Gold Mega Bullish Technicals, Wow!

Commodities / Gold & Silver 2009 Oct 11, 2009 - 02:17 PM GMTBy: Adam_Brochert

If you're not into technical analysis, you're not into it. I understand. Drawing squiggles on a chart seems like reading tea leaves to many. I get it. I personally believe that it increases your odds of success if you have the fundamentals right. In other words, technical analysis in isolation is not attractive to me, but laid over a solid foundation of fundamental analysis makes sense to me.

If you're not into technical analysis, you're not into it. I understand. Drawing squiggles on a chart seems like reading tea leaves to many. I get it. I personally believe that it increases your odds of success if you have the fundamentals right. In other words, technical analysis in isolation is not attractive to me, but laid over a solid foundation of fundamental analysis makes sense to me.

The Gold price chart, denominated in U.S. Dollars, makes sense to me. It is a thing of beauty. It is a Picasso for those who care to try their luck at reading price charts.

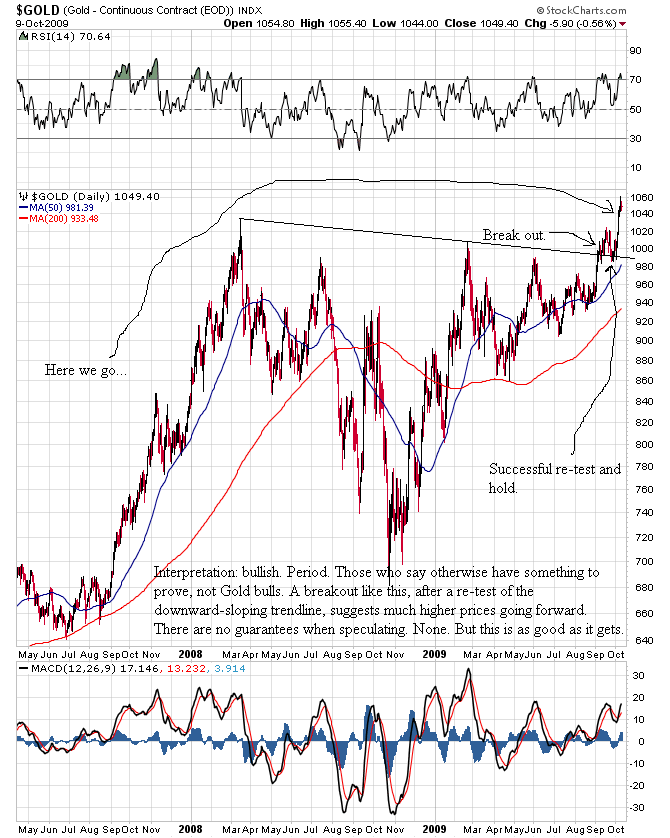

Here's a 2.5 year daily chart to show you what I mean:

The symmetry is perfect. The break-out is textbook. Can it fail to materialize and can Gold fall significantly from here? Yes. Investing/Speculating is never certain (I learned that when shorting the market last May and June). But those calling for a failure or steep correction here in the U.S. denominated Gold price are ignoring the dominant trend:

