Global Stock Markets Scale Fresh Highs on Investor Realisation of Economic Recovery

Stock-Markets / Financial Markets 2009 Sep 20, 2009 - 07:59 AM GMT Marking the one-year anniversary of the Lehman Brothers demise, risky assets last week again marched higher to the tune of economic data supporting the argument of a global economic recovery. A realization among investors that the economic transition from recession to recovery was gaining momentum, resulted in many global stock markets scaling fresh peaks for the year.

Marking the one-year anniversary of the Lehman Brothers demise, risky assets last week again marched higher to the tune of economic data supporting the argument of a global economic recovery. A realization among investors that the economic transition from recession to recovery was gaining momentum, resulted in many global stock markets scaling fresh peaks for the year.

Ben Bernanke, Federal Reserve chairman, on Tuesday said the US recession “is very likely over”. However, he remained cautious about the shape of the recovery and said he expected a “moderate” recovery in 2010 with growth “not much faster than the underlying potential growth rate of the economy”, i.e. approximately 3%.

“At the moment we don’t see (the economy) getting better or worse, but that’s better than you could say six months ago,” added Warren Buffett. “The terror of last year is gone and that’s thanks in part to the government.”

Source: Tom Toles, Slate.com

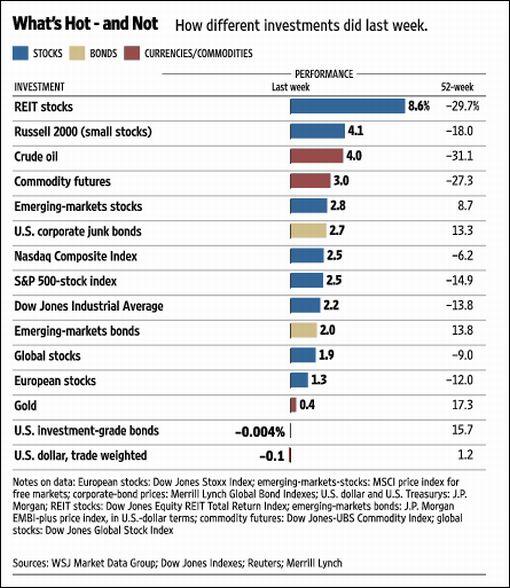

Not only did the US stock market indices record up-days on every day except Thursday, but all ten economic sectors that make up the S&P 500 also closed the week in the black. Most other stock markets (mature and emerging alike), commodities, oil, precious metals, high-yielding currencies and corporate bonds also put in a stellar performance as a bullish mood prevailed.

The CBOE Volatility Index (VIX), or “fear gauge”, traded at about the same level (23.9) as before the Lehman bankruptcy in September last year. Also, government bonds and other safe-haven assets such as the US dollar and Japanese yen were out of favor as investors sought higher returns elsewhere.

As investors started assuming more risk since March, the US Dollar Index headed lower, hitting a one-year low last week and trading in a confirmed downtrend as far as primary trend indicators are concerned. The combination of low interest rates and quantitative easing has made the US dollar an attractive currency for funding carry-trade transactions (i.e. selling low-yielding currencies to finance the purchase of higher-yielding currencies). (Click here for a short technical analysis.)

The declining dollar, central bank purchases, the de-hedging by gold producers and rising inflation expectations served as catalysts for gold bullion’s strength, causing the yellow metal to close above the $1,000 level for the sixth consecutive day on Friday. While gold’s move grabbed the headlines, platinum (+42.5%) and silver (+50.5%) have actually outperformed gold (+13.9%) significantly since the start of the year.

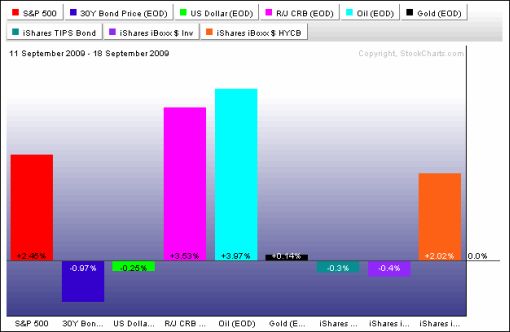

Source: StockCharts.com

The past week’s performance of the major asset classes is summarized by the chart below - a set of numbers that indicates an increase in risk appetite.

Source: StockCharts.com

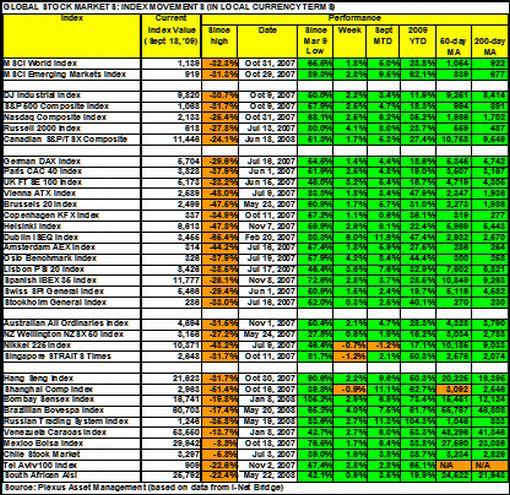

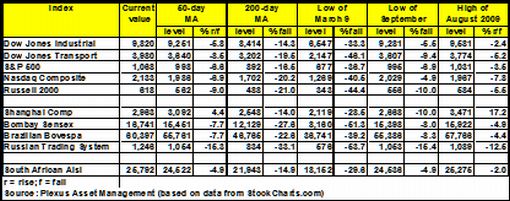

A summary of the movements of major global stock markets for the past week, as well as various other measurement periods, is given in the table below.

The MSCI World Index (+1.8%) and MSCI Emerging Markets Index (+2.8%) both made headway last week to take the year-to-date gains to +23.8% and a staggering +62.1% respectively. These indices are still more than 30% down from the 2007 highs, but markets such as Mexico (-8.8%) and Chile (-5.8%) have almost wiped out all their financial crisis losses.

The major US indices extended their gains to two consecutive weeks, marking eight up-weeks during the past ten weeks. The year-to-date gains are as follows: Dow Jones Industrial Index +11.9%, S&P 500 Index +18.3%, Nasdaq Composite Index +35.2% and Russell 2000 Index +23.7%. Interestingly, since the Nasdaq Index was created in 1971, only 1991, 1995 and 2003 have seen bigger year-to-date gains.

