Doomsday for the Natural Gas Market?

Commodities / Natural Gas Sep 19, 2009 - 06:42 AM GMTBy: Joseph_Dancy

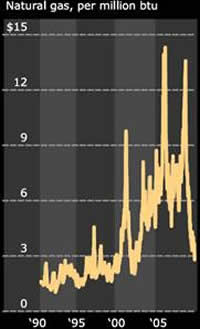

The bearish story for natural gas is becoming very well known. Lots of bearish natural gas analysts are around - rightfully so. With record levels of natural gas storage and weak industrial and generation demand spot prices have dropped to seven year lows (see chart, courtesy Bloomberg).

The bearish story for natural gas is becoming very well known. Lots of bearish natural gas analysts are around - rightfully so. With record levels of natural gas storage and weak industrial and generation demand spot prices have dropped to seven year lows (see chart, courtesy Bloomberg).

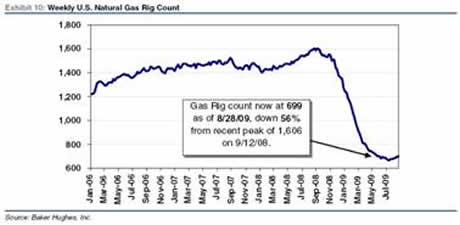

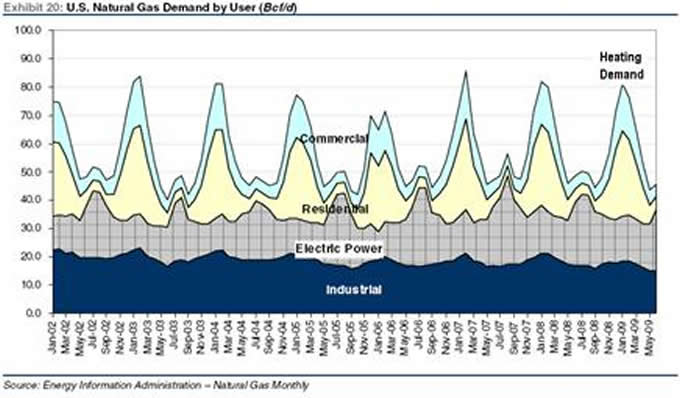

September and October are historically the months with the lowest total natural gas demand as the heating season has not started and demand from electric peaking plants is subdued with the end of summer’s heat and air conditioning loads. Natural gas drilling activity, measured by the rig count, has fallen to under 700 from 1,606 rigs running last year – a drop of 56% from year ago levels.

September and October are historically the months with the lowest total natural gas demand as the heating season has not started and demand from electric peaking plants is subdued with the end of summer’s heat and air conditioning loads. Natural gas drilling activity, measured by the rig count, has fallen to under 700 from 1,606 rigs running last year – a drop of 56% from year ago levels.

Short term we have no argument with the bearish view of natural gas. But over the longer term, six to eighteen months out, we have run across some interesting - and very bullish - forecasts. A growing number of companies have also dropped hints during quarterly conference calls that they think natural gas markets will improve in 2010. If so, the natural gas equities in our opinion will run further and faster than the commodity.

Here is some of the recent commentary on the natural gas markets:

- An interview on Bloomberg radio mentioned that the “Mother of all contangos” was in place in the natural gas futures market. This means the price for natural gas to be sold next year is much higher than the current spot price. Over the last two decades the gap between the12 month forward contango price (the price you can get for natural gas futures sold a year from now) and the spot price has never been higher. The incentive is to store the natural gas according to the commentary, and sell it later when prices are higher – which explains the full storage facilities.

Bloomberg noted that when the contango was anywhere this steep in the past twenty years the natural gas spot price increased in value on average by 74%. The best play will be natural gas stocks according to the commentary, not the natural gas ETF investment vehicle.

Supporting this viewpoint is the fact that the current contango in natural gas is reminiscent of the "super contango" in crude-oil futures that occurred about half a year ago. At that time, crude contango helped push inventories at Cushing, Oklahoma to a record high. The price of crude oil since rallied by more than 50% while inventories are down 15% from their peak.

