Silver Coiled and Ready to Spring

Commodities / Gold & Silver Jun 29, 2007 - 04:38 PM GMTBy: Roland_Watson

Back in the middle of April I wrote an article that suggested a price pattern for silver that has not been publicized much. In an often polarized area of debate, it was a position that was neither bullish nor bearish but rather a suggestion that silver would drop into a channel formation prior to its next price explosion. I quote from the article:

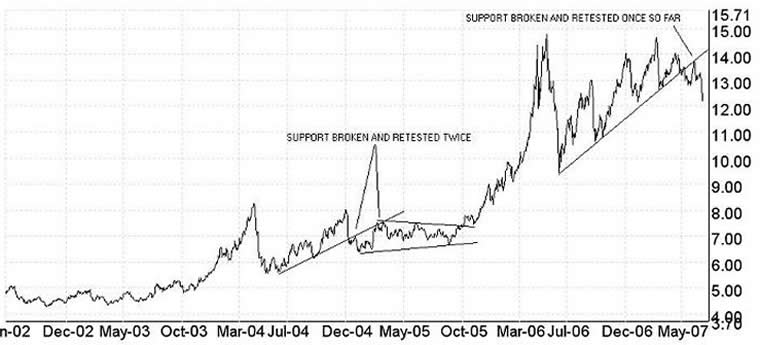

Note how after the big drop in April 2004, silver also advanced in a similar fashion to our current moves on a rising trend line until the old highs of $8.50 were nearly taken out in December 2004. However, this trend broke to the downside to begin a channel movement for silver for some months before the true breakout occurred in September 2005.

Will our current rising trend line support the price of silver or will we see a temporary breakdown? That previous rising trend line lasted 8 months. This current one has lasted 10 months. Once again, a breaking of the previous high of late February is required to maintain the bullish sequence of higher highs and invalidate that analysis.

The updated chart is shown below to show how the late February high was not taken out and we may have descended into a tighter price range. I have subsequently also noticed an interesting pattern during the previous silver correction in 2004-2005 that may repeat here. Note my first comment on how the rising support line was not only broken but became a line of resistance to further price rises.

Twice (possibly three times) silver tried to penetrate back through the support line but failed. Thereafter it did not crash but satisfied itself with merely forming a slowly narrowing channel until the next price breakout occurred. How does that compare with this current correction?

We note that just with the previous correction, silver broke down, rallied to retest the support line, failed to breach it and has just fallen back again. Technical analysis history has repeated itself or at least rhymed.

If that pattern repeats again, we may see one or two more retests below the extended support line and then a fall back into a narrowing channel prior to breakout. The last channel lasted nine months but there is no rule that demands this potential channel lasts the same period of time. The last breakout occurred in the month of September 2005.

A look at a seasonal chart for silver suggests June to September are weaker months for the price of silver. We also note that the previous breakouts for silver (see chart) occurred towards the end of the year. We already mentioned September for the $15 run up, but the $8.50 run up started in early October 2003. So far our analysis suggests an autumn breakout for silver.

One final question is regarding the possibility of silver breaking down to form a double bottom of $9 to $10 before its final run up. It may happen but I put it second in probability to what I have described above. The reason is that silver's volatility tends to force it to exhaust its price correction quickly. On a forty year silver chart, I see that silver corrections tend to be a one shot affair that rebounds or drags on a bit (as with the last major correction). Nevertheless, anyone who wishes protection against such a scenario may wish to average in their silver purchases over the next few months.

Further comments can be had by going to my silver blog at http://silveranalyst.blogspot.com where readers can obtain a free issue of The Silver Analyst and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk

By Roland Watson

http://silveranalyst.blogspot.com

Further analysis of the SLI indicator and more can be obtained by going to our silver blog at http://silveranalyst.blogspot.com where readers can obtain the first issue of The Silver Analyst free and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk .

Roland Watson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.