Gold the Asset Class of the Decade

Commodities / Gold & Silver 2009 Sep 26, 2009 - 06:40 PM GMTBy: Adam_Brochert

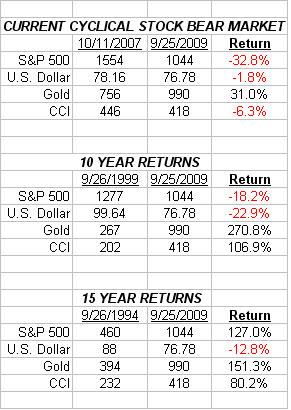

In the end as an investor, it's all about the scoreboard. For those who aren't traders, allocation to the correct asset classes is critical to long-term returns. Following are the returns for the S&P 500, the U.S. Dollar (using the Dollar Index as a proxy), Commodities (using the Continuous Commodity Index [$CCI] as a proxy) and Gold.

In the end as an investor, it's all about the scoreboard. For those who aren't traders, allocation to the correct asset classes is critical to long-term returns. Following are the returns for the S&P 500, the U.S. Dollar (using the Dollar Index as a proxy), Commodities (using the Continuous Commodity Index [$CCI] as a proxy) and Gold.

These returns ignore dividends, yields, and expenses, which are important concepts over the long-term and make this a less than ideal comparison. You can plug in whatever figures you think are appropriate and make your own comparison(s) if you're so inclined.

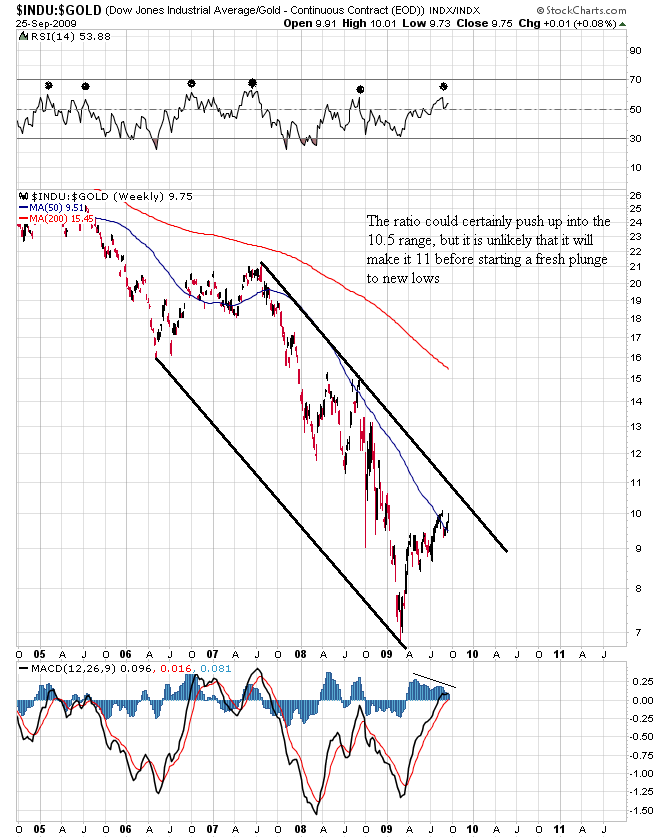

How is it possible that a hunk of metal has returns comparable to the stock market over the past 15 years? Does this surprise you? Are you familiar with the Dow to Gold ratio as a long-term concept? If not, perhaps it is not too late to familiarize your self with this concept, especially since the Dow to Gold ratio will drop to 2 at a minimum and may well drop below 1 this cycle.

Here's an up-to-date log scale chart of the Dow to Gold ratio over the past 5 years:

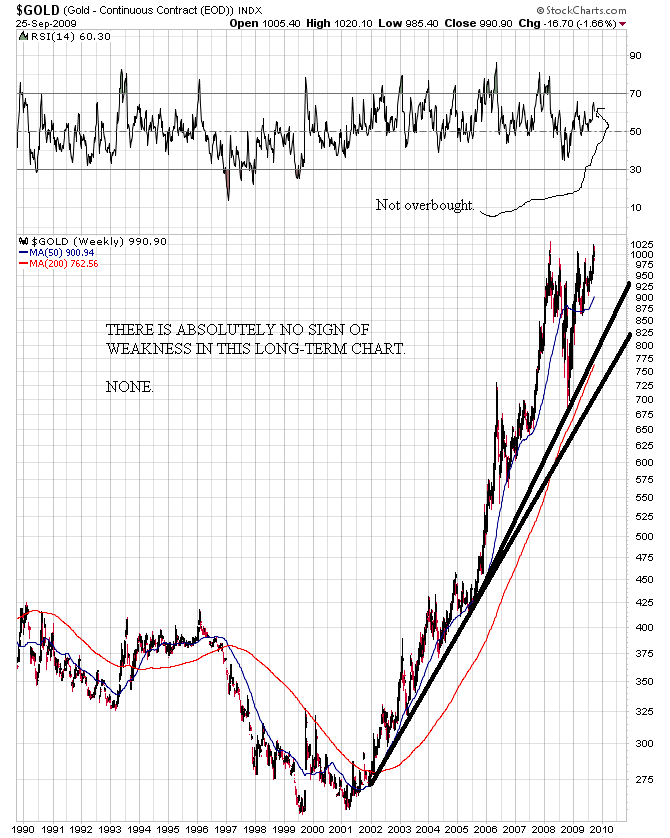

The long-term chart (20 year log scale candlestick chart) of Gold shows a strong bull market with no trend line breaks over the past 8 years and with aligned and rising 50 and 200 week moving averages:

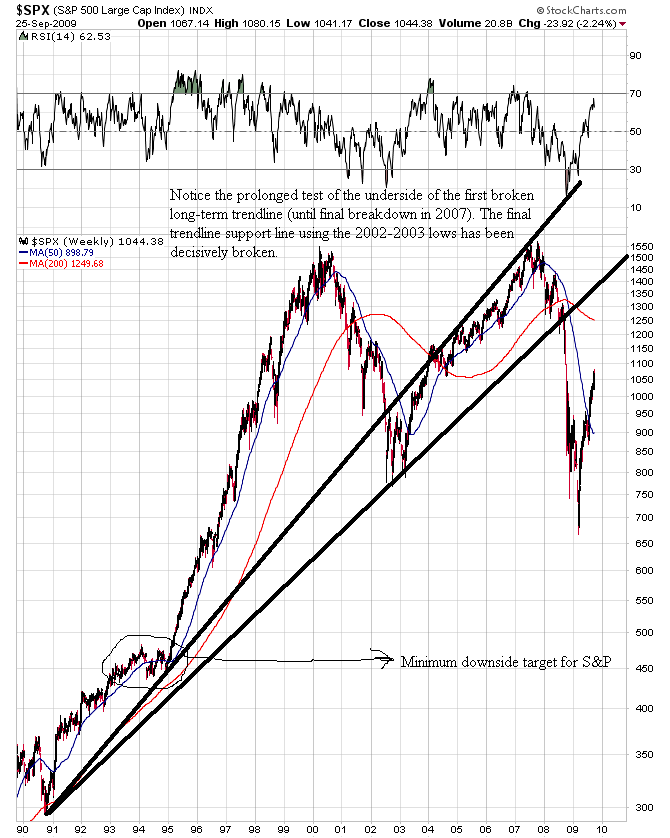

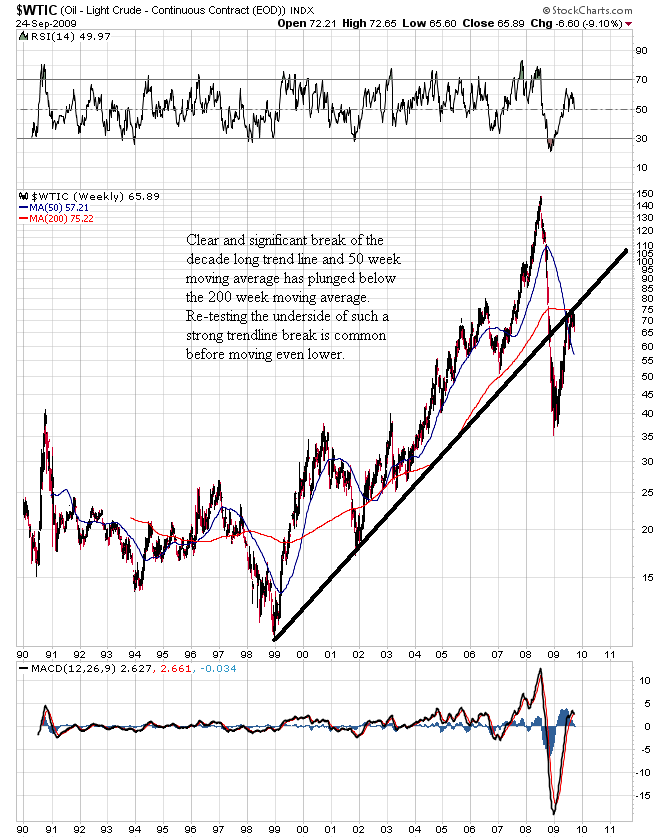

The bull market in stocks and commodities is no longer in force using basic chart analysis. Things are always subject to change, of course, but with a trailing P:E ratio of 150 (based on reported earnings, not the garbage operating earnings spewed by CNBC bulltards) and a very weak global economy, stocks and commodities will likely not resume a secular bull market any time soon. This is also the message in their long term charts (following are 20 year log scale charts of the S&P and everyone's favorite commodity, oil [$WTIC]):

Since the Dow to Gold ratio will get back to 2 (at a minimum), those who sell their general stocks and buy physical Gold will be able to trade their Gold for at least 5 times the number of stocks within the next decade. This is equivalent to a 400% gain in stocks over a decade or less without taking the risk of owning stocks! The Gold bull market is alive, well, and not close to being done in time or price.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.