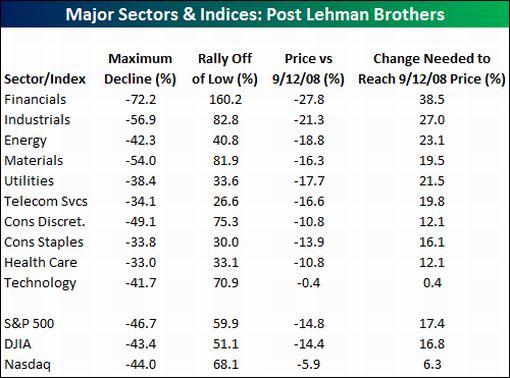

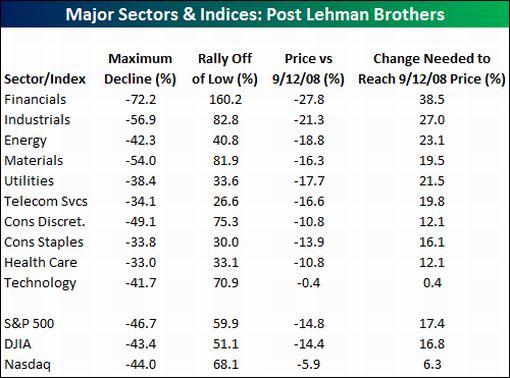

While the indices have gained considerably from their lows, they still have to rally by between 6.0% (Russell 2000) and 17.2% (S&P 500) to reach the levels of the Friday (September 12, 2008) before Lehman’s collapse.

Click here or on the table below for a larger image.

Top performers in the stock markets this week were Hungary (+7.4%), Macedonia (+7.3%), Ireland (+6.1%), Argentina (+5.7%) and Sri Lanka (+5.3%). At the bottom end of the performance rankings, countries included Kenya (-1.6%), Uganda (-1.5%), the Philippines (-1.3%), Singapore (-1.2%) and Slovakia (-1.2%).

Of the 98 stock markets I keep on my radar screen, 81% recorded gains, 13% showed losses and 4% remained unchanged. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the winners for the week included Market Vectors Solar (KWT) (+10.5%), United States Natural Gas (UNG) (+9.9%), iShares Cohen & Steers Realty Majors (ICF) (+9.6%) and Claymore/MAC Global Solar Energy (TAN) (+9.0%).

On the losing side of the slate, ETFs included ProShares Short Financials (SEF) (-4.5%), ProShares Short Russell 2000 (RWM) (-4.2%), Broadband HOLDRS (BDH) (-2.9%) and CurrencyShares British Pound Sterling Trust (FXB) (-2.6%).

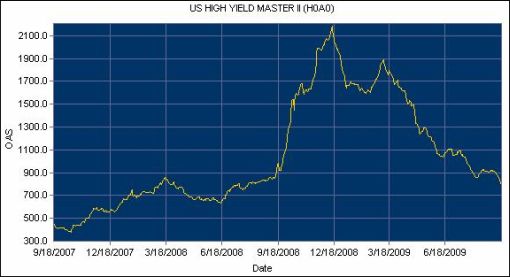

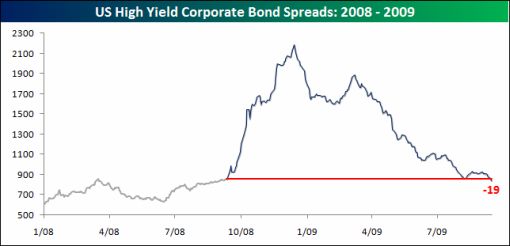

The cost of buying credit insurance for US and European companies eased sharply during the past two months, as shown by the tighter spreads for both the CDX (North American, investment-grade) Index (down from 118 to 103) and the Markit iTraxx Europe Index (down from 95 to 86).

Also, junk-bond yields continued declining, as shown by the Merrill Lynch US High Yield Index (and also by the good performance of the iShares iBoxx $ High Yield Corporate Bond ETF, HYG). The Index dropped by 63.4% to 798 from its record high of 2,182 on December 15, meaning the spread between high-yield debt and comparable US Treasuries was 798 basis points on Friday. This heralds the return of high-yield spreads to “pre-Lehman” levels (854 basis points on September 12, 2008).

Referring to the Federal Open Market Committee’s (FOMC) meeting next week, the quote du jour comes from straight-talking Bill King (The King Report). He said: “Traders and investors must contemplate what course of action the Fed will announce and enact after next week’s FOMC if ‘the US recession is very likely over’. If quantitative easing (QE), which is due to expire, is renewed, stocks should rally but commodities, gold and inflation plays should rally far more. The dollar should tank. China should go apoplectic. Benito will look foolish for saying ‘the recession is very likely over’. Bonds might rally initially but then look out below.

“If QE is not renewed, stocks and commodities should tank; the dollar should soar and bonds, after initially declining, should rally. China will be appeased. Benito will have validated his rhetoric with action.”

Other news is that the Federal Reserve and the Treasury are considering sweeping rules to regulate pay at banks. According to The New York Times “the rules depart from the hands-off approach that dominated bank regulation for the last three decades, but are not as strict as proposals from some European leaders”.

Also, the US Securities and Exchange Commission passed rules last week to firm up on the supervision of credit ratings agencies following a flood of criticism over their role in the financial crisis.

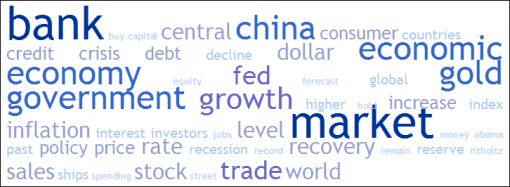

Next, a tag cloud of all the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “bank”, “market”, “economy”, “government”, “China” and “gold” featured prominently. “Recession” has become a footnote.

The major moving-average levels for the benchmark US indices, the BRIC countries and South Africa (from where I am writing this post) are given in the table below. With the exception of the Chinese Shanghai Composite Index, which is trading below its 50-day moving average, all the indices are above their respective 50- and 200-day moving averages. The 50-day lines are also in all instances above the 200-day lines.

The August highs and September lows are also given in the table as these levels define a support area for a number of the indices. On the other hand, the next potential upside target for the S&P 500 is about 1,120.

Click here or on the table below for a larger image.

