Conditions for Global Gold Confiscation by Governments

Commodities / Gold & Silver 2009 Sep 19, 2009 - 06:16 AM GMT As the sixth and final part of this series we now look at this question: "Is it possible to get a synthesis of world governments to override the attraction of gold??"

As the sixth and final part of this series we now look at this question: "Is it possible to get a synthesis of world governments to override the attraction of gold??"

The greatest issues that face the global monetary system is twofold: -

The vast over-issuance of the U.S. $ internationally, has debauched its international value. In time this will lead to hugely falling buying power and translate into very high prices for the resources of the world. Few believe the plans put forward to reduce quantitative easing will work as expected, as this will simply return the world to recession or worse still, depression. Such liquidity reductions can only take place in a climate where confidence can be maintained as money tightening kicks in. This is not just inside the States but globally. So 'confidence' in the $ and its future value and credibility has waned tremendously even amongst foreign [particularly Asian] governments. The globe's currencies are like branches of a tree coming out of a trunk. The U.S. $ is the trunk, resulting in the entire monetary system facing irreparable fractures should anything like another 'credit crunch' happen again. Most people believe that the current state of the international monetary system is headed towards such stresses. Hence, gold is an alternative wealth preserver for governments, as well as individuals and institutions [demonstrated by central banks being net gold buyers now].

The vast over-issuance of the U.S. $ internationally, has debauched its international value. In time this will lead to hugely falling buying power and translate into very high prices for the resources of the world. Few believe the plans put forward to reduce quantitative easing will work as expected, as this will simply return the world to recession or worse still, depression. Such liquidity reductions can only take place in a climate where confidence can be maintained as money tightening kicks in. This is not just inside the States but globally. So 'confidence' in the $ and its future value and credibility has waned tremendously even amongst foreign [particularly Asian] governments. The globe's currencies are like branches of a tree coming out of a trunk. The U.S. $ is the trunk, resulting in the entire monetary system facing irreparable fractures should anything like another 'credit crunch' happen again. Most people believe that the current state of the international monetary system is headed towards such stresses. Hence, gold is an alternative wealth preserver for governments, as well as individuals and institutions [demonstrated by central banks being net gold buyers now].

- The rise of China is underestimated. In a relatively short period of time the Chinese presence in the global economy will be so great that it will outgrow the U.S. economy. To quote President Sarkozy of France, "The political and economic reality of a multi-polar world will have to find sooner or later a translation on the monetary level. A multi-polar world can't count upon one currency only." Whether the Yuan makes its presence known as part of a newly shaped Special Drawing Right component or stands alone in the world monetary system, it will take the place of the $ eventually as it does so. This will force major changes in the global monetary system, not simply by adding another currency to it, but by diminishing the role of U.S. Monetary politics in the global monetary system. I have no doubt that the vast political differences between the two will bring a degree of uncertainty that will damage the cohesion of the global monetary system and make sure that gold once again finds the respect it had before 1971.

These are dramatic changes, the impact of which will form the foundation of our future global money systems. If the world's governments could act in unison over the issues facing the money system we have no doubt that monetary reformation would be so successful as to remove the need for gold in any part of the system. But with national interests always taking precedence over international interests, few governments could survive the voter revolts if their national interests or economy were held back or restrained in any way, by the interests of other nations. So it is nigh-on impossible for a global forum of governments to agree to a dominant money system. Even if they were, you can be sure that they would keep a firm grip on their gold in the probable event that the unity would only be temporary. Future money systems must reflect that!

On the other hand the potential for the strains caused by the U.S. $ and the shift in the world's power base to the East certainly have the potential to cause more global currency crises. This will only be seen as the world moves to a full-blown recovery. Then as oil and other resources become the focus of more vigorous demand, so higher prices, the strains will make these future crises mature. In that environment, governments that do not produce their own resources will face the dangers of rationing and capital flight restraint [Capital Controls, etc]. The stresses felt then, will considerably lessen any global cohesion on the monetary front. Gold will again become vital in maintaining confidence in paper money [Central and other banks, will fight any restoration of a Gold Standard or any form of money used as a means of exchange]. Because of their 'national interests' gold will only be allowed to remain as a confidence builder in paper money. Thus, it will continue to be used as only a reserve asset.

On the other hand the potential for the strains caused by the U.S. $ and the shift in the world's power base to the East certainly have the potential to cause more global currency crises. This will only be seen as the world moves to a full-blown recovery. Then as oil and other resources become the focus of more vigorous demand, so higher prices, the strains will make these future crises mature. In that environment, governments that do not produce their own resources will face the dangers of rationing and capital flight restraint [Capital Controls, etc]. The stresses felt then, will considerably lessen any global cohesion on the monetary front. Gold will again become vital in maintaining confidence in paper money [Central and other banks, will fight any restoration of a Gold Standard or any form of money used as a means of exchange]. Because of their 'national interests' gold will only be allowed to remain as a confidence builder in paper money. Thus, it will continue to be used as only a reserve asset.

Citizens store gold for governments.

We are witnessing the Chinese government encouraging Chinese citizens to investment in gold and silver. In all lands where gold is respected, including the U.S.A., citizens are holding increasing amounts of gold in their portfolios in one form or another. In so many gold-aware nations gold is taking a rising part in investment portfolios. Since the turn of the century, European central banks have made it clear that they believe gold to be an important reserve asset and have limited their sales of the metal. In the last year European central bank signatories have lowered these sales to a trickle. Russian and Chinese central banks have increased their purchases of gold enormously making global central banks net buyers of gold, by a long shot.

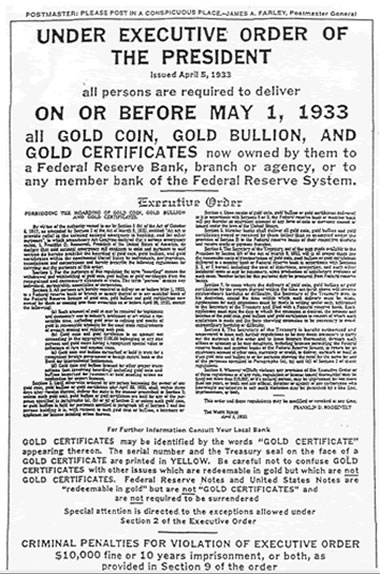

As we mentioned earlier in the series, the U.S. government has believed that gold ownership is a privilege, not a right.

Why?

Fit young men are seen as a national asset in times of war. When the need arises, citizen's gold will be seen as a national asset. If the need then arises, gold will be confiscated by government in the interests of the nation. The question you have to ask yourself is am I prepared for that eventuality or will I wait until it's too late as U.S. citizens did in 1933?

That is why the gold Exchange Traded Fund, The Ultimate Gold Fund has been designed to accommodate U.S. gold owners, holding their gold in Switzerland, in a manner that will prevent their gold from being confiscated!

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.