- Canadian natural gas producer Fortress Energy presented their market assessment in a report that was included with the company's recent second quarter earnings release. Fortress believes many industry analysts are misreading the size of the potential decline in natural gas production. Fortress management submits that the lack of drilling activity, the massive decline rates of many shale formations, and a recovering economy point to a “very alarming supply shortage about to hit North American natural gas markets.”

The company’s study concludes that “without question some dramatic supply issues are mounting. If rig counts remain at 700 for any length of time, and North American producers continue to focus on drilling shale wells, those wells’ robust initial production rates are clearly insufficient to offset declines.”

- Tudor Pickering Holt also is forecasting a major decline in natural gas supply by year-end. They take their 2010 forecast “to $7.50/mcf” which “pushes gassy names to top” of their “near-term list of trading opportunities”:

Gas supply model thoughts - Maintaining high confidence in direction and magnitude of gas supply at year-end (steep ~10% year over year decline). Our forecast model was built to predict overall US gas production based on rig count and well quality. . . . Our bullish gas 2010 gas call is predicated on a pretty steep drop off in production by year end. This is supported by improving trends in gas storage over the summer and our analytical work . . . [they go on to note some modeling issues with recently released government data]

- FirstEnergy Capital Corp. is taking a decidedly more bullish stance than many of its brethren when it comes to its natural gas market outlook. The firm is confident that natural gas storage withdrawals in the United States this winter will approach record levels and a price spike will soon follow. "We see the Street as being far too conservative on estimating U.S. cumulative gas storage withdrawals for the upcoming heating season, and expect that such withdrawals will be close to or at record levels," FirstEnergy analyst Martin King said in a recent note. King said this will set the stage for a rapid price rebound in the early going of 2010, and likely make FirstEnergy's current $7 (U.S.) per million Btu price forecast for 2010 "appear too conservative."

- Bill Powers had some interesting comments last month in his Powers Energy Investor report on the natural gas market:

“. . . the U.S. is heading towards a gas deliverability crisis that will be very damaging to the economy. Today’s conventional wisdom will only make the crisis worse. . . . I believe we are about to experience a big mismatch between U.S. reserves and gas deliverability due in large part to long-lived shale gas reserves.”

The number of drilling rigs drilling for natural gas remains below 700. Industry consensus is that 1,200 rigs are needed to keep North American natural gas production even. The natural decline rate on conventional wells is nearly double what it was two decades ago, and the decline rate on unconventional shale wells is well above 50% - the initial production rates are very impressive but decline quickly.

The number of drilling rigs drilling for natural gas remains below 700. Industry consensus is that 1,200 rigs are needed to keep North American natural gas production even. The natural decline rate on conventional wells is nearly double what it was two decades ago, and the decline rate on unconventional shale wells is well above 50% - the initial production rates are very impressive but decline quickly.

- Canadian natural gas production is down considerably due to the lack of drilling and low prices but imports have not declined as severely. Canadian producers have exported excess gas this summer to storage facilities in the U.S. as Canadian natural gas storage facilities near capacity. As the Canadian winter heating demand revives the decline of exports to the U.S. could be substantial, and surprising in their magnitude.

- An unnamed hedge fund has made a large bet last month that natural gas prices will triple by winter just as the spot price of the commodity slid to a seven-year low. Traders took notice when the fund spent millions for the right to buy US natural gas at $10 per million British thermal units in January and February, well above the spot level of just over $3.