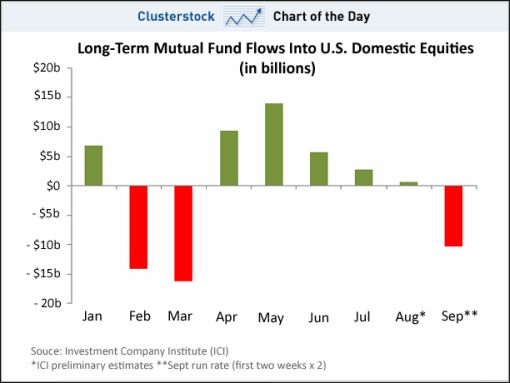

As stock markets continue to reach new highs, long-term mutual fund investors have reversed their strategy this month, selling shares for the first time since March, said Clusterstock. The outflows for the first two weeks of September were bigger than the inflows seen in the last three months combined.

Source: Clusterstock - Business Insider, September 17, 2009.

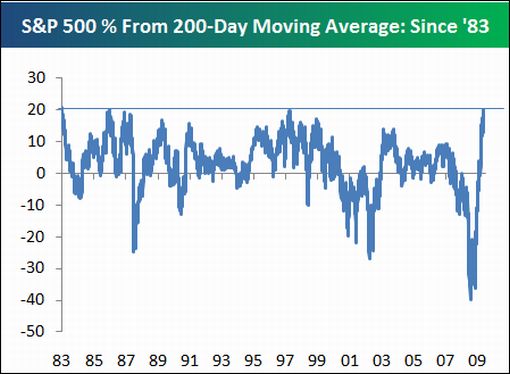

Bespoke highlights that the S&P 500 has now closed more than 20% above its 200-day moving average for the first time since May 1983. “This comes just six months after the Index traded the furthest below its 200-day since the Great Depression! Not even during the great bull run of the 90s did the Index get this far above its 200-DMA. This has happened only a handful of times in the history of the S&P 500,” said the report.

Source: Bespoke, September 16, 2009.

Short-term movement aside, when considering monthly data, three momentum-type oscillators (RSI, MACD and ROC) have reversed course over the past few months for the first time since the sell signals of 2007, and now indicate a positive primary trend.

Source: StockCharts.com

Putting matters in perspective from across the pond, David Fuller (Fullermoney) said: “Stock market action continues to confirm a bull market in every respect. Downside risk is probably limited to periodic mean reversions towards the rising 200-day moving averages. Such pullbacks generally offer the best buying opportunities.

“The main danger signs to look for will be an eventual tightening of monetary policy and an inverted yield curve. [PduP: The chart below shows that the next inverted yield curve is probably a long way off.] When this next happens, and both tend to be lead indicators, I will focus on introducing trailing stops for all equity positions, actual or mental, and ideally use strength to reduce equity exposure.

Source: Fullermoney.com

“Currently, I maintain that we are still in the second psychological perception stage of the current bull market, characterized by the ‘wall of worry’. With any luck, we can look forward to the third and climactic stage of a bull market cycle, in which investors become euphoric,” concluded Fuller.

For more discussion on the direction of financial markets, see my recent posts “Interview with Marc Faber“, “Is the rally ending, or does it have more to go?“, “Charts: Stocks face 15% correction in October“, “Albert Edwards: ‘I remain in the bearish camp‘”, “Bullion - a viable alternative to fiat currencies” and “More US dollar woes ahead“. (And do make a point of listening to Donald Coxe’s webcast of September 18, which can be accessed from the sidebar of the Investment Postcards site.)

Economy

The global economic recession is over, according to the latest Survey of Business Confidence of the World by Moody’s Economy.com. “Survey results during the first week of September improved notably across the entire global economy and most industries. Assessments of current business conditions and expectations regarding the outlook in early 2010 rose sharply.”

Source: Moody’s Economy.com

The Survey’s results were confirmed by the Organization for Economic Cooperation and Development’s index of leading indicators (covering 29 countries), which rose to 97.8 in July from 96.3 in June, reported The Wall Street Journal. The OECD said the indicators “point to broad economic recovery” and that “clear signals of recovery are now visible in all major seven economies, in particular in France and Italy, as well as in China, India and Russia”.

A snapshot of the week’s (mostly positive) US economic reports is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

September 18, 2009 • Loan delinquency and charge-off rates

September 17, 2009 • Housing starts - multi-family units led the charge in August • Jobless claims - initial claims decline, continuing claims advance

September 16, 2009 • The Energy Price Index lifts Consumer Price Index in August • Cars and many other components account for the strength in factory activity • Current account narrows in Q2

September 15, 2009 • Autos and non-auto components lift retail sales in August • Wholesale Price Index movement largely an energy price story

It is noteworthy that industrial production increased 0.8% in August after an upwardly revised 1.0% gain in July. Asha Bangalore (Northern Trust) said: “The Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) uses four variables - industrial production, nonfarm payroll employment, real personal income less transfer payments, and real manufacturing and trade sales - to determine turning points of a business cycle. The important aspect to note is that the trough of industrial production was in June 2009. Therefore, it is quite likely that the NBER will date the end of the Great Recession as June/July 2009 once additional information is available.”

Source: Northern Trust - Daily Global Commentary, September 16, 2009.

Economists surveyed by the The Wall Street Journal are increasingly confident that the US economy is growing again. They predicted that the US will grow at a 3% annual rate in the current quarter - well above the 0.6% forecast they made just three months ago - and will expand at a 2.5% pace in the fourth quarter.

Meanwhile, William White, the highly respected former chief economist at the Bank for International Settlements, warned (via the Financial Times) that government actions to help the economy in the short run may be sowing the seeds for future crises. “Are we going into a W[-shaped recession]? Almost certainly. Are we going into an L? I would not be in the slightest bit surprised,” he said, referring to the risks of a so-called double-dip recession or a protracted stagnation like Japan suffered in the 1990s. “The only thing that would really surprise me is a rapid and sustainable recovery from the position we’re in.”

Click here for a summary of Wells Fargo Securities’ weekly economic and financial commentary.

In addition to the interest rate announcement by the FOMC on Wednesday (September 23), US economic data reports for the week include the following:

Monday, September 21 • Leading economic indicators

Tuesday, September 22 • FHFA US Housing Price Index

Wednesday, September 23 • FOMC rate decision

Thursday, September 24 • Initial jobless claims • Existing home sales

Friday, September 25 • Durable goods orders • Michigan Sentiment Index • New home sales

Markets The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, September 18, 2009.

“Success is not final, failure is not fatal: it is the courage to continue that counts,” said Winston Churchill (hat tip: Charles Kirk - do make a point of visiting his excellent site). And isn’t this so true of the investment world where mistakes are the order of the day. Let’s hope the news items and quotes from market commentators included in the “Words from the Wise” review will assist readers of Investment Postcards to overcome the inevitable losing trades and focus on the next money-making opportunity.

