Betting on Commodities, Especially Crude Oil

Commodities / Crude Oil Oct 05, 2009 - 08:56 AM GMTBy: James_Quinn

In 2008, prices of oil, natural gas, gold, silver, copper, corn, wheat, and most other commodities reached multi-year, and in some cases multi-decade, highs. They’ve fallen sharply since then, but commodities aren’t going out of business. Another peak is coming, and it will be far higher, especially for oil.

In 2008, prices of oil, natural gas, gold, silver, copper, corn, wheat, and most other commodities reached multi-year, and in some cases multi-decade, highs. They’ve fallen sharply since then, but commodities aren’t going out of business. Another peak is coming, and it will be far higher, especially for oil.

The price run-up to 2008 came as a debt-induced economic acceleration in the developed countries sucked in imports from the emerging economies of Asia. Virtually all the world was gobbling up commodities, but supplies were still choked by the preceding decades of underinvestment in mine development, processing plants, pipelines, railroads, and other elements of the industrial infrastructure needed for producing and transporting raw materials.

Faster consumption and static production capacity had an unsurprising effect -- prices rose. Then they rose some more and kept on rising. And in the later stages of the commodity price boom, investors, especially hedge funds, joined the bidding as a way to bet on a growing world economy. More bidders, more price push.

But not forever. When the credit bubble that had been overstimulating just about every industry became unsustainable and financial markets everywhere collapsed, commodity prices collapsed along with them in anticipation of a deep recession or worse.

The recent bout of low commodity prices and the continuing weakness of the financial system are setting the stage for another, even bigger commodity boom. For a short while, high commodity prices had been drawing capital into commodity production, but that stopped when prices fell. Now, while government bureaucrats are funneling hundreds of billions to weak banks, sick insurance companies, clueless automakers, and the politically well connected, the capital needed for new mines, pipelines, drilling projects, refineries, and crops has dried up. There will be consequences. When the economy crawls out of the current recession, today’s paucity of investment in commodity infrastructure will leave us with meager supplies and roaring prices.

There will be a shortage of commodities in general, but the shortage won’t be uniform. Energy will be the stand-out for tight supply and rising prices.

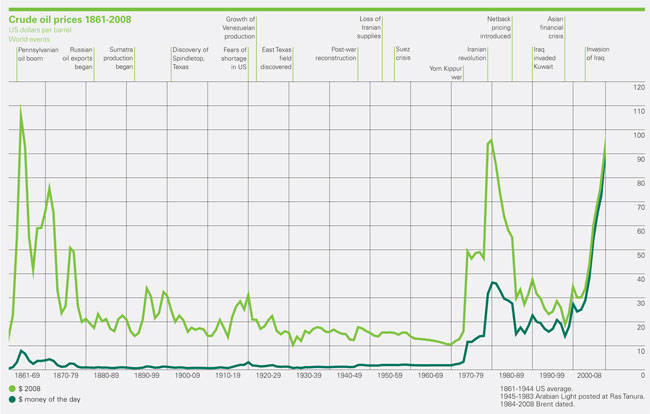

The decades of low oil prices shown in the chart meant minimal exploration and little investment to develop existing fields. The price surge in 2007-2008 did give an enormous boost to drilling, but the boost was short-lived. This year’s collapse in oil prices to $35 a barrel compelled oil companies to cut the number of rigs in service, consolidate operations, lay off workers, and delay or cancel projects. The atrophy in production capacity and the credit crunch's impact on exploration are setting the stage for a dramatic price rise.

That’s oil, but you could say more or less the same about most commodities. For oil, however, there’s more to the story. Four factors are now at work to make oil the price leader in the next commodity boom.

Factor # 1: Peak Oil

William Cummings of Exxon Mobil tells us, “All the easy oil and gas in the world has pretty much been found. Now comes the harder work in finding and producing oil from more challenging environments and work areas.” That’s about as cheerfully as the harsh reality can be put. After 150 years of harvesting the Earth’s “low-hanging fruit,” new supplies of oil are going to be progressively more difficult to find, and most of what is found will be expensive to exploit. That by itself means higher prices.

