The Best Reasons to Buy Silver and Gold Now

Commodities / Gold & Silver 2009 Oct 13, 2009 - 04:27 PM GMTBy: Sean_Brodrick

The spot price of gold soared to its highest level ever this week, as the dollar tanked and precious metals bears got mauled. But many investors, still sitting on the sidelines, ask themselves: Do I want to buy now? NOW?! When gold is over $1,000 an ounce?!

The spot price of gold soared to its highest level ever this week, as the dollar tanked and precious metals bears got mauled. But many investors, still sitting on the sidelines, ask themselves: Do I want to buy now? NOW?! When gold is over $1,000 an ounce?!

I understand those investors’ concerns — and if you’re one of them, nobody can make the decision for you. It’s doubly hard because the mainstream media is cranking up its anti-gold propaganda to a feverish pitch, like the story that ran in the Wall Street Journal on Tuesday, “Gold Is Still a Lousy Investment.”

I’m not going to give you a link to that story because it is crap. The gold price has doubled in the past four years. Anyone who thinks that a 100 percent return is a lousy investment has serious issues.

The question becomes, what will gold do over the next four years … or 10 years? I think it’s going higher. And silver too — in fact, I think silver will outperform gold.

Let me give you my four hottest reasons why metals should shine.

Reason #1 — Investor Demand Is Strengthening

As any investor knows, the more there is of something, the lower it is valued. That is the problem with all paper currencies now. Central banks have cranked up the printing presses (electronically, anyway) in a desperate bid to prop up financial institutions that are being crushed by the weight of their own bad decisions.

But what kind of money can’t be printed? Gold and silver! Precious metals are money — you can use them to buy stuff, and they are the ultimate currency when other currencies are being devalued. As central banks print more, the private demand for gold as an investment and inflation hedge is growing.

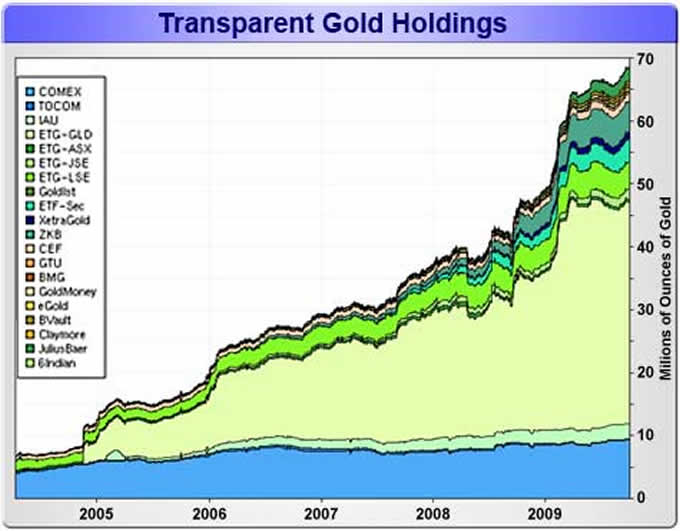

Just look at the track of the gold held by ETFs over the past five years …

Source: Sharelynx.com

This is all the gold held transparently by gold ETFs around the world — 68.2 million ounces, or 1,933.4 metric tonnes. Gold held in the SPDR Gold Trust, the biggest exchange-traded fund backed by the metal, hit 1,098 tonnes on Monday — close to record highs. That one fund has passed Switzerland as the world’s sixth-largest holder of physical gold.

Looking at the chart, you can see that gold buying by ETFs is accelerating. But if you think the ramp-up in gold-buying by ETFs is something, you should see what’s going on in silver …

