American's Need More Debt?

Economics / US Debt Sep 20, 2009 - 06:15 PM GMTBy: Mike_Shedlock

Numerous people sent me a link to a preposterous statement by fund manager Ken Fisher regarding debt. Please consider Too Much Debt? Please. We Need MORE Debt, Says Ken Fisher.

Numerous people sent me a link to a preposterous statement by fund manager Ken Fisher regarding debt. Please consider Too Much Debt? Please. We Need MORE Debt, Says Ken Fisher.

The conventional wisdom is that Americans are struggling to crawl out from under a mountain of debt that will restrain growth and weigh down the economy for decades.

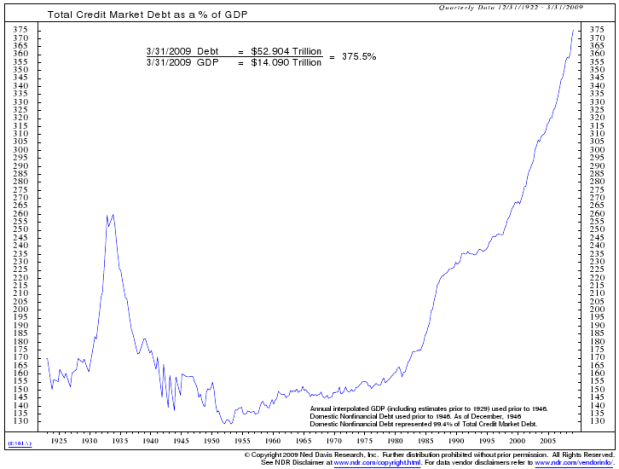

As [the following] chart shows, the US debt-to-GDP ratio recently soared to an all time high of 370%, meaning that for every $1 of output we produce, we have borrowed $3.70. This compares to a long-term debt-to-GDP average of about 150%.

Last time we went on a massive debt binge, in the 1920s, our debt-to-GDP ratio hit a relatively mild 250%, and we spent the better part of two decades (and the Great Depression) working it off. Many economists think the same thing will happen this time around.

But they're wrong, says Ken Fisher, CEO of Fisher Investments ($35 billion under management), in a wildly contrarian view.

The U.S. has too little debt, not too much, Fisher says. The U.S.'s return on assets is high and interest rates are low, so our borrowing capacity is much higher than our current debt levels.

Also, Fisher says, you have to look at the U.S. in the context of the world, because the U.S. is only 25% of world GDP. The world is way under-leveraged, so one country's particular debt-to-GDP ratio doesn't matter.

The idea that we need more debt is ludicrous. Consumers cannot service the levels of debt they have right now. This has increased defaults, foreclosures, bankruptcies, credit card writeoffs, and horrendous commercial real estate problems.

In the Business Insider Money Game Henry Blodget came to the conclusion, Ken Fisher is nuts.

We had Ken Fisher on TechTicker yesterday. Ken has managed money for nearly 40 years, and now has $35 billion of assets under management.

You make the big money on Wall Street when you hold a view that is so contrarian that most people think you are nuts. So Ken's argument certainly merits consideration. But I have to admit that, right now, I think he's nuts.Contrarian or Nuts?

Just because someone has ridiculous views does not make them contrarian. For example, the flat-earth society view is hardly contrarian, nor does it merit consideration.

To a certain extent one has to wonder if Fisher believes the nonsense he is spewing. As noted above, record high levels of debt become a problem when they becomes impossible to service. When that happens there is credit contraction (deflation) and asset prices crash.

Can Fisher Ever Say Sell?

Whether or not Fisher is nuts boils down to how much he is talking his book. Let's put this in perspective. When you are managing $35 billion, you can never say sell. Think about what it would do to stock prices.

Thus Ken Fisher will always be perpetually bullish. Moreover, it does not matter to Fisher whether stocks are going up in real (inflation adjusted) terms or not, he just wants them to go up. He does not care how or why.

When Fisher says "We need more debt" it's possible he means "Ken Fisher for the benefit of Ken Fisher investments needs people to take on more debt"

Certainly the biggest bull markets in any country in nominal terms comes in periods where debt growth is exponential. So it's possible Fisher is simply talking his book.

However, I happen to believe that Fisher believes the nonsense he is spouting. If so, I agree with Blodget: "Ken Fisher Is Nuts".

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.