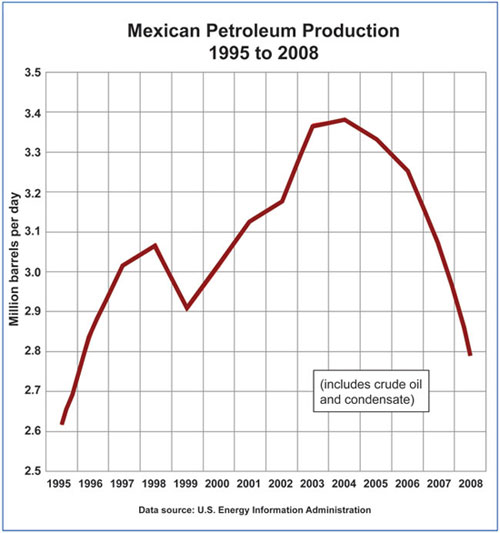

Mexico is a stark example of Peak Oil. Virtually all Mexican output comes from Cantarell, in the shallow waters of the Gulf of Mexico. It’s the second largest oil field in the world and is run by the state-owned Pemex.

When Cantarell was discovered in 1977, it held 17 billion barrels of oil. Since then, the Mexican government has been spending the oil revenues for the benefit of the “right” people and for the all-important project of holding on to power. Pemex isn’t a sideline for the Mexican economy; it provides 40% of all revenue the government collects.

The state is so dependent on oil revenue that Pemex built a nitrogen-injection project to push the oil out faster. It worked, but at a price. In 2004, production rose to 2.5 million barrels per day. But it’s now declining at a rate of 15% per year, and the decline is irreversible. Mexico won’t be an oil exporter for long.

Mexico, like most other oil exporters, is merely retracing the history of the U.S. oil industry. Because it was the one place where easily exploitable petroleum resources, a ready market for petroleum, and respect for property coincided, the U.S. was early in the oil business. Early to start, and early to peak. Its production history is a preview of how Peak Oil works.

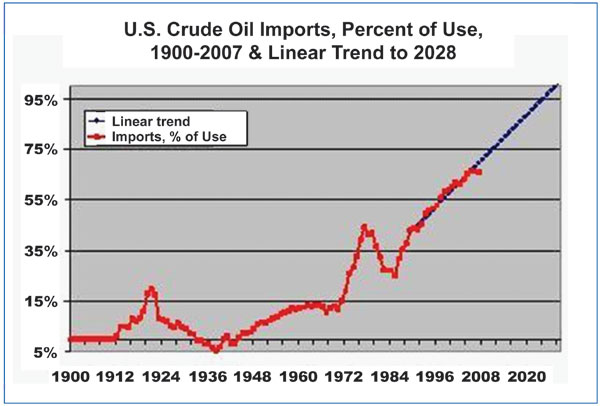

In 1973, the United States imported 30% of the crude oil it used. By 1977, imports had risen to 44% of consumption. Then, following a mini-boom in the development of marginal fields that had been made practical by the high oil prices of the late 1970s, imports dropped off to just 25% in 1985.

Since then, imports as a percent of domestic use have been in an almost steady uptrend. They now account for 66% of total domestic crude oil consumed. If the trend were to continue at the rate of the last two decades, in 2028 the U.S. would be totally dependent on imported oil.

Of course, the import trend won’t continue in a straight line to 2028, because production is now declining in the rest of the world. In 2004 the U.S. imported 600 million barrels of oil per year from Mexico. By 2012, total Mexican production will have declined to only 180 million barrels per year, and none of it will be available for export to the U.S. or anywhere else.

Factor # 2: The Big Green NO

If oil is destined to be scarcer, common sense tells us to look for alternatives. But for the Green extremists, only certain “clean” alternatives are worth considering.

The Greens demand that fossil fuels be abandoned in favor of sources that are cleaner and renewable. That immediately excludes coal, which is a giant exclusion. At current consumption rates, the U.S has more than 250 years of the dirty black stuff. That’s more energy than the entire world reserves of recoverable oil. But the Obama administration plans to phase out coal, because it’s been tagged as a global warming villain. The cap-and-trade bill that recently squeaked though the House of Representatives is part of that plan. Approval by the Senate would push the U.S. deeper into the energy scarcity hole.