For short comments - maximum 140 characters - on topical economic and market issues, web links and graphs, you can also follow me on Twitter by clicking here.

That’s the way it looks from Cape Town (from where I am leaving on my first trip to Dallas, Texas in just more than a week).

Hat tip: The Big Picture

The New York Times: Wall Street, one year later “The Times’s Andrew Ross Sorkin, Gretchen Morgenson and Joe Nocera recount the events of the weekend that Lehman Brothers failed and discuss the lessons learned from the financial crisis.”

Source: The New York Times, September 11, 2009.

Charlie Rose: Obama’s Wall Street speech “President Obama’s speech on Wall Street marking one year since the fall of Lehman Brothers and the global economic recovery plan with Jake Tapper of ABC News, author Jim Stewart and Andrew Ross Sorkin of The New York Times.

Source: Charlie Rose, September 14, 2009.

Financial Times: Bernanke says US recession probably over “The US recession ‘is very likely over’, Ben Bernanke, Federal Reserve chairman, said on Tuesday as Barack Obama, US President, heralded the end of the economic ‘freefall’.

“Their comments came after data showed retail sales rose 2.7% last month, their fastest rate in more than three years. The expected boost from the popular ‘cash for clunkers’ car rebate programme was accompanied by a surprise pick-up in other spending.

“This raised hopes that US consumers might be re-emerging from the rubble of the housing market collapse, the rollercoaster ride in equities markets and rising unemployment.

“‘This is a consumer that is in a lasting full recovery mode,’ said Chris Rupkey of the Bank of Tokyo/Mitsubishi UFJ. ‘The Fed is going to need to stop talking about its exit strategy and start implementing it if today’s data keeps up.’

“Others were more cautious, pointing out that August was the back-to-school month. ‘I’d like to see if this is just a one-month bounce or an actual trend,’ said Adam York, at Wells Fargo.

“Many economists believe that consumer spending will be constrained for months by households’ limited access to credit and their desire to reduce their debts.

“Mr Bernanke, who did not comment directly on the sales report, remained cautious about the shape of the recovery.

“He said he expected a ‘moderate’ recovery in 2010 with growth ‘not much faster than the underlying potential growth rate of the economy’ - which means around 3%.”

Source: Krishna Guha, Anna Fifield, Sarah O’Connor and Alan Rappeport, Financial Times, September 15, 2009.

The Wall Street Journal: The recession is over … sort of “Barrons.com’s Bob O’Brien comments on Ben Bernanke’s speech earlier this week in which he believes the recession is over, but not without qualifications.”

Source: The Wall Street Journal, September 16, 2009.

The Wall Street Journal: Economic confidence rebounds “Economists and consumers are feeling better about the economy a year after the most frightening moments of the financial crisis. Forecasters surveyed by The Wall Street Journal, giving the government generally good marks for its handling of the financial crisis, now see employers slowly adding jobs over the next 12 months.

“And the latest reading of consumer spirits shows signs of optimism. But most economists still expect the unemployment rate will climb to 10.2%, from today’s 9.7%, before falling early next year.

“‘We are in a technical recovery, but risks remain abundant,’ said Diane Swonk of Mesirow Financial. ‘It will still take some luck and skill to get Main Street to feel some of the relief Wall Street has felt.’

“Main Street is beginning to feel some relief, though, according to the Reuters/University of Michigan preliminary reading of consumer sentiment for September, released Friday.

“The index rose to 70.2 in September from to 65.7 in August, the first increase since June. Consumers felt better about current conditions, and about the future.

“The 51 forecasters surveyed over the past week, not all of whom answered every question, are increasingly confident that the US economy is growing again.

“They predicted in the new Wall Street Journal survey that the US will grow at a 3% annual rate in the current quarter - well above the 0.6% forecast they made just three months ago - and will expand at a 2.5% pace in the fourth quarter.

“While they predict the US will add jobs over the next 12 months, they see a net increase of only 200,000 jobs over that period, and predict unemployment to be a still-high 9.3% in December 2010.

“Job-market weakness is expected to keep the Fed from boosting interest rates, now near zero, until August 2010, the economists say.

“The Organization for Economic Cooperation and Development’s forecasting gauge bolsters the optimists’ case. Its index of leading indicators, which covers 29 of its member countries, rose to 97.8 in July, from 96.3 in June.

“The Paris research organization said Friday the indicators ‘point to broad economic recovery’. It said ‘clear signals of recovery are now visible in all major seven economies, in particular in France and Italy, as well as in China, India and Russia’.

“As they look back on a year of extraordinary government actions aimed at avoiding an even worse recession, economists in The Wall Street Journal survey give good grades to the response of the Bush and Obama administrations and the Federal Reserve - a median score of 80 out of 100.”

Source: Phil Izzo, Sara Murray and Justin Lahart, The Wall Street Journal, September 14, 2009.

MoneyNews: Buffett - economy has not turned up “The US economy has not begun to climb out of the worst recession since the Great Depression, but the ‘terror’ that followed last year’s near-collapse of the financial system is gone, due in part to government intervention, Warren Buffett told Reuters on Tuesday.

“Buffett maintained a positive outlook on the government’s much criticized Troubled Asset Relief Program (TARP) for banks, saying it may ultimately turn a profit for the government.

“‘At the moment we don’t see (the economy) getting better or worse, but that’s better than you could say six months ago,’ said the billionaire known as The Sage of Omaha for his long history of successful investments. ‘The terror of last year is gone and that’s thanks in part to the government.’

“US President Barack Obama said on Tuesday that measures undertaken by his administration to rescue the economy - including a $787 billion stimulus package - were working, but warned a complete recovery would take ’some time’.

“Federal Reserve Chairman Ben Bernanke also gave a fairly upbeat view, saying the longest and deepest recession since the 1930s was likely over, but added it would ‘feel like a very weak economy for some time’.”

Source: MoneyNews, September 16, 2009.

Financial Times: Economist warns of double-dip recession “The world has not tackled the problems at the heart of the economic downturn and is likely to slip back into recession, according to one of the few mainstream economists who predicted the financial crisis.

“Speaking at the Sibos conference in Hong Kong on Monday, William White, the highly-respected former chief economist at the Bank for International Settlements, also warned that government actions to help the economy in the short run may be sowing the seeds for future crises.

“‘Are we going into a W[-shaped recession]? Almost certainly. Are we going into an L? I would not be in the slightest bit surprised,’ he said, referring to the risks of a so-called double-dip recession or a protracted stagnation like Japan suffered in the 1990s.

“‘The only thing that would really surprise me is a rapid and sustainable recovery from the position we’re in.’

