Gold Just Broke Its Neck, Targets $5,250?

Commodities / Gold & Silver 2009 Oct 14, 2009 - 02:29 PM GMTBy: Graham_Summers

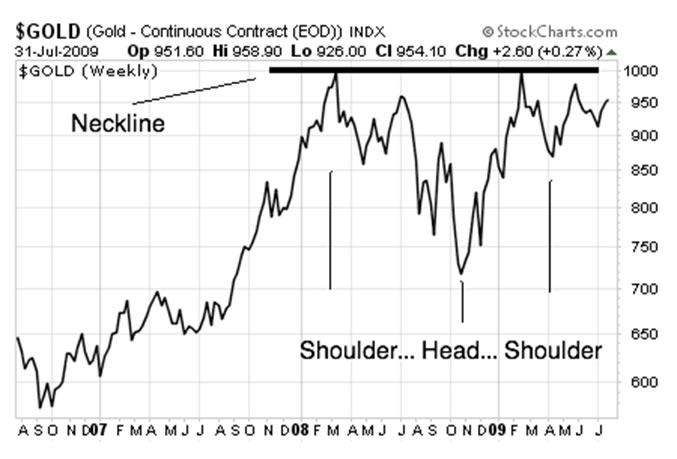

If you’ll recall, in August ago I wrote about the massive inverse head and shoulders pattern gold had formed during the last three years. I presented the below chart to illustrate this:

If you’ll recall, in August ago I wrote about the massive inverse head and shoulders pattern gold had formed during the last three years. I presented the below chart to illustrate this:

At that time I wrote:

… gold has formed a long-term inverse head and shoulders formation (two smaller collapses book-ending a major collapse). Typically a head and shoulders predicts a massive collapse. However, when the head and shoulders is inverse, as is the case for gold today, this typically predicts a MAJOR leg up.

Indeed, any move above the “neckline” of 1,000 would forecast a MAJOR move up to $1,300 or so…

Well, last week, gold broke the neckline:

As you can see, gold’s recent rally took it above the critical point of upwards resistance. This indicates that the next leg up in the gold bull market has begun. The reason here is simple: investors have begun to realize that every central bank on the planet is hell bent on devaluing their currencies.

Interestingly, this new breakout corresponds perfectly with historic trends. As I wrote in August:

If we were to go by the historic pattern of the gold market in the ‘70s, gold should experience upwards resistance for 19 months after its first peak today. Gold’s recent peak was $1,014 in March ’08 (roughly 17 months ago).

If this bull market parallels the last one, then gold should renew its upward momentum in a very serious way starting in October 2009. And this next leg up should be a major one (the biggest gains came during the second rally in gold’s bull market in the ‘70s).

Well, here were are in October 2009, and gold is definitely making a major move upwards. To me, the reason here is simple: investors have begun to realize that every central bank on the planet is hell bent on devaluing their currencies.

Everyone and their mother believes the Fed’s actions are hurting the US dollar. But few people have taken noticed that the Europeans don’t want a strong euro, just as the Japanese don’t want a strong yen, just as the Swiss don’t want a strong franc.

Why?

None of these guys want their currencies to appreciate too far against the dollar because most if not ALL of them export to the US or trade products based in dollars. Having a strong currency against a weak dollar means increased production costs against a lower sales price.

This means LOWER profitability.

To combat this, countries are either aggressively printing money to stimulate their economies (China, Europe, the UK) or openly manipulating their currencies (Switzerland) in an effort to devalue their money against the dollar. Case in point, this latest breakout in gold happened WITHOUT the dollar falling to a new low:

As you can see, gold broke out dramatically this week. But the dollar failed to fall to a new low. This tells us that gold is beginning to decouple from the dollar and is soaring as investors the world over flee paper money in general. And of course, they’re piling into the one currency that CANNOT be devalued:

GOLD.

So where will the precious metal go from here? The above head and shoulders pattern forecasts a move to $1,300. But if we truly get gold mania (as we did in the late ‘70s) gold could rise 750%: that was how high gold rallied from August ’76 to January 1980 during the last gold bull market.

If gold were to rally 750% from its recent low ($700), that would put the precious metal at $5,250 per ounce!!!

I know, the idea of gold above $5,000 an ounce seems ridiculous to me too. But gold has produced these kinds of returns before. And with virtually every central bank on the planet printing money in an effort to stimulate their economies, it’s not hard to see how gold mania could push the precious metal to prices that seem outlandish today.

In light of this, I suggest having some exposure to the precious metal. Gold’s had a wild ride since 2000. But if this gold bull market continues to mirror that of the ‘70s (as it has so far), then we’re in for some real fireworks in the next couple of years.

Indeed, on that note, I’ve put together a FREE Special Report detailing an unusual means of playing the gold explosion. While most investors blindly pile into the gold ETF or buy gold bullion, this backdoor play allows you to buy the precious metal at an incredible $188 an ounce. If gold breaks above $1,000, the opportunity for triple digits gains is huge.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.