The Green agenda favors solar power, wind power, geothermal energy, and hydropower (provided no fish are inconvenienced). The Greens also like ethanol, even though producing a gallon of ethanol eats more energy than a gallon of ethanol will produce. In the last decade, 160 ethanol plants have been built in the U.S., but only because of expensive subsidies from taxpayers.

The Green agenda isn’t looking for marginal changes, improvements here and there, or a mere tidying up of the energy industry. Given the prominence of fossil fuels as energy sources, what the Greens are seeking is a wrenching revolution.

Here’s where we are now:

| Energy Source | % Usage |

| Fossil fuels (oil, natural gas, coal) | 87% |

| Nuclear | 7% |

| Hydropower | 3% |

| Ethanol | 1.5% |

| Windmills, solar, geothermal | 1.5% |

| Totals | 100% |

The Green agenda calls for the “87%” to be replaced by “%.”((0%?)) It’s not going to happen, but part of the Green effort to move things in that direction is political opposition to the development of fossil fuel sources. That opposition will worsen the scarcity of oil.

Meanwhile, it will take decades for alternative energy sources to even begin to offset the decline in oil production. T. Boone Pickens argues that by investing $1 trillion to build wind facilities in the corridor from Texas to North Dakota between now and 2020, we could produce 20% of the nation’s electricity. And that, he contends, would free up our vast natural gas resources to be used as fuel for truck fleets and ultimately automobiles. Perhaps he’s right. Perhaps he’s completely right. But it will take eleven years to prove it.

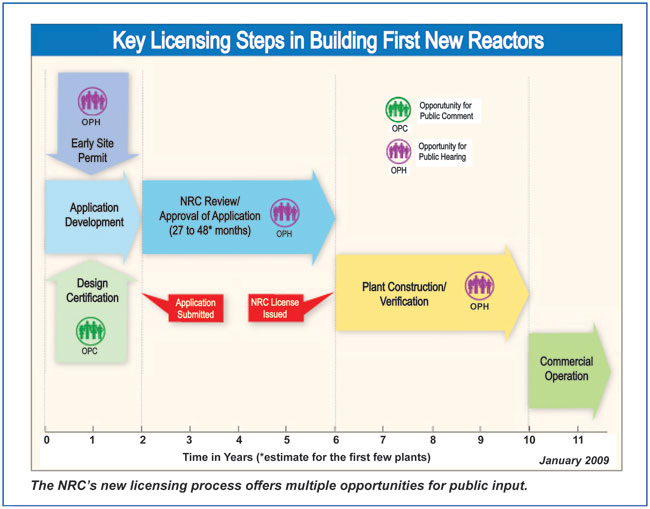

And nuclear? Even though it substitutes for fossil fuels, don’t expect the Greens to allow nuclear energy to come to the rescue. Currently, 104 nuclear reactors generate 20% of the electricity in the U.S. But they were all built before 1982. Because of a slow and brutally expensive regulatory process and because of latent political hostility, any undertaking to build a new plant and bring it on line would take ten years. There are some dissenters on this point among the enviro-fundamentalists, but for Greens generally, nuclear power is forbidden fruit.

Factor # 3: Neglect of Infrastructure

The infrastructure for producing petroleum products is rusting away and falling apart.

Not a single oil refinery has been built in the U.S. since 1976. The number of U.S. refineries has dropped to 149, less than half the count in 1981. Because of operating improvements and expansions at the surviving refineries, shrinkage in capacity has been held to only 10%. Meanwhile, however, gasoline consumption has risen 45%.

