American's Gambling $100 Billion in Casino's Like Rats in a Cage

Politics / Social Issues Oct 11, 2009 - 06:01 AM GMTBy: James_Quinn

The world is a vampire, sent to drain

The world is a vampire, sent to drain

secret destroyers, hold you up to the flames

and what do I get, for my pain

betrayed desires, and a piece of the game

even though I know-I suppose I'll show

all my cool and cold-like old job

despite all my rage I am still just a rat in a cage

despite all my rage I am still just a rat in a cagedespite all my rage I am still just a rat in a cage

someone will say what is lost can never be saved

despite all my rage I am still just a rat in a cage

Smashing Pumpkins – Rats in a Cage

Americans throw away close to $100 billion per year gambling in casinos and playing lotteries. This only includes the amount spent legally. Illegal gambling accounts for billions more. This is the net amount spent. In reality, $60 billion is spent on lottery tickets or $600 per household annually. Another $100 billion is squandered in gambling casinos. This amounts to $950 per household. The $160 billion spent on gambling each year is indicative of the get rich quick without hard work attitude of Americans. Even worse, households with income under $13,000 spend, on average, $645 a year on lottery tickets, about 9 percent of all their income. Our government feeds this addiction by siphoning off billions in taxes from these gambling revenues to redistribute as they see fit. Government sponsored gambling is a regressive tax on the poor and is immoral. Politicians have become addicted to the tax revenues being drained from the deprived in the country. Tax regulations for gambling companies vary a lot between different markets and in the UK, the government is at the moment losing tax money to casinos not on Gamstop, who is operating in the UK without a license (and no taxes paid to the government.

Gambling was illegal in the U.S. until the Great Depression. Nevada legalized gambling in 1931 and over time, Las Vegas became the gambling capital of the U.S. Atlantic City joined the club in 1978, building casinos in the midst of crime ridden slums. Gangster Bugsy Siegel opened the Flamingo Casino in 1947 and an era of mob involvement began. Over the last three decades gambling has exploded, as Indian reservations have been allowed to open casinos as payback for 3 centuries of being slaughtered by the white man. Riverboat gambling and lotteries have sprung up across the nation in order to fill the state coffers. Abetted by Congress, legislatures from 48 states now sponsor gambling operations and lottery monopolies to balance their budgets on the backs of their underprivileged and most susceptible citizens, while basking in the virtue of fighting tax increases.

Rather than control costs, states find it much easier to lure the poor into parting with the little money they have. The amount of money frittered away on games of chance rose by 59% between 1999 and 2007. This coincided with the national debt induced housing frenzy and the high stakes gambling attitude on Wall Street. It warms the cockles of my heart knowing that people were taking out home equity loans to gamble at casinos. In 1999, the bipartisan National Gambling Impact Commission found that 80% of gambling revenue comes from households with incomes of less than $50,000 a year. Those who can afford to lose the least, are spending the most.

The incredible escalation of gambling, encouraged and sustained by local and state governments has done long lasting damage to the social fabric of society and has further impoverished those who have the least to lose. The gambling industry has grown tenfold since 1975, with 41 states now running weekly lotteries. Nineteen states now have legalized commercial casinos, while twenty-nine states have Indian casinos. There are a total of 450 commercial casinos in the country. The first online gambling site launched in August 1995. It is currently estimated that there are well over 2,000 Internet gambling Web sites offering various wagering options, including sports betting, casino games, lotteries and bingo. Internet gambling revenue for offshore companies was estimated to be $5.9 billion in 2008 from players in the United States and $21.0 billion from players worldwide, according to H2 Gambling Capital. Two thirds of all adults placed some kind of bet in the last year. The social stigma of gambling has fallen by the wayside.

According to recent research, about 2.5 million adults in America are pathological gamblers and another 3 million of them should be considered problem gamblers, 15 million adults are at a risk for problem gambling and about 148 million are low-risk gamblers. Gambling addiction is a compulsive need that can be devastating for the person and his family. Gambling addiction statistics show that more than 80% of American adults report having gambled at some point in their lives. Gambling addiction statistics reveal that well over $500 billion is spent as annual wagers. The statistics show that during any year, 2.9% of U.S. adults are considered to be either pathological or problem gamblers. The average debt incurred by a male pathological gambler in the U.S. is between $55,000 and $90,000. The average rate of divorce for problem gamblers is nearly twice that of non-gamblers. The suicide rate for pathological gamblers is twenty times higher than for non-gamblers. 65% of pathological gamblers commit crimes to support their gambling habit. All of these wonderful side effects are fully supported and subsidized by the government.

I’m completely in favor of allowing citizens to do anything they want with their money. It’s theoretically a free country and if people chose to gamble with their disposable income rather than contribute to their 401k or kids college fund, that is their choice. What I do object to is state and local governments turning to gambling in an attempt to plug their budget deficits caused by doling out ungodly generous benefits to state union workers and frivolous wasteful pork projects designed to get lawmakers re-elected. The facts are that gambling negatively impacts the uneducated poor, senior citizens, and young adults the most. Government is preying on the ignorant to support their unquenchable thirst for more funds to support their social agendas. Gambling has been legalized in States and Cities run by Republicans and Democrats. But, the facts are that the venues with the largest gambling empires are controlled by the Democratic Party and have been for decades. Las Vegas, Atlantic City, Chicago, Connecticut, Detroit, and St. Louis are Democratic strongholds. It is not surprising to me that cities with the highest poverty rates such as Detroit, Atlantic City, and St. Louis are most dependent on taxes from gambling. The hypocrisy of the politicians in these cities is mind numbing. They are truly vampires draining the poor of the little they have to allegedly pay for programs to help the poor. Instead, the money is funneled to unions and crooked politicians.