“The comments from Mr White, who ran the economic department at the central banks’ bank from 1995 to 2008, carry weight because he was one of the few senior figures to predict the financial crisis in the years before it struck.

“Mr White repeatedly warned of dangerous imbalances in the global financial system as far back as 2003 and - breaking a great taboo in central banking circles at the time - he dared to challenge Alan Greenspan, then chairman of the Federal Reserve, over his policy of persistent cheap money.

“On Monday Mr White questioned how sustainable the signs of life in the global economy would prove to be once governments and central banks started to withdraw their unprecedented stimulus measures. ‘The green shoots are certainly out there - the question is what kind of fertiliser is being used on them,’ he said.

“Worldwide, central banks have pumped thousands of billions of dollars of new money into the financial system over the past two years in an effort to prevent a depression. Meanwhile, governments have gone to similar extremes, taking on vast sums of debt to prop up industries from banking to car making.

“These measures may already be inflating a bubble in asset prices, from equities to commodities, he said, and there was a small risk that inflation would get out of control over the medium term if central banks miss-time their ‘exit strategies’.”

Source: Robert Cookson and Sundeep Tucker, Financial Times, September 14, 2009.

Financial Times: Lending in Europe continues to shrink “The credit crunch in Europe worsened over the summer as corporate bond finance issuance failed to plug the gap left by a sharp contraction of bank lending.

“Net lending by banks went further into negative territory in July as companies paid back more loans than they took out new ones.

“Loans outstanding contracted by a net €25 billion ($36 billion) in the month, the fifth successive month of an increasing shrinkage of supply.

“At the same time, there was a retreat in the recent record corporate bond issuance.

“Bond issuance in July declined for the first time since March, by €20 billion month on month to €27 billion, although bankers are convinced that it was only seasonal.

“Bankers said the July trends had continued into August and would affect smaller companies most severely.

“Morgan Stanley, which compiled the credit crunch numbers from central bank data and Dealogic, said the scant availability of bank lending would penalise smaller companies that have no access to bond markets.

“‘As Europe’s commercial banks de-lever, lending is likely to be squeezed,’ said Huw van Steenis, banks analyst.

“According to Morgan Stanley, there was €319 billion of corporate bond issuance in the first seven months of the year and a decline of €33 billion in European bank-originated loans.

“That marked a reversal of the balance of corporate funding from the same time last year, when bank loans totalled €356 billion compared with corporate bond issuance of only €119 billion.

“Banks across Europe have insisted in recent months any decline in lending is due to a fall-off in demand, not supply.”

Source: Patrick Jenkins, Financial Times, September 13, 2009.

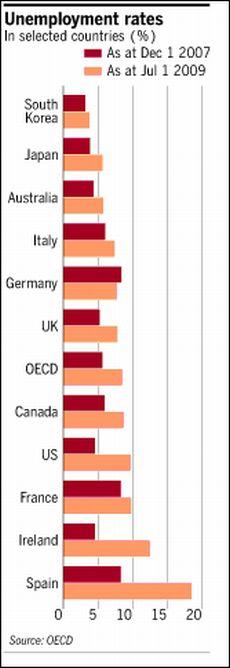

Financial Times: OECD warns 25 million jobs at risk from crisis “Up to 25 million people in high-income countries will have lost their jobs by the end of next year as the recession pushes the unemployment rate towards a record 10%, the Organisation for Economic Co-operation and Development forecast on Wednesday.

“The Paris-based OECD said that, while recent signs of economic recovery might mean unemployment peaked earlier and at a slightly lower level than its forecast, governments must intervene ‘quickly and decisively’ to prevent the sharp rise turning into long-term joblessness.

“Its annual employment outlook underlines fears that a recovery without jobs might be in prospect, even if the return to economic growth seen in some countries in the third quarter is sustained.

“‘Most OECD countries are already facing a jobs crisis. This is likely to get worse before it gets better,’ said Stefano Scarpetta, the report’s lead author and head of the organisation’s employment division.

“The OECD said 15 million jobs were lost between the end of 2007 and July this year and 10 million more could go by the end of next year in the 30-nation area if the recovery failed to gain momentum. A total increase of that magnitude would be equivalent to the population of a country larger than Australia.

“In 2007 the unemployment rate in the OECD hit a 25-year low of 5.6%, but it rose to a postwar high of 8.5% this July.”

Source: Brian Groom, Financial Times, September 16, 2009.

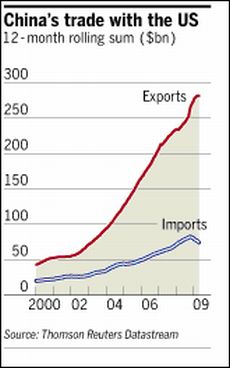

Financial Times: China turns to WTO in trade dispute “Barack Obama’s decision last week to impose emergency tariffs on Chinese tyres has fuelled an increasingly familiar Sino-US war of words over trade.

“Beijing launched an investigation on Monday into whether US poultry and car parts were being unfairly dumped in the Chinese market. It also requested formal consultations at the World Trade Organisation into the US tariffs - the first step in trying to have them declared illegal.

“Whether it will succeed is unclear. The particular ’safeguard’ measure that the US president invoked was, after all, written specifically to allow the US to block Chinese imports as part of the price for China joining the WTO in 2001.

“However, trade experts and lawyers say the episode does show the increasingly sophisticated legal strategies used by Beijing in its many disputes with trading partners, and the way it maximises political effect while trying to limit the actual economic damage.

“Opinion is divided as to whether this dispute - while breaking ground by using a particular trade law for the first time - is likely by itself to set off a protectionist spiral.

“Gao Yongfu, an expert in trade law at Shanghai Institute of Foreign Trade, said: “I think it unlikely that this dispute will be limited to just one industry - it’s likely to spread to others.”

“Prof Gao said other trading partners, including the European Union, were likely to follow suit, broadening if not deepening the restrictions on trade.

“Yet other trade lawyers and economists noted that China had threatened to retaliate in a way that had high political salience but modest economic impact.

“Beijing has built a reputation for rapid but controlled retaliation during trade disputes. One Washington trade lawyer said: ‘China always responds, so I don’t think this escalates. It just repeats each time the US does something.’”

Source: Alan Beattie and Geoff Dyer, Financial Times, September 14, 2009.