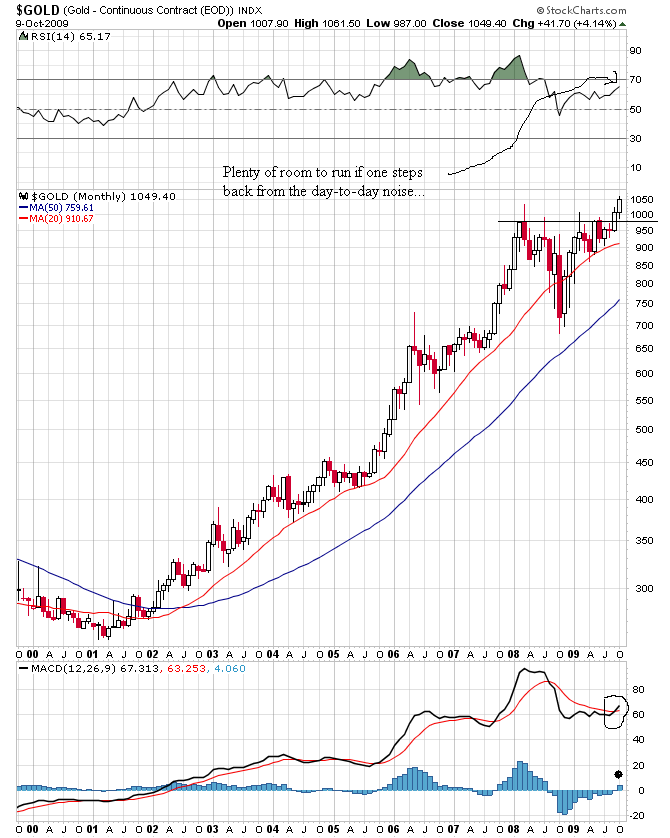

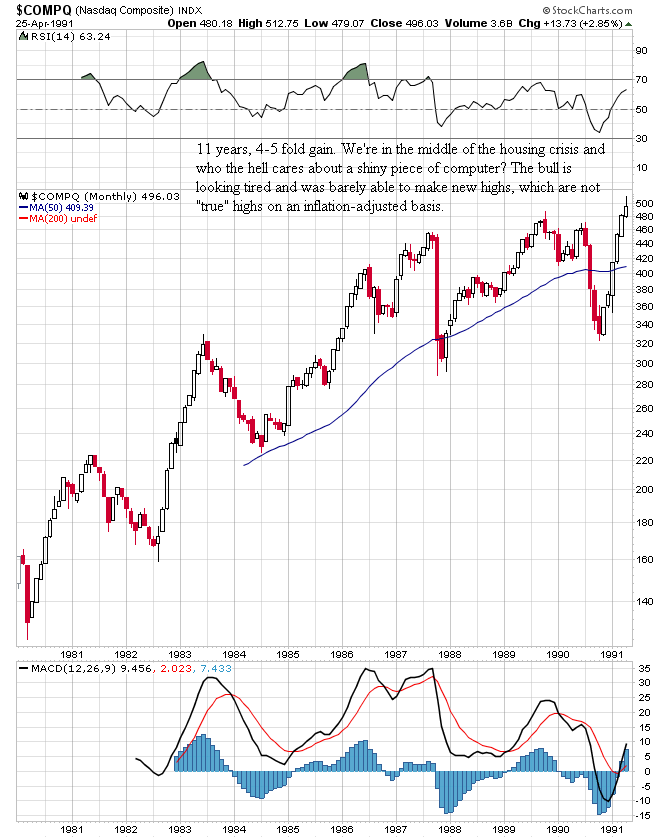

Gold has increased by 4-fold since the turn of the century. The mainstream sees Gold is going higher and is skeptical. Apparently it is a bubble according to some. Come on. You're telling me that an asset class that rises in value 4-fold over a decade is a bubble? Yeah, OK. We'll ignore the recent history of paper fiat-inspired bubbles and play pretend. Oh, wait. Let's look at an actual prior bubble that was unsustainable and ready to pop - the NASDAQ. Here's that historical 4-fold bubble waiting to pop in 1991:

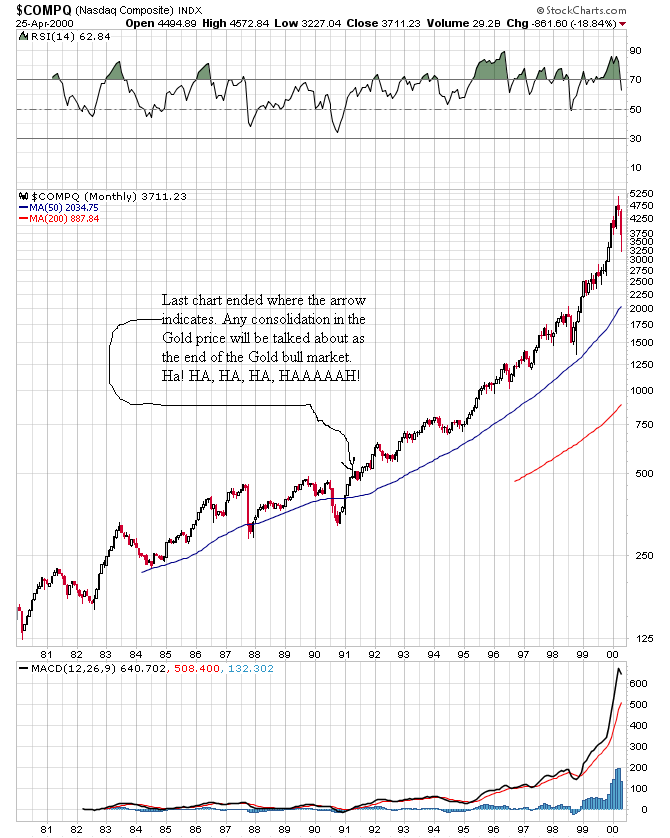

Oh, yeah, and here's what happened next in the "unsustainable" tech bubble (20 year monthly NASDAQ chart from 1980-2000):