TOP 20 U.S. CASINO MARKETS BY ANNUAL REVENUE

Gross revenue is earnings before taxes, salaries and expenses are paid — the equivalent of sales, not profit.

It is utterly disgusting that players with annual incomes of less than $10,000 spend almost three times as much on gambling as those with incomes of more than $50,000. With the vigorous support of state governments, US gamblers, many of them scraping by on insufficient incomes, had to lose $92 billion last year in casinos and lotteries for the states to raise $24 billion in new revenues. Most states gain political support for their lotteries by earmarking them for appealing causes such as education, schools, roads, and parks. How warm hearted. But there is no practical way to prevent a legislature from allocating these revenues to other reelection-prompting purposes. Revenues derived from gambling take money from poor families that would have been spent on such trivial expenses like food, utilities, mortgages and rent. The chart below unmistakably proves that the state is picking the pockets of the poor, ignorant and minorities. High School dropouts spend 125% more on lotteries per year than College graduates. Blacks spend 57% more than Whites.

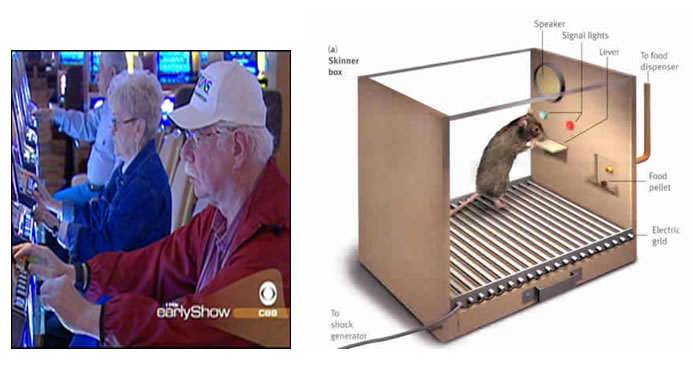

The other group most abused by the nanny State is senior citizens. Researchers at Pennsylvania State College of Medicine and the University of Pennsylvania surveyed 843 elderly people 65 years and older and discovered that 70 percent had been involved in at least one gambling activity in the past year and 11 percent fit the criteria of at-risk gamblers: they had recently laid down more than $100 on a single bet and/or they had bet more than they could afford to lose. Seniors are more likely than younger people to be living on fixed incomes-so even small losses can have a big impact. And they're more likely to have some type of age-related mental impairment affecting their ability to bet responsibly. Dr. David Oslin, the author of the study, stated,

"These seniors who are at-risk may not be ready for gamblers anonymous but many of them don't have a lot of money and spending on gambling could mean that they won't have anything left to buy medicines." Casino corporations are brilliant at marketing to senior citizens. Casino corporations segment local markets, track prospects' and players' observed worth, define their predicted value, and systematically maximize individual "share of wallet" through targeted and customized promotional messages, limited-time cash offers, and carefully tracked time-to-response and spending analysis. This is highly sophisticated and systematic coercion of granny. The casinos compensate their politician sugar daddies to the tune of $27 million in lobbying (aka bribes) dollars per year.

ANNUAL CASINO/GAMING LOBBYIST SPENDING

Now that the politicians and gaming industry have tied up the senior market, they have shifted their focus to addicting teenagers and young adults. TV glorifies poker tournaments on ESPN. Internet gambling sites make it as easy as pie to develop a gambling addiction. All you need is a credit card to initiate your addiction. Gambling among young people is soaring as 42% of 14-year-olds, 49% of 15-year-olds, 63% of 16-year-olds, and 76% of 18-year-olds have gambled. According to the American Psychological Association Internet gambling could be as addictive as alcohol and drugs. Government is robbing the most susceptible in our society, the young, the old, the poor, and the ignorant, to fund their grand plans.

My home state of Pennsylvania passed its $28 billion annual budget yesterday, three months after the start of the fiscal year. The economic crisis has crushed state tax revenues. This should have forced lawmakers to make tough decisions and cut costs. The humungous government bureaucracy has plenty of room to be pared back. Instead these brave politicians decided to for permit gambling on poker, blackjack and other so-called table games at the state’s slot-machine casinos. The Democratic Governor, Fast Eddie Rendell, formerly the mayor of Democratic controlled Philadelphia, refused to fire any unionized State employees. Pennsylvanian politicians would rather take the easy way out by imposing a regressive hidden tax on the poor to support unionized casinos and unionized State employees. Democrats know where there bread is buttered.

now I'm naked, nothing but an animal

but can you fake it, for just one more show

and what do you want, I want change

and what have you got

when you feel the same

even though I know-I suppose I'll show

all my cool and cold-like old job

despite all my rage I am still just a rat in a cage

despite all my rage I am still just a rat in a cage

someone will say what is lost can never be saved

despite all my rage I am still just a rat in a cage

Smashing Pumpkins – Rats in a Cage

The Government, which portrays itself as the protector of the poor and disadvantaged, has further impoverished those they pretend to defend by expanding casinos and lotteries throughout the land. These politicians can’t possibly be so dim-witted that they don’t understand that gambling has an adverse impact on the unfortunate and uneducated. I’ve concluded that these politicians just see us as rats in a cage. The only thing that drives them is power and money. They do not care where they get tax revenue, as long as they can get re-elected by doling out the dough to the right constituents. The uneducated and minority poor spend money they don’t have on State initiated games of chance. The State collects lottery revenue and taxes on casino revenue to pay for welfare programs that keep the poor trapped in poverty. Keeping the ignorant masses sedated with games of chance, easy credit, and welfare checks allows politicians to retain power and control. Despite all of our rage, we are still rats in a cage.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.