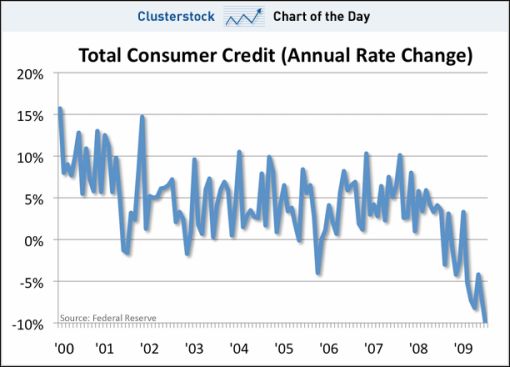

Chart of the day (Clustrstock): Consumer credit collapse “Hoping for a consumer-led recovery? Don’t hold your breath. The latest data from the Federal Reserve shows that the year-over-year decline in total consumer credit is collapsing at an accelerating rate. God forbid consumers go back to living within their means.”

Source: Joe Weisenthal and Kamelia Angelova, Clusterstock - Business Insider, September 9, 2009.

MoneyNews: Geithner - tax hikes not likely “Treasury Secretary Timothy Geithner acknowledged Tuesday the federal government had to take some ‘deeply offensive’ steps to help the country get past the financial crisis a year ago.

“But he also said in a nationally broadcast interview that things are ‘dramatically different’ now, although it’s too early to say the economy is in recovery.

“‘A year ago we really were on the verge of a full-sale run’ on banks, along the lines of the 1930s Depression, Geithner said in an interview broadcast on ABC’s ‘Good Morning America’. He said ‘the biggest fear now, the biggest challenge, is to make sure we change the rules of the game so it doesn’t happen again’.

“Asked about projections of a $1.6 trillion deficit and a growing US debt obligation to other countries, Geithner said the Obama administration still wants to avoid an increase in income taxes on the middle class. The secretary noted Barack Obama’s pledge against such a hike during his presidential campaign and said Obama remains ‘very committed’ to it.

“He also said it was too early to say just when the government might let allow expiration of an emergency lending program for financial institutions (TARP) and said he also didn’t know how soon Washington could extricate itself from direct involvement in the auto industry, although he said it likely won’t be within a year.

“Geithner said the administration cannot suggest any guarantee of financial stability, but said ‘what we have an obligation to do is to put that in place here and around the world. … That’s our obligation.’

“He acknowledged that to a large degree, Washington’s intervention in the private markets hasn’t gone over well with large elements of the public and said ‘the government had to do some deeply offensive things to undo the damage. … But we’re going to get out of this as soon as possible.’

“On the budget deficits, Geithner said, ‘I think Americans understand we have an unsustainable fiscal position. We have to bring these deficits down over time.’ He said the country must ‘get our fiscal house in order’ and stressed that Obama is vehemently opposed to a general income tax increase for people who make under $250,000 a year.

“The secretary said that while things are better than they were a year ago, ‘I would say there’s no recovery yet. We define recovery … as people back to work, people able to get a job again, businesses investing again … and we’re not at that point.’

“‘We’re going to do what it takes to get this economy going again,’ he said. ‘We’re going to look carefully at any sensible program.’”

Source: MoneyNews, September 15, 2009.

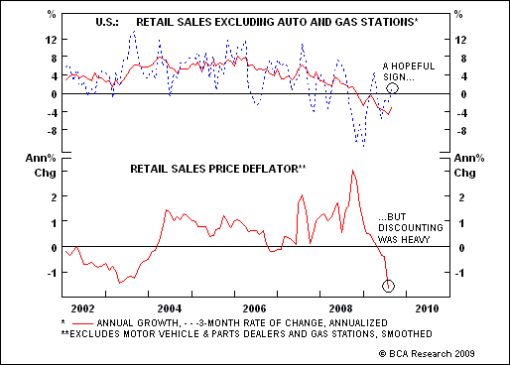

BCA Research: US retail sales - too soon to open the champagne “A slew of positive economic surprises have propelled stocks to new rally highs. However, the equity rally has entered a more risky phase, with breadth likely to narrow going forward.

“The improvement in household sentiment in recent months and the recent release of the retail sales report offer some hope for a recovery in final demand, but it is still far too soon to determine that a sustainable consumer revival is beginning. Importantly, the uptick in consumer spending outside of autos and gas stations occurred in the context of heavy discounting. This signals that consumer thrift remains well entrenched and that retailers are being forced to slash prices in order to boost sales, to the detriment of margins.

“We remain cautiously optimistic on the equity market, but worry that breadth will narrow as profit expectations for domestically-geared sectors could be disappointed. Investors should stay concentrated in globally-focused companies.”

Source: BCA Research, September 16, 2009.

Asha Bangalore (Northern Trust): Housing starts - multi-family units led the charge in August “Starts of new homes increased 1.5% to an annual rate of 598,000 in August, with a 25% increase in starts of multi-family units accounting for all the gain. The level of housing starts is the highest since November 2008.

“On a year-to-year basis, starts of new homes have dropped nearly 28%, which is a noticeable deceleration in the pace of activity from the 55% record decline seen in January 2009.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, September 17 2009.

MoneyNews: Gross - housing recovery no cure “Housing will not rebound to its former exuberance once the economy rebounds, says Bill Gross, manager of bond giant Pimco.

“Gross said investors will not trust their homes to give them good returns as they did in the past, and that housing will not lead the economy forward.

“‘Housing cannot lead us out of this big R recession no matter what the recent Case-Shiller home price numbers may suggest,’ Gross writes in his September outlook.

“Investors were buoyed by new home sales increasing by 9.6% in July, according to the Commerce Department. Yet the number of Americans owning homes could fall to 65% from a peak of 69%, reported Fortune magazine.

“Americans should not expect a robust bull market, Gross said. The new economy will pay off its debt, increase its savings, and see more ‘delevering, deglobalization, and regulation,’ he said.”

Source: Ellen Chang, MoneyNews, September 17, 2009.

MoneyNews: Millions more foreclosures loom “As many as six million Americans remain at risk of foreclosure over the next three years, according to a recent press release about the government’s Home Affordable Refinancing Program (HAMP).

“‘We recognize that any modification program seeking to avoid preventable foreclosures has limits, HAMP included,’ wrote Assistant Secretary for Financial Institutions Michael S. Barr.

“‘Even before the current crisis, when home prices were climbing, there were still many hundreds of thousands of foreclosures. Therefore, even if HAMP is a total success, we should still expect millions of foreclosures.’

“Some of these foreclosures, Barr observes, will result from investor borrowers who did not qualify for the program, or because borrowers did not respond to government outreach.

“‘Still others will be the product of borrowers who bought homes well beyond what they could afford and so would be unable to make the monthly payment even on a modified loan,’ Barr says.

