Copenhagen 2009 and the Stock Markets

Stock-Markets / Investing 2009 Oct 20, 2009 - 02:38 PM GMTBy: Richard_Shaw

We don’t know if the furor over climate, economic and sovereignty issues coming to a head over the impending December Copenhagen climate treaty is correct, incorrect, exaggerated or spot-on.

We don’t know if the furor over climate, economic and sovereignty issues coming to a head over the impending December Copenhagen climate treaty is correct, incorrect, exaggerated or spot-on.

Obama on Cost Impact of Climate Policies (March 18, 2009):

Warren Buffer on Cost Impact of Climate Policies (March 9, 2009):

There is now concern that Obama will sign a treaty that will limit the options of our legislators or subsequent presidents to modulate our approach to the climate change issue. Whatever burden the U.S. may carry under domestic policies, we expect the burden would be greater under international treaty requirements.

We believe that the general direction of domestic policy in the U.S., and plausible international treaties the President may sign, will among other things:

- limit manufacturing in the U.S. by cap and trade regulations

- limit personal consumption of energy by law and costs

- cause the cost of energy to increase

- cause goods and materials to become more expensive

- cause transportation to become more expensive

- prevent the U.S from growing out of its economic problems as effectively as it has in the past

- assure and accelerate the shift of economic growth and profitability from the U.S to emerging markets.

- not limit the amount of stuff manufactured worldwide as global consumerism increases

- increase the percentage of stuff consumed in the U.S. manufactured in emerging countries (who will not be subject to the same carbon emissions limits)

- cause the U.S. to become an even greater debtor while China becomes an even bigger creditor

- add momentum to the movement away from the U.S. Dollar toward an alternate single or composite world reserve currency

- increase the cost of Treasury borrowings

- increase the cost of commercial, mortgage and personal debt tied to Treasuries

- reduce the exchange value of the Dollar

- reduce home purchase and ownership affordability

- drive up federal and state taxes.

The pace and degree of these sorts of change is uncertain, but the direction of policy change is clear. Without commenting on the political or moral issues that are hotly debated, the clear implication of the direction is at least a reduced rate of improvement in U.S. standard or living, potentially an absolute decline, and adverse overall U.S. stock and bond consequences for a considerable time.

The political claims are that the conversion to alternate fuels and more energy efficiency will create a new and brighter economy — only time will tell. However, we expect at a minimum a very bumpy transition that will be difficult for investors. Countries not going through that transition or exempted from the transition may have smoother economies as a result.

As a general proposition, we’d prefer to have a large slug of our money working in economies that are not going through the economic experiments, successes and failures, and trials and tribulations that we expect domestic laws and international treaties will impose on the United States.

The short story is that the domestic and international energy and carbon policies (with their stricter limits on developed countries and lower limits on emerging countries) are in effect China and India stimulus plans — a wealth and wealth opportunity transfer from the U.S. to emerging countries.

The simplest investment response is to diversify cash, bonds and stocks more fully to other parts of the world, and to have a less U.S. centric portfolio. At least for now there are no significant currency controls, international investment limitations or tax surcharges on investment gains or income from non-domestic investments. For now, and we hope forever, you are free to invest your money globally. We suggest that you do so.

The logical investment responses would be:

1. Reduce stock allocations to the United States and increase emerging markets allocations.

2. To the extent you invest in U.S. companies, focus on those with low energy or materials consumption, or that will increase sales directly due to carbon or energy limits, or to those companies with substantial non-U.S. operations and sales.

3. Stay at the shorter duration on bonds, because Treasury interest rates are likely to increase and trend at higher levels than when the U.S. was less of a debtor and not limited in its ability to grow out of its debt.

4. Think through how decreased house affordability will ripple through various industries when investing domestically, because homes are likely to become less affordable as energy costs rise, mortgage rates rise, local taxes increase and construction materials cost more — while at the same time the equilibrium rate of unemployment will be higher than in the past and the rate of growth of wages will struggle to keep up with inflation.

5. Diversify fixed income assets to include high quality international debt denominated in other major world currencies.

6. Consider holding part of cash reserves in multiple currencies.

7. Expect carbon credit investments to become popular with a proliferation of funds which may eventually become useful in portfolios — not yet though.

8. Perhaps abandon the simplistic concept of developed and emerging markets (now cast in cement by index providers and index fund managers), and replace that with a differentiation between net creditor and net debtor nations, net importer and net exporter countries, resource exporters versus goods and services exporters, and low GDP growth versus high GDP growth countries.

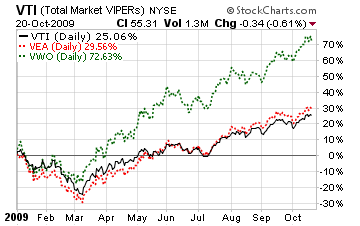

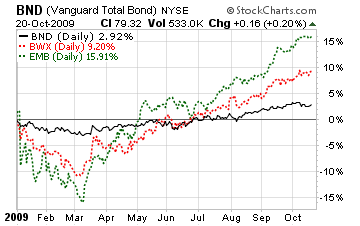

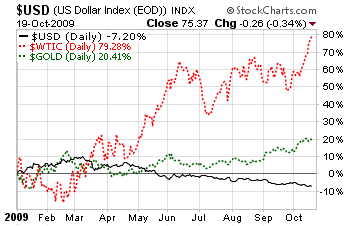

A simple way to monitor the shift would be to watch these three percentage performance charts:

- three equity funds: VTI, VEA and VWO (for total U.S. stocks, total developed market stocks ex Canada, and emerging markets stocks)

- three funds: BND, BWX and EMB (for U.S. bonds, local currency developed country bonds, and Dollar denominated emerging market bonds)

- three indexes: oil (proxy USO), gold (proxy GLD)and U.S. Dollar index (proxy UUP).

You can get a pretty good idea of the global picture from those nine plots without spending too much time. You could track the oil, gold and Dollar proxy funds instead of the indexes, but at least for oil, the tracking is not necessarily good.

Short-term versions of those three charts follow:

Enjoy the U.S. and global bull of the moment, but think long-term by becoming more of a global investor.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.