- EOG Resources noted in their latest conference call that “we've become more bullish regarding 2010 and 2011 gas prices. We still expect North American gas prices to remain quite low through year-end. As you know, we've historically devoted a lot of work to developing domestic gas supply models and we think our current model is the most granular and best we've ever built. It's telling us that December 2009 domestic production will be 4.8 Bcf a day lower than year-end 2008 and this deficit will deepen further throughout 2010. When added to the Canadian supply drop of at least 0.8 Bcf a day, we expect the gas market to turn sometime early in 2010 almost regardless of what happens. . . “

- Declines in Canadian natural gas production will set records this year as low prices keep the lid on drilling for new supplies, industry observers said last month. Volumes from Western Canada, where the bulk of the country's natural gas is produced, will drop by one billion cubic feet per day on average this year down from an earlier estimate of 750 million cubic feet per day, First Energy Capital Corp. analyst Martin King predicted. "This . . . will be the largest single year decline for natural gas production on record in Canada," King said in a supply update. Projected production rates will be "the lowest average natural gas production rate seen in Western Canada since 1995." King also noted exports to the United States likely will fall to 15-year lows.

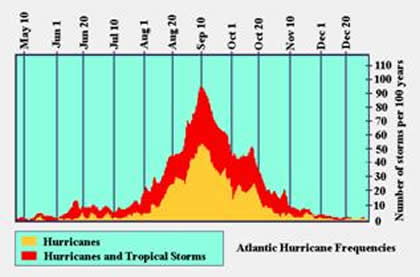

- The peak of the hurricane season is September 10th. While we have only had 4 named storms as of August 31st (five named storms as of this writing). In the past decade we have had three years when only 4 storms had formed by August 31st: 2000, 2001 and 2002. The following are the final statistics for each season – reflecting substantially increased activity near season-end:

2000 – 10 named storms, 6 hurricanes

2001 – 11 named storms, 9 hurricanes

2002 – 8 named storms, 4 hurricanes

Keep in mind that roughly 20% of U.S. natural gas and crude oil is produced in the Gulf of Mexico and in coastal areas, and roughly one-third of the nation’s refining capacity is on the Gulf coast. While any hurricanes that form over the next few months may not make landfall in the Gulf, when they have they have tended to severely disrupt operations and natural gas markets (note the ‘spikes’ in natural gas prices in the chart above, courtesy of hurricanes Gustav, Ike, Rita and Katrina).

Keep in mind that roughly 20% of U.S. natural gas and crude oil is produced in the Gulf of Mexico and in coastal areas, and roughly one-third of the nation’s refining capacity is on the Gulf coast. While any hurricanes that form over the next few months may not make landfall in the Gulf, when they have they have tended to severely disrupt operations and natural gas markets (note the ‘spikes’ in natural gas prices in the chart above, courtesy of hurricanes Gustav, Ike, Rita and Katrina).

- Some weather forecasting services are providing a preliminary glimpse at the upcoming 2009-10 winter -- and many of them indicate the patterns are setting up for a cold outlook in the Midwest. Some forecasters see the potential for the coldest US winter in a decade. "We do think there are opportunities for a potentially colder than normal winter coming up, one of the coldest we've seen in the past decade," suggests former EarthSat meteorologist Matt Rogers, now with the Commodity Weather Group.

Demand for natural gas is very cyclical. Winter demand for space heating increases total demand by over 90% from the low levels seen in a typical September or October (see chart). A cold winter in the Midwest and Northeast directly impacts demand for natural gas, and prices.

AccuWeather Senior Meteorologist Joe Bastardi is also seeing some similar historic weather trends that he says could herald a bitterly cold winter, particularly for the Northeast and South.

"The closest comparison we’re using for this upcoming winter is the 2002-03 winter season," Bastardi said. "Then you have the extreme case of the 1977-78 winter, which is also a possibility." The latter winter held the record for subfreezing temperatures for an unrelenting 51 days. Even a possible repetition of the milder 2002-03 season has some gas traders anxious. That was seven years ago, and the US population has grown by an estimated 26 million people, notably increasing natural gas heating loads.

We remain optimistic that over the next 12-18 months we will see higher natural gas prices as supply and demand realign. Profitable and well managed companies in the most inefficient part of the market – the small capitalization, publicly traded, firms – should outperform the commodity and their larger brethren.

As Berkshire Hathaway Co-Chairman Charles Munger has said, when the risk/reward ratio is tilted heavily in your favor invest heavily – good long term investment ideas are rare, act when they present themselves.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2009 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.