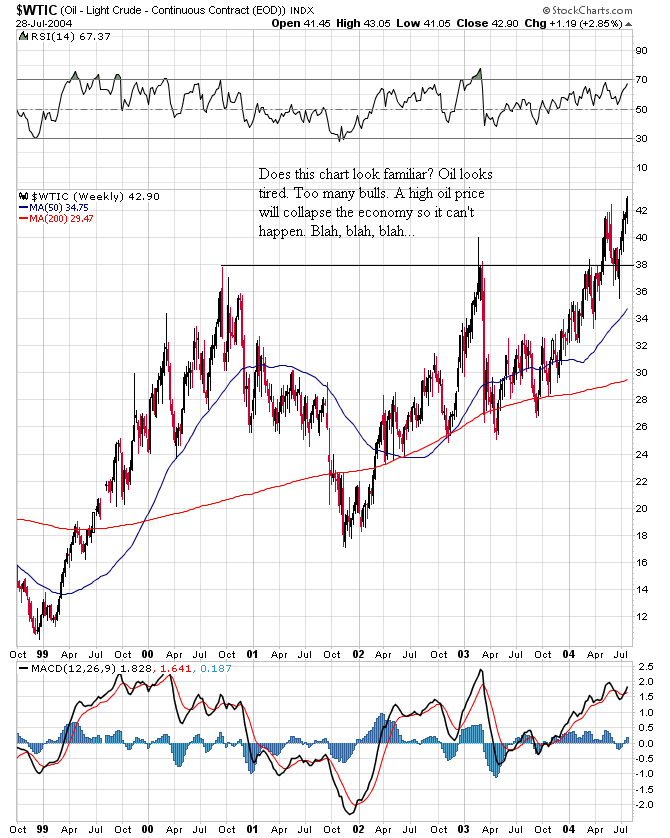

And how about oil? What does a paper fiat bubble in energy look like at the point when everyone is doubting it can happen? Here's oil on a weekly chart from 1999 to 2004:

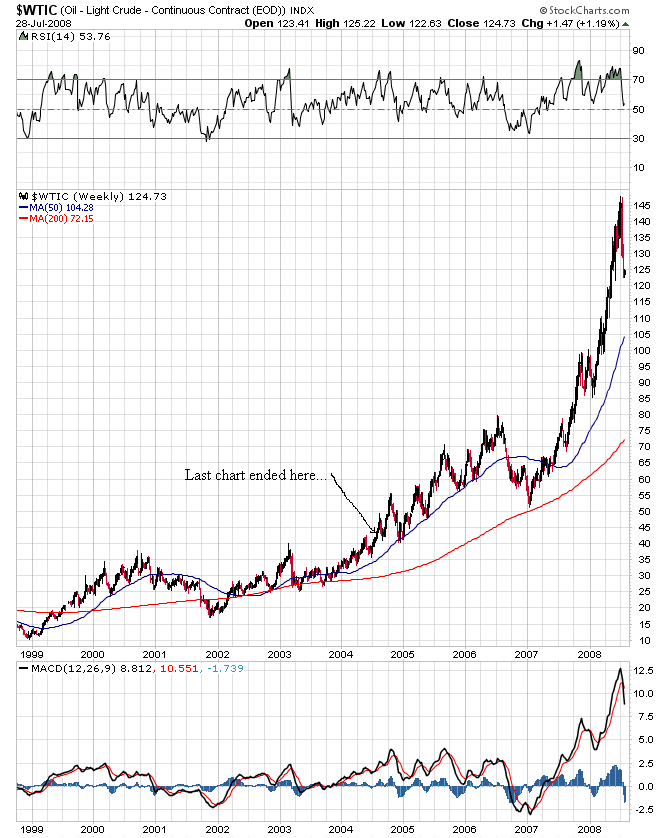

And we all know what happened next with oil:

Those who think it is not possible for Gold to have a similar chart - I get it. No growth, no dividends, just a piece of metal, blah, blah, blah. But when the system breaks down due to too much debt and too many paper promises, the bubble swings the other way. Invest where you want. But me, I'll bet on Gold.

I'll bet that a shiny piece of metal will outperform the hubris of a small group of men and women willing to risk systemic failure to maintain profits. Call me cynical if you wish, but I believe a one or two ounces of a shiny metal will be equal in value to the entire Dow Jones Industrial Average before this bust is over. It happened in the 1930s and it happened in the 1970s, both during the context of secular bear markets in stocks like the one we are smack dab in the middle of right now. The last secular Gold bull market under our current U.S. fiat paper monetary system went up 25 fold from bottom to top. We've got a long way to go. In my opinion, the bubble in Gold has just begun.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.