“The Home Affordable Refinancing Program was intended to help homeowners whose existing mortgages were up to 105% of their current house value, but has since been expanded to help those with mortgages up to 125% of current value.

“‘Overall, the GSEs (government sponsored enterprises Fannie Mae, Freddie Mac, and Ginnie Mae) have refinanced more than 2.7 million loans since the announcement of the Administration’s comprehensive housing plan,’ Barr notes.”

Source: Julie Crawshaw, MoneyNews, September 15, 2009.

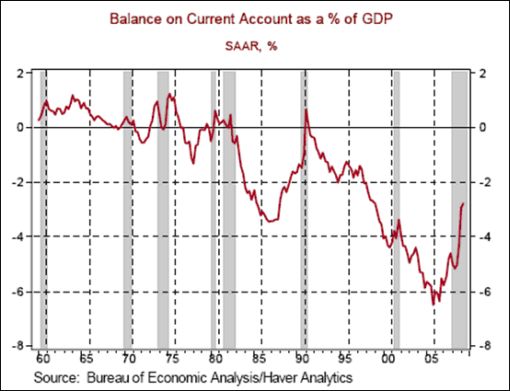

Asha Bangalore (Northern Trust): Current account narrows in Q2 “The current-account deficit of the US economy narrowed to $98.8 billion in the second quarter from $104.5 billion in the first quarter. As a percent of nominal GDP, the current account deficit was 2.8% in the second quarter, down from a 2.9% mark in the first quarter of 2009 and record high of 6.5% in the fourth quarter of 2005. The trade deficit widened in July (-$31.9 billion vs. -$27.5 billion in June) which raises the probability of a wider current account deficit in the third quarter.

“In the second quarter, the surplus on income declined, marking the fifth quarterly drop in the last six quarters. Foreign-owned assets in the US rose $16.4 billion in the second quarter after recording declines in the fourth quarter of 2008 (-$11.9 billion) and the first quarter (-$67.8 billion).”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, September 16, 2009.

Asha Bangalore (Northern Trust): Cars and many other components account for the strength in factory activity “Industrial production increased 0.8% in August after an upwardly revised 1.0% gain in July (previously estimated as a 0.5% increase). The Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) uses four variables - industrial production, nonfarm payroll employment, real personal income less transfer payments, and real manufacturing and trade sales - to determine turning points of a business cycle. The important aspect to note is that the trough of industrial production was in June 2009. Therefore, it is quietly likely that the NBER will date the end of the Great Recession as June 2009/July 2009 once additional information is available.

“Factory production increased 0.6% in August, after an upwardly revised 1.4% increase in July (previously estimated as a 1.0% gain). Production of autos rose 5.5% in August, following a 20.1% jump in the prior month. Primary metals; machinery; and electrical equipment, appliances, and components all posted gains between 0.5% and 1% during August. The operating rate of the factory sector rose to 66.6% in August, after establishing a record low of 65.1% in June 2009.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, September 16, 2009.

Asha Bangalore (Northern Trust): Energy Price Index lifts Consumer Price Index in August “The Consumer Price Index (CPI) moved up 0.4% in August after holding steady in July. The 9.1% increase in gasoline prices accounted for the sharp increase in the headline number. Excluding energy, the CPI increased only 0.1% in August compared with no change in July. Food prices rose 0.1% in August following a 0.3% decline in the prior month. The Energy Price Index recorded a 4.6% gain in August vs. a 0.4% decline in July. The decline in energy prices in the early weeks of September suggests a drop of the Energy Price Index for the month. On a year-to-year basis, the CPI declined 1.5% in August vs. a 2.1% in the twelve months ended July.

“The core CPI, which excludes food and energy, rose 0.1% in August, putting the year-to-year gain at 1.4%. The deceleration of the core CPI and declining trend of the overall CPI is indicative of inflation being a non-issue for several months.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, September 16, 2009.

Asha Bangalore (Northern Trust): Wholesale Price Index movement largely an energy price story “The Producer Price Index (PPI) of Finished Goods moved up 1.7% in August following a 0.9% drop in the prior month. The wide swings of this index are largely due to similar noticeable movements of the Energy Price Index. According to the Labor Department, over 90% of the increase in the wholesale finished goods price index during August was the result of higher energy prices, which rose 8.0%. The 23% jump in gasoline price was the biggest culprit. This is most likely to be reversed in September, given the drop in gasoline prices during the first two weeks of the month.

“The food price index was up 0.4% after recording a 1.5% drop in July. A large part of the increase in food prices was due to the 5.9% jump in prices of fresh fruits and melons. Excluding food and energy, the core PPI rose 0.2% in August compared with a 0.1% drop in July. The 0.8% increase of the light motor vehicle index in August accounted for over fifty percent of the gain in the core PPI. The 0.7% increase of the Passenger Car Price Index also played a role in lifting the core PPI.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, September 15, 2009.

The New York Times: Fed considers sweeping rules to regulate pay at banks “The Federal Reserve and the Treasury are preparing broad new rules that would force banks to rein in practices that made multimillionaires out of many financial executives during the housing bubble, officials said.

“The rules depart from the hands-off approach that dominated bank regulation for the last three decades, but are not as strict as proposals from some European leaders and suggestions from some members of Congress angered by the financial troubles of the last year.

“Fed officials would give banks wide leeway in how they structure their rewards. They would not prohibit million-dollar pay packages or address issues of fairness. Rather, the rules are intended to restrict pay plans that encourage reckless behavior by rewarding only short-term gains.

“And because the rules would be applied through the confidential bank examination process, it would be hard for consumers and investors to judge how strictly the rules were being applied.

“The effort is also meant to be a credible alternative to the call by some European leaders for specific limits on bonuses to financial executives, an idea opposed by the Obama administration. Officials from Europe and the

“Treasury are negotiating over compensation and other financial industry regulations in advance of a summit meeting next week in Pittsburgh of leaders from the Group of 20 industrialized and large emerging countries.

“The Obama administration opposes strict caps on pay, arguing that the size of the bonuses are not as important as the risk to the financial health of the bank that bonuses linked to performance can create.

“The simple proposition should be that you don’t want people being paid for taking too much risk, and you want to make sure that their compensation is tied to long-term performance,” said Timothy Geithner, the Treasury secretary, in an interview by telephone.”

Source: Edmund Andrews and Louise Story, The New York Times, September 19, 2009.

Financial Times: SEC tightens grip on ratings agencies “The US Securities and Exchange Commission passed rules on Thursday to tighten supervision of credit ratings agencies following a torrent of criticism over their role in the financial crisis.