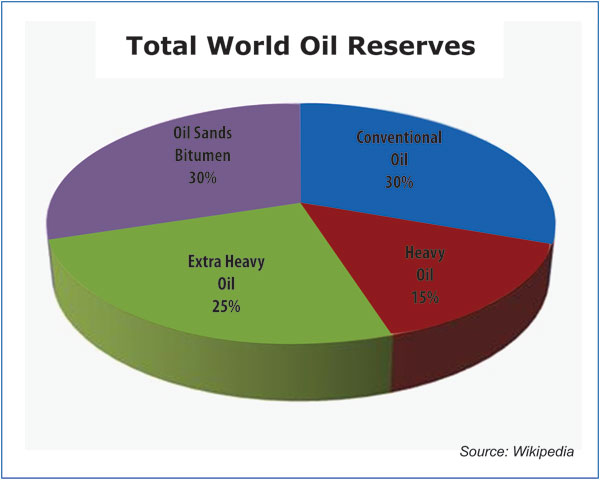

As new sources of easy-to-refine light oil become harder to find, the world will become more dependent on its abundant sources of difficult-to-handle heavy crude. One-third of Saudi Arabia’s 260-billion-barrel reserves are heavy crude. Worldwide, about 40% of oil resources are heavy or extra-heavy crude, and another 30% are in oil sands and bitumen, which are even more difficult to refine.

The U.S. isn’t ready for heavy crude. Only 30% of U.S. refineries can process it. And the U.S. isn’t doing anything to get ready. It won’t invest in anything that doesn’t look like a sick bank. Refinery capacity is already a bottleneck, and the bottle’s neck is narrowing.

The U.S. is clearly a laggard in refining. Canada, where 95% of reserves are in oil sands, has seen a rush of investment into producing and processing the super-dense resource. Saudi Arabia has promised billions of dollars in the next five years to expand its refining capacity to 6.5 million barrels per day, from the current 3.7 million, which will make them one of the largest refiners in the world. Meanwhile, the U.S. twiddles its thumbs and mumbles NIMBY.

The human element of the energy infrastructure is also in decline. Matt Simmons, the author of Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy, warns that the best-qualified petroleum geologists and engineers are now retiring, with no one to take their place.

Factor # 4: Growing Demand for Oil

The world’s population will continue to grow, and developing countries will continue to grow more prosperous. Both trends will add to the demand for fossil fuels.

China and India are sucking up oil at an ever-increasing rate. China has seen oil consumption grow by 8% per year since 2002; it now exceeds 8 million barrels per day. China’s middle-class population is nearing 300 million people. While U.S. auto sales were plummeting in 2008, China's auto sales rose 6.7%, to 9.38 million units. Sales in the first five months of 2009 are 14% above a year earlier.

India’s automobile sales are on pace to exceed 10 million in 2009. By 2020, the country’s oil imports are expected to more than triple from 2005 levels, rising to 5 million barrels per day.

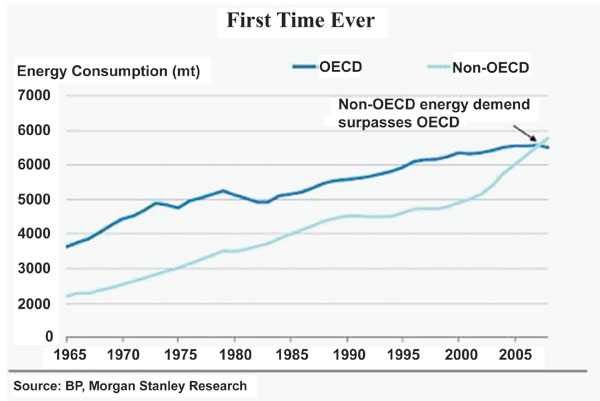

It isn’t just China and India that are adding to demand for oil. Others, notably Russian and Brazil, are doing the same. The non-OECD countries now have surpassed the OECD countries in energy usage. This trend will accelerate as the citizens of these countries grow wealthier and buy cars, TVs, and refrigerators.

Get ready for some loud but useless noise. When oil reaches $200 a barrel in the next few years, Congressmen will yell, posture, expound, skewer oil executives on TV, and get red in the face. They will do everything but admit the truth. We will be paying for decades of underinvestment in commodity infrastructure, malinvestment in ethanol, and lack of realism in answering the complaints of Green extremism.

The Department of Energy was created by President Carter in 1977 for the stated purpose of advancing the energy security of the United States. The Department now employs 109,000 people and spends $24 billion of taxpayer funds every year. The accomplishments of those well-funded 109,000 people have been few. We are about to learn in a way that no one will be able to overlook just how few.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.