction based on internal momentum. But I can tell you that gold should appreciate dramatically heading into the cycle bottom in 2014. Certainly it will be well above anything we're seeing now.

TGR: Is that because the U.S. dollar will depreciate dramatically or is it just the flight to safety?

CD: It's the flight to safety. In fact, a disconnect between the dollar and gold during those years wouldn't surprise me. Inflation is not going to be problematic. The major long-term problem we're facing is deflation. The final years of the 120-year cycle always bring deflation, usually depression. I know it sounds contradictory to say that gold would outperform in a deflationary environment, but, actually, the two best times to own gold, historically, are during hyperinflation and also hyperdeflation. This is because it is viewed as a safe haven and investors will flock to it when they see major economic instability.

TGR: You note that gold producers' sentiment has done a complete about face from a year ago, and that now they're pretty optimistic. Is their optimism justified?

CD: I think they should be in an optimistic position. Longer term, the gold producers have a lot of things going for them, not the least of which is the gold price. A higher gold price certainly bodes well for them longer term. In the intermediate term, now that we are in what I believe to be a measure of economic recovery, it's going to bode well for them just based on the increase in industrial and other forms of demand for their product. I don't believe that's misplaced optimism at all.

TGR: You're talking about a recovery, and we're getting some good economic news by the end of this year, but we're heading towards a depression. The pieces don't seem to fit together.

CD: Understand that I expect the worst part of the deflationary aspects of the 120-year cycle to begin around the year 2012. The last three years of the 120-year cycle are always the worst. If you look at the last 120-year cycle, I believe the stock market actually peaked out in 1892. That's pretty analogous to 2012, when I expect everything to just fall apart. You can still have a measure of recovery in the years heading up to this, up to a point. Now we're at that point.

Obviously, the 10-year cycle has been responsible for a lot of the recovery this year. Next year may not be the best year for stocks, but the Fed and the Treasury and the government have made such a concerted effort to revive and stimulate the economy, I think it's going to work for a while. I expect the economy to kind of muddle through 2010, possibly 2011. The year 2011 is the last year that any cycle of consequence peaks out; mainly, the six-year cycle. And that's why I say 2012 to 2014 will be very bad because, during that time, there will be no cycles up; they're all going to be down.

So until we get to around 2011 or 2012, we could have a measure of economic recovery. It's not going to be tremendous. Certainly, it won't be like what we saw in the '80s and '90s, coming out of those little recessions, but I think we're going to have some recovery up until then.

TGR: When we start getting some positive economic news, will that take individual investors off that wall of worry and back into the market?

CD: It will to some degree. I don't think you can have a major top in equities without people coming off the wall of worry to some extent. People will start to come out of the sidelines, put their cash into the stock market. Even if it turns out to be a misplaced investment, I think we are going to see people coming off these high levels of fear. The stock market typically bottoms six to nine months before economic recovery. If you consider that the S&P bottom was in March of this year, that means between roughly now and December we should start to see the recovery take place. That's not the only reason I have for saying that. That's just one of the reasons.

TGR: What are the other reasons?

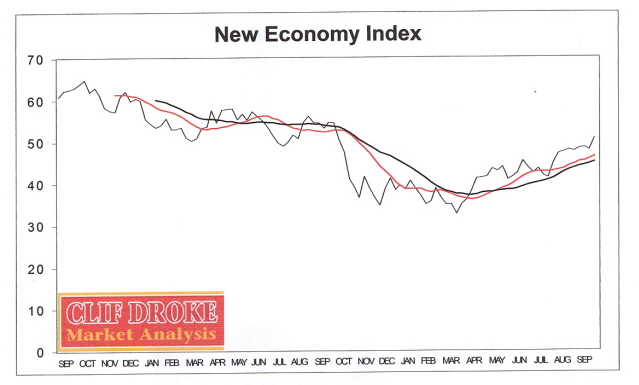

CD: I look at a basket of stocks, which I find reflect retail consumer demand. I have what's known as the New Economy Index, which is an average of some key stocks that have been known to precede economic recovery by anywhere from three to six months. Fed Ex is a big one; Monster Worldwide basically reflects the job market; Wal-Mart, of course, the retail economy; and there are some others. Collectively, that index has been making higher highs and higher lows and that's bullish for the economy. This index has been in recovery for the better part of six months and that's another reason I expect fourth quarter to show some economic recovery.

TGR: Are you also looking at silver and other precious metals as safe havens?

CD: Gold and silver are the two main ones. I think a long-term investor should concentrate on those two metals above any other natural resource in view of the 120-year cycle bottom.

TGR: What's your thinking about the rare earths and economic metals?

CD: From a long-term investment standpoint, I'd be very cautious, but tantalum, niobium and some others will do well as long as we're in economic recovery and global economic demand picks up. We're just barely starting to see it now. Certainly into 2010 I think the outlook will be fairly good for some of these rare earths and economic metals in the intermediate term.

A good up-and-coming company to look at is Commerce Resources Corp. (TSX-V:CCE, FSE:D7H, PK SHEETS:CMRZF). They're mining tantalum—from one of the richest tantalum deposits in the world—and niobium in Canada. Tantalum is a major part of the electronics industry and, as the economy recovers in the next couple of years, I think demand for their product will be very good. Also Commerce's President, Dave Hodge, told me a number of weeks ago and they were somewhat insulated from the credit crisis. That's a plus going forward, and I do see intermediate-term investment potential there.