“Credit ratings agencies, which are usually paid by the issuers they rate, came under fire during the crisis because they gave top ratings to hundreds of billions of dollars of bonds backed by risky mortgages and other loans that are now in many cases worthless.

“The SEC said on Thursday that ratings agencies must reveal more information on past ratings so that investors could compare relative performance. Banks will have to share the underlying data used to determine ratings, so that competing agencies can offer unsolicited ratings for structured finance products.

“The SEC said it would remove references to ratings in some of its rules as part of efforts to reduce overall reliance on ratings by investors.

“It also decided to get public feedback on whether ratings agencies should be subject to potential legal liability under securities law and what the possible consequences might be.

“Indeed, most lawsuits against ratings agencies have failed because their ratings are an ‘opinion’ and therefore subject to free-speech protection. The issue has become a key factor in the debate on the future of the industry.

“Fresh proposals were also put forward governing disclosure, including whether any “preliminary ratings” were obtained from other ratings agencies - in other words, whether there was ‘ratings shopping’.”

Source: Joanna Chung and Aline van Duyn, Financial Times, September 17, 2009.

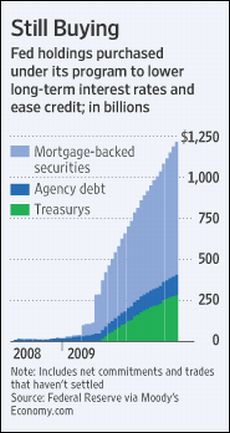

The Wall Street Journal: Fed likely to keep buying mortgage instruments “The Federal Reserve, which convenes its policy meeting next week, is likely to stay the course to buy $1.45 trillion in mortgage-linked securities despite potential resistance from a few regional Fed presidents.

“Central-bank officials plan to discuss winding down those purchases over the coming months to limit disruption to the market when the buying comes to an end.

“Some regional Fed policy makers have suggested the Fed might halt the program before it finishes its purchases of $1.25 trillion in mortgage-backed securities and $200 billion in Fannie Mae and Freddie Mac debt announced in the past year. But they are a small minority across the Fed system.

“Top Fed officials believe such a move would tighten overall monetary policy at a time when they still worry about the durability of the economic recovery. The Fed has completed about two-thirds of its purchases, almost $1 trillion worth, and is likely to complete the rest unless prospects for the economy improve radically in the coming months.

“At the Federal Open Market Committee’s September 22-23 meeting, the central bank’s policy makers - including the 12 regional Fed presidents - will assess the early signs of improvement now taking shape across the economy. Officials are encouraged by the rebound in financial-market conditions and initial indications that the housing market is pulling out of its deep dive.

“But they are hesitant to bank on a strong recovery. The sizable growth expected in the third quarter is due in part to short-term effects such as companies replenishing inventories and the government’s ‘cash for clunkers’ auto-rebate program. Higher saving by households is casting doubt on consumer spending. And even the moderate growth that Fed officials expect next year wouldn’t be enough to bring down the unemployment rate substantially.

“‘The economy seems to be brushing itself off and beginning its climb out of the deep hole it’s been in,’ San Francisco Fed President Janet Yellen said in a speech Monday. ‘But I regret to say that I expect the recovery to be tepid. What’s more, the gradual expansion gathering steam will remain vulnerable to shocks.’”

Source: Sudeep Reddy, The Wall Street Journal, September 16, 2009.

Bloomberg: Pimco’s Gross boosts government debt to 5-year high “Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co., increased holdings of government-related debt last month to the most in five years and cut mortgage securities.

“Gross boosted the $177.5 billion Total Return Fund’s investment in Treasuries, so-called agency debt and other bonds linked to the government to 44% of assets, the most since August 2004, from 25% in July, according to Pimco’s website. The fund cut mortgage debt to 38%, the lowest level since February 2007, from 47%.

“‘We are heading into what we call the New Normal, which is a period of time in which economies grow very slowly,’ Gross wrote at the start of the month in his September investment outlook for the Newport Beach, California, company.

“The Total Return Fund handed investors a 12.2% gain in the past year, beating 92% of its peers, according to data compiled by Bloomberg. The one-month return is 1.8%, outpacing 69% of its competitors.”

Source: Wes Goodman and Susanne Walker, Bloomberg, September 16, 2009.

Bespoke: High-yield spreads fall below pre-Lehman levels “For the first time since the recovery off the March lows, high yield credit spreads fell below their ‘pre-Lehman’ levels. Based on data from Merrill Lynch indices, high yield bonds are currently yielding 835 basis points more than comparable Treasuries. This compares to a level of 854 bps on 9/12/08, which was the Friday before Lehman’s bankruptcy.

“While credit market benchmarks have mostly recovered to ‘pre-Lehman’ levels, equities still have a ways to go. Even after the historically strong rally off the March lows, all three major indices and all ten major S&P 500 sectors remain below their ‘pre-Lehman’ levels. While the S&P 500 has gained nearly 60% from its lows, the index would still have to rally an additional 17.4% to reach its level from the Friday before Lehman’s bankruptcy.”

Source: Bespoke, September 16, 2009.

CNN Money: Insiders sell like there’s no tomorrow “Can hundreds of stock-selling insiders be wrong?

“The stock market has mounted an historic rally since it hit a low in March. The S&P 500 is up 55%, as US job losses have slowed and credit markets have stabilized.

“But against that improving backdrop, one indicator has turned distinctly bearish: Corporate officers and directors have been selling shares at a pace last seen just before the onset of the subprime malaise two years ago.

“While a wave of insider selling doesn’t necessarily foretell a stock market downturn, it suggests that those with the first read on business trends don’t believe current stock prices are justified by economic fundamentals.

“‘It’s not a very complicated story,’ said Charles Biderman, who runs market research firm Trim Tabs. ‘Insiders know better than you and me. If prices are too high, they sell.’

“Biderman, who says there were $31 worth of insider stock sales in August for every $1 of insider buys, isn’t the only one who has taken note. Ben Silverman, director of research at the InsiderScore.com web site that tracks trading action, said insiders are selling at their most aggressive clip since the summer of 2007.

“Silverman said the ‘orgy of selling’ is noteworthy because corporate insiders were aggressive buyers of the market’s spring dip. The S&P 500 dropped as low as 666 in early March before the recent rally took it back above 1,000.

“‘That was a great call,’ Silverman said. ‘They were buying when prices were low, so it makes sense to look at what they’re doing now that prices are higher.’”

Source: Colin Barr, CNN Money, September 12, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.