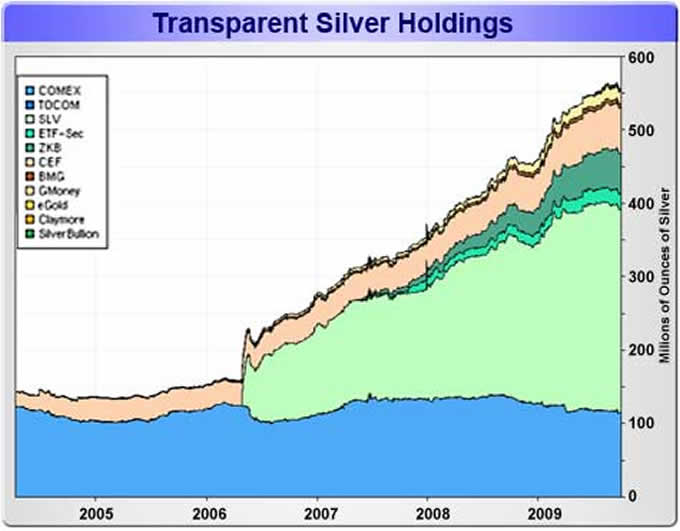

Source: Sharelynx.com

The biggest silver ETF by far is the iShares Silver Trust ETF (SLV). So far this year investors have sunk nearly $826 million into the SLV, according to Lipper FMI. That’s nearly as much as they pumped in during ALL of 2008.

So yes, investor demand for metals is heating up. Sure, all that metal could go back on the market in the future. But for now, this is a very bullish force.

Reason #2 — Central Banks Are Buying

There’s no money bigger than the central banks of the world, and the central banks have turned into net buyers of gold. For a decade, they were net sellers.

The World Gold Council reported that in the second quarter of this year — the latest figures available — central banks bought 14 tonnes of gold more than they sold. This was the first time they’ve been net buyers since at least 2000.

And then there’s the new, Third Central Bank Gold Agreement. On August 7, a group of 19 European central banks agreed to renew a pact to limit gold sales to 400 tonnes a year, down from 500 tonnes a year in the second agreement, which expired in late September. Sales in the second agreement really dropped off toward the end, coming in at 25 percent below the total quota as central banks turned from sellers to buyers.

The point is, if central banks — the big money — are buying, why the heck would you want to be selling? Why wouldn’t you want to buy also?

Reason #3 — A Big Gap Is Developing in Production

Last year’s financial crisis really crunched exploration budgets for miners of all types. Worldwide, exploration budgets dropped by 40 percent year over year, according to a study from Canada’s Metals Economics Group. Preliminary reports from the study show that 2009 exploration budgets will reach around $8.4 billion, compared with a global budget of $14 billion last year.

Junior mining companies cut their exploration budgets the most, although most intermediate and major players have made deep reductions of their own in their 2009 exploration plans.

This is going to worsen a supply/demand balance that is already squeezing gold prices higher.

Sources: World Gold Council/GFMS/Barclays

Reason #4 — Gold Is Still Cheap!

Gold has enjoyed a great run — up more than 300 percent from its low in 2001 and 100 percent since January 2006. That sounds good. But Tuesday’s all-time high was still sharply below the inflation-adjusted high. Just look at this chart …

Metals consultancy GFMS put the inflation-adjusted high for gold at $2,079 an ounce. Could it go higher? Bet on it!

These are just four reasons. I could have given you a lot more. And to be sure, there are forces that could weigh on gold prices. The U.S. dollar could find its feet and go higher … jewelry buying in India could fall so much that it could weigh on prices … investors could start selling ETF holdings.

But add it all up, and I think the odds favor much higher prices from here.

So What Should You Buy?

You can always buy the SPDR Gold Trust (GLD), which tracks the price of gold closely. I don’t like the GLD for a long-term investment, but it’s always good for a trade.

You could buy the Market Vectors Gold Miners ETF (GDX) — a basket of big gold and silver miners. ETFs like the GDX lower your risk while still giving you exposure to big moves in a sector or industry.

Or you could buy individual stocks, like I recommend in Red-Hot Global Small-Caps. Those subscribers received the “Gold Fever” report I published in July for free, just my way of saying “thank you” for being subscribers. Let’s see how the “Gold Fever” positions are doing as of Tuesday’s close …

Pretty darned good! The “Gold Fever” portfolio as a whole is up 25 percent since inception, more than DOUBLE the 12 percent rise in gold over the same time frame.

Just be aware that individual stocks are more risky than ETFs. You need to know when to get in as well as when to get out. Do your own due diligence.

I think gold and silver, and the stocks that are leveraged to them, have a long, long way to go. It’s not too late to get in on the action. In fact, the next leg up in gold may still be in its early stages.

Yours for trading profits,

Sean

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

Uncommon Wisdom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.