TGR: Is that because of the balance sheet or because they're producing or why?

CD: Part of it is the balance sheet, but also because the demand side didn't collapse.

TGR: Any other companies you can share with us?

CD: On the silver side, I've always been an admirer of the management of Endeavour Silver Corp. (NYSE/AMEX:EXK, DBF:EJD, TSX:EDR). It's a junior miner in Mexico, but I think someday soon it will become a mid-tier producer. Their mining model is very distinct from most junior producers in that they do less raw exploration. They basically go after companies that have already been fully permitted and have plants already in place and they can skip the time-consuming process of construction and feasibility, permitting, etc. Endeavour has built up quite an operation and I think they'll move very quickly into the mid-tier status of silver producers that's been vacant since Hecla Mining Company (NYSE:HL) moved into senior status. Basically, I think one strategic acquisition will put them over the hump.

TGR: Is such a strategic acquisition already in play?

CD: I don't think it's in play yet, but they're getting close. As Endeavour's Chairman, Bradford Cooke, explained it to me a few weeks ago, they're actively looking. Another thing worth pointing out about Endeavour is an unbroken five-year track record in terms of annual growth of sales, cash flow and production. Plus, it was the only silver company last year to have four consecutive quarters of falling cash costs, which is another reason I think they will hit that mid-tier status soon.

TGR: Is that because of efficiencies?

CD: Absolutely. Efficiencies and their mining model of not having to spend a lot of time and money being exploration-intensive.

TGR: Any gold companies on your radar?

CD: Romarco Minerals Inc. (TSX-V:R) is good one—extremely well-managed. Most of the shares, I believe, are institutionally held. If you look at the stock prices, it's quite phenomenal. I think it's a testament to the management of Romarco, Diane Garrett, the President and CEO. I think that's a company, Romarco Minerals, to keep an eye on.

TGR: What attracted you to Romarco?

CD: I live in North Carolina and actually the first mining boom in U.S. history took place in the Carolinas. A trend on the Carolina Slate Belt was heavily mined in the 1800s and early 1900s, but then was kind of been abandoned. Romarco has gone back in there and is reviving, as it were, the Carolina Slate Belt with their Haile Gold Mine. It has 1.62 million ounces of gold (measured and indicated) with 3.26 million total gold resource (including inferred), and is open in three directions.

TGR: If most of the shares are institutionally held and you're already pretty impressed with their share performance, how much upside is left in this?

CD: Their production can only increase, so I think they do have some meaningful intermediate term upside. Just looking at their pipeline, I think they've got one or two years of upside potential. Not necessarily straight up, of course, but excellent management and strong institutional ownership bodes very well for them.

TGR: Why is the 120-year cycle not being discussed by the media?

CD: For one thing, it's not something you see in a classical economic textbook. Basically we're taught that government and central banking control the outcome of the economy through money supply and interest rate manipulation. In fact, classical economics and mainstream financial theory do not like to discuss the prevalence of cycles. Nobody wants to think that we're at the mercy of forces beyond our control. That's basically is what a cycle is—a cosmic force or a force of nature, if you will.

TGR: Or maybe—in this case—it's too dark to bring into the light of day.

CD: Don't equate the end of the Grand Supercycle with Armageddon. No cycle should be viewed as anything more than a rough road map for navigating the markets. Rarely can any cycle be used to consistent success as a standalone trading tool. For best results, investors should combine cycle theory with chart behavior and comprehensive study of rigorous analyses of technicals, fundamentals, market psychology and market liquidity.

DISCLOSURE: Clif Droke: I personally and/or my family own the following companies mentioned in this interview: None

I personally and/or my family am paid by the following companies mentioned in this interview: None

Savvy market technician, seasoned chart reader and cycle analyst Clif Droke is a popular and prolific author. His Gold & Silver Stock Report (published every trading day since 2002) examines daily and weekly technical outlooks on individual stocks and forecasts the near-term outlook for leading indices. In addition to gold and silver, it covers uranium and energy stocks from a short-term technical standpoint. In his Momentum Strategies Report, launched in 1997, Clif shares forecasts and reviews of U.S. equity markets using his proprietary blend of internal momentum indicators, moving averages, various analytical methods and investor sentiment to isolate the best sectors for short- and intermediate-term trading gains. Updated three times a week, Momentum Strategies addresses six major sectors (gold/silver, oil/gas, transportation, financial, REIT and semiconductor/nanotech), in addition to covering real estate, natural resources, money supply and trends in bank credit and the general economy. Also launched in 1997, Clif's monthly Gold Strategies Review covers gold, U.S. and Canadian precious metals equity markets and mutual funds and other natural resources. He also puts out Silver Strategies Review and Junior Mining Stock Report each month—and more. A frequent contributor to Kitco commentaries and Financial Sense, he has an impressive array of critically acclaimed books to his credit too. They include a variety of how-to volumes (channel busting, parabolic analysis, selling short, chart reading and turnaround trading, to name just a few) and cover topics as diverse as the housing bubble and cattle futures.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

The GOLD Report is Copyright © 2009 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.